Peace-of-Meat

-

DATABASE (996)

-

ARTICLES (811)

Founded in 2000 by Hans-Jurgen Schmitz and Mark Tluszcz, Mangrove Capital Partners is a Luxembourg-based fund. It has, as an early investor, backed four unicorns, namely, Skype, Wix, WalkMe and LetGo, as well as a multitude of other successful tech startups. It participates at all stages of investment and has made over 120 investments, including as lead investor in 40 of these. It has seen 15 exits to date, including Skype and, most recently, has invested in the Seed round of Attentive.us and in the Series B of K Health and Series A of Flo Health.

Founded in 2000 by Hans-Jurgen Schmitz and Mark Tluszcz, Mangrove Capital Partners is a Luxembourg-based fund. It has, as an early investor, backed four unicorns, namely, Skype, Wix, WalkMe and LetGo, as well as a multitude of other successful tech startups. It participates at all stages of investment and has made over 120 investments, including as lead investor in 40 of these. It has seen 15 exits to date, including Skype and, most recently, has invested in the Seed round of Attentive.us and in the Series B of K Health and Series A of Flo Health.

Gan is best known for being the 67th employee of Alibaba and the former COO of Meituan-Dianping. Before joining Alibaba in 1999, Gan had worked at a state-owned coal trading enterprise for five years. At Alibaba, he served in multiple roles, including as director of online operation, director of marketing, regional manager and vice president. Gan left Alibaba to become COO of Meituan in 2011. In 2016, he was named the first president of Meituan-Dianping's Internet Plus University, which was founded to train company employees. Gan resigned from Meituan-Dianping in 2017 to join Hillhouse Capital as managing partner.

Gan is best known for being the 67th employee of Alibaba and the former COO of Meituan-Dianping. Before joining Alibaba in 1999, Gan had worked at a state-owned coal trading enterprise for five years. At Alibaba, he served in multiple roles, including as director of online operation, director of marketing, regional manager and vice president. Gan left Alibaba to become COO of Meituan in 2011. In 2016, he was named the first president of Meituan-Dianping's Internet Plus University, which was founded to train company employees. Gan resigned from Meituan-Dianping in 2017 to join Hillhouse Capital as managing partner.

GF Qianhe is an equity investment company launched by GF Securities in May 2012. Incorporated as Guangfa Qianhe Investments Co Ltd, with a registered capital of RMB 500m, the company was one of the earliest alternative investment companies to gain approval from the Securities Commission of China. As of late 2018, GF Qianhe has invested in 86 equity-related projects, among which four have gone public. By the end of 2014, its total investment value reached almost RMB 2bn and revenues of over RMB 340m.

GF Qianhe is an equity investment company launched by GF Securities in May 2012. Incorporated as Guangfa Qianhe Investments Co Ltd, with a registered capital of RMB 500m, the company was one of the earliest alternative investment companies to gain approval from the Securities Commission of China. As of late 2018, GF Qianhe has invested in 86 equity-related projects, among which four have gone public. By the end of 2014, its total investment value reached almost RMB 2bn and revenues of over RMB 340m.

Ramiro Salamanca is a well-known Spanish lawyer. He holds a degree in Law from the Autonomous University of Madrid and an Executive Master's in Public Management from IE Business School.For more than eight years, Salamanca worked as a lawyer for the Community of Madrid, where he served the Ministry of Environment, Housing and Land Management; the Ministry of Culture and Sports and the Government Spokesman. He was director of legal advice to Madrid Metro from 2012 to 2015.Since 2016, he has acted as CLO of Reclamador.es, a web platform that manages and automates consumer claims.

Ramiro Salamanca is a well-known Spanish lawyer. He holds a degree in Law from the Autonomous University of Madrid and an Executive Master's in Public Management from IE Business School.For more than eight years, Salamanca worked as a lawyer for the Community of Madrid, where he served the Ministry of Environment, Housing and Land Management; the Ministry of Culture and Sports and the Government Spokesman. He was director of legal advice to Madrid Metro from 2012 to 2015.Since 2016, he has acted as CLO of Reclamador.es, a web platform that manages and automates consumer claims.

