Plug and Play Tech Center

-

DATABASE (995)

-

ARTICLES (811)

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

He Chang (b. 1982) is the founder of the popular Huang Taiji, an internet venture specializing in traditional Chinese breakfast fare and food delivery. He studied design in Denmark and worked at Google China, Baidu and leading online travel booking company Qunar. He believes that the success of a startup depends on three criteria: the founder’s abilities and experience, the strength of the founding team, and the third, which is also the most important, societal trends.

He Chang (b. 1982) is the founder of the popular Huang Taiji, an internet venture specializing in traditional Chinese breakfast fare and food delivery. He studied design in Denmark and worked at Google China, Baidu and leading online travel booking company Qunar. He believes that the success of a startup depends on three criteria: the founder’s abilities and experience, the strength of the founding team, and the third, which is also the most important, societal trends.

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

Farben Consulting is a Portuguese real estate investor and consultancy based in Torres Novas and established in 1996. It has no website and has not disclosed any information about its business. In 2014 and 2015, Farben invested €1.5m for an equity stake of 98% in CoolFarm. The agtech became insolvent in October 2018 when Farben decided to stop supporting the startup due to lack of sales and market potential for B2B indoor farming solutions.

Farben Consulting is a Portuguese real estate investor and consultancy based in Torres Novas and established in 1996. It has no website and has not disclosed any information about its business. In 2014 and 2015, Farben invested €1.5m for an equity stake of 98% in CoolFarm. The agtech became insolvent in October 2018 when Farben decided to stop supporting the startup due to lack of sales and market potential for B2B indoor farming solutions.

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Baiyang Capital was founded in 2014 by BAHEAL Pharmaceutical Holdings Limited and several senior professionals in the pharmaceutical and healthcare fields. The investment management company operates multiple funds, targeting pharmaceutical and healthcare businesses.

Baiyang Capital was founded in 2014 by BAHEAL Pharmaceutical Holdings Limited and several senior professionals in the pharmaceutical and healthcare fields. The investment management company operates multiple funds, targeting pharmaceutical and healthcare businesses.

Prime Mont V.C is a private equity manager focused on investing in businesses with public listing potential and and in the integration, merger and reorganization of businesses in the Greater China capital markets. The team includes Institute of Economics (CASS) Deputy Director and Peking University HSBC Business School Professor Zhang Ping as its chief strategy officer.

Prime Mont V.C is a private equity manager focused on investing in businesses with public listing potential and and in the integration, merger and reorganization of businesses in the Greater China capital markets. The team includes Institute of Economics (CASS) Deputy Director and Peking University HSBC Business School Professor Zhang Ping as its chief strategy officer.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

Launched in 2007, 2bpartner is a venture capital firm created by the Minho regional business association (AIMinho) and several private investors and companies. The VC invests through the Minho Inovação e Internacionalização fund that was launched in 2011 and co-financed by COMPETE and private investors. DST Group became its major shareholder in 2012.

Launched in 2007, 2bpartner is a venture capital firm created by the Minho regional business association (AIMinho) and several private investors and companies. The VC invests through the Minho Inovação e Internacionalização fund that was launched in 2011 and co-financed by COMPETE and private investors. DST Group became its major shareholder in 2012.

Start-Up Chile is a public accelerator program set up by the Chilean government and looks to invest in startups across the world with Chile as their foundation. It has a diverse portfolio, having invested in startups from Europe, North America and Asia. Start-Up Chile primarily gives seed and grant funding, typically investing between $15,000 and $90,000.

Start-Up Chile is a public accelerator program set up by the Chilean government and looks to invest in startups across the world with Chile as their foundation. It has a diverse portfolio, having invested in startups from Europe, North America and Asia. Start-Up Chile primarily gives seed and grant funding, typically investing between $15,000 and $90,000.

