Peace-of-Meat

-

DATABASE (996)

-

ARTICLES (811)

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Co-founder and CEO of Brankas

Todd Schweitzer is an experienced economic and management consultant who founded Brankas, a payment processing platform for startups and other businesses. Between 2007 and 2010, Schweitzer worked with the US Peace Corps as a community economic advisor in the Dominican Republic. He then joined Strategy&, a subsidiary of PwC, as an engagement manager before leaving in 2015 for a brief stint at Seawood Resources, a Philippines-based investment company.Todd holds a bachelor’s degree in Economics from University of California, Irvine and a master’s in Public Policy from Harvard University.

Todd Schweitzer is an experienced economic and management consultant who founded Brankas, a payment processing platform for startups and other businesses. Between 2007 and 2010, Schweitzer worked with the US Peace Corps as a community economic advisor in the Dominican Republic. He then joined Strategy&, a subsidiary of PwC, as an engagement manager before leaving in 2015 for a brief stint at Seawood Resources, a Philippines-based investment company.Todd holds a bachelor’s degree in Economics from University of California, Irvine and a master’s in Public Policy from Harvard University.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Bezos-backed Chile’s first unicorn uses proprietary AI algorithm to analyze food molecules to produce plant-based meat and dairy products that taste like the original.

Bezos-backed Chile’s first unicorn uses proprietary AI algorithm to analyze food molecules to produce plant-based meat and dairy products that taste like the original.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

Founded in 2011, London-based Agronomics Limited’s principal investing interest is in environmentally-friendly alternatives to the traditional production of meat, wherever they may be located. There are currently 17 companies in its portfolio, all of them in the cellular-based or plant-based protein category and sustainable food production.Its most recent declared investments have been in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the December 2020 undisclosed pre-seed round of Chinese cellular foodtech CellX.

Founded in 2011, London-based Agronomics Limited’s principal investing interest is in environmentally-friendly alternatives to the traditional production of meat, wherever they may be located. There are currently 17 companies in its portfolio, all of them in the cellular-based or plant-based protein category and sustainable food production.Its most recent declared investments have been in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the December 2020 undisclosed pre-seed round of Chinese cellular foodtech CellX.

Co-founder, CTO of Meatable

Daan Luining is the Dutch co-founder and CTO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology, where he has worked since 2018. He is also a research director at the Cellular Agriculture Society in Leiden, a joint initiative for cell-based startups to share knowledge and to collaborate on projects to further scale the sector. Luining is also on the board of directors at the not-for-profit Cultured Meat Foundation that promotes sector innovation. His past posts have all been in the area of research, either as a researcher or a technician, and at the same time as completing studies. His last job was as a research strategist at New York-based New Harvest, a callular food rsearch funding body, where he worked for a year and met Dr. Kotter, the inventor of Meatable’s cellular technology. His research positions from 2009–15 were in the area of cell culture, mass spectrometry and DNA sequencing at the Maastricht University, University Medical Center Amsterdam, Utrecht University and Leiden University. Luining holds a master’s in biological sciences from Leiden University in the Netherlands.

Daan Luining is the Dutch co-founder and CTO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology, where he has worked since 2018. He is also a research director at the Cellular Agriculture Society in Leiden, a joint initiative for cell-based startups to share knowledge and to collaborate on projects to further scale the sector. Luining is also on the board of directors at the not-for-profit Cultured Meat Foundation that promotes sector innovation. His past posts have all been in the area of research, either as a researcher or a technician, and at the same time as completing studies. His last job was as a research strategist at New York-based New Harvest, a callular food rsearch funding body, where he worked for a year and met Dr. Kotter, the inventor of Meatable’s cellular technology. His research positions from 2009–15 were in the area of cell culture, mass spectrometry and DNA sequencing at the Maastricht University, University Medical Center Amsterdam, Utrecht University and Leiden University. Luining holds a master’s in biological sciences from Leiden University in the Netherlands.

Inspired by community-supported agriculture (CSA), Thousands of Farmers provides an e-commerce platform enabling consumers to subscribe to farm harvests in advance and share their profits.

Inspired by community-supported agriculture (CSA), Thousands of Farmers provides an e-commerce platform enabling consumers to subscribe to farm harvests in advance and share their profits.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

The biotech will expand its popular range of organic and probiotic treats for dogs and cats with cell-based pet food, planned for launch in 2022.

The biotech will expand its popular range of organic and probiotic treats for dogs and cats with cell-based pet food, planned for launch in 2022.

Co-founder, CEO of Meatable

Krijn De Nood is the Dutch co-founder and CEO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology with the use of pluripotent stem cells, where he has worked since 2018. He previously worked at McKinsey for six-and-a-half years in Amsterdam, New York and in Kenya. Prior to that, he worked as an equity derivatives trader at derivative trading company All Options after a short stint at Barclays Capital.De Nood holds two first degrees from the University of Amsterdam, in philosophy and in economics and finance.

