Peace-of-Meat

-

DATABASE (996)

-

ARTICLES (811)

Falkenbergs Sparbanks Foundation

Falkenbergs Sparbanks Foundation is part of the Swedish savings bank in the municpality of Falkenberg. Falkenbergs Sparbank is the 37th largest bank in Sweden in terms of total assets.

Falkenbergs Sparbanks Foundation is part of the Swedish savings bank in the municpality of Falkenberg. Falkenbergs Sparbank is the 37th largest bank in Sweden in terms of total assets.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Scottish Enterprise, a public arm of the Scottish Government, facilitates investments and economic growth of businesses in the eastern, central, and southern areas of Scotland. Led by Chairman Bob Keiller, Scottish Enterprise fulfills the objectives of the Scottish Government. It employs 1,100 staff across 14 offices in the UK and 33 overseas.Founded in 1975 as the Scottish Development Agency (SDA), it changed into Scottish Enterprise in 1991. Its operative structure was initially formed by Local Enterprise Companies (LECs) with boards led by local entrepreneurs. Since 2000, former limited companies have become wholly-owned subsidiaries of the Scottish Enterprise.Based on its performance report for 2017–2018, Scottish Enterprise has helped portfolio companies with £315m in R&D funds and secured capital investment of £215m.

Scottish Enterprise, a public arm of the Scottish Government, facilitates investments and economic growth of businesses in the eastern, central, and southern areas of Scotland. Led by Chairman Bob Keiller, Scottish Enterprise fulfills the objectives of the Scottish Government. It employs 1,100 staff across 14 offices in the UK and 33 overseas.Founded in 1975 as the Scottish Development Agency (SDA), it changed into Scottish Enterprise in 1991. Its operative structure was initially formed by Local Enterprise Companies (LECs) with boards led by local entrepreneurs. Since 2000, former limited companies have become wholly-owned subsidiaries of the Scottish Enterprise.Based on its performance report for 2017–2018, Scottish Enterprise has helped portfolio companies with £315m in R&D funds and secured capital investment of £215m.

Founded in 2014 by Cao Yi, formerly of Sequoia Capital and Ceyuan Ventures, Source Code Capital currently manages about US$500 million of capital, focusing on early-stage TMT (especially fintech, O2O, e-commerce) investments. Notable investments have included Qufenqi, Meituan, and PPzuche. Source Code Capital is part of the Sequoia Capital China.

Founded in 2014 by Cao Yi, formerly of Sequoia Capital and Ceyuan Ventures, Source Code Capital currently manages about US$500 million of capital, focusing on early-stage TMT (especially fintech, O2O, e-commerce) investments. Notable investments have included Qufenqi, Meituan, and PPzuche. Source Code Capital is part of the Sequoia Capital China.

InnoSpace is a startup service platform focusing on the early stage incubation of internet/mobile internet companies, with RMB angel funds and two 3-month startup accelerator programs each year. InnoSpace has helped its projects raise about RMB 600 million in total and is one of the four incubator partners of Intel in China.

InnoSpace is a startup service platform focusing on the early stage incubation of internet/mobile internet companies, with RMB angel funds and two 3-month startup accelerator programs each year. InnoSpace has helped its projects raise about RMB 600 million in total and is one of the four incubator partners of Intel in China.

Founded in 2012 by Wang Yawei, the former vice-president of China Asset Management and the founder of Top Ace Asset Management, Qianhe Capital provides asset management, equity investment and investment management services. As of April 2017, Qianhe Capital had RMB 24 billion under management and issued 11 trust plans and asset management plans.

Founded in 2012 by Wang Yawei, the former vice-president of China Asset Management and the founder of Top Ace Asset Management, Qianhe Capital provides asset management, equity investment and investment management services. As of April 2017, Qianhe Capital had RMB 24 billion under management and issued 11 trust plans and asset management plans.

Juan Campmany Ibañez is one of the founders of Tandem Campmany Guasch, a Spanish advertising agency that merged with the network DDB Worldwide in 1979. In 1997, he was appointed the CEO of DDB Madrid. Campmany is well known as an industry expert, responsible for shaping Spain’s advertising industry for over 40 years.

Juan Campmany Ibañez is one of the founders of Tandem Campmany Guasch, a Spanish advertising agency that merged with the network DDB Worldwide in 1979. In 1997, he was appointed the CEO of DDB Madrid. Campmany is well known as an industry expert, responsible for shaping Spain’s advertising industry for over 40 years.

Established in 2011, ShouTaiJinXin Fund is the institutional manager of a private fund under Shoutai Group. Qualified for private securities investment, equity investment and venture capital investment, ShouTaiJinXin Fund invests in the fields of education, automobile, transportation, healthcare, entertainment, corporate services, among others. By the end of 2016, it had managed funds worth RMB 60 billion in total.

