Plug and Play Tech Center

-

DATABASE (995)

-

ARTICLES (811)

Hike Capital was founded in December 2015 by Mark Yang, the founder of Ganji.com and Guazi.com, and Anna Xu, former general manager of the mobile internet department at NetEase and founder of the NetEase News app. The firm invests mainly in early-stage startups in the technological innovation, transaction platform, entertainment and lifestyle fields.

Hike Capital was founded in December 2015 by Mark Yang, the founder of Ganji.com and Guazi.com, and Anna Xu, former general manager of the mobile internet department at NetEase and founder of the NetEase News app. The firm invests mainly in early-stage startups in the technological innovation, transaction platform, entertainment and lifestyle fields.

Agentes y Asesores Financieros

Agentes y Asesores Financieros is a Madrid-based small and medium enterprise (SME) founded in 2003 that has evolved from traditional legal and financial advice to one focused on real estate asset management and advisory services and management of financial investments. It is led by José Antonio Bautista Molero.

Agentes y Asesores Financieros is a Madrid-based small and medium enterprise (SME) founded in 2003 that has evolved from traditional legal and financial advice to one focused on real estate asset management and advisory services and management of financial investments. It is led by José Antonio Bautista Molero.

Suzhou Industrial Park Bioventure Investment Management Limited (Bioventure) was established in September 2013. It has invested in 50 companies and manages RMB2bn worth of total assets. Bioventure invests mostly in the life sciences and bio-pharmaceutical industries, seeking early-stage startups with high growth potential. Bioventure provides post-investment support and services including funding, business operations and management.

Suzhou Industrial Park Bioventure Investment Management Limited (Bioventure) was established in September 2013. It has invested in 50 companies and manages RMB2bn worth of total assets. Bioventure invests mostly in the life sciences and bio-pharmaceutical industries, seeking early-stage startups with high growth potential. Bioventure provides post-investment support and services including funding, business operations and management.

Founded in 2018, Linden Asset Group currently has offices in Nanjing, Shenzhen and Singapore. With both US dollar- and RMB-denominated funds under management, it is focused on the fields of biotechnology, medtech and smart technology in the Asia Pacific region. Linden Asset prefers growth-stage startups that are cutting-edge in their respective areas and plans for overseas expansion.

Founded in 2018, Linden Asset Group currently has offices in Nanjing, Shenzhen and Singapore. With both US dollar- and RMB-denominated funds under management, it is focused on the fields of biotechnology, medtech and smart technology in the Asia Pacific region. Linden Asset prefers growth-stage startups that are cutting-edge in their respective areas and plans for overseas expansion.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

Yamaha Motor Ventures & Laboratory Silicon Valley

The investment arm of Yamaha Motor Group (Japan) was founded in 2015 and is headquartered in Palo Alto, California. It focuses on industrial automation and transportation technology, and on smart and automated solutions in particular. Recent investments include automated strawberry picker Advanced Farm Technologies' US$7.5m Series A round and drone and robotics startup Exyn Technology's US$16m Series A round.

The investment arm of Yamaha Motor Group (Japan) was founded in 2015 and is headquartered in Palo Alto, California. It focuses on industrial automation and transportation technology, and on smart and automated solutions in particular. Recent investments include automated strawberry picker Advanced Farm Technologies' US$7.5m Series A round and drone and robotics startup Exyn Technology's US$16m Series A round.

DG Incubation was founded in 2009 as the investment arm of Japanese internet company Digital Garage Group. The firm invests through its Open Network Lab Seed Accelerator Program for its seed-stage portfolio, and through DG Incubation for its early-to-late stage portfolio. DG Incubation gives foundation support to early-stage startups, such as problem identification. For later-stage startups, the firm gives data and analysis and supports the recruitment process, among others. It has offices in Tokyo, Kamakura (Japan) and San Francisco. It has invested in 98 companies to date and has seen 23 exits including companies like Facebook, Twitter and LinkedIn.

DG Incubation was founded in 2009 as the investment arm of Japanese internet company Digital Garage Group. The firm invests through its Open Network Lab Seed Accelerator Program for its seed-stage portfolio, and through DG Incubation for its early-to-late stage portfolio. DG Incubation gives foundation support to early-stage startups, such as problem identification. For later-stage startups, the firm gives data and analysis and supports the recruitment process, among others. It has offices in Tokyo, Kamakura (Japan) and San Francisco. It has invested in 98 companies to date and has seen 23 exits including companies like Facebook, Twitter and LinkedIn.

