Plug and Play Tech Center

-

DATABASE (995)

-

ARTICLES (811)

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

Deutsche Telekom is Germany's largest telecoms company, with operations in over 50 countries and more than 178 million mobile customers. It is a major investor in tech companies and has managed more than 20 investments and seven acquisitions to date. Its most well-known acquisition is teleco operator T-Mobile for €828m in 2014. Recent investments include HypeLabs' US$3m seed round and the €6m Series A round of automated IoT platform Axonise.

Deutsche Telekom is Germany's largest telecoms company, with operations in over 50 countries and more than 178 million mobile customers. It is a major investor in tech companies and has managed more than 20 investments and seven acquisitions to date. Its most well-known acquisition is teleco operator T-Mobile for €828m in 2014. Recent investments include HypeLabs' US$3m seed round and the €6m Series A round of automated IoT platform Axonise.

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

CTO and co-founder of Everimpact

Alain Retière is CTO and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more accurate carbon emissions data to public bodies, municipalities, and businesses.Retière has rich experience in sustainable development, climate change, as well as satellite technology. He was previously an agro-economist and senior scientific advisor at sustainable development organizations, public bodies, and international organisations, with three decades of field experience across 120 countries. In the course of his career, Retière spent a total of 13 years as director of two satellite-related agencies under the UN. This included three years managing CLIMSAT, a specialized center under the UNDP helping local government bodies assess the impact of climate change by using satellite and geo-spatial data, as well as 10 years at the helm of UNOSAT, the UN emergency satellite service. For his service at UNOSAT, he received the UN21 Award from UN Secretary-General Kofi Annan in 2005.Retière graduated from Groupe Ecole supérieure d'Agriculture d'Angers and holds a postgraduate degree from Université Pierre et Marie Curie, which is now part of Sorbonne University.

Alain Retière is CTO and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more accurate carbon emissions data to public bodies, municipalities, and businesses.Retière has rich experience in sustainable development, climate change, as well as satellite technology. He was previously an agro-economist and senior scientific advisor at sustainable development organizations, public bodies, and international organisations, with three decades of field experience across 120 countries. In the course of his career, Retière spent a total of 13 years as director of two satellite-related agencies under the UN. This included three years managing CLIMSAT, a specialized center under the UNDP helping local government bodies assess the impact of climate change by using satellite and geo-spatial data, as well as 10 years at the helm of UNOSAT, the UN emergency satellite service. For his service at UNOSAT, he received the UN21 Award from UN Secretary-General Kofi Annan in 2005.Retière graduated from Groupe Ecole supérieure d'Agriculture d'Angers and holds a postgraduate degree from Université Pierre et Marie Curie, which is now part of Sorbonne University.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

Founder and CEO of Orain

Xavier Sans Serra is the founder and CEO of payment and interactive chat app and IoT hardware startup Orain. He is based in Barcelona, where he has worked since 2016. Prior to this, he founded two other tech startups: Knowxel, which has been in operation from 2013 to 2016, and Neqta, which operated from 2011 to 2013. Knowxel was a social network for seeking skilled people for one-off work projects while Neqta was a research project to develop hardware to power portable devices. Both companies were developed at the Autonomous University of Barcelona, where the initial development of Orain also took place. Sans holds two master's degrees from Barcelona's Ramon Llull University: one in Engineering and Telecommunications Engineering and the other in Networks and Telecommunications. Between 2010 to 2012, he was a member of the Electromagnetism and Communications Research Group at Ramon Llull University's La Salle campus, where he was involved in a research project on geomagnetically-induced currents, which led to publications in scientific journals.

Xavier Sans Serra is the founder and CEO of payment and interactive chat app and IoT hardware startup Orain. He is based in Barcelona, where he has worked since 2016. Prior to this, he founded two other tech startups: Knowxel, which has been in operation from 2013 to 2016, and Neqta, which operated from 2011 to 2013. Knowxel was a social network for seeking skilled people for one-off work projects while Neqta was a research project to develop hardware to power portable devices. Both companies were developed at the Autonomous University of Barcelona, where the initial development of Orain also took place. Sans holds two master's degrees from Barcelona's Ramon Llull University: one in Engineering and Telecommunications Engineering and the other in Networks and Telecommunications. Between 2010 to 2012, he was a member of the Electromagnetism and Communications Research Group at Ramon Llull University's La Salle campus, where he was involved in a research project on geomagnetically-induced currents, which led to publications in scientific journals.

