Peace-of-Meat

-

DATABASE (996)

-

ARTICLES (811)

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

Charles Songhurst is a founding partner of hedge fund Katana Capital and also runs the Songhurst Group, which holds assets in a variety of private companies, besides being a prolific angel investor having invested in more than 500 companies to date across sectors and geographies. His most recent investments have included in the 2021 seed rounds of home-based eye medtech Quadrant Eye and in the $2m funding of Canadian small business logistics startup Tyltgo. Songhurst is a former general manager and former head of corporate strategy at Microsoft. He has a bachelor's in philosophy, politics and economics from Oxford University.

Gemilang Dana Sentosa is an entity formed by shareholders of DOKU, one of Indonesia’s pioneering e-wallet services. Its most notable investment is in Bareksa, an online investment portal.

Gemilang Dana Sentosa is an entity formed by shareholders of DOKU, one of Indonesia’s pioneering e-wallet services. Its most notable investment is in Bareksa, an online investment portal.

Citic Private Equity Funds Management

A private equity arm of China state-backed conglomerate Citic Group Corp., CITICPE is one of the largest PE investors in China, with RMB 9 billion under management.

A private equity arm of China state-backed conglomerate Citic Group Corp., CITICPE is one of the largest PE investors in China, with RMB 9 billion under management.

Founder and CEO of GiftTalk, a Chinese gift-giving platform. Wen, a friend of Chen Anni, helped her found Kuaikan (formerly Kuaikan Comic) as an angel investor.

Founder and CEO of GiftTalk, a Chinese gift-giving platform. Wen, a friend of Chen Anni, helped her found Kuaikan (formerly Kuaikan Comic) as an angel investor.

Mohit Goel is one of India’s youngest real estate tycoons and an angel investor. He appeared as one of a panel of potential investors on the India reality TV show The Vault, which features start-ups pitching their business ideas to angel investors in order to seek funding. Goel is CEO of Omaxe, a real estate firm based in New Delhi. As the second-generation head of the company, he was credited for structural changes aimed at turning the firm around amidst challenging market conditions and introducing fresh concepts and customer-centric ideas to strengthen the business. Goel is also the north zone head of CREDAI Youth Wing, an industry body bringing together the next generation of leaders in India’s real estate and property developer market. In 2014, he was named Young Male Entrepreneur of the Year at the Infra & Realty Sutra Awards and also received the Young Achiever’s Award at ABP News’ Real Estate Awards.

Mohit Goel is one of India’s youngest real estate tycoons and an angel investor. He appeared as one of a panel of potential investors on the India reality TV show The Vault, which features start-ups pitching their business ideas to angel investors in order to seek funding. Goel is CEO of Omaxe, a real estate firm based in New Delhi. As the second-generation head of the company, he was credited for structural changes aimed at turning the firm around amidst challenging market conditions and introducing fresh concepts and customer-centric ideas to strengthen the business. Goel is also the north zone head of CREDAI Youth Wing, an industry body bringing together the next generation of leaders in India’s real estate and property developer market. In 2014, he was named Young Male Entrepreneur of the Year at the Infra & Realty Sutra Awards and also received the Young Achiever’s Award at ABP News’ Real Estate Awards.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

Jason Stockwood is the chairman and co-owner of Grimsby Town Football Club. The Grimsby working-class lad managed to get a scholarship to study in the US, worked at Trailfinders and Lastminute.com in the 1990s. He was a non-executive director of Skyscanner and international MD at Travelocity Business and also at Match.com. In 2010, he became the CEO and vice-chair of online insurance company, Simply Business, that was sold for £400m in 2017.The co-founder of VC 53° has also invested in British startups across market segments, including the Series B investment round of food-sharing app OLIO in September 2021 and August 2020 financing of carbon tracking platform for banks and investors CoGo UK.