Young data scientist Gabriel Leupin is proficient in Python and SQL. He has a degree in French language and literature, with a minor in Philosophy from the Louisiana State University. He has also completed business programs at Université Denis Diderot (Paris VII) and studied statistics, data mining and analysis at Stanford University.He has worked as a research assistant in CORE Diagnostics and as a business developer in PogoLab. He has also taught languages at the Académie de Creteil and has invested in various businesses.

Young data scientist Gabriel Leupin is proficient in Python and SQL. He has a degree in French language and literature, with a minor in Philosophy from the Louisiana State University. He has also completed business programs at Université Denis Diderot (Paris VII) and studied statistics, data mining and analysis at Stanford University.He has worked as a research assistant in CORE Diagnostics and as a business developer in PogoLab. He has also taught languages at the Académie de Creteil and has invested in various businesses.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

Beatriz González is Spain’s first and only female head of a venture capital firm. In 2013, she founded Seaya Ventures and became the MD of one of Spain’s top 10 VC funds. The VC also has interests in South America. Its portfolio includes 17 mid to large startups like Cabify, Glovo and Wallbox. The VC focuses on the internet, digital and media sectors, backing startups with investments of €5–10 million each. González is also a board member for numerous startups including Cabify and Glovo. As an angel investor, she has invested in the pre-seed and seed rounds of Spanish femtech WOOM.

Beatriz González is Spain’s first and only female head of a venture capital firm. In 2013, she founded Seaya Ventures and became the MD of one of Spain’s top 10 VC funds. The VC also has interests in South America. Its portfolio includes 17 mid to large startups like Cabify, Glovo and Wallbox. The VC focuses on the internet, digital and media sectors, backing startups with investments of €5–10 million each. González is also a board member for numerous startups including Cabify and Glovo. As an angel investor, she has invested in the pre-seed and seed rounds of Spanish femtech WOOM.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Established in 2007, Exago is an innovation management software and service provider for companies in 19 countries across four continents. Its clients include Shell, Carrefour and Barclays. Exago has offices in Lisbon, London, and São Paulo, Brazil.

Established in 2007, Exago is an innovation management software and service provider for companies in 19 countries across four continents. Its clients include Shell, Carrefour and Barclays. Exago has offices in Lisbon, London, and São Paulo, Brazil.

