Peace-of-Meat

-

DATABASE (996)

-

ARTICLES (811)

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Shanghai-based Shengyin Incubation is a wholly-owned subsidiary of Shengyin Investment, specialized in private equity investment, merger & acquisition, investment consultancy and startup incubation. It invests mainly in early-stage startups in agritech, new retail, education and enterprise services. Shengyin Incubation is also eyeing commercial opportunities brought by new technologies such as AI, blockchain and IoT. Since its establishment in 2006, Shengyin Incubation has invested in over 100 startups, of which 26 have been listed on China's stock exchanges in Shanghai and Shenzhen.

Shanghai-based Shengyin Incubation is a wholly-owned subsidiary of Shengyin Investment, specialized in private equity investment, merger & acquisition, investment consultancy and startup incubation. It invests mainly in early-stage startups in agritech, new retail, education and enterprise services. Shengyin Incubation is also eyeing commercial opportunities brought by new technologies such as AI, blockchain and IoT. Since its establishment in 2006, Shengyin Incubation has invested in over 100 startups, of which 26 have been listed on China's stock exchanges in Shanghai and Shenzhen.

Ibersol is a Portuguese restaurant sector investor established in 1994. It holds the franchises of several of Spain and Portugal's top-selling fast-food chains including Burger King in both nations, Pans & Company in Spain and KFC in Portugal and Angola.To date, it has invested in one startup, the Portuguese healthy food service EatTasty, with undisclosed investment in the company's seed stage, phase one, that raised €1.1m. It also acquired one food sector entity, the Spanish restaurant group, Eat Out Group, for an undisclosed sum in 2016.

Ibersol is a Portuguese restaurant sector investor established in 1994. It holds the franchises of several of Spain and Portugal's top-selling fast-food chains including Burger King in both nations, Pans & Company in Spain and KFC in Portugal and Angola.To date, it has invested in one startup, the Portuguese healthy food service EatTasty, with undisclosed investment in the company's seed stage, phase one, that raised €1.1m. It also acquired one food sector entity, the Spanish restaurant group, Eat Out Group, for an undisclosed sum in 2016.

Founded in October 2013, JD Finance was renamed as JD Digits in November 2018. The fintech arm of Chinese e-commerce giant JD.com focuses on applying digital technology, artificial intelligence and IoT in five sectors: finance, smart cities, agriculture, campus development and marketing.The company manages five sub-brands: JD Finance, JD iCity, JD Agriculture, JD Shaodongjia, and JD MO Media. In September 2017, a joint venture was established with Central Group, one of Thailand’s biggest retailers. In December 2017, JD Digits also started operating an AI lab in Silicon Valley.

Founded in October 2013, JD Finance was renamed as JD Digits in November 2018. The fintech arm of Chinese e-commerce giant JD.com focuses on applying digital technology, artificial intelligence and IoT in five sectors: finance, smart cities, agriculture, campus development and marketing.The company manages five sub-brands: JD Finance, JD iCity, JD Agriculture, JD Shaodongjia, and JD MO Media. In September 2017, a joint venture was established with Central Group, one of Thailand’s biggest retailers. In December 2017, JD Digits also started operating an AI lab in Silicon Valley.

Carlos Gallardo is an industrial engineer with an MBA from Stanford University. He spent most of his career at the pharmaceutical company Almirall and was promoted through the ranks rapidly holding multiple C-level roles. He became the MD for UK and Ireland for over five years and joined Almirall’s board of directors in 2014.In 2015, he founded CG Health Ventures, a VC firm investing in early-stage digital health companies worldwide. He’s also an active angel investor and advisor for startups developing frontier technologies in the healthcare sector.

Carlos Gallardo is an industrial engineer with an MBA from Stanford University. He spent most of his career at the pharmaceutical company Almirall and was promoted through the ranks rapidly holding multiple C-level roles. He became the MD for UK and Ireland for over five years and joined Almirall’s board of directors in 2014.In 2015, he founded CG Health Ventures, a VC firm investing in early-stage digital health companies worldwide. He’s also an active angel investor and advisor for startups developing frontier technologies in the healthcare sector.

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

FSI is an independent private equity firm based in Milan. It currently manages the mid-market Fund FSI I. Before its launch in 2017, the FSI investment team had already made PE investments in the Italian mid-market for several years at Fondo Strategico Italiano.The FSI investors include some of Italy’s largest institutional investors, primary sovereign funds from the Middle East, Far East and Central Asia. The firm also has a network of asset managers, insurance companies, European banks, family offices and foundations.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

DCVC (formerly Data Collective)

San Francisco-based DCVC, formerly named Data Collective, has made more than 400 investments in its 20 year history, with deep tech and science in general its key investment interests. It currently has 148 companies in its portfilio and has managed 48 exits to date, including acquisitions by Twitter and Amazon. Its most recent investments have included in the April 2021 £60m Series A round of British antibody medtech Alchemab Therapeutics and in the March 2021 $75m Series B round of Israeli blockchain development tool StarkWare Industries.