Jason Stockwood is the chairman and co-owner of Grimsby Town Football Club. The Grimsby working-class lad managed to get a scholarship to study in the US, worked at Trailfinders and Lastminute.com in the 1990s. He was a non-executive director of Skyscanner and international MD at Travelocity Business and also at Match.com. In 2010, he became the CEO and vice-chair of online insurance company, Simply Business, that was sold for £400m in 2017.The co-founder of VC 53° has also invested in British startups across market segments, including the Series B investment round of food-sharing app OLIO in September 2021 and August 2020 financing of carbon tracking platform for banks and investors CoGo UK.

The Ford Foundation is an international philanthropy established in 1936 by Edsel Ford, son of the founder of the Ford Motor Company Henry Ford. The foundation funds initiatives in various fields with the goal of advancing human welfare. Headquartered in New York, it has offices outside the US, including an Indonesian branch that was opened in 1953. In 2014, it awarded a total of US$750,000 to 12 projects through Cipta Media Seluler (CMS), an open grant that supports social change initiatives powered by mobile phone-related technologies in Indonesia.

The Ford Foundation is an international philanthropy established in 1936 by Edsel Ford, son of the founder of the Ford Motor Company Henry Ford. The foundation funds initiatives in various fields with the goal of advancing human welfare. Headquartered in New York, it has offices outside the US, including an Indonesian branch that was opened in 1953. In 2014, it awarded a total of US$750,000 to 12 projects through Cipta Media Seluler (CMS), an open grant that supports social change initiatives powered by mobile phone-related technologies in Indonesia.

Launched in 2007, Seedcamp is Europe’s first seed fund and accelerator. Founded by 30 European investors, it focuses on pre-seed and seed stage startups. It has backed nearly 200 companies, producing one unicorn. About 90% of its portfolio have raised further funding of about US$350 million.The company typically invests in one of three ways:€75,000 for 7% of equityFull access to the Seedcamp Platform for 3% warrantsUp to €200,000 in seed funding

Launched in 2007, Seedcamp is Europe’s first seed fund and accelerator. Founded by 30 European investors, it focuses on pre-seed and seed stage startups. It has backed nearly 200 companies, producing one unicorn. About 90% of its portfolio have raised further funding of about US$350 million.The company typically invests in one of three ways:€75,000 for 7% of equityFull access to the Seedcamp Platform for 3% warrantsUp to €200,000 in seed funding

Álvaro Ortiz is a business angel with over 15 years of experience in the fields of User Experience, E-commerce, Communities, Online Marketing, Front-end development and Project Management.He founded Mumumío, an e-commerce platform that sold quality food directly from producers. Ortiz is currently the CEO and founder of Populate, a startup that builds tools and platforms for civic engagement.Besides being an internet expert and a founder of several startups, he has also been involved in fundraising for other startups.

Álvaro Ortiz is a business angel with over 15 years of experience in the fields of User Experience, E-commerce, Communities, Online Marketing, Front-end development and Project Management.He founded Mumumío, an e-commerce platform that sold quality food directly from producers. Ortiz is currently the CEO and founder of Populate, a startup that builds tools and platforms for civic engagement.Besides being an internet expert and a founder of several startups, he has also been involved in fundraising for other startups.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Lachy Groom is a young San Francisco-based Australian entrepreneur and angel investor who gained recognition as a teenage coder and was founder of Cardnap and PSDtoWP, acquired by PSD2HTML.com. He also ran fintech Stripe until 2018. To date, he has invested in nine early-stage startups. His recent investments include in the $9m second phase of home physiotherapy tech solution SWORD Health's Series A round, in the $3.8m seed round of collaboration platform for data scientists, Deepnote, and in the $2.2m seed round of trading platform Convictional.

Lachy Groom is a young San Francisco-based Australian entrepreneur and angel investor who gained recognition as a teenage coder and was founder of Cardnap and PSDtoWP, acquired by PSD2HTML.com. He also ran fintech Stripe until 2018. To date, he has invested in nine early-stage startups. His recent investments include in the $9m second phase of home physiotherapy tech solution SWORD Health's Series A round, in the $3.8m seed round of collaboration platform for data scientists, Deepnote, and in the $2.2m seed round of trading platform Convictional.