Established in 2011, ShouTaiJinXin Fund is the institutional manager of a private fund under Shoutai Group. Qualified for private securities investment, equity investment and venture capital investment, ShouTaiJinXin Fund invests in the fields of education, automobile, transportation, healthcare, entertainment, corporate services, among others. By the end of 2016, it had managed funds worth RMB 60 billion in total.

The Repsol Foundation, part of the Repsol Group, is committed to improving social and environmental outcomes.Repsol has launched a €50m social investment fund to be used in developing a portfolio of social enterprises focused on energy transition and social inclusion of vulnerable groups in Spain. The firm invested €9,5m during 2018.

The Repsol Foundation, part of the Repsol Group, is committed to improving social and environmental outcomes.Repsol has launched a €50m social investment fund to be used in developing a portfolio of social enterprises focused on energy transition and social inclusion of vulnerable groups in Spain. The firm invested €9,5m during 2018.

A major competitor of Douyin (Chinese version of TikTok), the short-video platform Kuaishou was launched in March 2011. The company currently has 262.4m daily active users for its app. Over 2.6m pieces of short videos are uploaded everyday by its users. Kuaishou went public in Hong Kong in February 2021.

A major competitor of Douyin (Chinese version of TikTok), the short-video platform Kuaishou was launched in March 2011. The company currently has 262.4m daily active users for its app. Over 2.6m pieces of short videos are uploaded everyday by its users. Kuaishou went public in Hong Kong in February 2021.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

VAS Ventures is the investment vehicle of Martin Varsavsky, a serial entrepreneur from Argentina and founder of companies such as Jazztel, Fon, Ya.com, Prelude and Viatel.Varsavsky began teaching entrepreneurship at Columbia University in 2012. He is also a member of the Advisory Council for Innovation in Justice, created by the Spanish Ministry of Justice in February 2018.VAS Ventures is headquartered in Madrid and has been co-investing with German publishing house Axel Springer since 2019.

VAS Ventures is the investment vehicle of Martin Varsavsky, a serial entrepreneur from Argentina and founder of companies such as Jazztel, Fon, Ya.com, Prelude and Viatel.Varsavsky began teaching entrepreneurship at Columbia University in 2012. He is also a member of the Advisory Council for Innovation in Justice, created by the Spanish Ministry of Justice in February 2018.VAS Ventures is headquartered in Madrid and has been co-investing with German publishing house Axel Springer since 2019.

