Offshore energy

DATABASE (155)

ARTICLES (132)

Shell Foundation is the not-for-profit investment arm of the global energy giant Shell. Based in London, the foundation was set up in 2000 to invest in social and environmental impact companies, including startups with the potential to reach out to over 10m low-income consumers and achieve financial viability within 10 years. The foundation mainly invests at the pre-seed and seed funding stage and currently has 77 startups in its portfolio. In January 2021, it joined the $790,000 seed round of African agritech social enterprise AgroCenta and also gave a $350,000 grant to sustainable mobility platform Easy Matatu in Uganda.

Shell Foundation is the not-for-profit investment arm of the global energy giant Shell. Based in London, the foundation was set up in 2000 to invest in social and environmental impact companies, including startups with the potential to reach out to over 10m low-income consumers and achieve financial viability within 10 years. The foundation mainly invests at the pre-seed and seed funding stage and currently has 77 startups in its portfolio. In January 2021, it joined the $790,000 seed round of African agritech social enterprise AgroCenta and also gave a $350,000 grant to sustainable mobility platform Easy Matatu in Uganda.

Chairman and Business Development Manager of AEInnova

Raúl Aragonés Ortiz is AEInnova’s chairman, former CEO, principal founder and originator of the idea behind the company. He is currently AEInnova's business development manager and holds a PhD in Microelectronics. He is also a professor at the IESE Business School and Salesians School Sarrià in Barcelona. Before founding AEInnova, Aragonés was an R&D investigator in chip systems, ASIC design, energy harvesting and smart cities at the Autonomous University of Barcelona. He holds memberships in the Astronomical Association of Terrassa and the Institute of Electrical and Electronics Engineers (IEEE). Since 2018, he has also been a business advisor to the startup Happy Customer Box.

Raúl Aragonés Ortiz is AEInnova’s chairman, former CEO, principal founder and originator of the idea behind the company. He is currently AEInnova's business development manager and holds a PhD in Microelectronics. He is also a professor at the IESE Business School and Salesians School Sarrià in Barcelona. Before founding AEInnova, Aragonés was an R&D investigator in chip systems, ASIC design, energy harvesting and smart cities at the Autonomous University of Barcelona. He holds memberships in the Astronomical Association of Terrassa and the Institute of Electrical and Electronics Engineers (IEEE). Since 2018, he has also been a business advisor to the startup Happy Customer Box.

CCO and co-founder of Modulous Tech

Reimell Ragnauth is co-founder and Chief Commercial Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2019. He also works part-time as a strategic investor to data analysis company iaidō and is a non-executive chairman at construction insulation company PMP Manufacturing.Before Modulous, he was chief business development officer at gold fintech startup Glint for a year and established its US office. He previously worked as the managing director of Spiralite Ductwork in the area of building energy efficiency from 2010-17. Prior to this, all of his positions were in the finance and investment area: at 3i Group as Associated Director of Quoted Private Equity 2007-9; at the Electra Group as a senior associate of the EQMC Fund 2006-7; at consultancy Deloitte as an associate director of private equity transaction services 2004-6; at Orbis Investments 2001-4 working in investment analysis; and as Manager of Business Recovery Services at PwC in London 1996-2000. Ragnauth holds a Master’s in Law from Cambridge University.

Reimell Ragnauth is co-founder and Chief Commercial Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2019. He also works part-time as a strategic investor to data analysis company iaidō and is a non-executive chairman at construction insulation company PMP Manufacturing.Before Modulous, he was chief business development officer at gold fintech startup Glint for a year and established its US office. He previously worked as the managing director of Spiralite Ductwork in the area of building energy efficiency from 2010-17. Prior to this, all of his positions were in the finance and investment area: at 3i Group as Associated Director of Quoted Private Equity 2007-9; at the Electra Group as a senior associate of the EQMC Fund 2006-7; at consultancy Deloitte as an associate director of private equity transaction services 2004-6; at Orbis Investments 2001-4 working in investment analysis; and as Manager of Business Recovery Services at PwC in London 1996-2000. Ragnauth holds a Master’s in Law from Cambridge University.

