Peace-of-Meat

-

DATABASE (996)

-

ARTICLES (811)

Marin Holding Limited is a Cyprus-based holding company, headquartered in Limassol. Its subsidiary Marin Ship Management focuses on the maritime logistic sector. Founded in February 2007 as a member of Germany's NSC Group in Hamburg, Marin's core activity is to provide crew management services to NSC and other clients. Marin Ship Management has worked with over 50 vessels including Containers, MPC, Con-Bulkers, Bulk carriers, Car carriers, Oil and Chemical tankers worldwide. Managing Director Martina Meinders-Michael has 20 years of experience in the shipping sector.

Marin Holding Limited is a Cyprus-based holding company, headquartered in Limassol. Its subsidiary Marin Ship Management focuses on the maritime logistic sector. Founded in February 2007 as a member of Germany's NSC Group in Hamburg, Marin's core activity is to provide crew management services to NSC and other clients. Marin Ship Management has worked with over 50 vessels including Containers, MPC, Con-Bulkers, Bulk carriers, Car carriers, Oil and Chemical tankers worldwide. Managing Director Martina Meinders-Michael has 20 years of experience in the shipping sector.

Startupbootcamp Commerce Amsterdam

Startupbootcamp Commerce Amsterdam is part of the Startupbootcamp accelerator global group that was originally founded in Denmark in 2010. The Commerce Amsterdam programs are dedicated to early-stage startups in the e-commerce and retail verticals. They help founders during the MVP development phase and provide mentoring support across logistics solutions, fraud security, AI, big data, advertising, marketing and sales.The programs are based in a co-working space in Amsterdam and founders receive €15,000 to cover their living expenses in the city during the three-month period of intense mentorship, masterclasses and pitching opportunities.

Startupbootcamp Commerce Amsterdam is part of the Startupbootcamp accelerator global group that was originally founded in Denmark in 2010. The Commerce Amsterdam programs are dedicated to early-stage startups in the e-commerce and retail verticals. They help founders during the MVP development phase and provide mentoring support across logistics solutions, fraud security, AI, big data, advertising, marketing and sales.The programs are based in a co-working space in Amsterdam and founders receive €15,000 to cover their living expenses in the city during the three-month period of intense mentorship, masterclasses and pitching opportunities.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

BDMI is a New York-based VC company that is part of the global media group, Bertelsmann, which backs mainly companies in the new digital media ecosystem. The company usually invests through Series A and Series B rounds ranging from US$500,000 to US$5 million with reserves for follow-ons.Companies backed by BDMI get access to a vast network of media companies in the Bertelsmann group and benefit from their extensive media expertise with a global perspective.The firm’s portfolio includes startups from North America, Europe and Israel.

BDMI is a New York-based VC company that is part of the global media group, Bertelsmann, which backs mainly companies in the new digital media ecosystem. The company usually invests through Series A and Series B rounds ranging from US$500,000 to US$5 million with reserves for follow-ons.Companies backed by BDMI get access to a vast network of media companies in the Bertelsmann group and benefit from their extensive media expertise with a global perspective.The firm’s portfolio includes startups from North America, Europe and Israel.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

Everbright New Economy USD Fund

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

B Capital Group is best known as the venture capital firm co-founded by Eduardo Saverin, co-founder of Facebook. Its investment thesis focuses on connecting highly innovative and agile startups with major corporates that are in need of innovation and have the resources to innovate. As such, B Capital has a special interest in B2B companies that have great potential to disrupt critical industries. This includes startups that are disrupting healthcare and biotechnology, as well as finance and insurance. B Capital has also supported some notable B2C companies, including coffee chain Kopi Kenangan and used car marketplace Carro.

B Capital Group is best known as the venture capital firm co-founded by Eduardo Saverin, co-founder of Facebook. Its investment thesis focuses on connecting highly innovative and agile startups with major corporates that are in need of innovation and have the resources to innovate. As such, B Capital has a special interest in B2B companies that have great potential to disrupt critical industries. This includes startups that are disrupting healthcare and biotechnology, as well as finance and insurance. B Capital has also supported some notable B2C companies, including coffee chain Kopi Kenangan and used car marketplace Carro.

Carlos Cadenas is a computer engineer with extensive industry experience. In 2008, he founded Fogg as CEO. The travel tech startup was later acquired by Skyscanner. He stayed on at Skyscanner as CPO and expanded the product development division from 150 to over 400 people across 10 sites globally, including engineering, design and product management.Cadenas is also an investor, mentor and board member in multiple startups. Currently, he’s the COO of GoCardless, one of the fastest-growing fintechs in Europe, helping the company to scale up its business internationally.