San Francisco-based DCVC, formerly named Data Collective, has made more than 400 investments in its 20 year history, with deep tech and science in general its key investment interests. It currently has 148 companies in its portfilio and has managed 48 exits to date, including acquisitions by Twitter and Amazon. Its most recent investments have included in the April 2021 £60m Series A round of British antibody medtech Alchemab Therapeutics and in the March 2021 $75m Series B round of Israeli blockchain development tool StarkWare Industries.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

Based in the municipality of Falkenburg, the Bertebos Foundation was founded in 1994 by Olof and Brita Stenström to promote education and scientific research in the food industry. The family-run foundation holds 30% shares in the family business Bertegruppen AB. The group’s food brand portfolio includes producer of ice-cream and sorbets SIA Glass and Berte Qvarn that runs a dairy farm, flour mill and bakery.

Based in the municipality of Falkenburg, the Bertebos Foundation was founded in 1994 by Olof and Brita Stenström to promote education and scientific research in the food industry. The family-run foundation holds 30% shares in the family business Bertegruppen AB. The group’s food brand portfolio includes producer of ice-cream and sorbets SIA Glass and Berte Qvarn that runs a dairy farm, flour mill and bakery.

Founded in 1999 by Jack Ma, Alibaba was initially an online B2B platform for small businesses in China. Today it is one of the world’s largest internet companies. Alibaba provides internet infrastructure and marketing platforms for businesses and brands globally to connect with their consumers. Its core businesses include e-commerce, cloud computing, and digital media and entertainment, as it increasingly identifies itself as a data company, rather than as an e-retailer. It is also engaged in building ecosystems of logistics and local services through its invested companies.

Founded in 1999 by Jack Ma, Alibaba was initially an online B2B platform for small businesses in China. Today it is one of the world’s largest internet companies. Alibaba provides internet infrastructure and marketing platforms for businesses and brands globally to connect with their consumers. Its core businesses include e-commerce, cloud computing, and digital media and entertainment, as it increasingly identifies itself as a data company, rather than as an e-retailer. It is also engaged in building ecosystems of logistics and local services through its invested companies.

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

Established in 1996, SBI Investment is a venture capital firm that focuses on growth sectors such as information technology, biotechnology, life science, mobile, environment and energy. The VC arm of the SBI Group is developed to quickly find new, emerging technologies and investing in those technologies to further the development of the group. SBI Group then introduces the new technologies to existing businesses in order to help them stay ahead in the market, as well as to revitalize local industries in Japan, particularly in the financial and banking sectors.