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

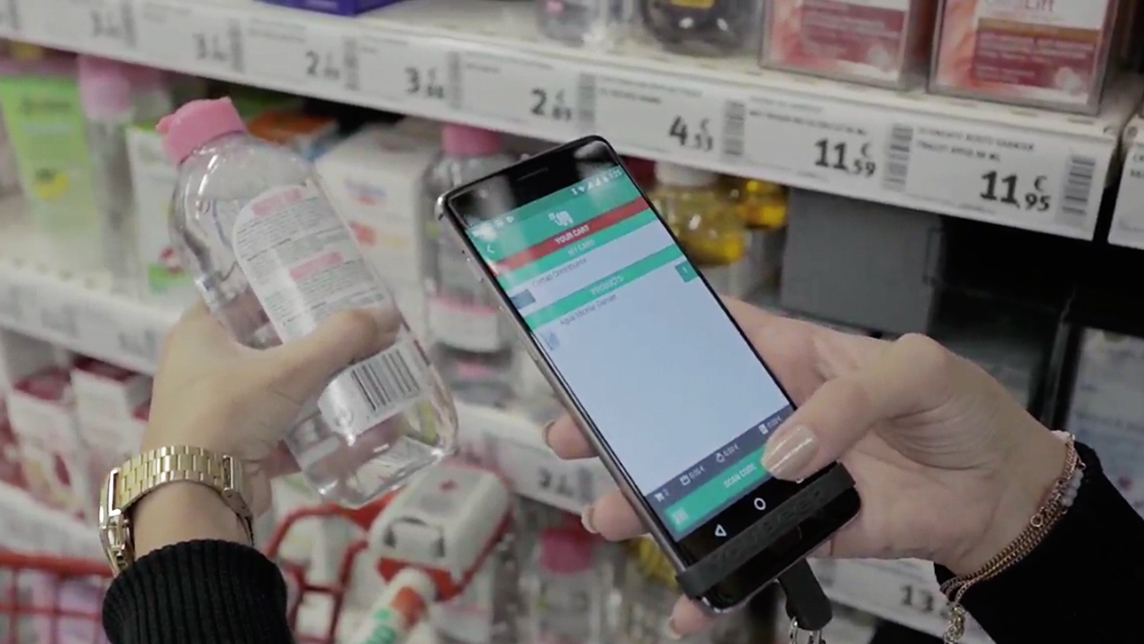

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

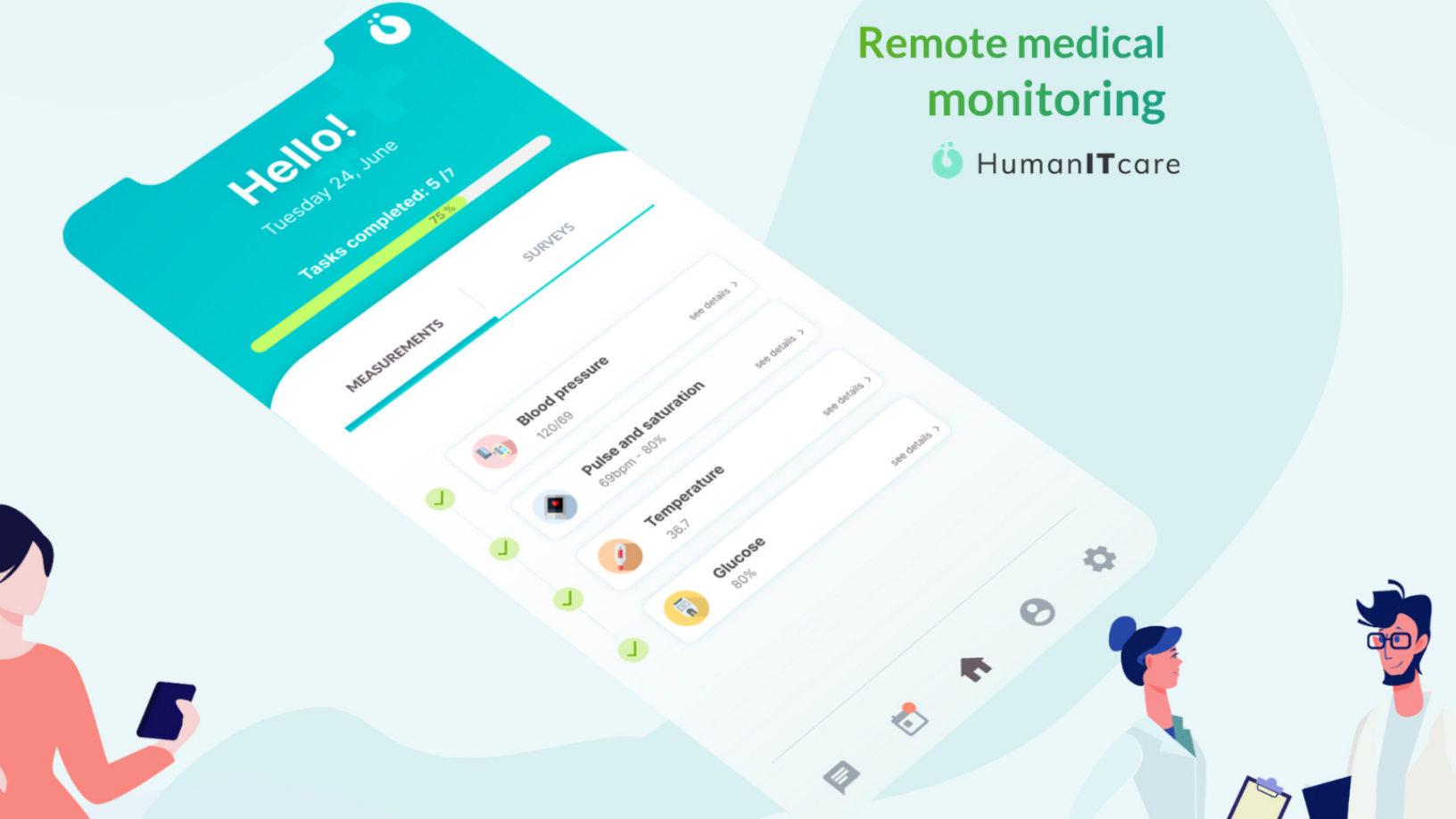

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Can Indonesia plug its tech talent gap to keep its digital economy growing?

Local institutions are stepping up to boost tech skills among students and jobseekers, as the government opens the way for more foreign talent joining startups

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Sorry, we couldn’t find any matches for“Plug and Play Tech Center”.