Plug and Play Tech Center

-

DATABASE (995)

-

ARTICLES (811)

Captii Ventures focuses on building Southeast Asian based startups by providing access to entrepreneurial expertise and experience to support business growth and development. It is a multi stage investor, with a special interest in mobile tech startups, marketplace platforms that facilitate better matching of supply and demand and in new media that disrupts traditional communication channels. It likes startups that use technology to solve age old problems.

Captii Ventures focuses on building Southeast Asian based startups by providing access to entrepreneurial expertise and experience to support business growth and development. It is a multi stage investor, with a special interest in mobile tech startups, marketplace platforms that facilitate better matching of supply and demand and in new media that disrupts traditional communication channels. It likes startups that use technology to solve age old problems.

Coatue is a tech sector hedge fund that invests in public and private equity markets. It is run by Philippe Laffont, who founded the hedge fund after leaving Tiger Management in 1999. Coatue is based in New York City and has several other offices around the globe. Its Beijing office was set up in 2014 and has since invested in several notable Chinese startups, including Didi Chuxing, Mafengwo and Kuaikan Comic.

Coatue is a tech sector hedge fund that invests in public and private equity markets. It is run by Philippe Laffont, who founded the hedge fund after leaving Tiger Management in 1999. Coatue is based in New York City and has several other offices around the globe. Its Beijing office was set up in 2014 and has since invested in several notable Chinese startups, including Didi Chuxing, Mafengwo and Kuaikan Comic.

Eduardo Saverin is a Brazilian tech entrepreneur and angel investor who is most famous for co-founding Facebook. A skilled investor, he reportedly made US$300,000 from trading while he was a Harvard undergraduate. He was also a co-founder and partner at B Capital Group that invested in logistics startup Ninja Van. In 2015, he invested in Indonesian e-commerce site Bilna and joined another funding round when Bilna merged with Moxy to form Orami.

Eduardo Saverin is a Brazilian tech entrepreneur and angel investor who is most famous for co-founding Facebook. A skilled investor, he reportedly made US$300,000 from trading while he was a Harvard undergraduate. He was also a co-founder and partner at B Capital Group that invested in logistics startup Ninja Van. In 2015, he invested in Indonesian e-commerce site Bilna and joined another funding round when Bilna merged with Moxy to form Orami.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

China Merchants Capital (CMC), the investment management platform of China Merchants Group, was established in 2012 with a registered capital of RMB 1 billion. As of the end of 2014, it had assets under management worth nearly US$3 billion. CMC invests mainly in the infrastructure, medical & pharmaceutical, financial services, real estate, high-tech, agriculture & foods, media, equipment machinery, mining and energy sectors, among others.

Novabase Capital is a Portuguese VC originally established in 1993 to invest in domestic technology projects. The firm has also invested in local tech startups since 2003. To date, it has invested in 21 companies, including 10 exits. It has invested €11m in four funds with a total investment value of over €27m. Recent investments include HypeLabs' US$3m seed round and the €1.5m seed round of IoT platform for industry Glartek.

Novabase Capital is a Portuguese VC originally established in 1993 to invest in domestic technology projects. The firm has also invested in local tech startups since 2003. To date, it has invested in 21 companies, including 10 exits. It has invested €11m in four funds with a total investment value of over €27m. Recent investments include HypeLabs' US$3m seed round and the €1.5m seed round of IoT platform for industry Glartek.

As one of the original enterprises of the Japanese Mitsubishi Group, Mitsubishi Motors started its automotive business in the pre-World War era. Mitsubishi Heavy Industries produced and imported cars for local use. The automotive company became part of the Renault-Nissan-Mitsubishi alliance in 2016 after Nissan acquired a controlling stake in Mitsubishi Motors. Indonesia's Gojek is its latest investment to expand into the ride-hailing tech sector in Southeast-Asia.