Krijn De Nood is the Dutch co-founder and CEO at cell-based meat startup Meatable, the first to claim a highly scalable culture technology with the use of pluripotent stem cells, where he has worked since 2018. He previously worked at McKinsey for six-and-a-half years in Amsterdam, New York and in Kenya. Prior to that, he worked as an equity derivatives trader at derivative trading company All Options after a short stint at Barclays Capital.De Nood holds two first degrees from the University of Amsterdam, in philosophy and in economics and finance.

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

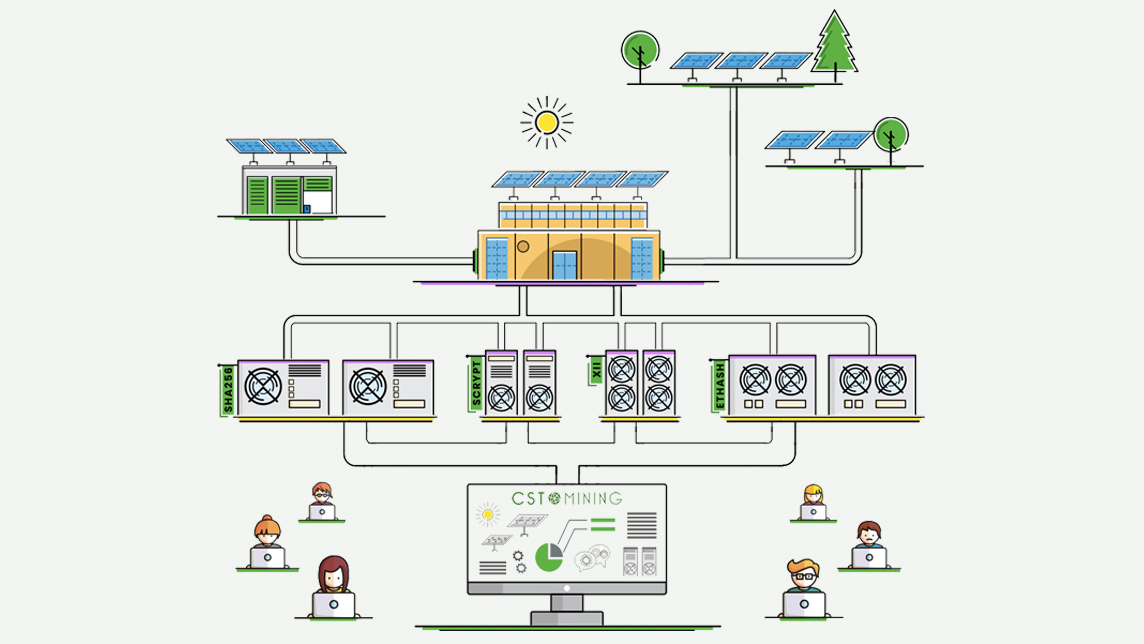

Cryptosolartech: Harnessing solar power to make cryptomining less environmentally harmful

The Spanish startup also sources cheaper electricity for cryptomining. It recently raised €8.85m in a pre-ICO, enabling it to build the world's first solar-powered cryptomining farm

Indonesian fintechs plug payday gaps, help workers stay away from loan sharks

Cash advance or “earned wage access” programs, already popular employee benefits in the US and Europe, are attracting investors and diverse clients in Indonesia

Mass production and delivery delays – common challenges facing China EV startups

As Tesla postponed delivery yet again, its Chinese rivals are scrambling too

Future Food Asia 2021: Impact assessments – getting the metrics right

Common impact measures are useful but each situation requires specific, sometimes subjective considerations. The priority is to gauge if the impact has led to positive changes

Infraspeak to raise up to €12m in Series A funding to accelerate European expansion

CEO Felipe Ávila da Costa discusses his rapidly growing facilities management platform that's helping airports, malls and hospitals run smoothly from Brazil to Mozambique

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Women entrepreneurs get ahead faster in Portugal

Still a long way to go for equality, but female founders in Portugal have made significant headstarts as tech innovators

Amidst a flurry of funding from overseas, local players urge a review of startup ownership rules in Indonesia

From China, Clever Home to build “Home Depot” marts in Africa

Combining B2B2C and O2O models, Clever Home is turning its 40,000sqm trade center in Nigeria into the "Yiwu marketplace" for Chinese companies looking to set up shop in Africa

Portofolio: Showing rookie investors the ropes without the rip-offs

Through investment education and the guidance of master traders, Portofolio aims to show aspiring forex and derivatives traders and investors how to avoid scams and stabilize their returns

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

IsCleanAir targets 2021 revenue to double on Covid-led health security push

IsCleanAir’s water-based air-purifying IoT system reduces air contaminants by more than 90%, and uses 7–10 times less electricity than conventional filter-based systems

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Sorry, we couldn’t find any matches for“Peace-of-Meat”.