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

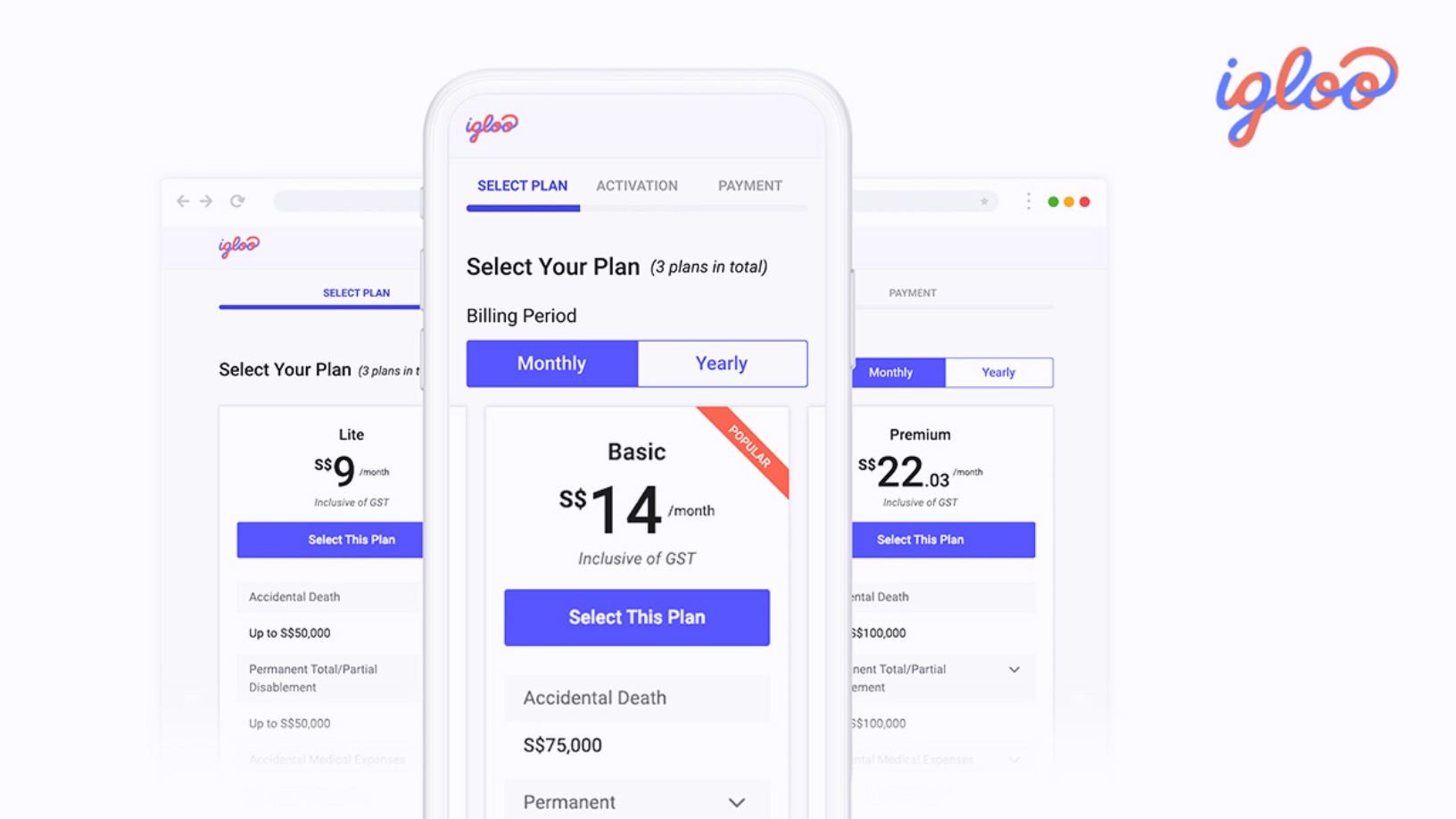

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Xrush makes brushing fun for kids with "smart toothbrushes"

Imitating every brushing move by a child, Xrush's smart gadget uses interactive games to motivate kids to brush their teeth properly

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Affordable pet healthcare insurance at your finger “Tips”

Over 78% of China's pet owners buy insurance to get the best services for their dogs and cats. Tips, an online platform for pet insurance and healthcare products, wants their business

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

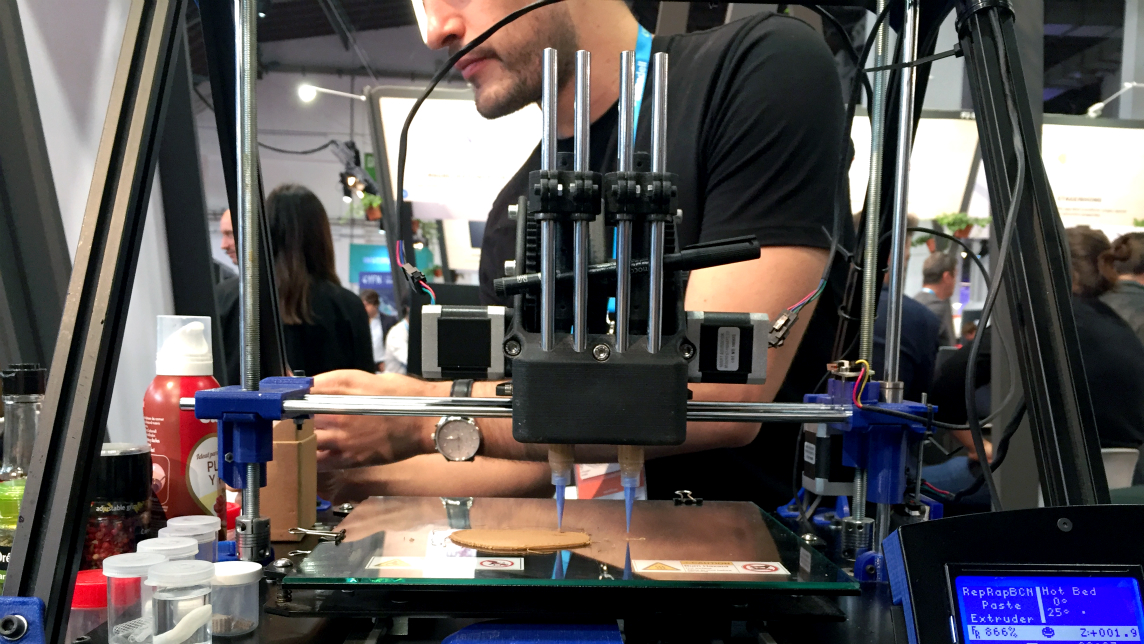

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“Peace-of-Meat”.