CTO and co-founder of Carbo Culture

US native Christopher Carstens graduated in mechanical engineering in 2002 at the University of California, Berkeley. He started his career as a technology analyst at The Spark Group in San Francisco.In 2004, the engineer co-founded Solid Gas Technologies to build a methane hydrate production system. Carstens also founded Homeland Fuels to construct a bioreactor using ethanol. He exited both companies in 2006 and went to work at World Waste Technologies in California as project manager and engineer. In 2012, he started working at Graphene Technologies as R&D engineer.In 2013, he joined an innovation accelerator program at Singularity University where he met Finnish participant Henrietta Moon. They co-founded Finnish startup Carbo Culture in 2016 with Carstens as CTO based at the California plant.The serial entrepreneur and inventor also founded Hydrate Dynamics as CTO in 2015 to develop gas storage and transportation facilities using clathrate hydrates technology. In 2018, he was appointed by the US Department of Energy to be a member of the Methane Hydrate Advisory Committee until January 2020.

US native Christopher Carstens graduated in mechanical engineering in 2002 at the University of California, Berkeley. He started his career as a technology analyst at The Spark Group in San Francisco.In 2004, the engineer co-founded Solid Gas Technologies to build a methane hydrate production system. Carstens also founded Homeland Fuels to construct a bioreactor using ethanol. He exited both companies in 2006 and went to work at World Waste Technologies in California as project manager and engineer. In 2012, he started working at Graphene Technologies as R&D engineer.In 2013, he joined an innovation accelerator program at Singularity University where he met Finnish participant Henrietta Moon. They co-founded Finnish startup Carbo Culture in 2016 with Carstens as CTO based at the California plant.The serial entrepreneur and inventor also founded Hydrate Dynamics as CTO in 2015 to develop gas storage and transportation facilities using clathrate hydrates technology. In 2018, he was appointed by the US Department of Energy to be a member of the Methane Hydrate Advisory Committee until January 2020.

Formerly known as Guangdong Technology Venture Capital Group, Technology Financial Group is a state-owned firm based in Guangzhou. It has a subsidiary in Guangdong province and has set up nine offices in other provinces across China. Technology Financial Group began investing in companies when it was founded in 1992, and it has assets under management of RMB 50bn. With a focus on VC investment, it also provides financial services such as asset management.The firm invests mainly in the high-end equipment manufacturing; new-generation information technology; new material; art, entertainment and media; consumption; biotech and pharmacy; energy and environmental protection; and automotive sectors.

Formerly known as Guangdong Technology Venture Capital Group, Technology Financial Group is a state-owned firm based in Guangzhou. It has a subsidiary in Guangdong province and has set up nine offices in other provinces across China. Technology Financial Group began investing in companies when it was founded in 1992, and it has assets under management of RMB 50bn. With a focus on VC investment, it also provides financial services such as asset management.The firm invests mainly in the high-end equipment manufacturing; new-generation information technology; new material; art, entertainment and media; consumption; biotech and pharmacy; energy and environmental protection; and automotive sectors.

Sofina began in 1898 as Société Financière de Transport et d’Entreprises Industrielles, an engineering conglomerate in Belgium. In the late 1960s, Sofina changed course to become an investment company. As a holding company, its major investments lie in the consumer goods, energy, and distribution sectors, with stakes in companies like Danone and communications satellite operator SES. It has also been involved in various venture capital investment activities, both as an LP to other VCs and as a VC itself, running the Sofina Growth portfolio. The Sofina Growth portfolio spans a wide range of sectors and geographies, from China to Southeast Asia, with investments in notable companies like Zilingo, Byju’s and Kopi Kenangan.

Sofina began in 1898 as Société Financière de Transport et d’Entreprises Industrielles, an engineering conglomerate in Belgium. In the late 1960s, Sofina changed course to become an investment company. As a holding company, its major investments lie in the consumer goods, energy, and distribution sectors, with stakes in companies like Danone and communications satellite operator SES. It has also been involved in various venture capital investment activities, both as an LP to other VCs and as a VC itself, running the Sofina Growth portfolio. The Sofina Growth portfolio spans a wide range of sectors and geographies, from China to Southeast Asia, with investments in notable companies like Zilingo, Byju’s and Kopi Kenangan.

