Peace-of-Meat

-

DATABASE (996)

-

ARTICLES (811)

TI Platform Management is a US-based investment firm founded by Alex Bangash and Trang T Nguyen, who are also the founders of LP network and investment news platform TrustedInsight. Founded in 2015, the firm seeks out disruptive business models and invests in a range of categories, from furniture and home construction to healthcare and deep-tech. It has invested in Singapore-based enzyme engineering startup Allozymes, B2B pharmacy fulfillment service TruePill, and supply chain management startup Tyltgo.

TI Platform Management is a US-based investment firm founded by Alex Bangash and Trang T Nguyen, who are also the founders of LP network and investment news platform TrustedInsight. Founded in 2015, the firm seeks out disruptive business models and invests in a range of categories, from furniture and home construction to healthcare and deep-tech. It has invested in Singapore-based enzyme engineering startup Allozymes, B2B pharmacy fulfillment service TruePill, and supply chain management startup Tyltgo.

BlueRun Ventures China was founded in 2005, focusing on early-stage investment of companies. The investments are usually from US$100,000 to US$10 million.

BlueRun Ventures China was founded in 2005, focusing on early-stage investment of companies. The investments are usually from US$100,000 to US$10 million.

Founded in 2015 by three former core members of Legend Capital, JOY Capital is a venture capital firm focused on investment in TMT industries.

Founded in 2015 by three former core members of Legend Capital, JOY Capital is a venture capital firm focused on investment in TMT industries.

Founded by famous angel investor Cai Wensheng, founder and chairman of Meitu, Longling Capital is an equity investment firm that invests primarily in early-stage tech startups.

Founded by famous angel investor Cai Wensheng, founder and chairman of Meitu, Longling Capital is an equity investment firm that invests primarily in early-stage tech startups.

Lynx Asia is an investment advisory firm based in Singapore. Its investments cover a broad range of industries, from retail and real estate to energy and manufacturing.

Lynx Asia is an investment advisory firm based in Singapore. Its investments cover a broad range of industries, from retail and real estate to energy and manufacturing.

Established in 1998, Ecovacs specializes in R&D, design, manufacturing and sales of service robots for household and business use.

Established in 1998, Ecovacs specializes in R&D, design, manufacturing and sales of service robots for household and business use.

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

CICC Alpha is a subsidiary of China International Capital Corporation Limited (CICC), managing a RMB 2 billion fund focusing on internet and financial innovation.

CICC Alpha is a subsidiary of China International Capital Corporation Limited (CICC), managing a RMB 2 billion fund focusing on internet and financial innovation.

Shenzhen Qianhai Dunray Capital Management Co., Ltd.

Founded in 2015, Shenzhen Qianhai Dunray Capital Management Co., Ltd., manages four funds and has paid-in capital of RMB 10 million.

Founded in 2015, Shenzhen Qianhai Dunray Capital Management Co., Ltd., manages four funds and has paid-in capital of RMB 10 million.

Cosun Fund is a wholly-owned subsidiary of Cosun, an electronic communication devices manufacturer. Founded in 2014, Cosun Fund is based in Huizhou, Guangdong province.

Cosun Fund is a wholly-owned subsidiary of Cosun, an electronic communication devices manufacturer. Founded in 2014, Cosun Fund is based in Huizhou, Guangdong province.

Founded in 2017, Suzhou Longmen Ventures mainly invests in businesses working on innovative drugs and medical devices. It manages tens of billions RMB in assets.

Founded in 2017, Suzhou Longmen Ventures mainly invests in businesses working on innovative drugs and medical devices. It manages tens of billions RMB in assets.

The NYSE-listed Chinese auto content and marketing online operator is also one of the biggest players in the auto e-commerce market. Tencent, JD.com and Baidu together own almost a 34% stake in BitAuto, which started out as a platform connecting auto sellers with buyers.is also one of the biggest players in the auto e-commerce market. Tencent, JD.com and Baidu together own almost a 34% stake in BitAuto, which started out as a platform connecting auto sellers with buyers.

The NYSE-listed Chinese auto content and marketing online operator is also one of the biggest players in the auto e-commerce market. Tencent, JD.com and Baidu together own almost a 34% stake in BitAuto, which started out as a platform connecting auto sellers with buyers.is also one of the biggest players in the auto e-commerce market. Tencent, JD.com and Baidu together own almost a 34% stake in BitAuto, which started out as a platform connecting auto sellers with buyers.

