Plant-based meat

-

DATABASE (849)

-

ARTICLES (621)

Cambridge Enterprise Venture Partners

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

Based in Linz, Klaus Hofbauer is an angel investor via his investment vehicle HOKL Ventures and the co-founder and CEO of Austria’s leading career job portal Karriere.at, established in 2004. As an angel investor, Hofbauer’s investments have included agriculture marketplace Markta, second-hand electronics marketplace Refurbed and leisure fishing booking site Hejfish. As a shareholder, he joined Refurbed as a board member in 2020.

Based in Linz, Klaus Hofbauer is an angel investor via his investment vehicle HOKL Ventures and the co-founder and CEO of Austria’s leading career job portal Karriere.at, established in 2004. As an angel investor, Hofbauer’s investments have included agriculture marketplace Markta, second-hand electronics marketplace Refurbed and leisure fishing booking site Hejfish. As a shareholder, he joined Refurbed as a board member in 2020.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

Gerard Olivé is a serial entrepreneur based in Barcelona. He is currently the co-CEO and co-founder of Antai Venture Builder, in charge of a multimillion-euro advertising inventory. He graduated in Audiovisual Communications at Barcelona's Ramon Llull University. As an angel investor, Olivé made his first disclosed investment in 2016 when he participated in the pre-seed and subsequent seed funding rounds of Spanish femtech WOOM. He founded BeRepublic, a strategic consulting firm specializing in digital businesses in southern Europe and Latin America. In 2015, he co-founded BeAgency, an interactive marketing agency with offices in Barcelona and Madrid. He is also a co-founder and mentor of Connector Startup Accelerator. He has also co-founded startups like Wallapop, Glovo, CornerJob, Deliberry, Shoppiday, Shopery, BePretty, Mascoteros, Marmota, Havet, Prontopiso, Medox and Trendier.

Gerard Olivé is a serial entrepreneur based in Barcelona. He is currently the co-CEO and co-founder of Antai Venture Builder, in charge of a multimillion-euro advertising inventory. He graduated in Audiovisual Communications at Barcelona's Ramon Llull University. As an angel investor, Olivé made his first disclosed investment in 2016 when he participated in the pre-seed and subsequent seed funding rounds of Spanish femtech WOOM. He founded BeRepublic, a strategic consulting firm specializing in digital businesses in southern Europe and Latin America. In 2015, he co-founded BeAgency, an interactive marketing agency with offices in Barcelona and Madrid. He is also a co-founder and mentor of Connector Startup Accelerator. He has also co-founded startups like Wallapop, Glovo, CornerJob, Deliberry, Shoppiday, Shopery, BePretty, Mascoteros, Marmota, Havet, Prontopiso, Medox and Trendier.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

SyndicateRoom is a Cambridge-based VC authorized and regulated by the Financial Conduct Authority (FCA), founded in 2013 by Gonçalo de Vasconcelos and Tom Britton, after studying together at the University of Cambridge. The company was initially started as an equity crowdfunding platform allowing its members to co-invest with experienced angel investors and high-net-worth individuals. Each investor is offered the same investment opportunities as lead investors, with the same share class and price per share.In July 2019, Gonçalo de Vasconcelos stepped down as CEO and was replaced by Graham Schwikkard. Soon afterward, the company announced a pivot of its investment model, becoming a VC fund that no longer offers individual crowdfunding investment opportunities. In the same year, SyndicateRoom launched Access EIS, the first data-driven Enterprise Investment Scheme fund.

SyndicateRoom is a Cambridge-based VC authorized and regulated by the Financial Conduct Authority (FCA), founded in 2013 by Gonçalo de Vasconcelos and Tom Britton, after studying together at the University of Cambridge. The company was initially started as an equity crowdfunding platform allowing its members to co-invest with experienced angel investors and high-net-worth individuals. Each investor is offered the same investment opportunities as lead investors, with the same share class and price per share.In July 2019, Gonçalo de Vasconcelos stepped down as CEO and was replaced by Graham Schwikkard. Soon afterward, the company announced a pivot of its investment model, becoming a VC fund that no longer offers individual crowdfunding investment opportunities. In the same year, SyndicateRoom launched Access EIS, the first data-driven Enterprise Investment Scheme fund.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