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

CEO and founder of SOURCE Global (formerly Zero Mass Water)

Cody Frieson is the US founder and CEO of SOURCE Global (formerly Zero Mass Water), the first off-grid drinking water production tech based on solar-powered panels. The Arizona State University Fulton Engineering School professor of innovation invented the Hydropanel, the key to SOURCE’s technology, and continues to teach part-time at the university. He is also a fellow at both the NGO Aspen Institute, which is committed to realizing a free, just and equitable society, and also at Unreasonable – an entity composed of entrepreneurs, institutions and investors dedicated to “discover profit in solving global problems.”Frieson was also previously founder, president and CTO of rechargeable zinc battery startup Fluidic Energy, another of his inventions, where he worked from 2007 to 2013, when it was acquired and became NantEnergy. In 2019, Freison won the Lemelson-MIT Student Prize for innovations to benefit the world – the US’ most prestigious student innovation award with a $500,000 prize. Frieson holds a PhD in Materials Science and Engineering from The Massachusetts Institute of Technology (MIT).

Cody Frieson is the US founder and CEO of SOURCE Global (formerly Zero Mass Water), the first off-grid drinking water production tech based on solar-powered panels. The Arizona State University Fulton Engineering School professor of innovation invented the Hydropanel, the key to SOURCE’s technology, and continues to teach part-time at the university. He is also a fellow at both the NGO Aspen Institute, which is committed to realizing a free, just and equitable society, and also at Unreasonable – an entity composed of entrepreneurs, institutions and investors dedicated to “discover profit in solving global problems.”Frieson was also previously founder, president and CTO of rechargeable zinc battery startup Fluidic Energy, another of his inventions, where he worked from 2007 to 2013, when it was acquired and became NantEnergy. In 2019, Freison won the Lemelson-MIT Student Prize for innovations to benefit the world – the US’ most prestigious student innovation award with a $500,000 prize. Frieson holds a PhD in Materials Science and Engineering from The Massachusetts Institute of Technology (MIT).

Beta-i was established in 2010 as a Portuguese accelerator, incubator and event organizer to boost the Portuguese tech ecosystem. Beta-i is well-known for organizing some of Portugal's most successful accelerators and the annual tech startup event Lisbon Investment Summit. In 2019, it made its first investment in a startup Didimo by joining the seed round for the 3D digital twin designer platform.The company's best known acceleration program Lisbon Challenge is a twice yearly event open to all tech sectors, attracting around 10 participants based in Portugal and overseas. Its two-month programs have accelerated more than 200 startups, with about 75% coming from abroad. Beta-i also organizes the international energy accelerator Free Electrons, with EDP as one of its sponsors. Free Electrons has already accelerated 27 startups and is now running its third edition with 15 startups, five of which are Portugal-based. All the selected participants will have the chance to work for one year with at least one of the 10 global energy utilities that form the Free Electrons consortium. Another Beta-i event is The Journey, the first accelerator in Portugal dedicated to tourism tech startups from all over the world. Launched in partnership with the government's Portugal Tourism in 2017, the Lisbon-based program is part of the national Tourism 4.0 plan. The five-month program is now in its third edition and gives successful applicants the opportunity to develop pilot projects with Portuguese companies like the Vila Galé hotel chain, Barraqueiro transport company and Parques de Sintra, a UNESCO World Heritage site.

Beta-i was established in 2010 as a Portuguese accelerator, incubator and event organizer to boost the Portuguese tech ecosystem. Beta-i is well-known for organizing some of Portugal's most successful accelerators and the annual tech startup event Lisbon Investment Summit. In 2019, it made its first investment in a startup Didimo by joining the seed round for the 3D digital twin designer platform.The company's best known acceleration program Lisbon Challenge is a twice yearly event open to all tech sectors, attracting around 10 participants based in Portugal and overseas. Its two-month programs have accelerated more than 200 startups, with about 75% coming from abroad. Beta-i also organizes the international energy accelerator Free Electrons, with EDP as one of its sponsors. Free Electrons has already accelerated 27 startups and is now running its third edition with 15 startups, five of which are Portugal-based. All the selected participants will have the chance to work for one year with at least one of the 10 global energy utilities that form the Free Electrons consortium. Another Beta-i event is The Journey, the first accelerator in Portugal dedicated to tourism tech startups from all over the world. Launched in partnership with the government's Portugal Tourism in 2017, the Lisbon-based program is part of the national Tourism 4.0 plan. The five-month program is now in its third edition and gives successful applicants the opportunity to develop pilot projects with Portuguese companies like the Vila Galé hotel chain, Barraqueiro transport company and Parques de Sintra, a UNESCO World Heritage site.