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

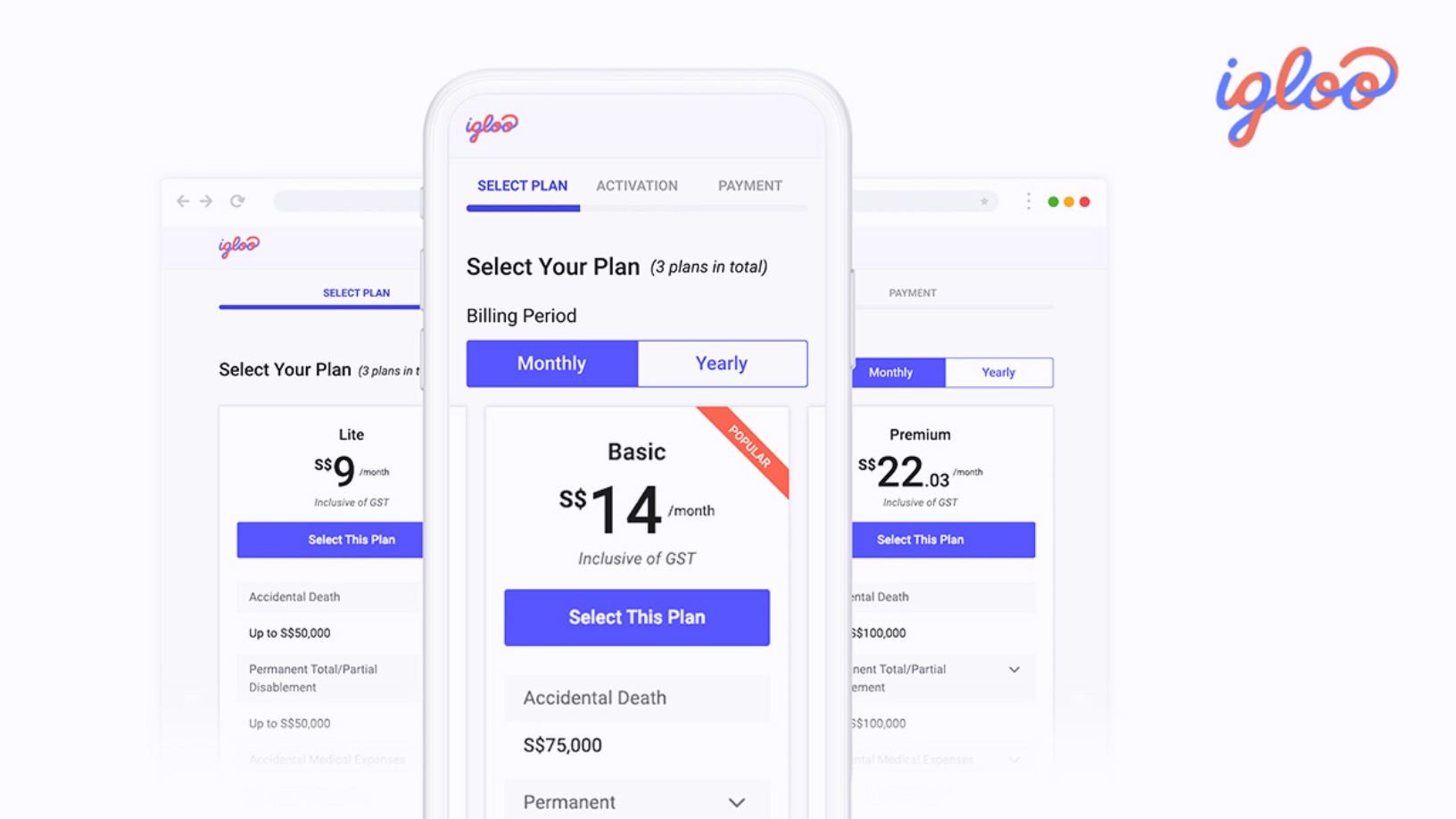

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Xrush makes brushing fun for kids with "smart toothbrushes"

Imitating every brushing move by a child, Xrush's smart gadget uses interactive games to motivate kids to brush their teeth properly

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Affordable pet healthcare insurance at your finger “Tips”

Over 78% of China's pet owners buy insurance to get the best services for their dogs and cats. Tips, an online platform for pet insurance and healthcare products, wants their business

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

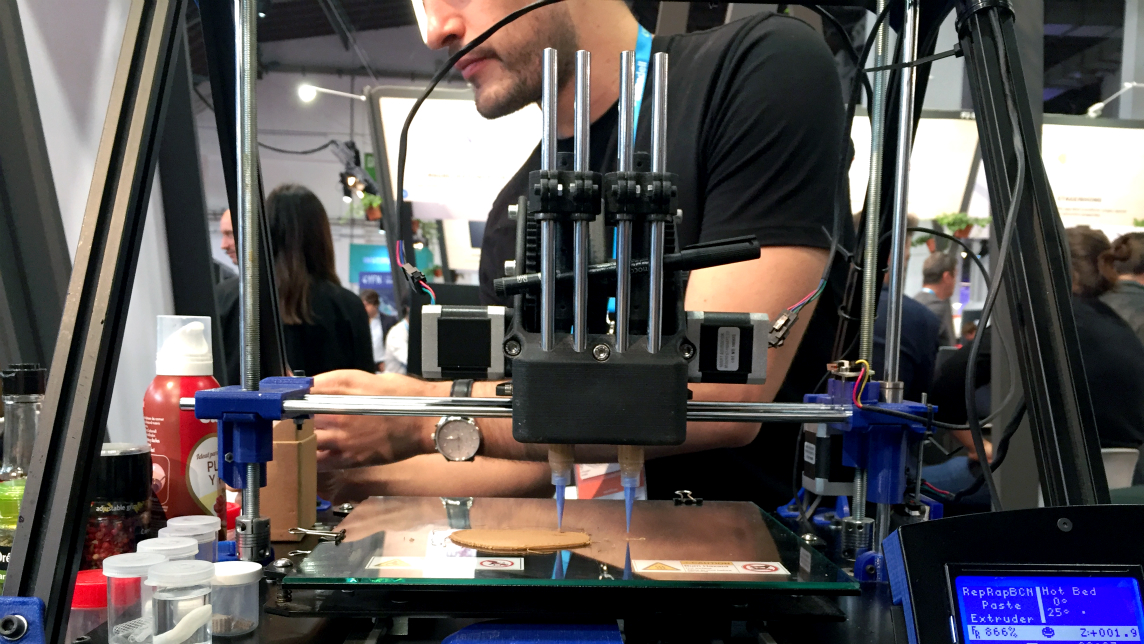

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“Peace-of-Meat”.