Ocean Engagement Fund

-

DATABASE (428)

-

ARTICLES (263)

Founded in 2013, Sino-Ocean Capital is the investment arm of the Chinese real estate developer Sino-Ocean Group. It mainly invests in the sectors of big data, healthcare, logistics, environmental protection, real estate and finance. It currently manages RMB 50bn worth assets and $700m US dollar funds. The limited partners include insurance companies, large-sized enterprises and sovereign wealth funds.In 2019, Sino-Ocean Capital launched a RMB 3-5bn fund to acquire logistics properties and planned to invest RMB 48bn in logistics over the next five years. It also on the track to raise $1.5bn for its latest real estate fund to invest in offices in Beijing.

Founded in 2013, Sino-Ocean Capital is the investment arm of the Chinese real estate developer Sino-Ocean Group. It mainly invests in the sectors of big data, healthcare, logistics, environmental protection, real estate and finance. It currently manages RMB 50bn worth assets and $700m US dollar funds. The limited partners include insurance companies, large-sized enterprises and sovereign wealth funds.In 2019, Sino-Ocean Capital launched a RMB 3-5bn fund to acquire logistics properties and planned to invest RMB 48bn in logistics over the next five years. It also on the track to raise $1.5bn for its latest real estate fund to invest in offices in Beijing.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

WWF-backed biotech Oceanium has developed a biorefinery that transforms seaweed into alt-proteins and compostable packaging that will soon be launched commercially.

WWF-backed biotech Oceanium has developed a biorefinery that transforms seaweed into alt-proteins and compostable packaging that will soon be launched commercially.

Co-founder and CMO of Zaask

Kiruba Shankar Eswaran holds a bachelor’s in Engineering from Anna University and an MBA from The Lisbon MBA while on a full merit scholarship. Following that, he was a manager of mobile payments at mobile engagement solutions firm TIMWE.

Kiruba Shankar Eswaran holds a bachelor’s in Engineering from Anna University and an MBA from The Lisbon MBA while on a full merit scholarship. Following that, he was a manager of mobile payments at mobile engagement solutions firm TIMWE.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Aqua-Spark is a Netherlands-based fund that supports aquaculture businesses around the world, with the vision to create profitable aquaculture ventures that can help to restore ocean ecosystems that have been damaged by overfishing. Its portfolio covers a wide range of enterprises, ranging from low-cost fish farms in Madagascar to biotechs and high tech aquaculture companies.

Aqua-Spark is a Netherlands-based fund that supports aquaculture businesses around the world, with the vision to create profitable aquaculture ventures that can help to restore ocean ecosystems that have been damaged by overfishing. Its portfolio covers a wide range of enterprises, ranging from low-cost fish farms in Madagascar to biotechs and high tech aquaculture companies.

42CAP is a German VC fund established in 2016 for seed and early-stage investments in European startups. Alex Meyer and Thomas Wilke, both founders of eCircle, one of Europe’s largest SaaS companies that was sold to Teradata in 2012, are co-founders and partners of 42CAP. They have taken advantage of 42CAP’s success to invest in international AI-powered startups. To date, the company has made 21 investments, most recently in the Series A rounds of streaming analytics integration software company Crosser, in customer data and engagement platform CrossEngage and in the Series B round of marketing platform Adversity.

42CAP is a German VC fund established in 2016 for seed and early-stage investments in European startups. Alex Meyer and Thomas Wilke, both founders of eCircle, one of Europe’s largest SaaS companies that was sold to Teradata in 2012, are co-founders and partners of 42CAP. They have taken advantage of 42CAP’s success to invest in international AI-powered startups. To date, the company has made 21 investments, most recently in the Series A rounds of streaming analytics integration software company Crosser, in customer data and engagement platform CrossEngage and in the Series B round of marketing platform Adversity.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

Founder of NYSE-listed Chinese online classifieds/marketplace giant 58.com, Yao Jinbo graduated from China Ocean University in 1999 with degrees in computer science and chemistry. He founded 58.com in 2005. He has experience in network marketing, network channel development and domain name strategy. Yao also co-founded the Xueda Education Group.