Ufi Ventures is the investment arm of Ufi VocTech Trust, a UK-based grant-funding body created following the sale of Learndirect in 2010. With an initial fund of £50m, the organization is focussed on delivering an increase in the scale of vocational learning. The firm can invest from £150,000 to £1m as equity or debt in early-stage companies. To date, its disclosed investments include many UK public-private training initiatives, plus seed investments in two tech startups: soft-skills VR software Bodyswaps (£470,000) and childcare marketplace Kinderly (£325,000).

Ufi Ventures is the investment arm of Ufi VocTech Trust, a UK-based grant-funding body created following the sale of Learndirect in 2010. With an initial fund of £50m, the organization is focussed on delivering an increase in the scale of vocational learning. The firm can invest from £150,000 to £1m as equity or debt in early-stage companies. To date, its disclosed investments include many UK public-private training initiatives, plus seed investments in two tech startups: soft-skills VR software Bodyswaps (£470,000) and childcare marketplace Kinderly (£325,000).

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

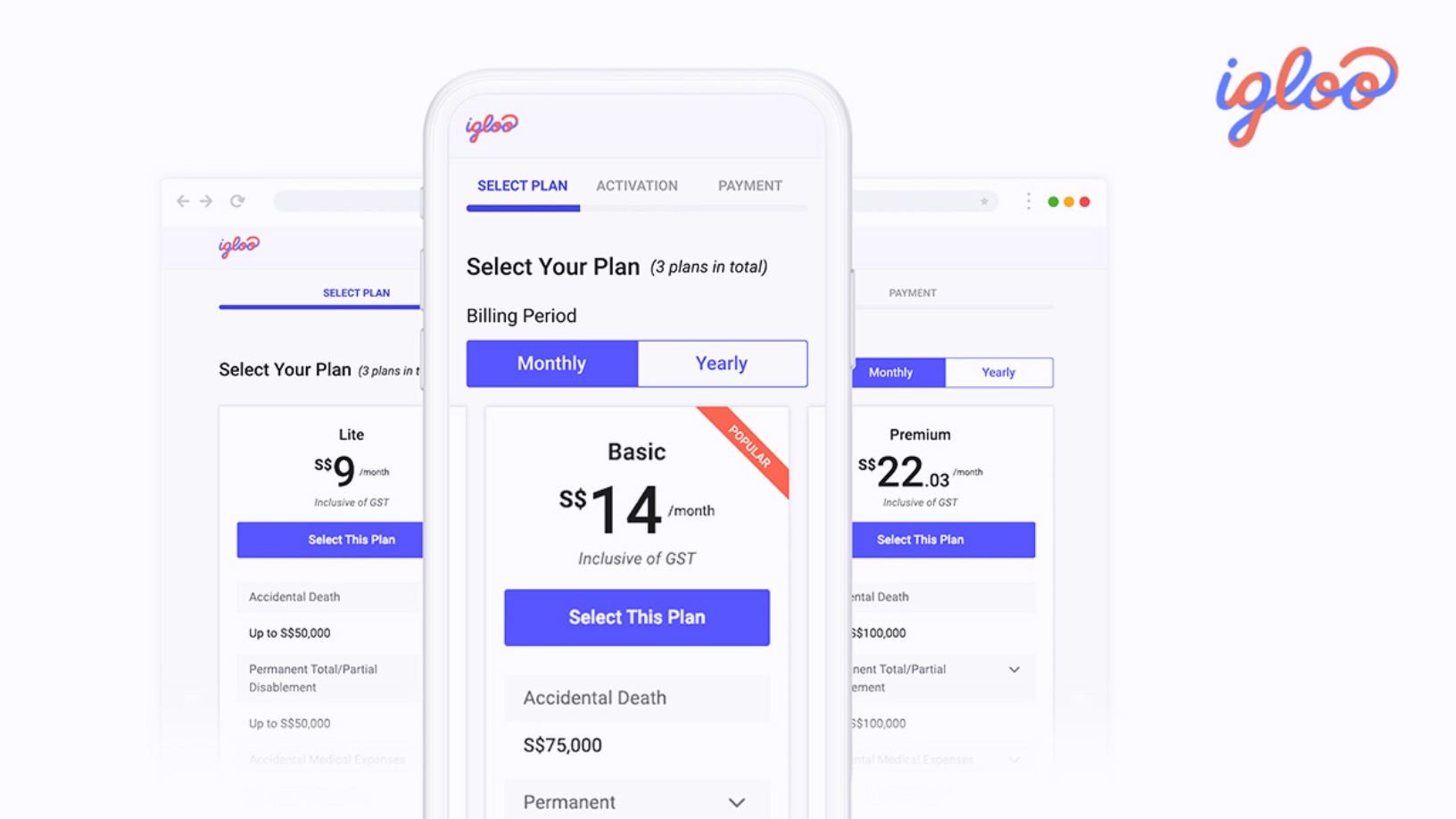

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Xrush makes brushing fun for kids with "smart toothbrushes"

Imitating every brushing move by a child, Xrush's smart gadget uses interactive games to motivate kids to brush their teeth properly

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Affordable pet healthcare insurance at your finger “Tips”

Over 78% of China's pet owners buy insurance to get the best services for their dogs and cats. Tips, an online platform for pet insurance and healthcare products, wants their business

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

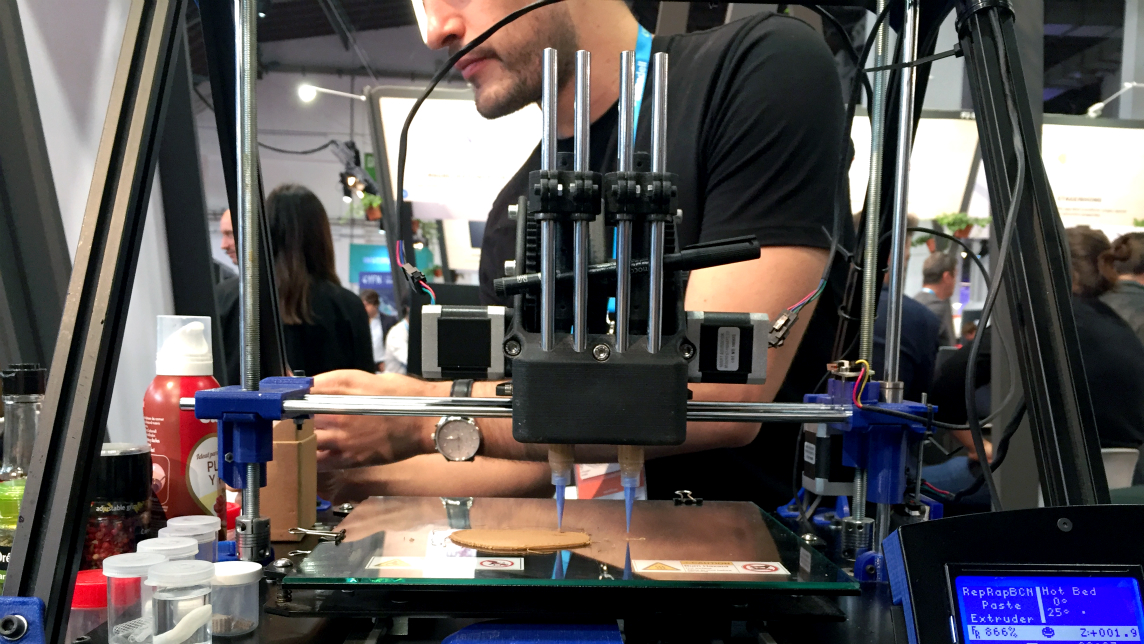

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“Peace-of-Meat”.