Plug and Play Tech Center

-

DATABASE (995)

-

ARTICLES (811)

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

Ufi Ventures is the investment arm of Ufi VocTech Trust, a UK-based grant-funding body created following the sale of Learndirect in 2010. With an initial fund of £50m, the organization is focussed on delivering an increase in the scale of vocational learning. The firm can invest from £150,000 to £1m as equity or debt in early-stage companies. To date, its disclosed investments include many UK public-private training initiatives, plus seed investments in two tech startups: soft-skills VR software Bodyswaps (£470,000) and childcare marketplace Kinderly (£325,000).

Ufi Ventures is the investment arm of Ufi VocTech Trust, a UK-based grant-funding body created following the sale of Learndirect in 2010. With an initial fund of £50m, the organization is focussed on delivering an increase in the scale of vocational learning. The firm can invest from £150,000 to £1m as equity or debt in early-stage companies. To date, its disclosed investments include many UK public-private training initiatives, plus seed investments in two tech startups: soft-skills VR software Bodyswaps (£470,000) and childcare marketplace Kinderly (£325,000).

Gopher Asset Management is a subsidiary of Noah Holdings, China’s first and largest independent wealth management company and only NYSE-listed wealth manager. Set up in 2010, Gopher’s assets under management reached RMB 86.7 billion in 2015, up 74.3% from 2014. Of these assets, PE/VC assets more than tripled to comprise 43.7% of total portfolio in 2015, versus 20.9% in 2014. Gopher’s investments cover nearly 1,000 high-growth companies in TMT, mobile Internet, IoT, healthcare, high-tech manufacturing and more. In 2016, it is focusing on Internet-based businesses relating to big data in healthcare, education, culture and finance.

Gopher Asset Management is a subsidiary of Noah Holdings, China’s first and largest independent wealth management company and only NYSE-listed wealth manager. Set up in 2010, Gopher’s assets under management reached RMB 86.7 billion in 2015, up 74.3% from 2014. Of these assets, PE/VC assets more than tripled to comprise 43.7% of total portfolio in 2015, versus 20.9% in 2014. Gopher’s investments cover nearly 1,000 high-growth companies in TMT, mobile Internet, IoT, healthcare, high-tech manufacturing and more. In 2016, it is focusing on Internet-based businesses relating to big data in healthcare, education, culture and finance.

Justin Mateen is the co-founder and former CMO of dating app Tinder. The well-known American internet entrepreneur is also an adviser to Home Chef, Rich Uncles, LLC, Jobr, Hutch, Cargomatic and Common. He was named in Forbes 30 under 30 in 2014. His career as an entrepreneur started with Site Canvas and Cover Canvas, after he graduated from USC Marshall School of Business. The early stage investor supports innovative tech and real estate companies.

Justin Mateen is the co-founder and former CMO of dating app Tinder. The well-known American internet entrepreneur is also an adviser to Home Chef, Rich Uncles, LLC, Jobr, Hutch, Cargomatic and Common. He was named in Forbes 30 under 30 in 2014. His career as an entrepreneur started with Site Canvas and Cover Canvas, after he graduated from USC Marshall School of Business. The early stage investor supports innovative tech and real estate companies.

Yago Arbeloa is a serial entrepreneur with over 20 years of experience founding internet and advertising companies in Spain.Arbeloa is president of MIOGROUP, a marketing and advertising group with yearly turnover of more than €50m. He is also president of the Internet Investors and Entrepreneurs Association. Through Viriditas Ventures, his investment vehicle, Arbeloa has backed tech startups such as We are Knitters, Rentuos, Baluwo, iContainers and Reclamador.es.

Yago Arbeloa is a serial entrepreneur with over 20 years of experience founding internet and advertising companies in Spain.Arbeloa is president of MIOGROUP, a marketing and advertising group with yearly turnover of more than €50m. He is also president of the Internet Investors and Entrepreneurs Association. Through Viriditas Ventures, his investment vehicle, Arbeloa has backed tech startups such as We are Knitters, Rentuos, Baluwo, iContainers and Reclamador.es.

Chris Bouwer is a Barcelona-based angel investor, active in the Spanish tech ecosystem and known for backing startups including Delivery Hero, Fanly and Airhelp. More recently, he was the lead investor in a funding round by Polaroo, a mobile app that manages and automates household payments, as well as investing in Cobee, a compensation and benefits management SaaS. He’s currently Board Advisor in Cellulant, a financial service provider providing digital payments in Africa. Bouwer has a background in sales, with his last key position as VP of Sales (2007–2015) in Adyen, a Dutch PSP services fintech he co-founded.