Founder of NYSE-listed Chinese online classifieds/marketplace giant 58.com, Yao Jinbo graduated from China Ocean University in 1999 with degrees in computer science and chemistry. He founded 58.com in 2005. He has experience in network marketing, network channel development and domain name strategy. Yao also co-founded the Xueda Education Group.

Álvaro Ortiz is a business angel with over 15 years of experience in the fields of User Experience, E-commerce, Communities, Online Marketing, Front-end development and Project Management.He founded Mumumío, an e-commerce platform that sold quality food directly from producers. Ortiz is currently the CEO and founder of Populate, a startup that builds tools and platforms for civic engagement.Besides being an internet expert and a founder of several startups, he has also been involved in fundraising for other startups.

Álvaro Ortiz is a business angel with over 15 years of experience in the fields of User Experience, E-commerce, Communities, Online Marketing, Front-end development and Project Management.He founded Mumumío, an e-commerce platform that sold quality food directly from producers. Ortiz is currently the CEO and founder of Populate, a startup that builds tools and platforms for civic engagement.Besides being an internet expert and a founder of several startups, he has also been involved in fundraising for other startups.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

Co-founder of Berrybenka

Yenti Elizabeth co-founded Berrybenka with her friend, Claudia Widjaja who is also the wife of Berrybenka’s CEO. She is currently a general manager at PT Gamatara Trans Ocean Shipyard. She graduated with a bachelor’s degree in Accounting from Tarumanagara University in Jakarta, before going on to study Marketing Communications at the London School Of Public Relation in Jakarta.

Yenti Elizabeth co-founded Berrybenka with her friend, Claudia Widjaja who is also the wife of Berrybenka’s CEO. She is currently a general manager at PT Gamatara Trans Ocean Shipyard. She graduated with a bachelor’s degree in Accounting from Tarumanagara University in Jakarta, before going on to study Marketing Communications at the London School Of Public Relation in Jakarta.

Co-founder and CEO of Brankas

Todd Schweitzer is an experienced economic and management consultant who founded Brankas, a payment processing platform for startups and other businesses. Between 2007 and 2010, Schweitzer worked with the US Peace Corps as a community economic advisor in the Dominican Republic. He then joined Strategy&, a subsidiary of PwC, as an engagement manager before leaving in 2015 for a brief stint at Seawood Resources, a Philippines-based investment company.Todd holds a bachelor’s degree in Economics from University of California, Irvine and a master’s in Public Policy from Harvard University.

Todd Schweitzer is an experienced economic and management consultant who founded Brankas, a payment processing platform for startups and other businesses. Between 2007 and 2010, Schweitzer worked with the US Peace Corps as a community economic advisor in the Dominican Republic. He then joined Strategy&, a subsidiary of PwC, as an engagement manager before leaving in 2015 for a brief stint at Seawood Resources, a Philippines-based investment company.Todd holds a bachelor’s degree in Economics from University of California, Irvine and a master’s in Public Policy from Harvard University.

Last-mile delivery tech pioneer Mox expands into e-commerce amid Covid-19 online shopping surge

Last-mile logistical solutions provider Mox scaled its business across markets during the Covid-19 lockdown and is looking to raise €8.2m

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

DefinedCrowd: Helping companies mine, structure highly accurate data in AI applications

The Portuguese startup's quality-controlling smart data platform is driving its exponential growth and major partnerships with the likes of IBM's Watson Studio and Amazon

Bizhare equity crowdfunding attracts over 50,000 retail investors, starts secondary trading

A partner of the Indonesia Central Securities Depository, Bizhare also lowered minimum investment amounts, implemented scripless trading and handpicked businesses on its platform

