Peace-of-Meat

-

DATABASE (996)

-

ARTICLES (811)

Zheng Weihe (Alex Zheng) and his wife Li Huang started Cowin Capital, one of China's earliest private equity funds, in 2000 with RMB 80 million of their own money, investing in six companies within a year. Today, it has more than RMB 10 billion in assets under management, across six PE funds. It has invested in over 150 companies to date, with 57 successful exits, including 27 IPOs – earning Zheng the moniker "The Marksman".

Zheng Weihe (Alex Zheng) and his wife Li Huang started Cowin Capital, one of China's earliest private equity funds, in 2000 with RMB 80 million of their own money, investing in six companies within a year. Today, it has more than RMB 10 billion in assets under management, across six PE funds. It has invested in over 150 companies to date, with 57 successful exits, including 27 IPOs – earning Zheng the moniker "The Marksman".

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

Pau Molinas is an investor and board member in several technology companies. He was one of the first investors in Gestoos, a gesture recognition startup, of which he is currently advisor.Molinas developed his professional career at HP, where he was its global VP overseeing HP’s printer operations. He graduated in Mechanical Engineering and specialized in Business Management from INSEAD, the London Business School as well as Spanish business schools EADA and IESE.

Pau Molinas is an investor and board member in several technology companies. He was one of the first investors in Gestoos, a gesture recognition startup, of which he is currently advisor.Molinas developed his professional career at HP, where he was its global VP overseeing HP’s printer operations. He graduated in Mechanical Engineering and specialized in Business Management from INSEAD, the London Business School as well as Spanish business schools EADA and IESE.

Huang is co-founder and CEO of TTPOD, a cross-platform music player. He co-founded TTPOD in 2007, which, by 2013, had accumulated 200 million users and was subsequently sold to Alibaba Group. In 2015, Huang became COO of Baofeng Mojing, a VR device creator controlled by Shenzhen-listed internet company Baofeng Group. In 2016, Baofeng Mojing sold 2 million VR devices. Huang participated in Kuaipeilian's seed funding round.

Huang is co-founder and CEO of TTPOD, a cross-platform music player. He co-founded TTPOD in 2007, which, by 2013, had accumulated 200 million users and was subsequently sold to Alibaba Group. In 2015, Huang became COO of Baofeng Mojing, a VR device creator controlled by Shenzhen-listed internet company Baofeng Group. In 2016, Baofeng Mojing sold 2 million VR devices. Huang participated in Kuaipeilian's seed funding round.

Arthur Kosten is an adviser for Booking.com and other companies like Festicket and eVentures Africa Fund. He was the former CMO and co-founder of Booking.com. Together with other business angels and VCs, he generally invests about US$200,000 to US$1 million in various marketplace platforms for expansion in Europe. He is also an investor and board member of rentalcars.com, catawiki.com, treatwell, 8fit.com, festicket and healthcare.com.

Arthur Kosten is an adviser for Booking.com and other companies like Festicket and eVentures Africa Fund. He was the former CMO and co-founder of Booking.com. Together with other business angels and VCs, he generally invests about US$200,000 to US$1 million in various marketplace platforms for expansion in Europe. He is also an investor and board member of rentalcars.com, catawiki.com, treatwell, 8fit.com, festicket and healthcare.com.

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

Established in 2018, Robot Union is a pan-European robotics association that is funded by the European Union. It is an EU initiative under the Horizon 2020 program for investment in research and innovation across sectors and countries. Through various competitions, robotics startups can win equity-free awards of up to €223,000 each. Robot Union selected its first batch of 20 startups in September 2018.

Established in 2018, Robot Union is a pan-European robotics association that is funded by the European Union. It is an EU initiative under the Horizon 2020 program for investment in research and innovation across sectors and countries. Through various competitions, robotics startups can win equity-free awards of up to €223,000 each. Robot Union selected its first batch of 20 startups in September 2018.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

Farben Consulting is a Portuguese real estate investor and consultancy based in Torres Novas and established in 1996. It has no website and has not disclosed any information about its business. In 2014 and 2015, Farben invested €1.5m for an equity stake of 98% in CoolFarm. The agtech became insolvent in October 2018 when Farben decided to stop supporting the startup due to lack of sales and market potential for B2B indoor farming solutions.