Rodolfo Lomascolo is a serial entrepreneur with a strong technical foundation in the software, e-commerce and energy sector. He has more than 25 years of experience in C-level positions and is one of the pioneers who fostered the early growth of the tech ecosystem in Spain. For over 14 years, Lomascolo was CEO of the Internet Publishing Services Certification Authority (ipsCA) that was eventually acquired by the STS Group, of which he was subsequently vice-president of International Business Development, growing the company's revenue from zero to €30m in three years. In 2015, he became co-founder and CEO of Pervasive Technologies, a company that deploys big data, machine learning and IoT for digital innovation.

Rodolfo Lomascolo is a serial entrepreneur with a strong technical foundation in the software, e-commerce and energy sector. He has more than 25 years of experience in C-level positions and is one of the pioneers who fostered the early growth of the tech ecosystem in Spain. For over 14 years, Lomascolo was CEO of the Internet Publishing Services Certification Authority (ipsCA) that was eventually acquired by the STS Group, of which he was subsequently vice-president of International Business Development, growing the company's revenue from zero to €30m in three years. In 2015, he became co-founder and CEO of Pervasive Technologies, a company that deploys big data, machine learning and IoT for digital innovation.

Based in Zurich, Swiss Re is a provider of reinsurance, insurance and other forms of insurance-based risk transfers. Founded in 1863, it operates through a network of about 80 offices in 25 countries and regions across the world.

Based in Zurich, Swiss Re is a provider of reinsurance, insurance and other forms of insurance-based risk transfers. Founded in 1863, it operates through a network of about 80 offices in 25 countries and regions across the world.

Artav is the major distributor for XL Axiata, one of Indonesia’s biggest mobile network operators. Founded in 2011, Artav distributes mobile phone products including prepaid/postpaid cards and vouchers through physical retail and electronic channels. Artav is the majority shareholder of Kioson, with a 53% stake in the O2O fintech. One of Artav’s commissioners is Viperi Limiardi who is also a co-founder of Kioson.

Artav is the major distributor for XL Axiata, one of Indonesia’s biggest mobile network operators. Founded in 2011, Artav distributes mobile phone products including prepaid/postpaid cards and vouchers through physical retail and electronic channels. Artav is the majority shareholder of Kioson, with a 53% stake in the O2O fintech. One of Artav’s commissioners is Viperi Limiardi who is also a co-founder of Kioson.

Established in 2015, EQT Ventures is a Stockholm-based investor that describes itself as "half VC, half startup." It has invested in more than 50 companies, acting as lead investor in almost two-thirds of its investments, to date, of a total investment fund of €566m. EQT Ventures invests across sectors locally and globally and has successfully managed the exits of two Scandinavian startups.

Established in 2015, EQT Ventures is a Stockholm-based investor that describes itself as "half VC, half startup." It has invested in more than 50 companies, acting as lead investor in almost two-thirds of its investments, to date, of a total investment fund of €566m. EQT Ventures invests across sectors locally and globally and has successfully managed the exits of two Scandinavian startups.

Jörg Mohaupt is the head of media at Warner Music Group and an angel investor who has funded several startups to date, many in the area of music. His other most recently known investments were in the August 2019 £2.2m seed round of British fintech for adolescents Penfold and in the May 2019 $1.7m seed round of Swedish music sampling store Tracklib.

Jörg Mohaupt is the head of media at Warner Music Group and an angel investor who has funded several startups to date, many in the area of music. His other most recently known investments were in the August 2019 £2.2m seed round of British fintech for adolescents Penfold and in the May 2019 $1.7m seed round of Swedish music sampling store Tracklib.