Founded in 2015, Xin Ding Capital makes equity, pre-IPO and overseas investments. It also provides consultation services to startups in the biomedicine, new energy vehicle, chip and semiconductor manufacturing and artificial intelligence sectors that want to get listed on the National Equities Exchange and Quotations, a Chinese over-the-counter system for trading shares of public limited companies. As of May 2018, Xin Ding Capital has invested nearly RMB 2 billion in over 30 projects.

Founded in 2015, Xin Ding Capital makes equity, pre-IPO and overseas investments. It also provides consultation services to startups in the biomedicine, new energy vehicle, chip and semiconductor manufacturing and artificial intelligence sectors that want to get listed on the National Equities Exchange and Quotations, a Chinese over-the-counter system for trading shares of public limited companies. As of May 2018, Xin Ding Capital has invested nearly RMB 2 billion in over 30 projects.

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

Rodolfo Lomascolo is a serial entrepreneur with a strong technical foundation in the software, e-commerce and energy sector. He has more than 25 years of experience in C-level positions and is one of the pioneers who fostered the early growth of the tech ecosystem in Spain. For over 14 years, Lomascolo was CEO of the Internet Publishing Services Certification Authority (ipsCA) that was eventually acquired by the STS Group, of which he was subsequently vice-president of International Business Development, growing the company's revenue from zero to €30m in three years. In 2015, he became co-founder and CEO of Pervasive Technologies, a company that deploys big data, machine learning and IoT for digital innovation.

Rodolfo Lomascolo is a serial entrepreneur with a strong technical foundation in the software, e-commerce and energy sector. He has more than 25 years of experience in C-level positions and is one of the pioneers who fostered the early growth of the tech ecosystem in Spain. For over 14 years, Lomascolo was CEO of the Internet Publishing Services Certification Authority (ipsCA) that was eventually acquired by the STS Group, of which he was subsequently vice-president of International Business Development, growing the company's revenue from zero to €30m in three years. In 2015, he became co-founder and CEO of Pervasive Technologies, a company that deploys big data, machine learning and IoT for digital innovation.

SoftBank Internet and Media Inc (SIMI)

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

Founded by the charismatic Japanese billionaire Masayoshi Son, SoftBank Group Corp is a multinational conglomerate with assets totaling about $342bn in 2020. SoftBank is best known in Japan for its mobile phone network and distribution business, and it was the sole distributor of the Apple iPhone in Japan until 2011. SoftBank also has subsidiaries in online gaming, publishing, and energy, and owns stakes in Alibaba Group and Sprint.Outside of Japan, SoftBank is known for its venture capital investments. In October 2016, it teamed up with Saudi Arabia's Public Investment Fund to lead a $100bn tech fund, named Vision Fund. Through Vision Fund, SoftBank has made some major high-profile investments into tech companies, such as TikTok developer ByteDance, e-commerce platforms like Coupang, Tokopedia and Flipkart, and coworking operator WeWork.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

X1 Wind's PivotBuoy: Innovative floating platform to help scale offshore wind energy

With a downwind turbine on its patented single point mooring system, Spanish startup X1 Wind aims to disrupt the market with light, cheaper and easy to install offshore platforms

Portugal looks to its marine heritage to create an oceantech leader

Portugal is tapping oceantech disruption to create new value out of its blue economy, with strong government push

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Jungle.ai: Tapping data and AI to prevent outages and breakdowns

Forewarned is forearmed. Performance predictions by Jungle.ai can help save billions of dollars and hours of frustration caused by sudden power failures

