Plug and Play Tech Center

-

DATABASE (995)

-

ARTICLES (811)

Sway Ventures, formerly AITV, is a US-based venture capital firm with offices in San Francisco, La Jolla and London investing in early to mid-stage technology companies. The VC team comprises former founders and specialists from four key areas: capital, revenue, talent and product. Its portfolio includes Uber, Owl and Zipline.

Sway Ventures, formerly AITV, is a US-based venture capital firm with offices in San Francisco, La Jolla and London investing in early to mid-stage technology companies. The VC team comprises former founders and specialists from four key areas: capital, revenue, talent and product. Its portfolio includes Uber, Owl and Zipline.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Chinese rock musician and composer Wang Feng was the founder and lead vocals of the rock band No. 43 Baojia Street. In 2015, Wang invested in Yemalive and officially released the FIIL headset brand.

Chinese rock musician and composer Wang Feng was the founder and lead vocals of the rock band No. 43 Baojia Street. In 2015, Wang invested in Yemalive and officially released the FIIL headset brand.

MidPlaza Holding is a holding company consisting of businesses in property development and information technology. Founded in 1983, the company’s brands include a major internet service provider Biznet and the Ayana group of residential properties and hotels.

MidPlaza Holding is a holding company consisting of businesses in property development and information technology. Founded in 1983, the company’s brands include a major internet service provider Biznet and the Ayana group of residential properties and hotels.

Co-founder of Fenbushi Capital, China’s first venture capital firm that focuses exclusively on blockchain investment, and of Bitshares, a blockchain-based financial platform. Among the earliest investors and entrepreneurs in the blockchain industry, Shen has 12 years of experience in senior management at brokerages, hedge funds and investment banks. He received his bachelor’s degree in mathematics from the University of Shanghai for Science and Technology and his master’s degree in Systems Engineering from the Georgia Institute of Technology.

Co-founder of Fenbushi Capital, China’s first venture capital firm that focuses exclusively on blockchain investment, and of Bitshares, a blockchain-based financial platform. Among the earliest investors and entrepreneurs in the blockchain industry, Shen has 12 years of experience in senior management at brokerages, hedge funds and investment banks. He received his bachelor’s degree in mathematics from the University of Shanghai for Science and Technology and his master’s degree in Systems Engineering from the Georgia Institute of Technology.

Ignacio Martín de Andrés has over eight years of experience working at consultancies such as KPMG, PwC and Grant Thornton.He made an angel investment in Reclamador.es, a web platform that manages and automates consumer claims, and has also helped define the company's strategy and service-level agreement.Since 2019, he's been a partner at Venture Partnership, supporting the company by defining growth strategy, KPIs and process optimization for startups in the company’s investment portfolio.

Ignacio Martín de Andrés has over eight years of experience working at consultancies such as KPMG, PwC and Grant Thornton.He made an angel investment in Reclamador.es, a web platform that manages and automates consumer claims, and has also helped define the company's strategy and service-level agreement.Since 2019, he's been a partner at Venture Partnership, supporting the company by defining growth strategy, KPIs and process optimization for startups in the company’s investment portfolio.

Founded in 2012, BAIC Capital is the investment arm of China's state-owned carmaker, BAIC Group. Headquartered in Beijing, it has branches in six cities across China and has two subsidiaries in Frankfurt and Silicon Valley. It currently manages over 40 funds, worth RMB 30bn. With a focus on connected cars and mobility services, it has invested in more than 100 companies including EV manufacturer BAIC BJEV, battery manufacturer and technology company CATL and ride-hailing giant Didi Chuxing.

Founded in 2012, BAIC Capital is the investment arm of China's state-owned carmaker, BAIC Group. Headquartered in Beijing, it has branches in six cities across China and has two subsidiaries in Frankfurt and Silicon Valley. It currently manages over 40 funds, worth RMB 30bn. With a focus on connected cars and mobility services, it has invested in more than 100 companies including EV manufacturer BAIC BJEV, battery manufacturer and technology company CATL and ride-hailing giant Didi Chuxing.

