Orizon T

-

DATABASE (14)

-

ARTICLES (122)

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Co-founder and COO of Aruna

Indraka Fadhlillah became an entrepreneur after graduating from university. Between 2011 and 2015, he was the co-founder and CEO of a T-shirt production startup “Give Production”. In 2015, he joined two former Telkom University students to establish PasarLaut.com that was later re-branded as Aruna. Hailing from the coastal region, Indraka is building up connections in the fishery business as the COO of Aruna.

Indraka Fadhlillah became an entrepreneur after graduating from university. Between 2011 and 2015, he was the co-founder and CEO of a T-shirt production startup “Give Production”. In 2015, he joined two former Telkom University students to establish PasarLaut.com that was later re-branded as Aruna. Hailing from the coastal region, Indraka is building up connections in the fishery business as the COO of Aruna.

Founder and CEO of Geetest

After graduating with a bachelor’s degree in Remote Sensing and Information Engineering from Wuhan University in 2009, Wu worked as a lab researcher at his alma mater. In 2012, he left Wuhan University to found Geetest with Zhang Zhenyu.

After graduating with a bachelor’s degree in Remote Sensing and Information Engineering from Wuhan University in 2009, Wu worked as a lab researcher at his alma mater. In 2012, he left Wuhan University to found Geetest with Zhang Zhenyu.

Deutsche Telekom is Germany's largest telecoms company, with operations in over 50 countries and more than 178 million mobile customers. It is a major investor in tech companies and has managed more than 20 investments and seven acquisitions to date. Its most well-known acquisition is teleco operator T-Mobile for €828m in 2014. Recent investments include HypeLabs' US$3m seed round and the €6m Series A round of automated IoT platform Axonise.

Deutsche Telekom is Germany's largest telecoms company, with operations in over 50 countries and more than 178 million mobile customers. It is a major investor in tech companies and has managed more than 20 investments and seven acquisitions to date. Its most well-known acquisition is teleco operator T-Mobile for €828m in 2014. Recent investments include HypeLabs' US$3m seed round and the €6m Series A round of automated IoT platform Axonise.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

TI Platform Management is a US-based investment firm founded by Alex Bangash and Trang T Nguyen, who are also the founders of LP network and investment news platform TrustedInsight. Founded in 2015, the firm seeks out disruptive business models and invests in a range of categories, from furniture and home construction to healthcare and deep-tech. It has invested in Singapore-based enzyme engineering startup Allozymes, B2B pharmacy fulfillment service TruePill, and supply chain management startup Tyltgo.

TI Platform Management is a US-based investment firm founded by Alex Bangash and Trang T Nguyen, who are also the founders of LP network and investment news platform TrustedInsight. Founded in 2015, the firm seeks out disruptive business models and invests in a range of categories, from furniture and home construction to healthcare and deep-tech. It has invested in Singapore-based enzyme engineering startup Allozymes, B2B pharmacy fulfillment service TruePill, and supply chain management startup Tyltgo.

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Product Manager and co-founder of SigmaRail

Mario Fernández Marín is Co-founder of railway consultancy firm SigmaRail and is also its product manager. From 2004 to 2008, Fernández undertook internships at several Spanish and French enterprises including Unión Fenosa, Dusco-SesameTV, Groupe Assonance and IRCICA. He was a research engineer at the Polytechnic University of Madrid before joining Airbus in 2009, where he working at both its Paris and Madrid operations. He later became Lead Design Engineer at both Siemens and Thales for three years. Fernández is a telecommunications engineering graduate of the Polytechnic University of Madrid.

Mario Fernández Marín is Co-founder of railway consultancy firm SigmaRail and is also its product manager. From 2004 to 2008, Fernández undertook internships at several Spanish and French enterprises including Unión Fenosa, Dusco-SesameTV, Groupe Assonance and IRCICA. He was a research engineer at the Polytechnic University of Madrid before joining Airbus in 2009, where he working at both its Paris and Madrid operations. He later became Lead Design Engineer at both Siemens and Thales for three years. Fernández is a telecommunications engineering graduate of the Polytechnic University of Madrid.