A spinoff from Chinese investment bank China International Capital Corp, CDH has its roots in private equity. It started in 2002, raising its first fund of US$102 million. As of end-2015, it had over US$15 billion in assets under management, spanning private equity, public equities, real estate and more. It has invested in more than 150 companies, including WH Group, Belle International, Mengniu Dairy, Qihoo 360 and Luye Pharma; and has offices in Beijing, Hong Kong, Shanghai, Shenzhen, Singapore and Jakarta.

A spinoff from Chinese investment bank China International Capital Corp, CDH has its roots in private equity. It started in 2002, raising its first fund of US$102 million. As of end-2015, it had over US$15 billion in assets under management, spanning private equity, public equities, real estate and more. It has invested in more than 150 companies, including WH Group, Belle International, Mengniu Dairy, Qihoo 360 and Luye Pharma; and has offices in Beijing, Hong Kong, Shanghai, Shenzhen, Singapore and Jakarta.

Beijing Kunlun Tech Co., Ltd. (Kunlun) is a Beijing-based gaming, fintech and software company founded in 2008. It went public on the Shenzhen Stock Exchange in 2015. In 2016, Kunlun acquired a 60% stake in Grindr. It now invests primarily in sectors such as social networking, live streaming, IoT and AI. Four of the companies in which it invested - Qudian, Yinke, Opera and Ruhan - have gone public as of April 2019.

Beijing Kunlun Tech Co., Ltd. (Kunlun) is a Beijing-based gaming, fintech and software company founded in 2008. It went public on the Shenzhen Stock Exchange in 2015. In 2016, Kunlun acquired a 60% stake in Grindr. It now invests primarily in sectors such as social networking, live streaming, IoT and AI. Four of the companies in which it invested - Qudian, Yinke, Opera and Ruhan - have gone public as of April 2019.