Zhongguancun Longmen Investment

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

Founded in 2002, Bluesail was initially known as a manufacturer of PVC gloves, with an annual capacity of tens of billions of pairs at its peak. At the end of 2012, it began to expand into more health-related areas.In 2018, it acquired a 93.37% stake in Biosensors International Group that specializes in developing, manufacturing and licensing technologies for use in interventional cardiology procedures and critical care. The two companies were merged and Bluesail began to produce more high-end medical consumables. In 2019, the company and senior executives invested in CH Biomedical to collaborate in the development of innovative medical devices for sale in China and overseas.

Founded in 2002, Bluesail was initially known as a manufacturer of PVC gloves, with an annual capacity of tens of billions of pairs at its peak. At the end of 2012, it began to expand into more health-related areas.In 2018, it acquired a 93.37% stake in Biosensors International Group that specializes in developing, manufacturing and licensing technologies for use in interventional cardiology procedures and critical care. The two companies were merged and Bluesail began to produce more high-end medical consumables. In 2019, the company and senior executives invested in CH Biomedical to collaborate in the development of innovative medical devices for sale in China and overseas.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

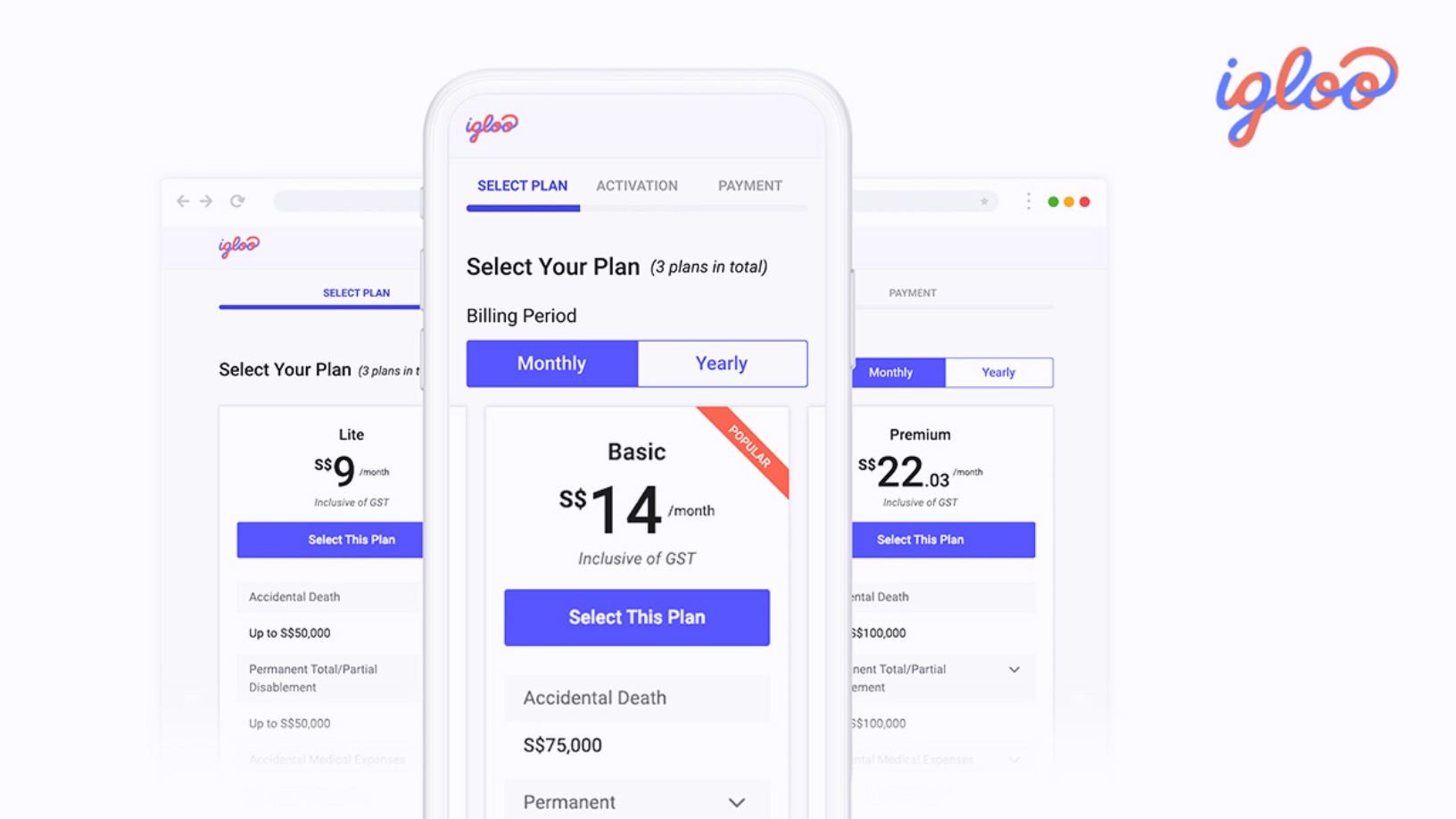

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Xrush makes brushing fun for kids with "smart toothbrushes"

Imitating every brushing move by a child, Xrush's smart gadget uses interactive games to motivate kids to brush their teeth properly

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Affordable pet healthcare insurance at your finger “Tips”

Over 78% of China's pet owners buy insurance to get the best services for their dogs and cats. Tips, an online platform for pet insurance and healthcare products, wants their business

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

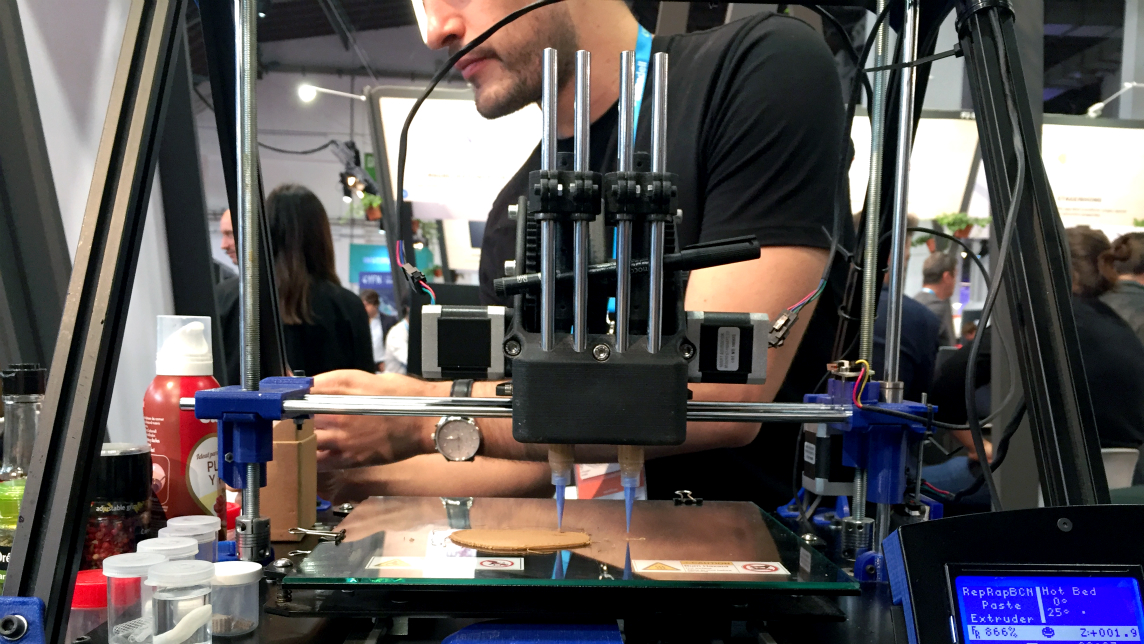

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“Peace-of-Meat”.