Chow Tai Fook Jewellery Group Limited

Hong Kong-based Chow Tai Fook Jewellery Group Limited was founded as a jewelry store in Guangzhou in 1929. Listed on the Stock Exchange of Hong Kong in December 2011, it is one of the world's largest jewelry companies, with total assets of around US$8 billion. The Group owns several jewelry brands, including Chow Tai Fook, Chow Tai Fook T MARK, Hearts On Fire, MONOLOGUE and SOINLOVE, and operates a retail network in East Asia and the US. The Group invests in other firms through its VMS Legend Investment Fund, which has funded companies from fields such as fintech, hardware, healthcare, streaming media and cloud.

Hong Kong-based Chow Tai Fook Jewellery Group Limited was founded as a jewelry store in Guangzhou in 1929. Listed on the Stock Exchange of Hong Kong in December 2011, it is one of the world's largest jewelry companies, with total assets of around US$8 billion. The Group owns several jewelry brands, including Chow Tai Fook, Chow Tai Fook T MARK, Hearts On Fire, MONOLOGUE and SOINLOVE, and operates a retail network in East Asia and the US. The Group invests in other firms through its VMS Legend Investment Fund, which has funded companies from fields such as fintech, hardware, healthcare, streaming media and cloud.

Joe Zhou graduated from Beijing University of Technology in 1982 and worked five years as a lecturer at his alma mater. In 1987, he went to study in the US and obtained a master’s at the New Jersey Institute of Technology in 1989. He stayed in New Jersey and worked for five years at AT&T Bell Labs and its spin-off Lepton Inc.In 1995, Zhou returned to work in China as the VP of UTStarcom China until 1999 when he joined Softbank China Venture Capital as the head of its Beijing office. In October 2001, he became a partner at Softbank’s SAIF for five years. In 2007, he became a founding managing partner at Kleiner Perkins Caufield & Byers China. In April 2008, he co-founded Keytone Ventures as managing partner.

Joe Zhou graduated from Beijing University of Technology in 1982 and worked five years as a lecturer at his alma mater. In 1987, he went to study in the US and obtained a master’s at the New Jersey Institute of Technology in 1989. He stayed in New Jersey and worked for five years at AT&T Bell Labs and its spin-off Lepton Inc.In 1995, Zhou returned to work in China as the VP of UTStarcom China until 1999 when he joined Softbank China Venture Capital as the head of its Beijing office. In October 2001, he became a partner at Softbank’s SAIF for five years. In 2007, he became a founding managing partner at Kleiner Perkins Caufield & Byers China. In April 2008, he co-founded Keytone Ventures as managing partner.

Founded under a different name in 2002, the company became UCAR in 2016. A comprehensive car services provider, it now operates in nearly 300 cities across China. It has served around 60 million Chinese users and manages a total of 400,000 vehicles. UCAR has four business units: car rental service provider zuche.com, chauffeured car service provider 10101111.com, auto e-commerce platform maimaiche.com and automotive financing service platform carbank.cn. It invests in automotive businesses and startups.

Founded under a different name in 2002, the company became UCAR in 2016. A comprehensive car services provider, it now operates in nearly 300 cities across China. It has served around 60 million Chinese users and manages a total of 400,000 vehicles. UCAR has four business units: car rental service provider zuche.com, chauffeured car service provider 10101111.com, auto e-commerce platform maimaiche.com and automotive financing service platform carbank.cn. It invests in automotive businesses and startups.