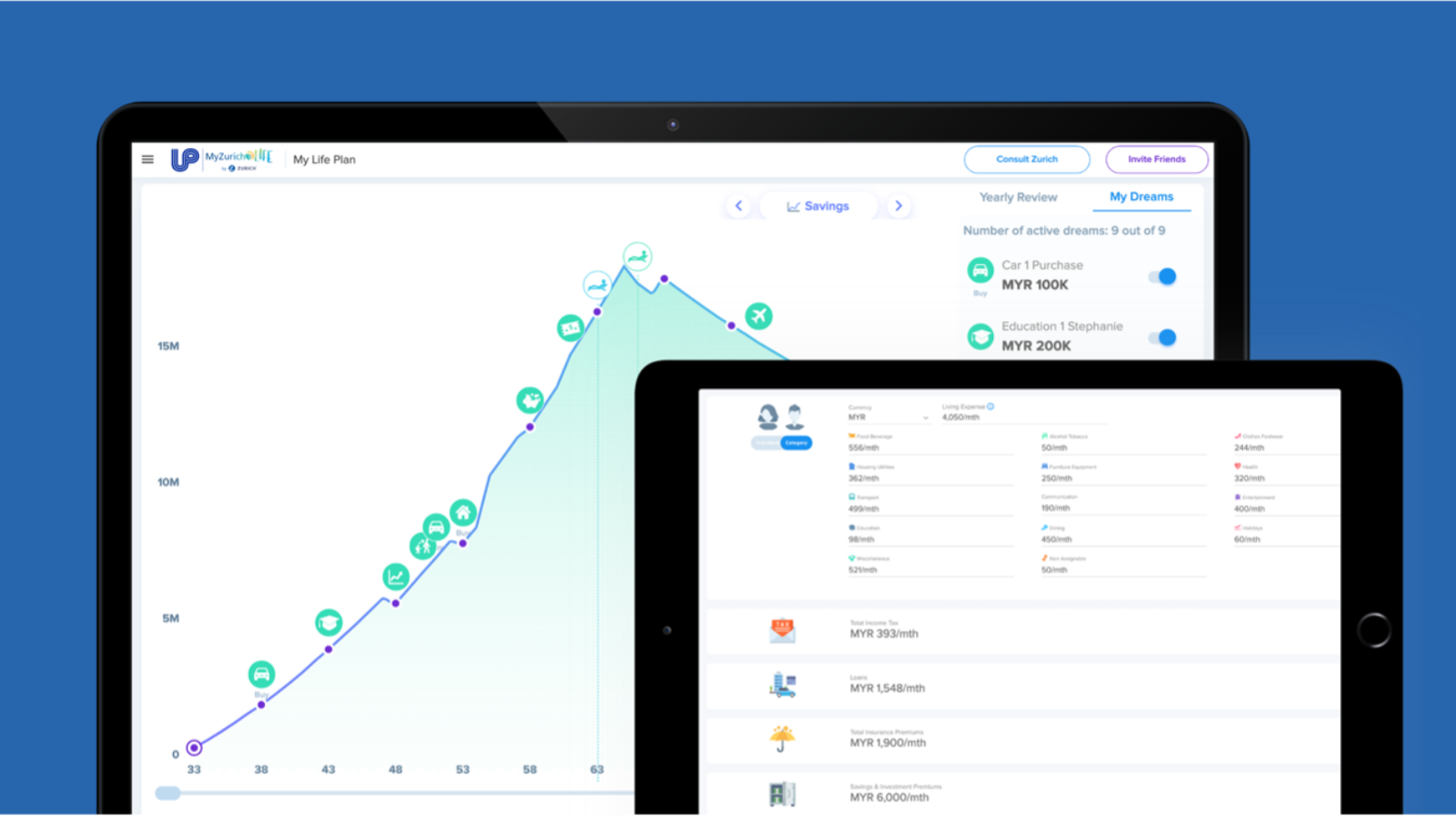

BetterTradeOff: Taking the pain out of financial planning

The Singapore-based startup’s user numbers rose sharply during Covid-19. It wants to raise $11.5m by year-end, is planning a launch in Australia and is eyeing the US market