Founded in 2012 by Wang Yawei, the former vice-president of China Asset Management and the founder of Top Ace Asset Management, Qianhe Capital provides asset management, equity investment and investment management services. As of April 2017, Qianhe Capital had RMB 24 billion under management and issued 11 trust plans and asset management plans.

Founded in 2012 by Wang Yawei, the former vice-president of China Asset Management and the founder of Top Ace Asset Management, Qianhe Capital provides asset management, equity investment and investment management services. As of April 2017, Qianhe Capital had RMB 24 billion under management and issued 11 trust plans and asset management plans.

Sky9 Capital is founded by the former co-founder and managing director of Lightspeed China Partners, Cao Darong. As an early-stage venture capital firm, it focuses on investing in TMT (Technology, Media and Telecommunications), especially Internet innovation and enterprise services. The company has a strong presence in Beijing, Shanghai, Shenzhen and Silicon Valley in the US.

Sky9 Capital is founded by the former co-founder and managing director of Lightspeed China Partners, Cao Darong. As an early-stage venture capital firm, it focuses on investing in TMT (Technology, Media and Telecommunications), especially Internet innovation and enterprise services. The company has a strong presence in Beijing, Shanghai, Shenzhen and Silicon Valley in the US.

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

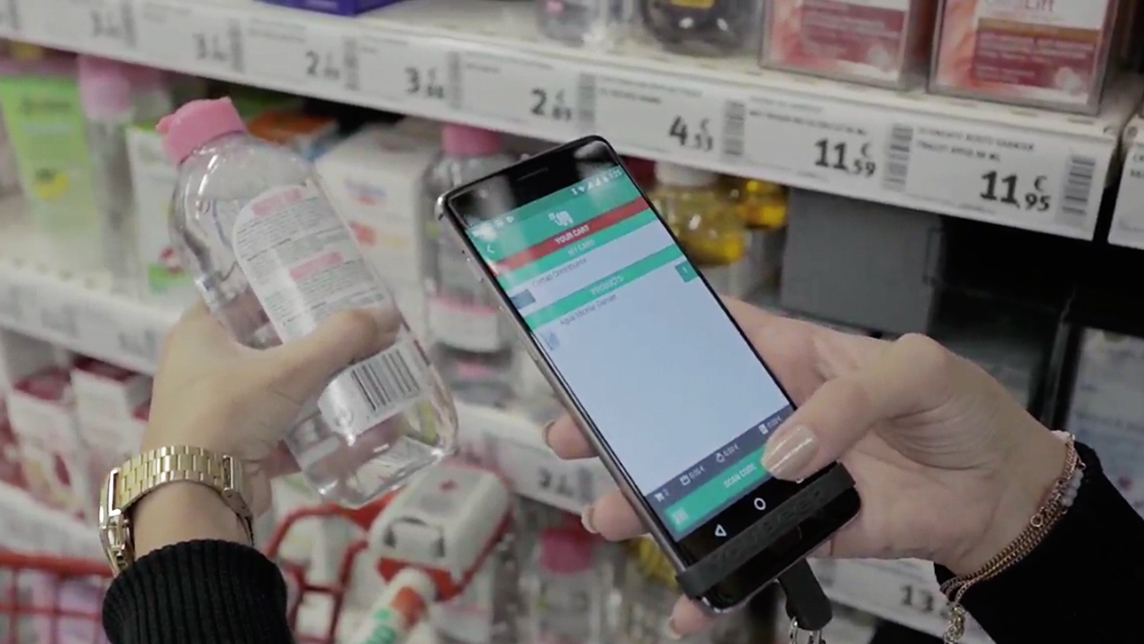

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

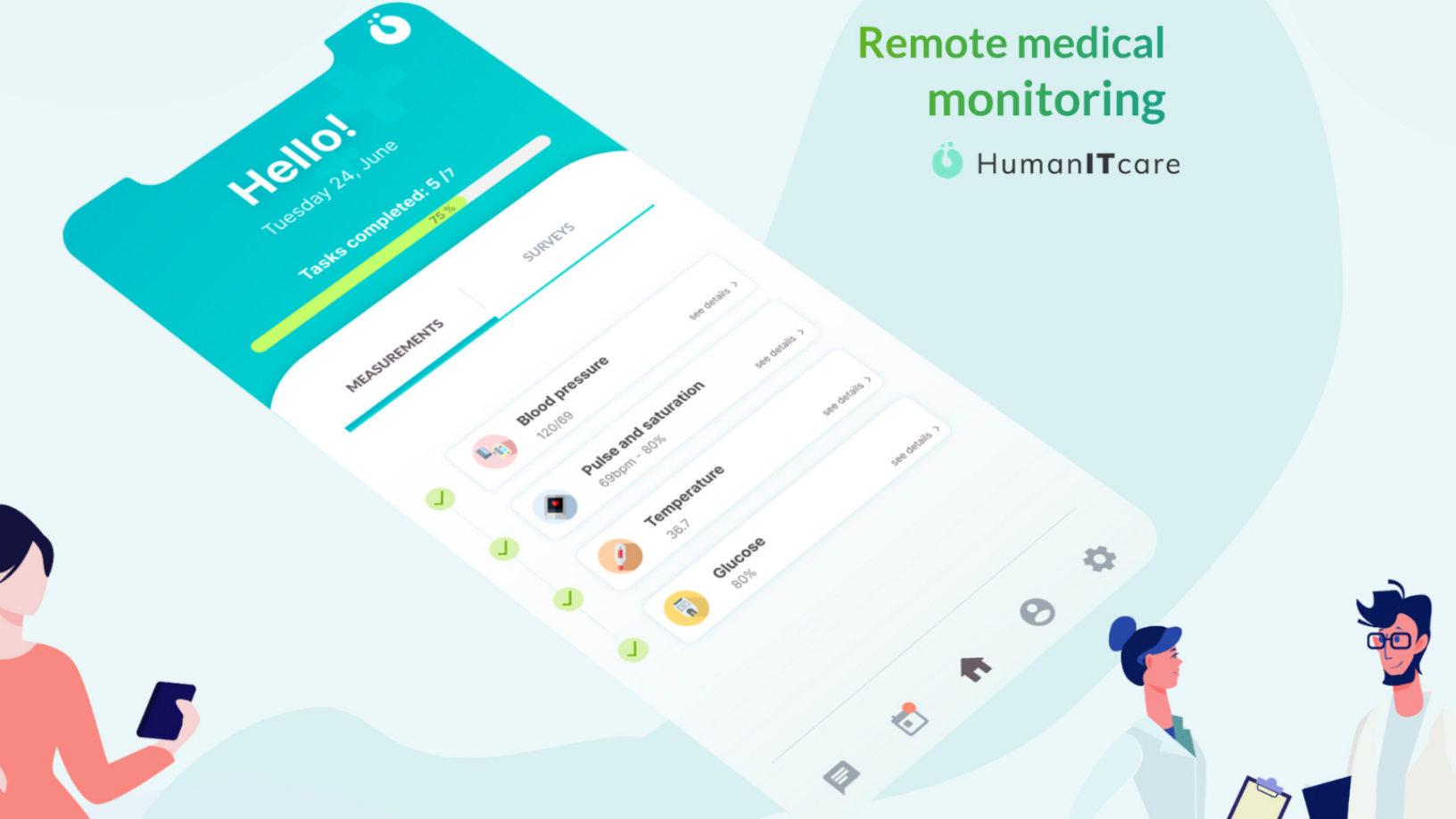

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Can Indonesia plug its tech talent gap to keep its digital economy growing?

Local institutions are stepping up to boost tech skills among students and jobseekers, as the government opens the way for more foreign talent joining startups

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Sorry, we couldn’t find any matches for“Plug and Play Tech Center”.