Chris Bouwer is a Barcelona-based angel investor, active in the Spanish tech ecosystem and known for backing startups including Delivery Hero, Fanly and Airhelp. More recently, he was the lead investor in a funding round by Polaroo, a mobile app that manages and automates household payments, as well as investing in Cobee, a compensation and benefits management SaaS. He’s currently Board Advisor in Cellulant, a financial service provider providing digital payments in Africa. Bouwer has a background in sales, with his last key position as VP of Sales (2007–2015) in Adyen, a Dutch PSP services fintech he co-founded.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

A UK-based investor founded in 2018, Haatch currently has 14 mainly UK and Ireland-based companies in its portfolio, valued in excess of $160m. It has launched two funds to date and typically makes investments from £100,000 to £300,000 and up to £2m for Series A or B rounds. Its most recent investments include a £470,000 seed round in VR training soft-skills provider Bodyswaps, an undisclosed seed round in virtual office workspace Re-Flow, and a £155,000 post-seed round in tech development team provider Deazy. In many cases, Haatch is the sole investor.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

Shanghai Artificial Intelligence Industry Investment Fund

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

CEO and co-founder of Carbo Culture

Finnish native Pia Henrietta Moon, has been a scout leader since 2003. Her first job was in event management and tourism operations in India for Sunset Getaways & Insta tourism in 2007. While studying at the University of Economics and Business in Vienna, she met American engineer Christopher Carstens in 2013 at a global solutions innovation program organized by Singularity University in California. She left university in 2014 and co-founded Carbo Culture as CEO in 2016 with Carstens as CTO.In 2016, Moon also joined the electronics company Yleiselektroniikka as a board member, the youngest person in Finland to hold such a position in a listed company. Moon also founded edtech startup Mehackit in 2013 and became its chairwoman for four years. She exited both companies in 2018 to focus on running Carbo Culture.While at university, Moon also worked for over two years at Rails Girls, a not-for-profit for women in tech. In Finland, she joined the student entrepreneurship society in 2011 and completed an internship in 2010 at the Ministry for Foreign Affairs of Finland. In 2015, she joined the World Economic Forum’s Global Shapers youth community initiative in Helsinki.

Finnish native Pia Henrietta Moon, has been a scout leader since 2003. Her first job was in event management and tourism operations in India for Sunset Getaways & Insta tourism in 2007. While studying at the University of Economics and Business in Vienna, she met American engineer Christopher Carstens in 2013 at a global solutions innovation program organized by Singularity University in California. She left university in 2014 and co-founded Carbo Culture as CEO in 2016 with Carstens as CTO.In 2016, Moon also joined the electronics company Yleiselektroniikka as a board member, the youngest person in Finland to hold such a position in a listed company. Moon also founded edtech startup Mehackit in 2013 and became its chairwoman for four years. She exited both companies in 2018 to focus on running Carbo Culture.While at university, Moon also worked for over two years at Rails Girls, a not-for-profit for women in tech. In Finland, she joined the student entrepreneurship society in 2011 and completed an internship in 2010 at the Ministry for Foreign Affairs of Finland. In 2015, she joined the World Economic Forum’s Global Shapers youth community initiative in Helsinki.

Yale University’s Physics and Philosophy graduate Justin Kan is a tech millionaire. The American Korean became famous by broadcasting his life through a webcam on the Justin.tv website that later evolved into the global video game streaming platform Twitch. After an internship working on endless spreadsheets, Yale’s former Men of Branford Calendar model decided to become a technopreneur in 2005. He became a partner of Y Combinator in 2014 but left in 2017 to focus on Justin Kan Enterprises, Titanic’s End and Whale. He recently founded Atrium LTS and became CEO of the law services platform.

Yale University’s Physics and Philosophy graduate Justin Kan is a tech millionaire. The American Korean became famous by broadcasting his life through a webcam on the Justin.tv website that later evolved into the global video game streaming platform Twitch. After an internship working on endless spreadsheets, Yale’s former Men of Branford Calendar model decided to become a technopreneur in 2005. He became a partner of Y Combinator in 2014 but left in 2017 to focus on Justin Kan Enterprises, Titanic’s End and Whale. He recently founded Atrium LTS and became CEO of the law services platform.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

The Venture City is a tech accelerator with international growth hubs. The VC was established in 2017 by former Facebook executive Laura González-Estéfani with co-founder Clara Bullrich from Guggenheim Partners Latin America/LJ Partnership.The ecosystem accelerator is data-driven and has diverse interests in AI, healthtech, cybersecurity, SaaS, marketplaces, fintech, blockchain and VR. It also provides the full A-Z package of expertise to support startups that have the potential to scale internationally, especially in LatAm, Asia and Africa.