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

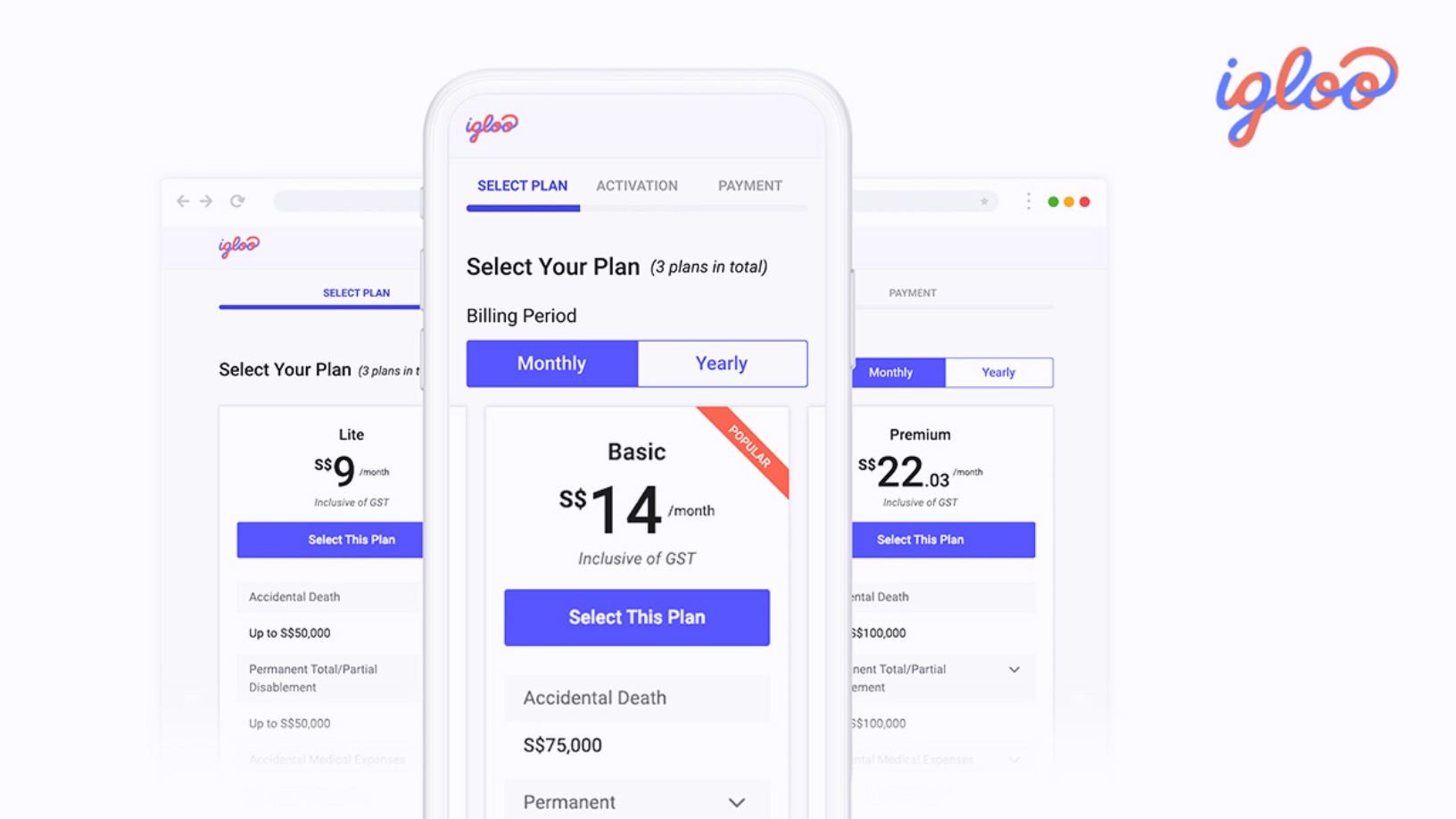

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Xrush makes brushing fun for kids with "smart toothbrushes"

Imitating every brushing move by a child, Xrush's smart gadget uses interactive games to motivate kids to brush their teeth properly

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Affordable pet healthcare insurance at your finger “Tips”

Over 78% of China's pet owners buy insurance to get the best services for their dogs and cats. Tips, an online platform for pet insurance and healthcare products, wants their business

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

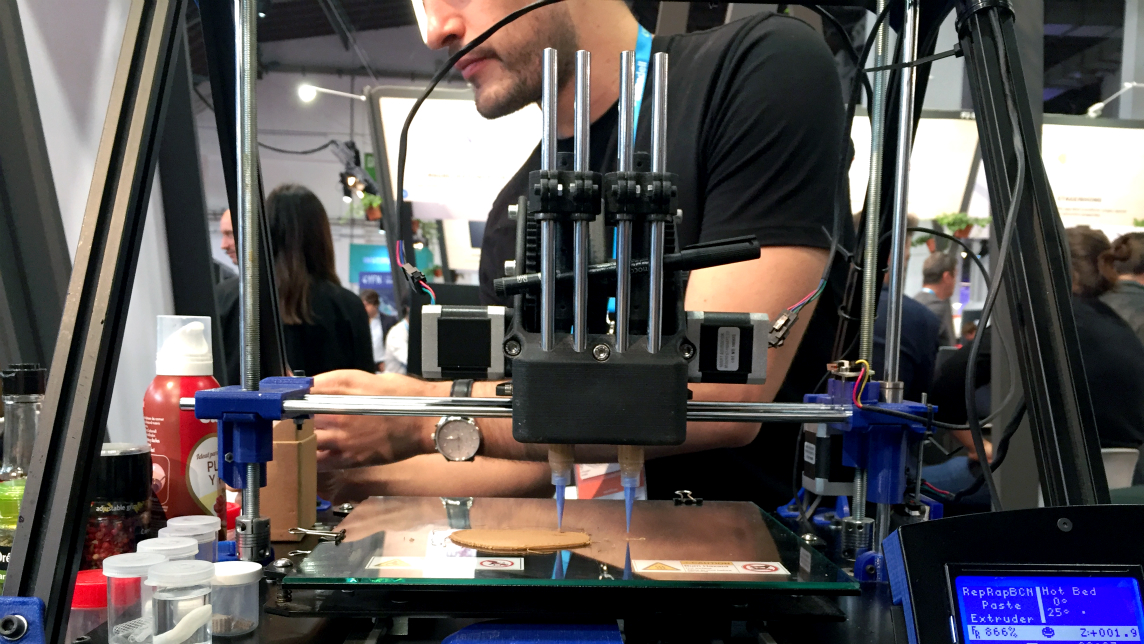

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“Peace-of-Meat”.