Farben Consulting is a Portuguese real estate investor and consultancy based in Torres Novas and established in 1996. It has no website and has not disclosed any information about its business. In 2014 and 2015, Farben invested €1.5m for an equity stake of 98% in CoolFarm. The agtech became insolvent in October 2018 when Farben decided to stop supporting the startup due to lack of sales and market potential for B2B indoor farming solutions.

BAN madri+d is a network of angel investors specializing in finding and backing technology-based startups in their seed stage of development and also headquartered in Madrid .With over 116 active investors, the institution aims to establish a competitive entrepreneurial ecosystem through collaboration with business experts, research centers and public institutions.To date, BAN madri+d has already invested (directly and indirectly) more than €70,000 across 480 projects.

BAN madri+d is a network of angel investors specializing in finding and backing technology-based startups in their seed stage of development and also headquartered in Madrid .With over 116 active investors, the institution aims to establish a competitive entrepreneurial ecosystem through collaboration with business experts, research centers and public institutions.To date, BAN madri+d has already invested (directly and indirectly) more than €70,000 across 480 projects.

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

Based in New York, VectoIQ was formed in 2016 to fund startups in the smart mobility space. It is led by Steve Girsky, former vice-chairman of General Motors with more than 30 years in the automobile industry. Mary Chan is the managing partner, who also worked at GM as president of global connected consumer. The VC mainly invests in sectors relating to autonomous vehicles, connected car, smart mobility, MaaS, electrification and cybersecurity.

Based in New York, VectoIQ was formed in 2016 to fund startups in the smart mobility space. It is led by Steve Girsky, former vice-chairman of General Motors with more than 30 years in the automobile industry. Mary Chan is the managing partner, who also worked at GM as president of global connected consumer. The VC mainly invests in sectors relating to autonomous vehicles, connected car, smart mobility, MaaS, electrification and cybersecurity.

