Peace-of-Meat

-

DATABASE (996)

-

ARTICLES (811)

Telmo Valido is Director of Corporate Underwriting at Hudson Advisors. His previous employers include Permira, CABB, Telepizza and the Boston Consulting Group. Valido received his master’s in Mechanical Engineering from Instituto Superior Técnico and his MBA from MIT Sloan School of Management.

Telmo Valido is Director of Corporate Underwriting at Hudson Advisors. His previous employers include Permira, CABB, Telepizza and the Boston Consulting Group. Valido received his master’s in Mechanical Engineering from Instituto Superior Técnico and his MBA from MIT Sloan School of Management.

Founded in 2006 by executives from the People’s Bank of China, the China Securities Regulatory Commission, commercial banks, brokerages, insurance companies, funds and other financial institutions, Sensegain Asset Management has AUM (assets under management) of RMB 69 billion. It focuses on private equity, venture capital investment, M&A, market value management for public companies and public equity investment. Sensegain has 150+ FTEs with strong financial backgrounds and a broad range of industry expertise.

Founded in 2006 by executives from the People’s Bank of China, the China Securities Regulatory Commission, commercial banks, brokerages, insurance companies, funds and other financial institutions, Sensegain Asset Management has AUM (assets under management) of RMB 69 billion. It focuses on private equity, venture capital investment, M&A, market value management for public companies and public equity investment. Sensegain has 150+ FTEs with strong financial backgrounds and a broad range of industry expertise.

Changxing Angel was founded in 2015 by the local government of Changxing county in Jiaxing city, Zhejiang province. In 2016, it set up an incubator in Hangzhou called UNI Tech-Forest . Startups in Uni Tech-Forest could enjoy the policy support of Changxing county and the tech ecosystems in Hangzhou. As at October 2019, it had more than 60 companies in its incubator, most of which are from new energy, new material, electronics and smart manufacturing sectors.

Changxing Angel was founded in 2015 by the local government of Changxing county in Jiaxing city, Zhejiang province. In 2016, it set up an incubator in Hangzhou called UNI Tech-Forest . Startups in Uni Tech-Forest could enjoy the policy support of Changxing county and the tech ecosystems in Hangzhou. As at October 2019, it had more than 60 companies in its incubator, most of which are from new energy, new material, electronics and smart manufacturing sectors.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

Bpifrance Large Venture is the growth equity arm of French state investor Bpifrance. It is a €1bn VC fund focused on high-growth, capital-intensive, innovative tech and life sciences companies that have already raised capital. It invests minority stakes of at least €10m as well as co-invests alongside current or new investors in rounds of at least about €20m. It has invested €600m to date and currently has 34 portfolio companies, including 18 listed ones.

Bpifrance Large Venture is the growth equity arm of French state investor Bpifrance. It is a €1bn VC fund focused on high-growth, capital-intensive, innovative tech and life sciences companies that have already raised capital. It invests minority stakes of at least €10m as well as co-invests alongside current or new investors in rounds of at least about €20m. It has invested €600m to date and currently has 34 portfolio companies, including 18 listed ones.

One of China’s most famous angel investors and a prolific speaker, Xu Xiaoping (b.1960) is the managing partner of ZhenFund, a TMT-focused seed fund he founded with close friend and business partner Wang Qiang, in collaboration with Sequoia Capital China, in 2011. Xu began investing in 2006, after the New Oriental Education & Technology Group he co-founded became the first Chinese education company to list on NYSE. Trained as a professional musician, Xu plays the piano, violin, and oboe, and composes music as a hobby. He is also the author of more than 10 books. He studied at the Beijing Central Conservatory of Music and holds a master's in Music from the University of Saskatchewan.

One of China’s most famous angel investors and a prolific speaker, Xu Xiaoping (b.1960) is the managing partner of ZhenFund, a TMT-focused seed fund he founded with close friend and business partner Wang Qiang, in collaboration with Sequoia Capital China, in 2011. Xu began investing in 2006, after the New Oriental Education & Technology Group he co-founded became the first Chinese education company to list on NYSE. Trained as a professional musician, Xu plays the piano, violin, and oboe, and composes music as a hobby. He is also the author of more than 10 books. He studied at the Beijing Central Conservatory of Music and holds a master's in Music from the University of Saskatchewan.