Carlos Cadenas is a computer engineer with extensive industry experience. In 2008, he founded Fogg as CEO. The travel tech startup was later acquired by Skyscanner. He stayed on at Skyscanner as CPO and expanded the product development division from 150 to over 400 people across 10 sites globally, including engineering, design and product management.Cadenas is also an investor, mentor and board member in multiple startups. Currently, he’s the COO of GoCardless, one of the fastest-growing fintechs in Europe, helping the company to scale up its business internationally.

Founded in 1969, Hong Kong-based Sun Hung Kai & Co is an investment company listed in the Hong Kong Stock Exchange. Its founder, Fung King-hey, is also the co-founder of Sun Hung Kai Properties. It invests mainly in finance, fintech, health insurance, media and technology sectors. The company has about HKD 43bn in assets and is the main shareholder of UA Finance and Everbright Sun Hung Kai.

Founded in 1969, Hong Kong-based Sun Hung Kai & Co is an investment company listed in the Hong Kong Stock Exchange. Its founder, Fung King-hey, is also the co-founder of Sun Hung Kai Properties. It invests mainly in finance, fintech, health insurance, media and technology sectors. The company has about HKD 43bn in assets and is the main shareholder of UA Finance and Everbright Sun Hung Kai.

Based in Sofia, BrightCap ventures is an early-stage VC supported by the European Investment Fund and Ministry of Economy of Bulgaria. Founded in 2018, the company has invested in seven startups based in various countries across market verticals. To date, it has managed one exit for London-based Cloudpipes, a cloud integration as a service manager.Its most recent investments include co-leading a post-seed round with Begin Capital to raise €2m for Spanish femtech Woom and a funding round for Enview, a 3D geospacial analytics company based in the US.

Based in Sofia, BrightCap ventures is an early-stage VC supported by the European Investment Fund and Ministry of Economy of Bulgaria. Founded in 2018, the company has invested in seven startups based in various countries across market verticals. To date, it has managed one exit for London-based Cloudpipes, a cloud integration as a service manager.Its most recent investments include co-leading a post-seed round with Begin Capital to raise €2m for Spanish femtech Woom and a funding round for Enview, a 3D geospacial analytics company based in the US.

This private Portuguese healthcare group was established in 2000 and based in Lisbon. It made its first investment in a startup in 2019 when it led the €600,000 seed round of medtech UpHill, a SaaS for healthcare professionals to keep up-to-speed on the latest clinical treatments and protocols using AI. The group’s Hospital da Luz was one of UpHill’s first customers.

This private Portuguese healthcare group was established in 2000 and based in Lisbon. It made its first investment in a startup in 2019 when it led the €600,000 seed round of medtech UpHill, a SaaS for healthcare professionals to keep up-to-speed on the latest clinical treatments and protocols using AI. The group’s Hospital da Luz was one of UpHill’s first customers.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