American financial services company Capital Group was established in 1931. As one of the world’s oldest investment management firms, it has over $2tn assets under management. Major known investments include arms and aerospace firm BAE Systems and British American Tobacco. In 1992, Capital Group established Capital Group Private Markets, which specializes in alternative private equity and venture capital investments. This organization has invested in companies like ride-hailing firms Gojek and Didi Chuxing, Philippines media conglomerate ABS-CBN, and more.

American financial services company Capital Group was established in 1931. As one of the world’s oldest investment management firms, it has over $2tn assets under management. Major known investments include arms and aerospace firm BAE Systems and British American Tobacco. In 1992, Capital Group established Capital Group Private Markets, which specializes in alternative private equity and venture capital investments. This organization has invested in companies like ride-hailing firms Gojek and Didi Chuxing, Philippines media conglomerate ABS-CBN, and more.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

The venture capital arm of semiconductor and telecom equipment giant Qualcomm is a San-Diego investor focusing on VR, robotics, IoT, cloud and digital health companies in the US, Europe, Israel, China, Korea and India.

The venture capital arm of semiconductor and telecom equipment giant Qualcomm is a San-Diego investor focusing on VR, robotics, IoT, cloud and digital health companies in the US, Europe, Israel, China, Korea and India.

Founded in 2011, Tokyo-based venture capital firm GREE Ventures focuses on investing in early stage (pre-Series A and Series A) internet and mobile companies. The firm invests in Japan, Southeast Asia, and other geographies within Asia.

Founded in 2011, Tokyo-based venture capital firm GREE Ventures focuses on investing in early stage (pre-Series A and Series A) internet and mobile companies. The firm invests in Japan, Southeast Asia, and other geographies within Asia.

Founded by NetPosa and Shanghai Boyong Asset Management Co. Ltd. in 2016, Boyong Fund focuses on startups that create cutting-edge technology and other core competencies in the fields of video, big data, deep learning and service robots.

Founded by NetPosa and Shanghai Boyong Asset Management Co. Ltd. in 2016, Boyong Fund focuses on startups that create cutting-edge technology and other core competencies in the fields of video, big data, deep learning and service robots.

Led by Ben Einstein, the Boston-based venture capital firm focuses on startups involved in hardware and software development. The VC invests up to US$500,000 in pre-seed, pre-product startups to Series A funding rounds. The firm has investment and engineering departments that provide engineering and product design support services. It has worked with Google, Ferrari and Disney.

Led by Ben Einstein, the Boston-based venture capital firm focuses on startups involved in hardware and software development. The VC invests up to US$500,000 in pre-seed, pre-product startups to Series A funding rounds. The firm has investment and engineering departments that provide engineering and product design support services. It has worked with Google, Ferrari and Disney.

Founded in 2008, KIZOO Technology Ventures is a seed and early-stage VC. Current CEO Michael Greve, who founded Flug.de and Web.de, has many years of experience in the German-speaking Internet industry. KIZOO generally focuses on SaaS, Internet and mobile startups, although it has recently ventured into rejuvenation biotech, investing in companies such as CellAge and LysoClear.

Founded in 2008, KIZOO Technology Ventures is a seed and early-stage VC. Current CEO Michael Greve, who founded Flug.de and Web.de, has many years of experience in the German-speaking Internet industry. KIZOO generally focuses on SaaS, Internet and mobile startups, although it has recently ventured into rejuvenation biotech, investing in companies such as CellAge and LysoClear.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