Currently based in the UK, Carlos González-Cadenas is a serial entrepreneur and business angel. In 2017, he became the CPO and CTO of GoCardless, one of the fintech partners of Billin. He founded Fogg in Barcelona in 2008 to build an advanced semantic search platform for the travel industry that was acquired by Scotland's Skyscanner in 2013. As CPO of Skyscanner in UK, he was able to scale the product development organization globally before the company was acquired by the Ctrip group for US$1.75 billion in November 2016. He was also part of Oberlo that was acquired by Shopify.

Currently based in the UK, Carlos González-Cadenas is a serial entrepreneur and business angel. In 2017, he became the CPO and CTO of GoCardless, one of the fintech partners of Billin. He founded Fogg in Barcelona in 2008 to build an advanced semantic search platform for the travel industry that was acquired by Scotland's Skyscanner in 2013. As CPO of Skyscanner in UK, he was able to scale the product development organization globally before the company was acquired by the Ctrip group for US$1.75 billion in November 2016. He was also part of Oberlo that was acquired by Shopify.

Founded in San Francisco in 2009, Eniac Ventures is an early-stage investor in diverse sectors. It currently has 59 startups in its portolio. The vast majority of its exits have been via acquisitions by larger companies such as Anchor sold to Spotify. The VC also invested in Airbnb and Medallia that went public in 2020 and 2019 respectively.Recent investments in June 2021 include co-leading the $4.2m seed round of US mental healthcare platform Nirvana Health and participation in the $30m Series B round of Briq, a US financial planning and workflow automation platform for the construction industry. The VC also joined in the Series A round of Vence, the California-based producer of smart wearables for livestock management.

Founded in San Francisco in 2009, Eniac Ventures is an early-stage investor in diverse sectors. It currently has 59 startups in its portolio. The vast majority of its exits have been via acquisitions by larger companies such as Anchor sold to Spotify. The VC also invested in Airbnb and Medallia that went public in 2020 and 2019 respectively.Recent investments in June 2021 include co-leading the $4.2m seed round of US mental healthcare platform Nirvana Health and participation in the $30m Series B round of Briq, a US financial planning and workflow automation platform for the construction industry. The VC also joined in the Series A round of Vence, the California-based producer of smart wearables for livestock management.

Founder of PreAngel Fund, an early-stage investment firm with over RMB 300 million under management. Since 2011, PreAngel has invested in 260+ startups from China and the US. Leo Wang has over 14 years of experience in mobile, telecommunication and internet industries.

Founder of PreAngel Fund, an early-stage investment firm with over RMB 300 million under management. Since 2011, PreAngel has invested in 260+ startups from China and the US. Leo Wang has over 14 years of experience in mobile, telecommunication and internet industries.

Founded in September 2016, OrionStar is an AI firm backed by Cheetah Mobile. Having created its own AI technologies in the fields of voice interaction, image recognition and visual navigation, OrionStar offers a series of robotics products, including smart speakers and mechanical arms.

Founded in September 2016, OrionStar is an AI firm backed by Cheetah Mobile. Having created its own AI technologies in the fields of voice interaction, image recognition and visual navigation, OrionStar offers a series of robotics products, including smart speakers and mechanical arms.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

Waheed Ali became a Labour life peer and Baron of Norbury at aged 33, the youngest to join the House of Lords in 1998. He is also one of the few openly gay Muslim politicians in the world and a gay rights activist. Waheed Ali left school and started work in financial research at the age of 16 to support his mother and siblings. He moved on to a media career by co-founding an independent television company Planet 24 with Bob Geldof during the 1990s, pioneering TV reality shows like Survivor. Planet 24 was sold to ITV franchisee Carlton Communications in 1999 for £15m. He also backed Elizabeth Murdoch’s TV production company Shine that was sold to her father, Rupert Murdoch’s media group, 21st Century Fox. Of Guyana and Trinidad descent, the well-known British media tycoon is also a businessman and investor. In 2011, he lost millions by investing in loss-making Chorion that owned the Agatha Christie literary rights. He formed a television production company Silvergate Media to acquire the rights to several Chorion TV series like Beatrix Potter. As an investor, he became the chairman of online fashion marketplace ASOS for 12 years until 2012. He later founded the “ASOS of India,” Koovs that was listed in London in 2014. Most recently, he joined the Series B funding round of London-based zero-food-waste app OLIO in September 2021.