Public-listed PT Surya Semesta Internusa Tbk (aka Surya Internusa or SSIA) is a property conglomerate with interests in hospitality, property, construction and infrastructure. Founded by the President Director Johannes Suriadjaja in 1971 as a private property developer, the company was listed as SSIA in 1997. His daughter Christina Suriadjaja is a co-founder of Travelio, a tech startup that was originally created for Surya Internusa in 2014.

Public-listed PT Surya Semesta Internusa Tbk (aka Surya Internusa or SSIA) is a property conglomerate with interests in hospitality, property, construction and infrastructure. Founded by the President Director Johannes Suriadjaja in 1971 as a private property developer, the company was listed as SSIA in 1997. His daughter Christina Suriadjaja is a co-founder of Travelio, a tech startup that was originally created for Surya Internusa in 2014.

CEO and co-founder of Vence

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

Zriser Group is a Valencia-based family office fund started in 2007 by Ana and Pablo Serratosa Luján as a way to diversify their family investment strategy. The decision led to a diversified asset management scheme previously based on corporate acquisitions, then to a diversified portfolio of business and real estate investments.The firm has invested to date in eight tech-startups in the Spanish ecosystem.

Zriser Group is a Valencia-based family office fund started in 2007 by Ana and Pablo Serratosa Luján as a way to diversify their family investment strategy. The decision led to a diversified asset management scheme previously based on corporate acquisitions, then to a diversified portfolio of business and real estate investments.The firm has invested to date in eight tech-startups in the Spanish ecosystem.

Stanley Ventures / Stanley Black & Decker

Founded in 1843, Connecticut-based Stanley Black & Decker, is one of the oldest US manufacturing companies. It has acquired tons of organizations in recent decades and invests in a very selected number of startups. Its most recent disclosed tech startup investments via its VC arm Stanley Ventures were in the 2021 $1.8m seed round of Spain’s Triditive, and in the 2019 undisclosed investment round of Argentinian field operations software Iguana Fix.

Founded in 1843, Connecticut-based Stanley Black & Decker, is one of the oldest US manufacturing companies. It has acquired tons of organizations in recent decades and invests in a very selected number of startups. Its most recent disclosed tech startup investments via its VC arm Stanley Ventures were in the 2021 $1.8m seed round of Spain’s Triditive, and in the 2019 undisclosed investment round of Argentinian field operations software Iguana Fix.

Western Technology Investment (WTI)

Founded in 1980, Western Technology Investment invests in tech and life science startups. To date, it has invested over $6bn in 1,300 companies worldwide across diverse market segments.The Silicon Valley-based WTI currently has more than 500 companies in its global portfolio. Recent investments include US anti-aging medtech Elevio’s $15m funding in November 2020 and the $4.3m seed round in August 2020 for US fintech for teens Copper Banking.

Founded in 1980, Western Technology Investment invests in tech and life science startups. To date, it has invested over $6bn in 1,300 companies worldwide across diverse market segments.The Silicon Valley-based WTI currently has more than 500 companies in its global portfolio. Recent investments include US anti-aging medtech Elevio’s $15m funding in November 2020 and the $4.3m seed round in August 2020 for US fintech for teens Copper Banking.

Founded in 1980, INELCOM is a large Spanish manufacturing company that specializes in hardware, including microelectronics, optoelectronics and digital signal processors. It does not typically invest in tech startups, and, to date, its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed pre-seed and seed funding rounds totalling just over €3m. It is the startup’s industrial partner and manufactures its hardware.

Founded in 1980, INELCOM is a large Spanish manufacturing company that specializes in hardware, including microelectronics, optoelectronics and digital signal processors. It does not typically invest in tech startups, and, to date, its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed pre-seed and seed funding rounds totalling just over €3m. It is the startup’s industrial partner and manufactures its hardware.

Incorporated as Composite Capital Management (HK) Limited, the VC was founded in Hong Kong in January 2016 by David Ma who was a former partner at Hillhouse Capital Group that specializes in China-tech investments. Ma was at Hillhouse for seven years before founding Composite Capital that now manages total assets valued at RMB 3bn.

Incorporated as Composite Capital Management (HK) Limited, the VC was founded in Hong Kong in January 2016 by David Ma who was a former partner at Hillhouse Capital Group that specializes in China-tech investments. Ma was at Hillhouse for seven years before founding Composite Capital that now manages total assets valued at RMB 3bn.