As one of the original enterprises of the Japanese Mitsubishi Group, Mitsubishi Motors started its automotive business in the pre-World War era. Mitsubishi Heavy Industries produced and imported cars for local use. The automotive company became part of the Renault-Nissan-Mitsubishi alliance in 2016 after Nissan acquired a controlling stake in Mitsubishi Motors. Indonesia's Gojek is its latest investment to expand into the ride-hailing tech sector in Southeast-Asia.

Google co-founder Larry Page is controlling shareholder of Alphabet Inc, Google’s parent company. As of June 2021, Page’s net worth was $106.2bn, making him the sixth richest person in the world. To date, he has made disclosed investments in five tech companies. The two most recent were both in 2016: an undisclosed quantum of investment in US-based electric personal aircraft startup Kitty Hawk Corporation, as well as participation in space mining company Planetary Resources’ $21m Series A round.

Google co-founder Larry Page is controlling shareholder of Alphabet Inc, Google’s parent company. As of June 2021, Page’s net worth was $106.2bn, making him the sixth richest person in the world. To date, he has made disclosed investments in five tech companies. The two most recent were both in 2016: an undisclosed quantum of investment in US-based electric personal aircraft startup Kitty Hawk Corporation, as well as participation in space mining company Planetary Resources’ $21m Series A round.

TI Platform Management is a US-based investment firm founded by Alex Bangash and Trang T Nguyen, who are also the founders of LP network and investment news platform TrustedInsight. Founded in 2015, the firm seeks out disruptive business models and invests in a range of categories, from furniture and home construction to healthcare and deep-tech. It has invested in Singapore-based enzyme engineering startup Allozymes, B2B pharmacy fulfillment service TruePill, and supply chain management startup Tyltgo.

TI Platform Management is a US-based investment firm founded by Alex Bangash and Trang T Nguyen, who are also the founders of LP network and investment news platform TrustedInsight. Founded in 2015, the firm seeks out disruptive business models and invests in a range of categories, from furniture and home construction to healthcare and deep-tech. It has invested in Singapore-based enzyme engineering startup Allozymes, B2B pharmacy fulfillment service TruePill, and supply chain management startup Tyltgo.

Stanford Graduate School of Business

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Established by the Shenzhen Government in 1999, Shenzhen Capital Group invests mainly in small- and medium-sized enterprises as well as high-tech startups in the fields of information technology, internet, biomedicine, new energy, high-end equipment manufacturing, etc. As of June 2018, it had invested RMB 37.6 billion in 889 projects and startups, 140 of which have been listed on 16 stock exchanges around the world.

Established by the Shenzhen Government in 1999, Shenzhen Capital Group invests mainly in small- and medium-sized enterprises as well as high-tech startups in the fields of information technology, internet, biomedicine, new energy, high-end equipment manufacturing, etc. As of June 2018, it had invested RMB 37.6 billion in 889 projects and startups, 140 of which have been listed on 16 stock exchanges around the world.

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

Grand China Capital is a Beijing-based venture capital firm. It invests mainly in media, entertainment, sports, tourism, and smart manufacturing sectors. It provides businesses with services such as financial investment, strategic consulting and data-based marketing. Grand China Capital co-launched a RMB 2 billion fund with Japan's SBI Group (previously known as Softbank Investment Co., Ltd) in September 2018 to drive tech development in the Asia Pacific region.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

La Famiglia is a Munich-based VC fund founded in 2016, comprising family businesses, tech entrepreneurs, business angels and industry experts led by Jeanette Fürstenberg and Robert Lacher. To date, it has managed one exit, API payroll engine, Rollbox. It has invested in 23 companies, including in OnTruck's Series B round and in the Series A round of CloudNC, Coya, Asana Rebel and FreightHub. Logistics and AI are two principal areas of interest for its investments.