Waheed Ali became a Labour life peer and Baron of Norbury at aged 33, the youngest to join the House of Lords in 1998. He is also one of the few openly gay Muslim politicians in the world and a gay rights activist. Waheed Ali left school and started work in financial research at the age of 16 to support his mother and siblings. He moved on to a media career by co-founding an independent television company Planet 24 with Bob Geldof during the 1990s, pioneering TV reality shows like Survivor. Planet 24 was sold to ITV franchisee Carlton Communications in 1999 for £15m. He also backed Elizabeth Murdoch’s TV production company Shine that was sold to her father, Rupert Murdoch’s media group, 21st Century Fox. Of Guyana and Trinidad descent, the well-known British media tycoon is also a businessman and investor. In 2011, he lost millions by investing in loss-making Chorion that owned the Agatha Christie literary rights. He formed a television production company Silvergate Media to acquire the rights to several Chorion TV series like Beatrix Potter. As an investor, he became the chairman of online fashion marketplace ASOS for 12 years until 2012. He later founded the “ASOS of India,” Koovs that was listed in London in 2014. Most recently, he joined the Series B funding round of London-based zero-food-waste app OLIO in September 2021.

Established in 2011, Shilling Capital Partners is a Portuguese angel investment fund and one of the three subsidiaries of Mogope, a Portuguese investment manager, whose partners are also co-founders of Shilling. To date, the company has invested in 18 startups, both tech and bricks-and-mortar, and has managed three exits, including BestTables that was acquired by TripAdvisor. It typically invests between €250,000 and €1m in seed and Series A rounds and ensures liquidity until the next funding round, or when the startup becomes capable of funding its own growth. Recent investments include petcare marketplace Barkyn, healthy meal service delivery app EatTasty and blockchain-based online betting application BetProtocol.

Established in 2011, Shilling Capital Partners is a Portuguese angel investment fund and one of the three subsidiaries of Mogope, a Portuguese investment manager, whose partners are also co-founders of Shilling. To date, the company has invested in 18 startups, both tech and bricks-and-mortar, and has managed three exits, including BestTables that was acquired by TripAdvisor. It typically invests between €250,000 and €1m in seed and Series A rounds and ensures liquidity until the next funding round, or when the startup becomes capable of funding its own growth. Recent investments include petcare marketplace Barkyn, healthy meal service delivery app EatTasty and blockchain-based online betting application BetProtocol.