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

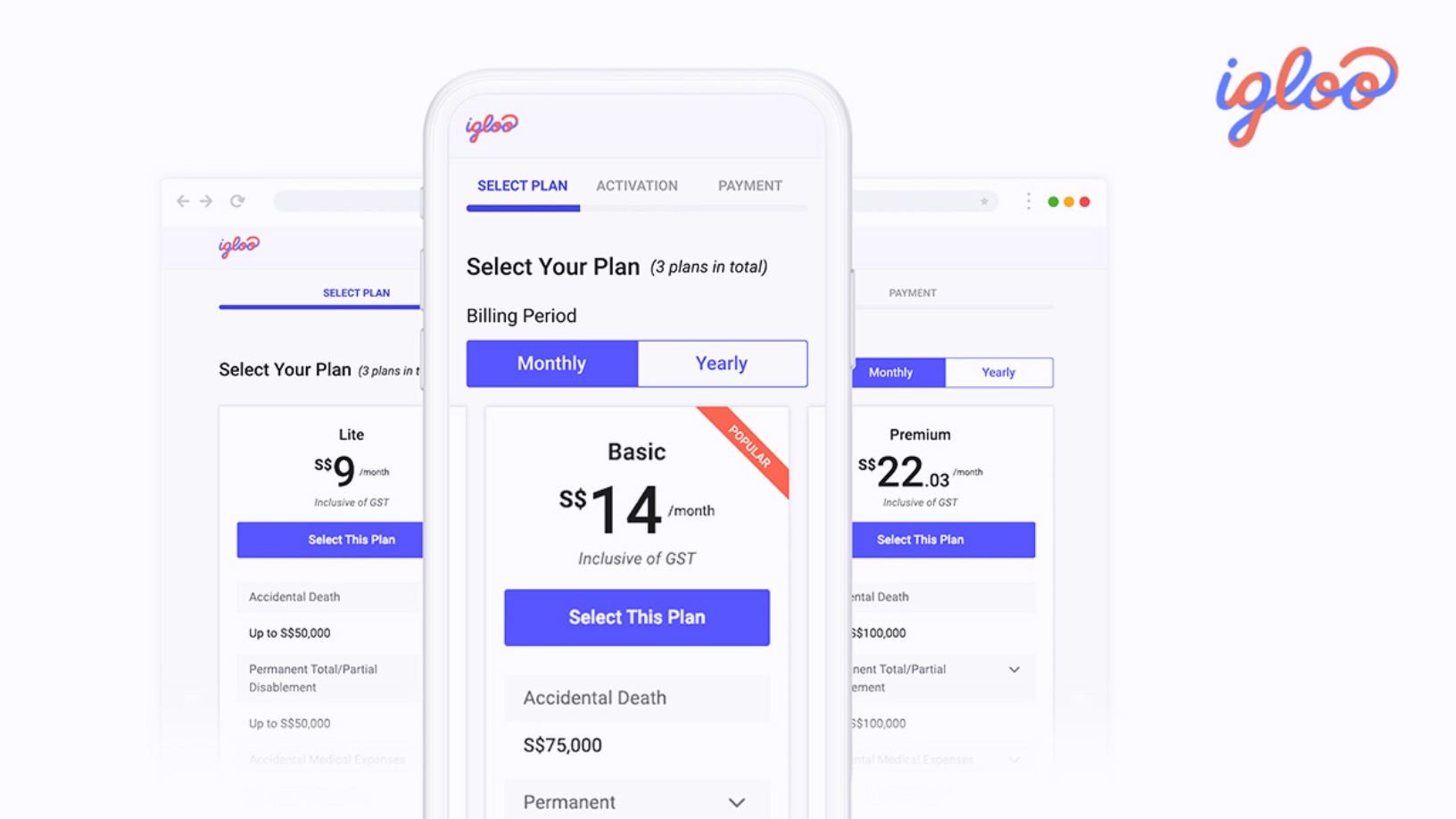

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Xrush makes brushing fun for kids with "smart toothbrushes"

Imitating every brushing move by a child, Xrush's smart gadget uses interactive games to motivate kids to brush their teeth properly

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Affordable pet healthcare insurance at your finger “Tips”

Over 78% of China's pet owners buy insurance to get the best services for their dogs and cats. Tips, an online platform for pet insurance and healthcare products, wants their business

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

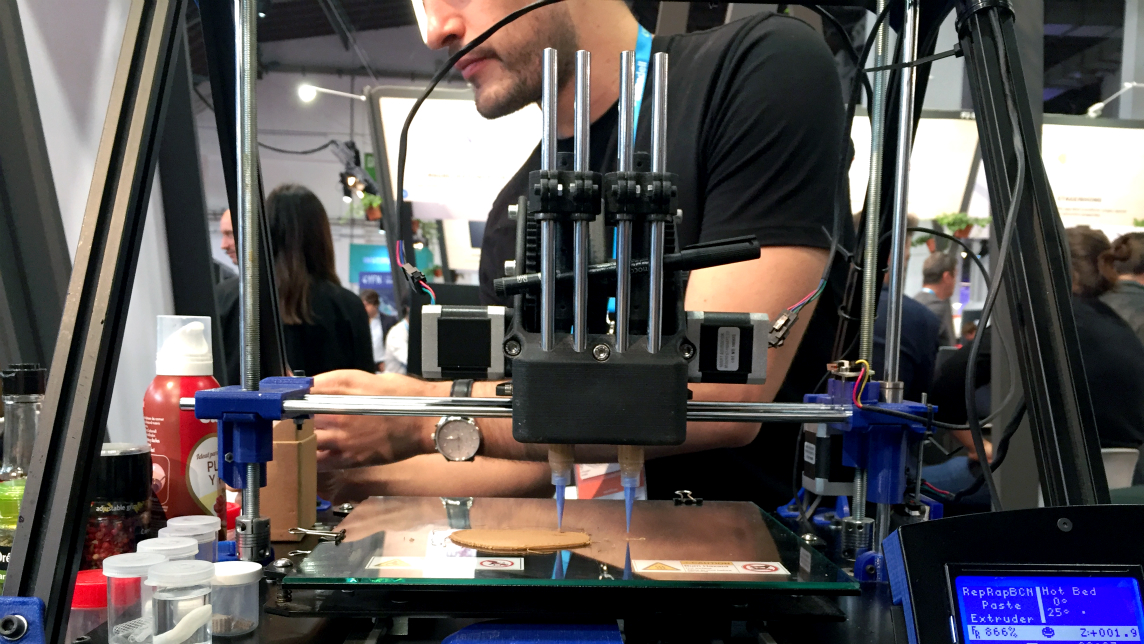

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“Peace-of-Meat”.