CEO and co-founder of OLIO

Tessa Clarke is the British CEO and co-founder of food-sharing app OLIO that was inspired by her experience of having to throw away perfectly good unused food when she was packing up to move from Switzerland back to the UK in 2014.After graduating with a first-class degree in social and political sciences at the University of Cambridge in UK in 1997, she worked for three years at the Boston Consulting Group as a junior associate. She joined an MBA program at Stanford University Graduate School of Business in 2002 and met Saasha Celestial-One, who was also studying for an MBA at Stanford. In 2015, Clarke and Celestial-One decided to use their savings to create a food-sharing app OLIO after successfully testing the idea as a private WhatsApp group in North London.Before becoming an entrepreneur in 2015, Clarke has held various senior management roles since completing her MBA in 2004. She worked for global business publisher EMAP from 2005 until 2009, when she joined Dyson Inc as e-commerce managing director (MD). In 2013, she left Dyson to become MD of fintech PayLater based in Switzerland run by the Wonga payday loan company. Known then as Tessa Cook, she later became Wonga’s MD for eight months when she was tasked with “cleaning up” the tarnished reputation of the high interest loan company. From 2013 to 2021, she was also chair of the management board of St George’s Palace, a boutique apart-hotel and spa complex in Bansko, Bulgaria.In 2018, she became a fellow at Unreasonable, an organization that supports social and environmental entrepreneurship. For two years until 2021, Clarke was ambassador for the Meaningful Business 100 global event that advocates the achievement of the UN’s Sustainable Development Goals. She was also a board member for six years at Contentive, a global B2B media and information company. In 2021, her busy schedule now includes becoming a business mentor for not-for-profit Virgin Startup.

Tessa Clarke is the British CEO and co-founder of food-sharing app OLIO that was inspired by her experience of having to throw away perfectly good unused food when she was packing up to move from Switzerland back to the UK in 2014.After graduating with a first-class degree in social and political sciences at the University of Cambridge in UK in 1997, she worked for three years at the Boston Consulting Group as a junior associate. She joined an MBA program at Stanford University Graduate School of Business in 2002 and met Saasha Celestial-One, who was also studying for an MBA at Stanford. In 2015, Clarke and Celestial-One decided to use their savings to create a food-sharing app OLIO after successfully testing the idea as a private WhatsApp group in North London.Before becoming an entrepreneur in 2015, Clarke has held various senior management roles since completing her MBA in 2004. She worked for global business publisher EMAP from 2005 until 2009, when she joined Dyson Inc as e-commerce managing director (MD). In 2013, she left Dyson to become MD of fintech PayLater based in Switzerland run by the Wonga payday loan company. Known then as Tessa Cook, she later became Wonga’s MD for eight months when she was tasked with “cleaning up” the tarnished reputation of the high interest loan company. From 2013 to 2021, she was also chair of the management board of St George’s Palace, a boutique apart-hotel and spa complex in Bansko, Bulgaria.In 2018, she became a fellow at Unreasonable, an organization that supports social and environmental entrepreneurship. For two years until 2021, Clarke was ambassador for the Meaningful Business 100 global event that advocates the achievement of the UN’s Sustainable Development Goals. She was also a board member for six years at Contentive, a global B2B media and information company. In 2021, her busy schedule now includes becoming a business mentor for not-for-profit Virgin Startup.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Currently based in the UK, Carlos González-Cadenas is a serial entrepreneur and business angel. In 2017, he became the CPO and CTO of GoCardless, one of the fintech partners of Billin. He founded Fogg in Barcelona in 2008 to build an advanced semantic search platform for the travel industry that was acquired by Scotland's Skyscanner in 2013. As CPO of Skyscanner in UK, he was able to scale the product development organization globally before the company was acquired by the Ctrip group for US$1.75 billion in November 2016. He was also part of Oberlo that was acquired by Shopify.