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

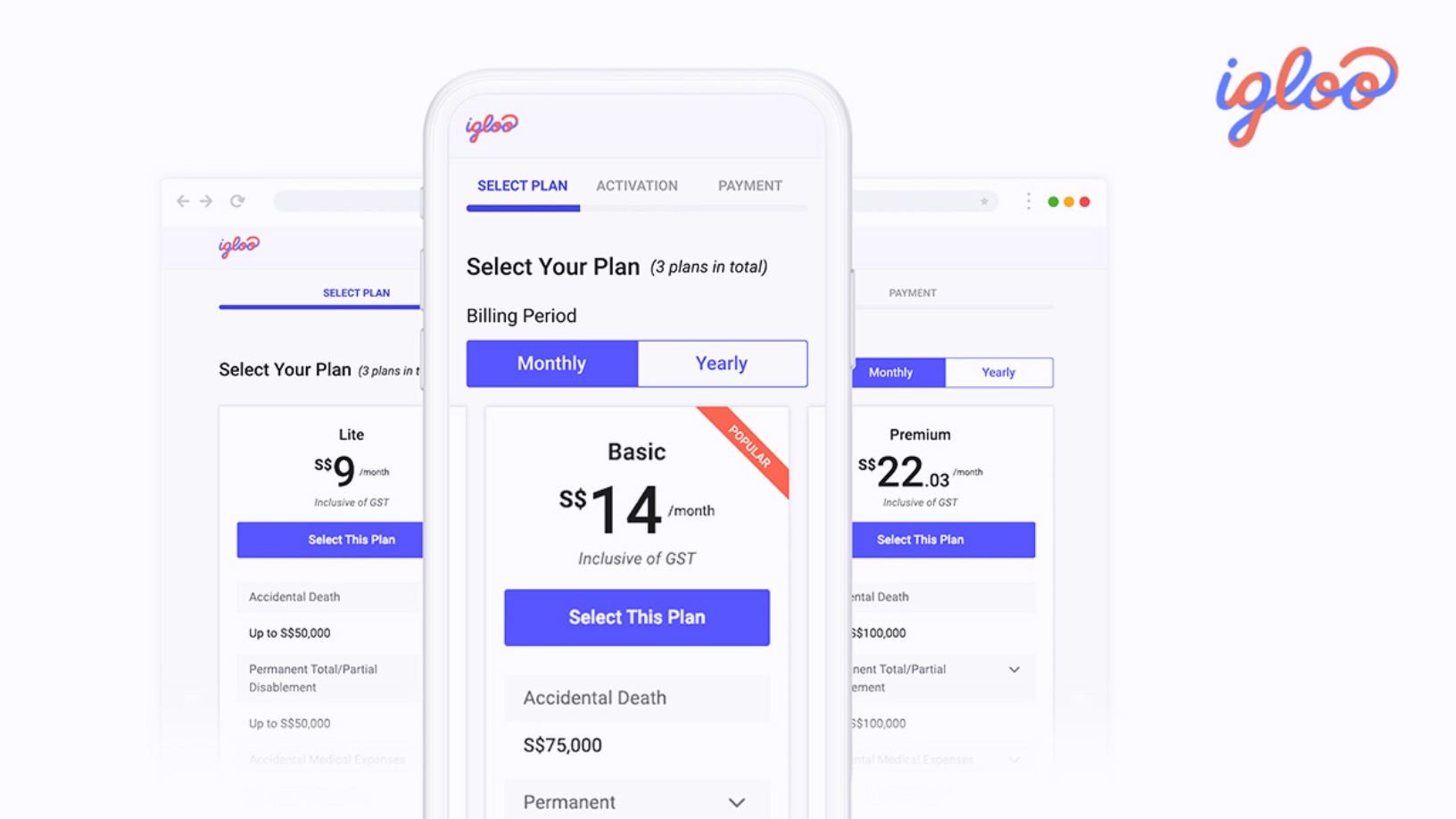

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Xrush makes brushing fun for kids with "smart toothbrushes"

Imitating every brushing move by a child, Xrush's smart gadget uses interactive games to motivate kids to brush their teeth properly

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Affordable pet healthcare insurance at your finger “Tips”

Over 78% of China's pet owners buy insurance to get the best services for their dogs and cats. Tips, an online platform for pet insurance and healthcare products, wants their business

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

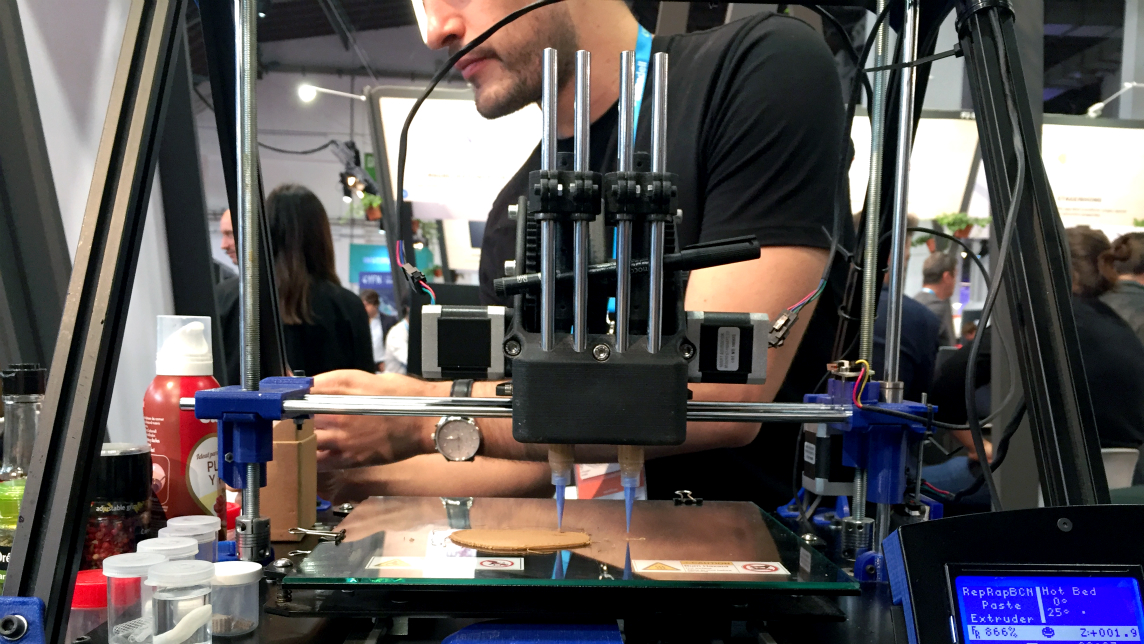

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“Peace-of-Meat”.