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

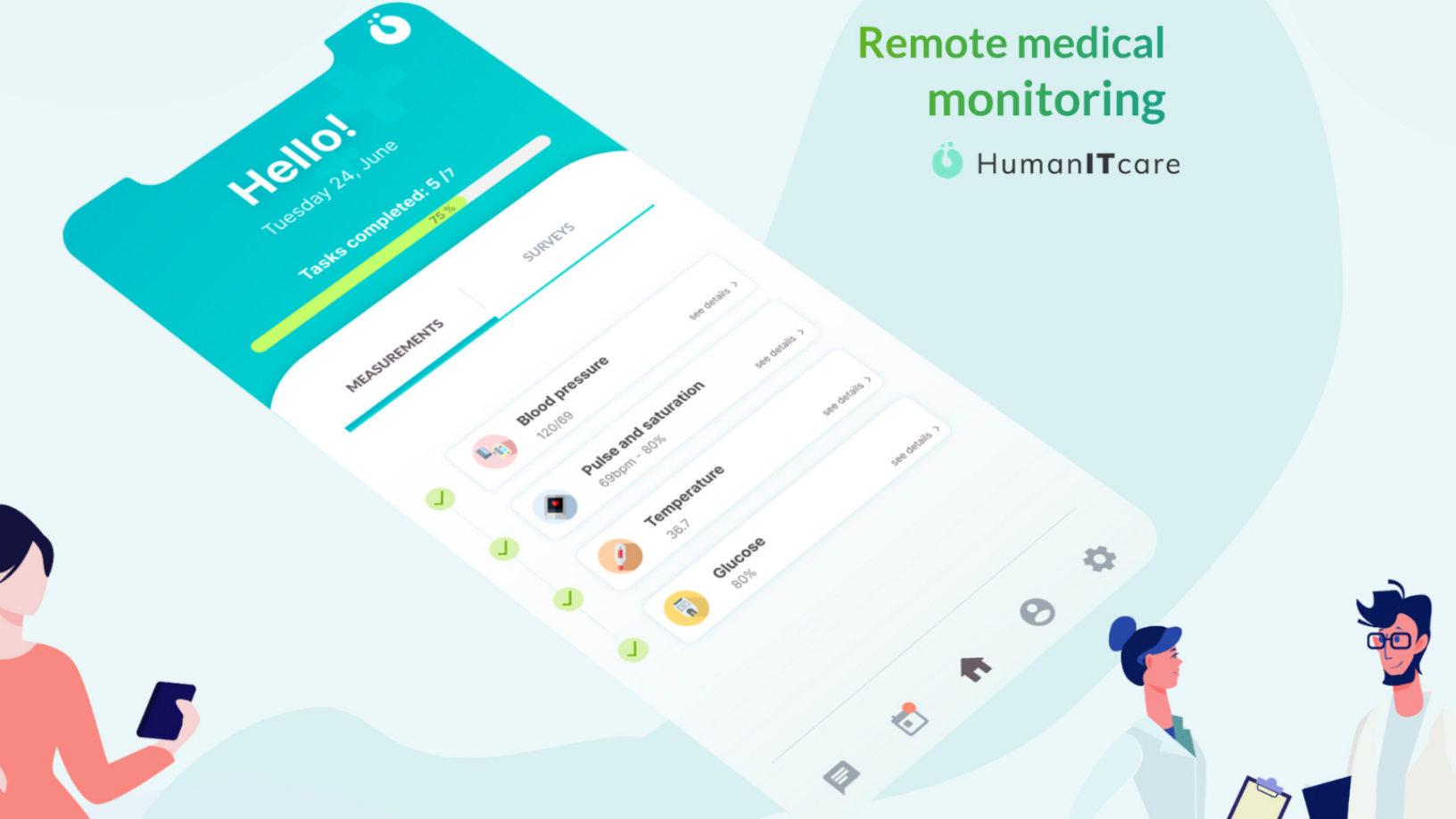

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Can Indonesia plug its tech talent gap to keep its digital economy growing?

Local institutions are stepping up to boost tech skills among students and jobseekers, as the government opens the way for more foreign talent joining startups

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Sorry, we couldn’t find any matches for“Plug and Play Tech Center”.