La Famiglia is a Munich-based VC fund founded in 2016, comprising family businesses, tech entrepreneurs, business angels and industry experts led by Jeanette Fürstenberg and Robert Lacher. To date, it has managed one exit, API payroll engine, Rollbox. It has invested in 23 companies, including in OnTruck's Series B round and in the Series A round of CloudNC, Coya, Asana Rebel and FreightHub. Logistics and AI are two principal areas of interest for its investments.

Gin Venture Capital, also commonly known as GVC, is a Madrid-based investment management firm that has a multidisciplinary team with expertise and experience in strategic consulting, finance, marketing, sales, engineering, IT and logistics. Its investment commitment is for a maximum of five years. The firm usually co-invests through minimum investment tickets of €25,000. Its investment focus is on tech startups and SMEs and has developed proprietary technology companies in the clean-energy sector and IoT.

Gin Venture Capital, also commonly known as GVC, is a Madrid-based investment management firm that has a multidisciplinary team with expertise and experience in strategic consulting, finance, marketing, sales, engineering, IT and logistics. Its investment commitment is for a maximum of five years. The firm usually co-invests through minimum investment tickets of €25,000. Its investment focus is on tech startups and SMEs and has developed proprietary technology companies in the clean-energy sector and IoT.

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

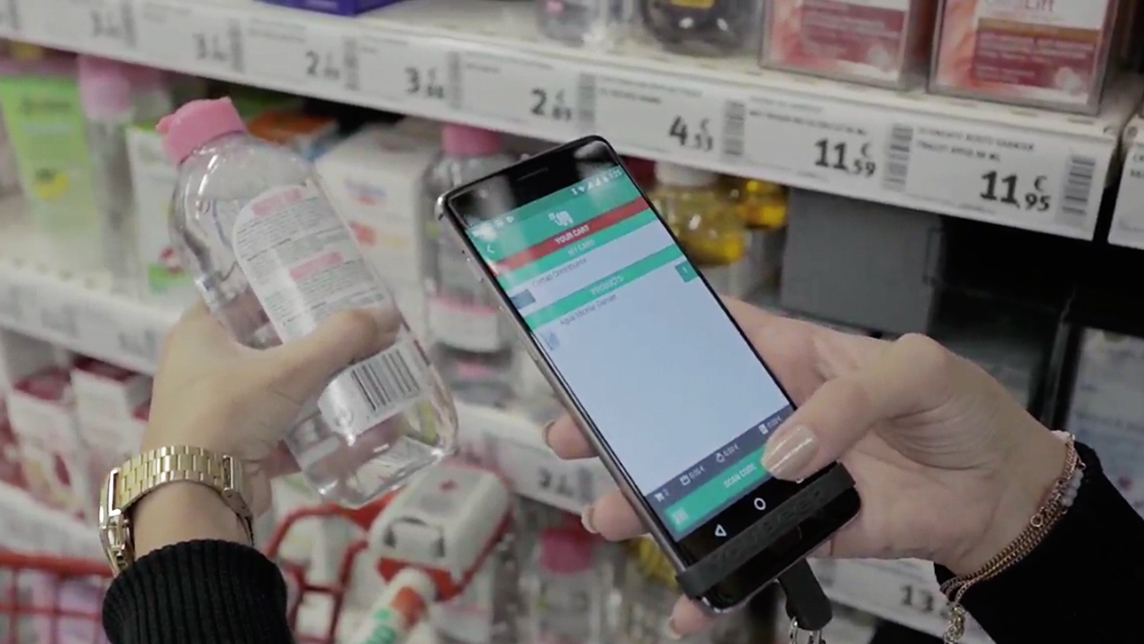

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

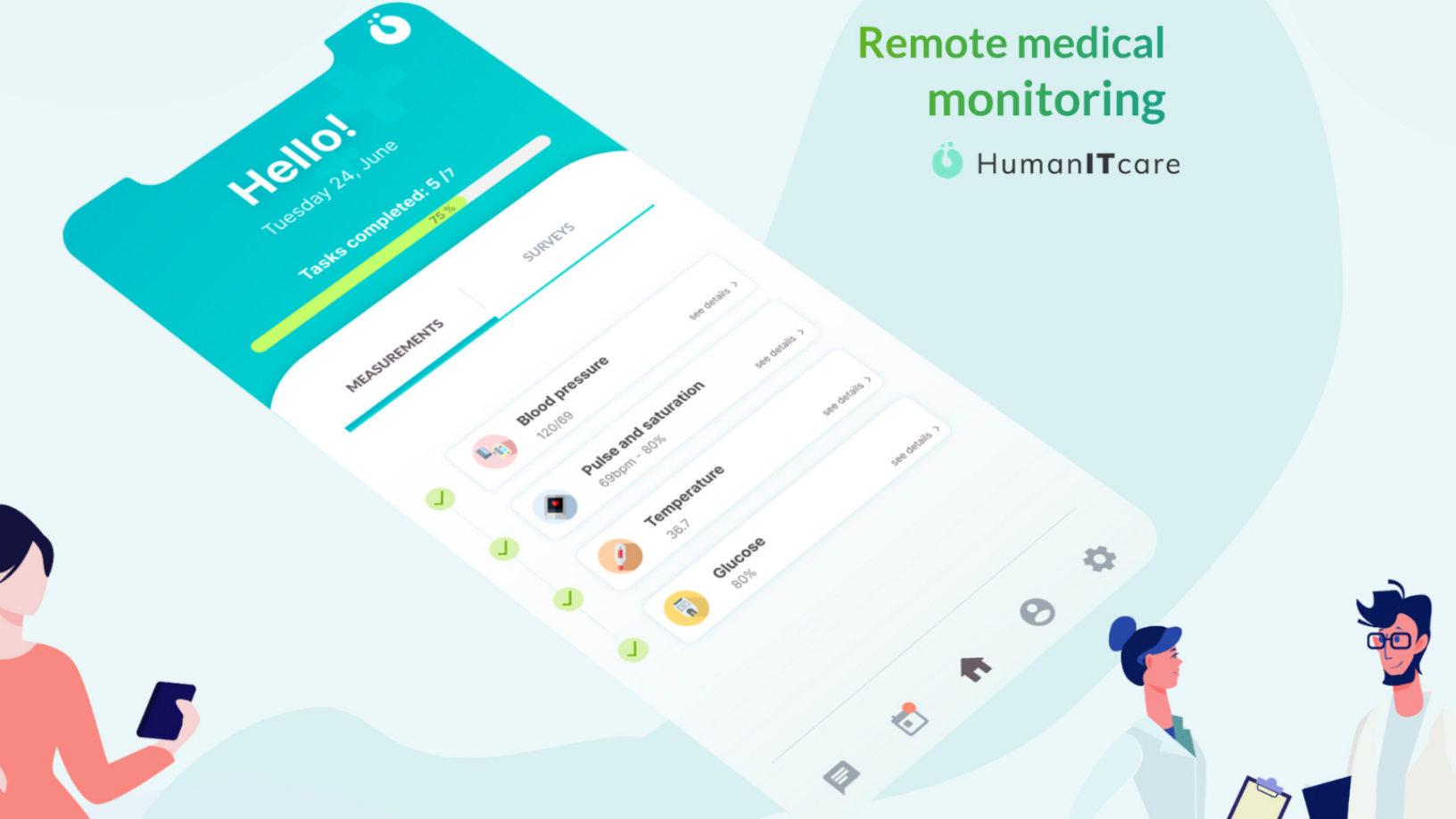

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Can Indonesia plug its tech talent gap to keep its digital economy growing?

Local institutions are stepping up to boost tech skills among students and jobseekers, as the government opens the way for more foreign talent joining startups

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Sorry, we couldn’t find any matches for“Plug and Play Tech Center”.