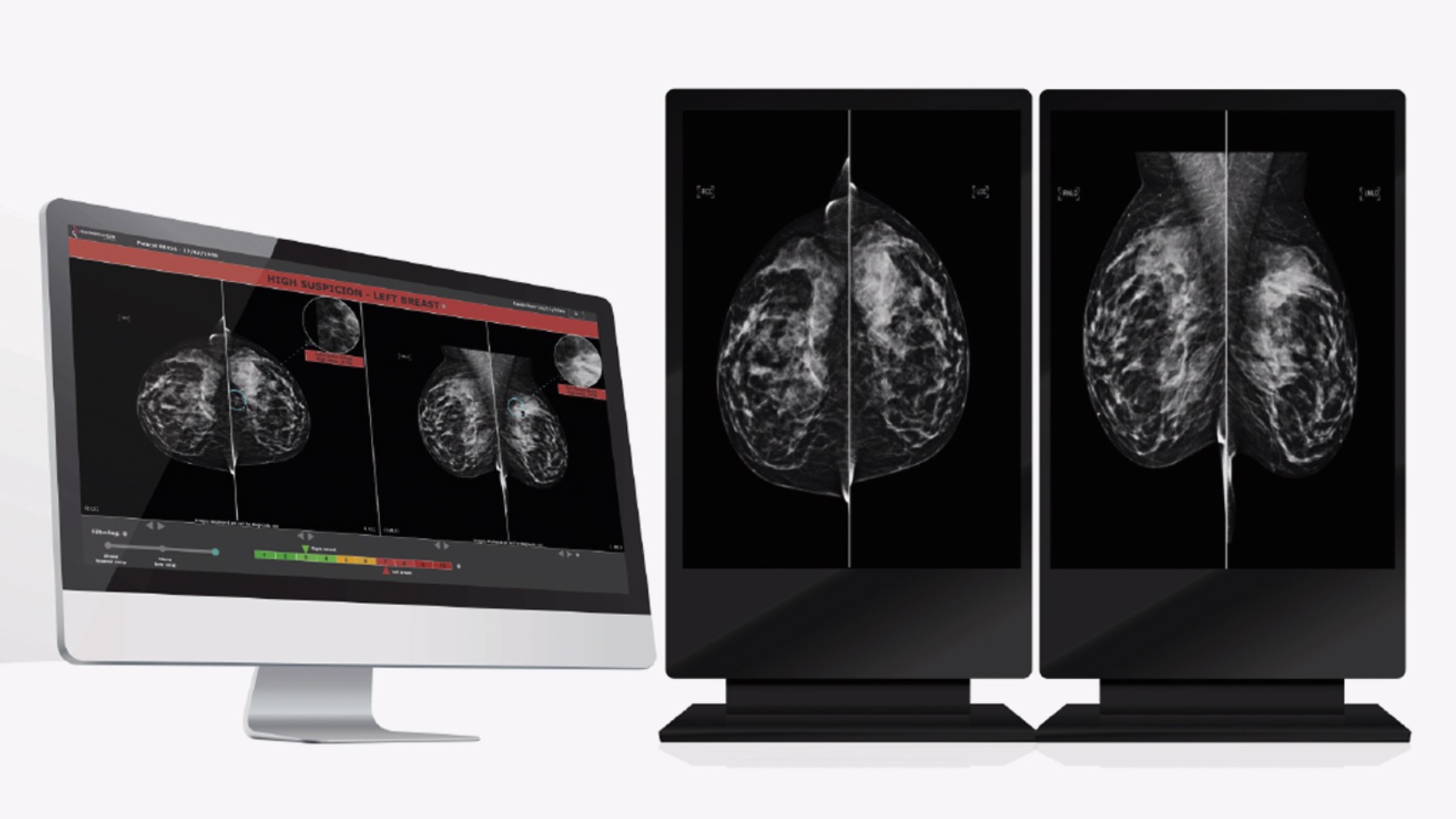

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

South Summit 2021: Martin Varavsky, Leandro Sigman on post-Covid healthcare trends

Serial entrepreneur Martin Varavsky and Insud Pharma Chairman Leandro Sigman share their thoughts and projections on the future of health tech

In a united move, Portuguese startups fight to mitigate Covid-19 impact in unprecedented crisis

As strong growth of previous years falters, Portugal's startups were quick to mobilize themselves to detail the help they would need from the state to deal with their biggest challenge yet

HeartGenetics: Using genetic data and AI to improve predictive health outcomes

Amid growing demand for personalized health and wellness solutions, the Portuguese startup is seeking €2m to expand to Germany and the UK

Nucaps Nanotechnology: New encapsulation tech for nutritional and pharmaceutical sectors

Nucaps Nanotechnology is growing through a mix of accelerating market penetration and continuous R&D

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“Ocean Engagement Fund”.