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

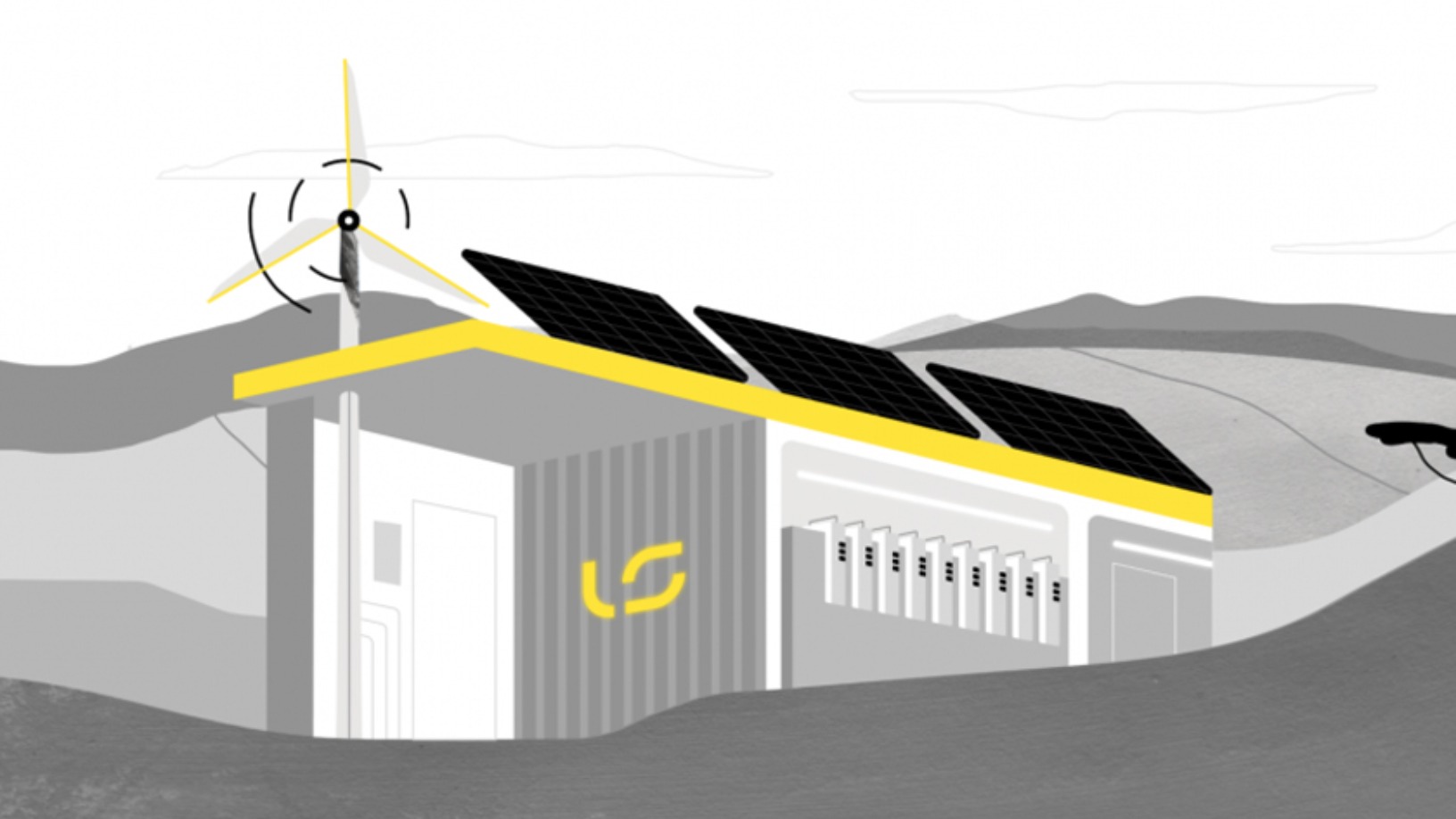

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

Solatom: Cost-effective flatpack mobile solar energy units for SMEs

Solatom's turnkey solar thermal solutions can cut energy costs by 37%. Its real-time data analytics can also be used to ensure that the industrial processing units are operating at optimal conditions