The Venture City is a tech accelerator with international growth hubs. The VC was established in 2017 by former Facebook executive Laura González-Estéfani with co-founder Clara Bullrich from Guggenheim Partners Latin America/LJ Partnership.The ecosystem accelerator is data-driven and has diverse interests in AI, healthtech, cybersecurity, SaaS, marketplaces, fintech, blockchain and VR. It also provides the full A-Z package of expertise to support startups that have the potential to scale internationally, especially in LatAm, Asia and Africa.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

Everbright New Economy USD Fund

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

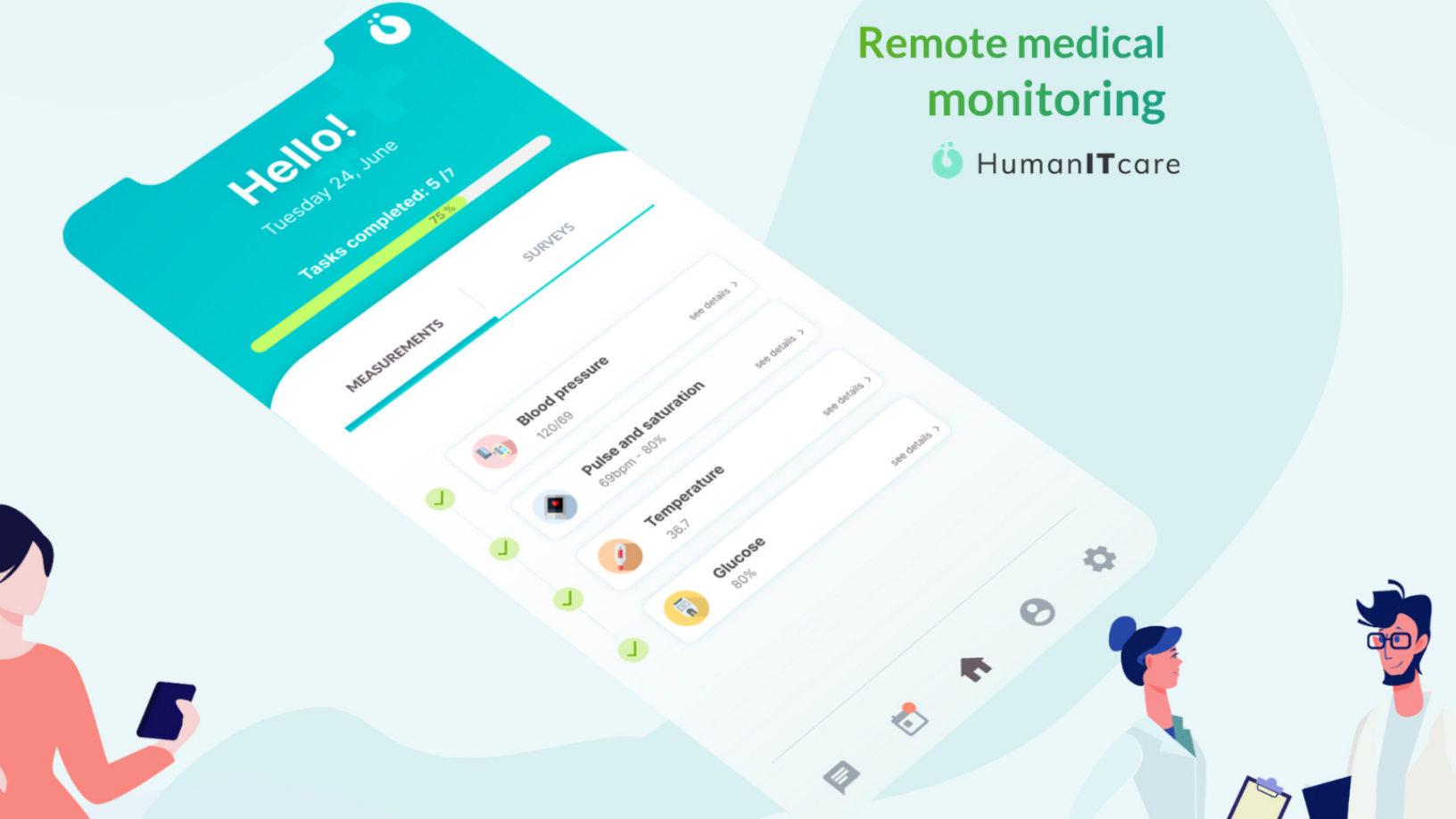

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Can Indonesia plug its tech talent gap to keep its digital economy growing?

Local institutions are stepping up to boost tech skills among students and jobseekers, as the government opens the way for more foreign talent joining startups

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Sorry, we couldn’t find any matches for“Plug and Play Tech Center”.