Co-founder of NPAW

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Nutrinsect: Aiming at insects for human consumption for the planet's sake

Nutrinsect expects insect-based foodstuffs to supplement meat to satisfy the ever-growing hunger for protein

Day Day Cook: Creating content that sells

She may not be a celebrity chef but Norma Chu, the analyst-turned-cook, is a familiar face in food-obsessed Hong Kong, where she has her recipe website to encourage youths to learn cooking

TOPDOX relaunched: from consumer to corporate

Half a million users later, productivity software startup TOPDOX made the jump to B2B. Its co-founder and CEO, Nelson Pereira, tells us why

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Faromatics' ChickenBoy robot brings smart analytics to poultry farming

The makers of the AI-based robot for managing large-scale poultry farming are seeking up to €4m in a second round funding as they launch their invention in Europe

The rising Indonesian edtech star wants to help high-school dropouts earn their diploma and learn the relevant skills to find a job – with an innovative solution lauded at this year’s MIT Solve Challenge

Something positive could come out of the Facebook fallout

Users and startups could learn a lot from the Facebook-Cambridge Analytica scandal. For a start, don’t succumb to apathy

Bobobobo: Indonesian luxury at a click

Amid a booming local e-commerce market, this startup carves a niche for itself in upscale trending goods and experiences influenced by Indonesia’s rich traditions

In this shipping container, you can work out and save money

By eliminating the need to pay for an expensive gym membership, ParkBox is good news for gym buffs

Indonesian state enterprises launch e-wallet LinkAja, competing with Go-Pay and OVO

Even with a wider range of services and extensive state backing, LinkAja faces a tough battle

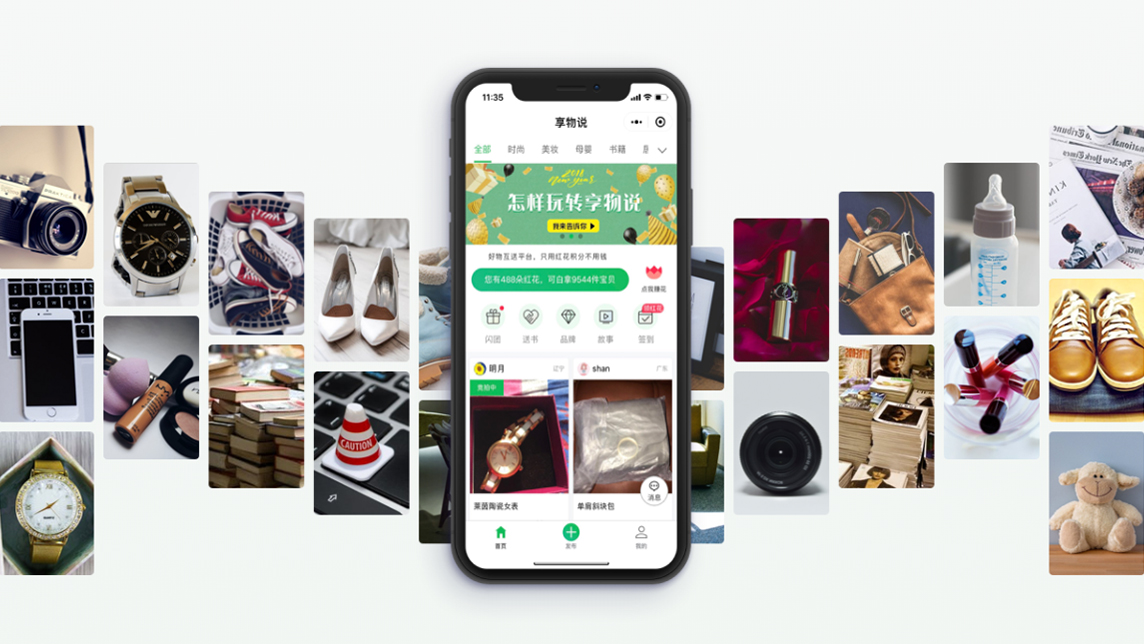

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Will China ride into a car-sharing future?

Chinese car-sharing startups face reckoning as more than 500 players crowd into a fast-growing, but young, market

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

Will this one-year-old startup revolutionize traditional industries?

Targeting retail and tourism first, Aibee aims to help traditional businesses keep up with their online counterparts using its all-in-one AI solutions

#WahyooChallenge: From charity to publicity

Inspired by social media trends, the Wahyoo team came up with a way to give back to society, and found their idea going viral

Sorry, we couldn’t find any matches for“Orizon T”.