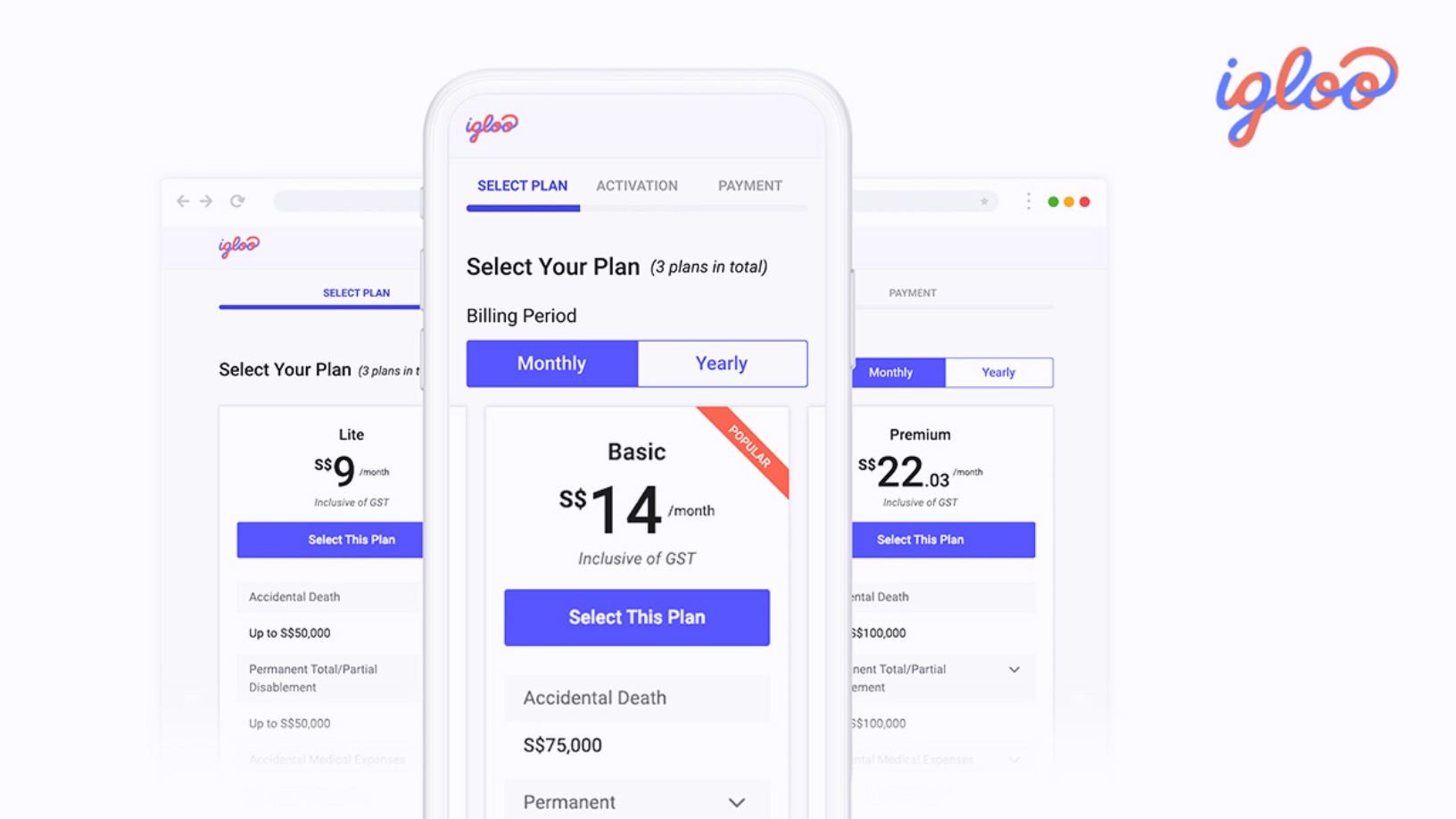

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Xrush makes brushing fun for kids with "smart toothbrushes"

Imitating every brushing move by a child, Xrush's smart gadget uses interactive games to motivate kids to brush their teeth properly

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Affordable pet healthcare insurance at your finger “Tips”

Over 78% of China's pet owners buy insurance to get the best services for their dogs and cats. Tips, an online platform for pet insurance and healthcare products, wants their business

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

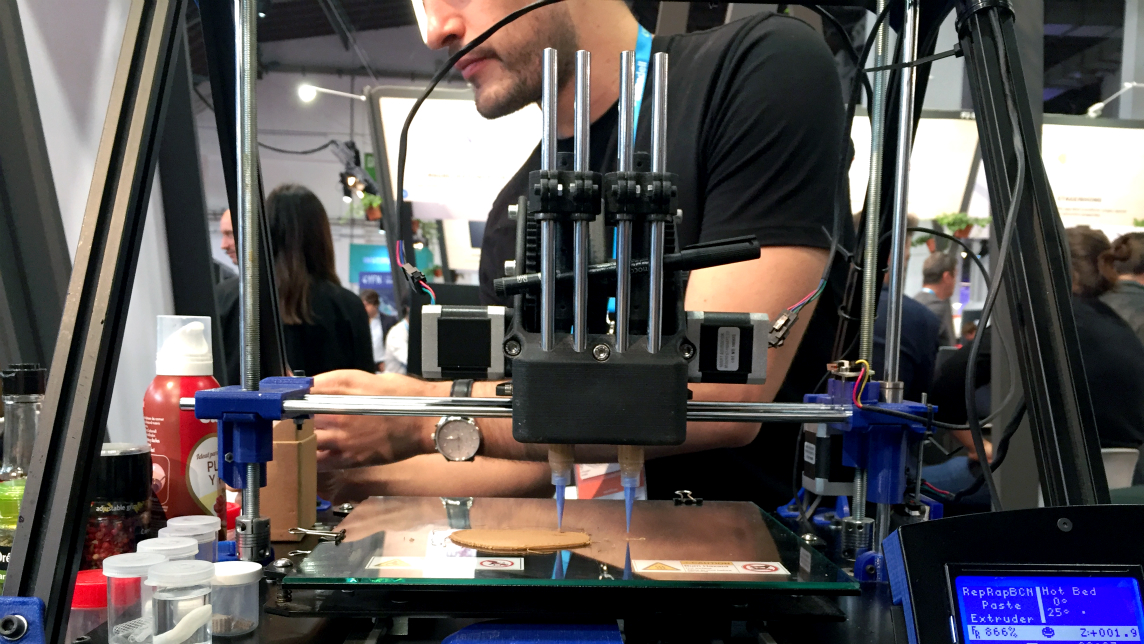

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“Peace-of-Meat”.