Currently based in the UK, Carlos González-Cadenas is a serial entrepreneur and business angel. In 2017, he became the CPO and CTO of GoCardless, one of the fintech partners of Billin. He founded Fogg in Barcelona in 2008 to build an advanced semantic search platform for the travel industry that was acquired by Scotland's Skyscanner in 2013. As CPO of Skyscanner in UK, he was able to scale the product development organization globally before the company was acquired by the Ctrip group for US$1.75 billion in November 2016. He was also part of Oberlo that was acquired by Shopify.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

Founded in 2009, Andreessen Horowitz is based in Menlo Park in California. The numeronym is the first and last letter of the firm’s brand with the characters count in-between. Starting with initial capital of $300m, the VC quickly raised a second venture fund of $650m in 2010 and another worth $1.5bn in 2014. In 2019, a new office was set up in San Francisco.Founded by Marc Andreessen and Ben Horowitz, the firm has invested in tech pioneers like Skype, Facebook, Groupon and Twitter. Andreessen is the software engineer who pioneered web browser Mosaic and co-founded Netscape. In 1995, Horowitz joined Andreessen as product manager at Netscape that was sold to AOL for $4.2bn in 2016. He also co-founded Opsware (Loudcloud), an automation software company that was sold to Hewlett Packard for $1.6bn in 2007.

Founded in 2009, Andreessen Horowitz is based in Menlo Park in California. The numeronym is the first and last letter of the firm’s brand with the characters count in-between. Starting with initial capital of $300m, the VC quickly raised a second venture fund of $650m in 2010 and another worth $1.5bn in 2014. In 2019, a new office was set up in San Francisco.Founded by Marc Andreessen and Ben Horowitz, the firm has invested in tech pioneers like Skype, Facebook, Groupon and Twitter. Andreessen is the software engineer who pioneered web browser Mosaic and co-founded Netscape. In 1995, Horowitz joined Andreessen as product manager at Netscape that was sold to AOL for $4.2bn in 2016. He also co-founded Opsware (Loudcloud), an automation software company that was sold to Hewlett Packard for $1.6bn in 2007.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Zhenmeat: Offering a modern plant-based meat alternative in China

The Chinese startup is providing a product adapted for Chinese tastes in an emerging market.

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

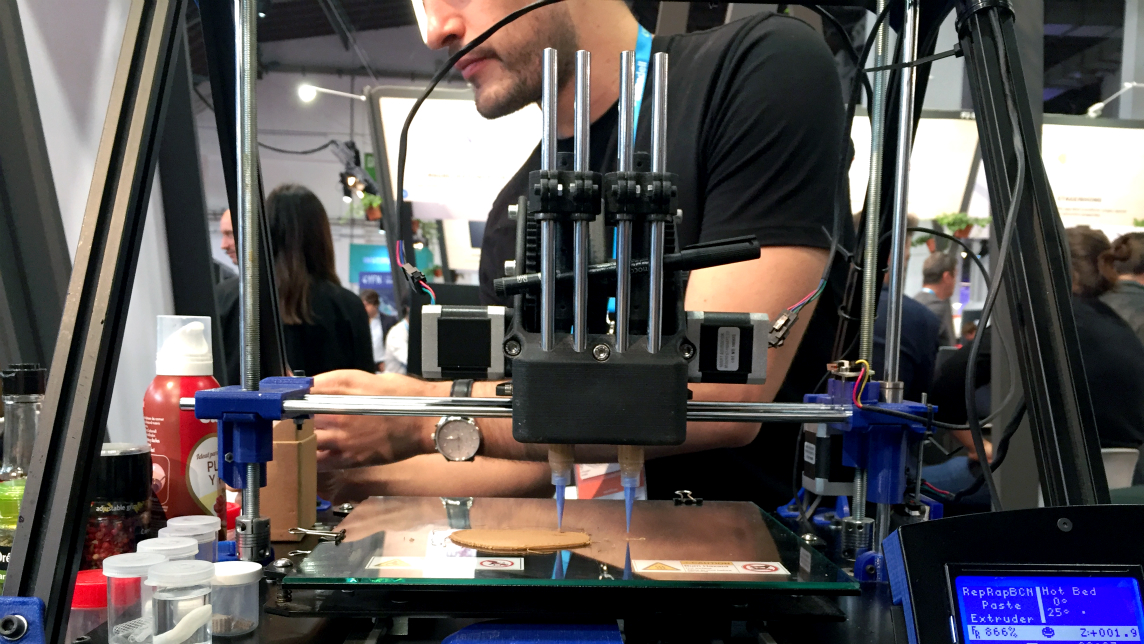

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

NotCo: Will this Bezos-backed plant-based foodtech be Chile's first unicorn?

Armed with $85m Series C funding, NotCo has expanded to the US, competing head-on with popular US alt-protein brands for a foothold in the multibillion-dollar vegan market

Sorry, we couldn’t find any matches for“Plant-based meat”.