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

Dipole Tech: Using blockchain to democratize access to renewable energy in Asia

Having established key markets in the Philippines and Thailand, China’s Dipole Tech is next gaining ground at home for its energy trading app

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

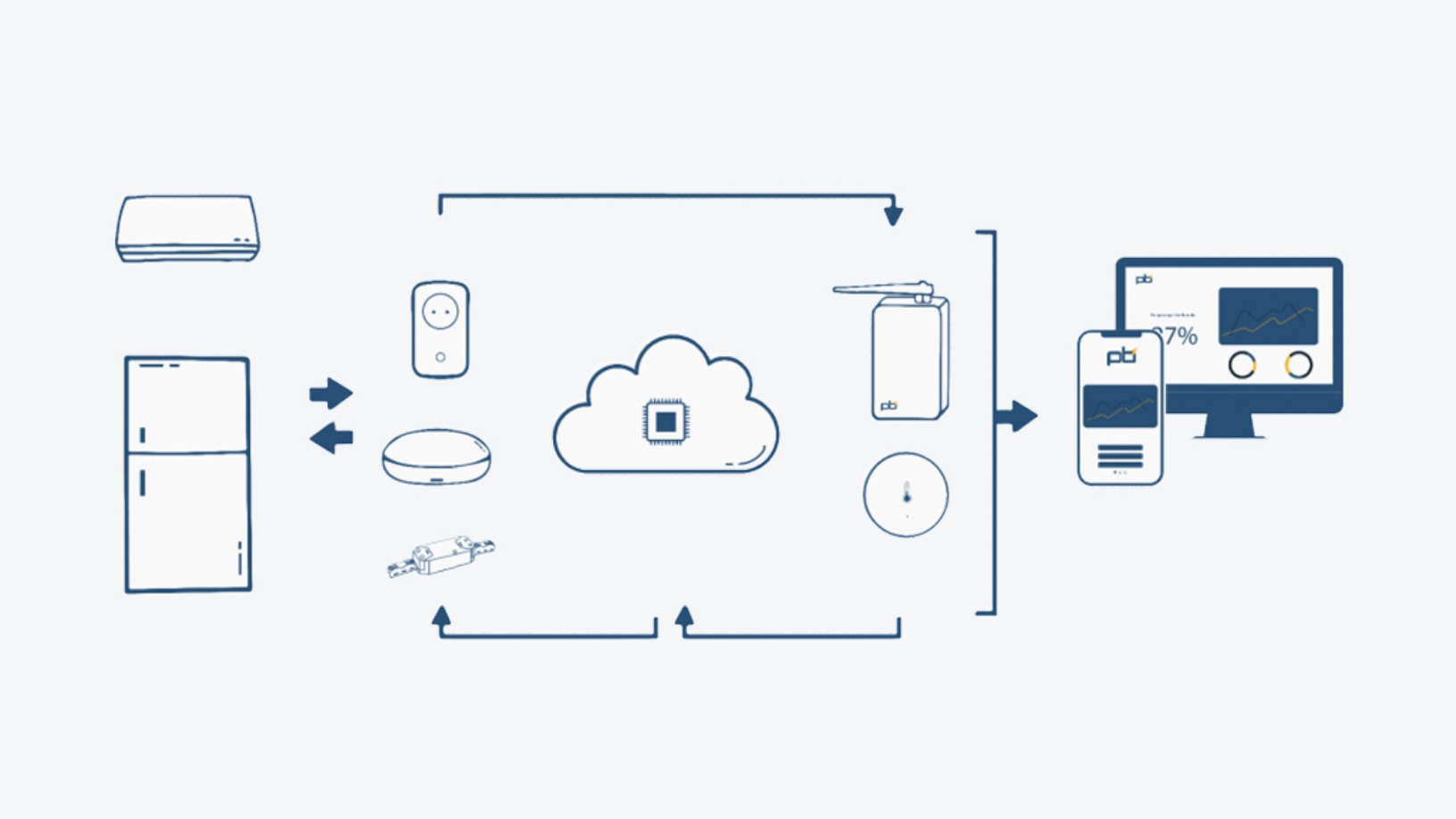

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

Sorry, we couldn’t find any matches for“Offshore energy”.