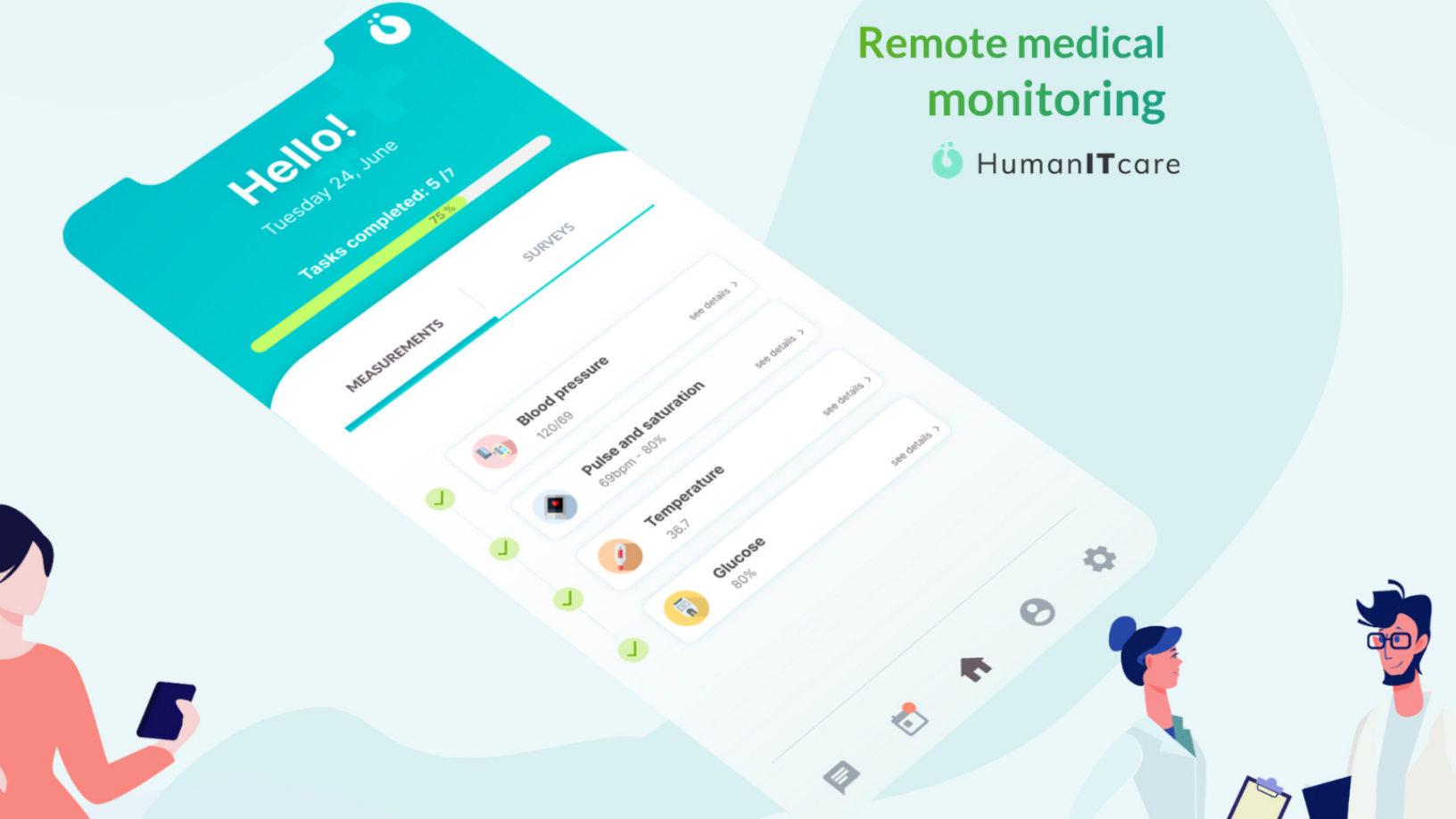

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Can Indonesia plug its tech talent gap to keep its digital economy growing?

Local institutions are stepping up to boost tech skills among students and jobseekers, as the government opens the way for more foreign talent joining startups

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Sorry, we couldn’t find any matches for“Plug and Play Tech Center”.