Plug and Play Tech Center

-

DATABASE (995)

-

ARTICLES (811)

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Founded in 1973 in Hong Kong, CCB International is a financial and investment services company owned by China Construction Bank Corporation (CCB). Through its subsidiaries, the company provides customers worldwide with services including direct investment, underwriting, financial advisory, corporate mergers and acquisitions, asset management and securities brokerage. CCB International (Holdings) serves customers worldwide. Its core business is divided into three main areas: pre-IPO, IPO and post-IPO.

Founded in 1973 in Hong Kong, CCB International is a financial and investment services company owned by China Construction Bank Corporation (CCB). Through its subsidiaries, the company provides customers worldwide with services including direct investment, underwriting, financial advisory, corporate mergers and acquisitions, asset management and securities brokerage. CCB International (Holdings) serves customers worldwide. Its core business is divided into three main areas: pre-IPO, IPO and post-IPO.

Sales and Marketing specialist of Atomian

With a degree from the Open University of Catalonia in marketing and social selling studies and an MBA from EAE Business school, Vives i Fàbregas is one of Atomian’s co-founders and an entrepreneur. He has experience in multinationals (Ricoh Spain and NGR Group Spain), SMEs and start-ups (DERICHEBOURG, Eladi Fenoll, Execus) in sales, marketing and corporate strategic consulting. He is also founder and CEO of LeadToWin and CEO of Plexiled Lighting, S.L. and is a specialist in digital transformation and lead generation channels and a professor at Inesdi Digital Business School.

With a degree from the Open University of Catalonia in marketing and social selling studies and an MBA from EAE Business school, Vives i Fàbregas is one of Atomian’s co-founders and an entrepreneur. He has experience in multinationals (Ricoh Spain and NGR Group Spain), SMEs and start-ups (DERICHEBOURG, Eladi Fenoll, Execus) in sales, marketing and corporate strategic consulting. He is also founder and CEO of LeadToWin and CEO of Plexiled Lighting, S.L. and is a specialist in digital transformation and lead generation channels and a professor at Inesdi Digital Business School.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Linear Venture was co-founded by Wang Huai, a former Facebook employee, and Zhan Chuan, who served as a senior executive to Alibaba’s Tmall and JD.com. The firm invests mainly in early-stage technology-driven startups in the intelligence and big data fields.

Linear Venture was co-founded by Wang Huai, a former Facebook employee, and Zhan Chuan, who served as a senior executive to Alibaba’s Tmall and JD.com. The firm invests mainly in early-stage technology-driven startups in the intelligence and big data fields.

Indonesian Paradise Property is a group of property developers and management companies focusing on lifestyle destinations and hospitality properties in prime locations in Indonesia. Its portfolio includes Jakarta's Plaza Indonesia mall and Grand Hyatt Jakarta, as well as the Sahid Kuta resort in Bali.

Indonesian Paradise Property is a group of property developers and management companies focusing on lifestyle destinations and hospitality properties in prime locations in Indonesia. Its portfolio includes Jakarta's Plaza Indonesia mall and Grand Hyatt Jakarta, as well as the Sahid Kuta resort in Bali.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Partner of Zhenfund, Wang Qiang (b.1962) co-founded this TMT-focused seed fund with his longtime friend and partner Xu Xiaoping, in collaboration with Sequoia Capital China, in 2011. The angel investor also co-founded NYSE-listed New Oriental Education & Technology Group, where he was executive vice president in charge of teaching and training at Beijing New Oriental School, and Industry vice-president and group chairman. A leading specialist in English-language education in China, Wang has lectured at the English department of Peking University and served as senior consultant to the English channel of China National Radio. He majored in English language and literature at Peking University and holds a master's degree in computer science from the State University of New York. Wang is a lover and collector of antiquarian books.

Partner of Zhenfund, Wang Qiang (b.1962) co-founded this TMT-focused seed fund with his longtime friend and partner Xu Xiaoping, in collaboration with Sequoia Capital China, in 2011. The angel investor also co-founded NYSE-listed New Oriental Education & Technology Group, where he was executive vice president in charge of teaching and training at Beijing New Oriental School, and Industry vice-president and group chairman. A leading specialist in English-language education in China, Wang has lectured at the English department of Peking University and served as senior consultant to the English channel of China National Radio. He majored in English language and literature at Peking University and holds a master's degree in computer science from the State University of New York. Wang is a lover and collector of antiquarian books.

British Oxford-educated engineer William Reeve is a serial investor and entrepreneur who built two successful businesses Fletcher Research and LOVEFiLM.com from scratch and led them to successful exits. He is currently Chairman of online investment management platform Nutmeg.com, CEO of proptech accelerator Goodlord and Non-Executive Director of Dunhelm Soft Furnishings. He was also Co-CEO and Chairman at grocery delivery company Hubbub.co.uk and was Non-Executive Chairman at healthy snack startup Graze.com. He was Head of Operations at Paddy Power betting agency, Managing Director of Oxalyst Systems and has been a non-executive director at a host of online platforms including Secret Escapes, Zoopla! and DealChecker.co.uk.

British Oxford-educated engineer William Reeve is a serial investor and entrepreneur who built two successful businesses Fletcher Research and LOVEFiLM.com from scratch and led them to successful exits. He is currently Chairman of online investment management platform Nutmeg.com, CEO of proptech accelerator Goodlord and Non-Executive Director of Dunhelm Soft Furnishings. He was also Co-CEO and Chairman at grocery delivery company Hubbub.co.uk and was Non-Executive Chairman at healthy snack startup Graze.com. He was Head of Operations at Paddy Power betting agency, Managing Director of Oxalyst Systems and has been a non-executive director at a host of online platforms including Secret Escapes, Zoopla! and DealChecker.co.uk.

The investment arm of Taikang Insurance Group, Taikang Asset Management (Taikang Asset) manages RMB 1.9tn worth of assets, including RMB 1.1tn third-party assets, RMB 420bn alternative investment and RMB 440bn pension funds as of June 2020. Investments are mainly in infrastructure sectors such as transportation, energy, utilities, environmental protection, telecoms and real estate.Taikang Asset is an important platform for Taikang Insurance Group to carry out global business. In November 2007, its wholly-owned unit Hong Kong was set up and has received licenses from the Hong Kong stock exchange for businesses including securities dealing, advisory and asset management. In September 2016, Taikang Asset founded Taikang Asset (Beijing), a new equity investment platform, and raised RMB 2bn for its Phase I Industrial Development Fund by May 2017. Apart from managing and utilizing self-owned and insurance capital, the company manages assets for clients and provides advice on asset management. It also issues public security investment funds among other asset management businesses.

The investment arm of Taikang Insurance Group, Taikang Asset Management (Taikang Asset) manages RMB 1.9tn worth of assets, including RMB 1.1tn third-party assets, RMB 420bn alternative investment and RMB 440bn pension funds as of June 2020. Investments are mainly in infrastructure sectors such as transportation, energy, utilities, environmental protection, telecoms and real estate.Taikang Asset is an important platform for Taikang Insurance Group to carry out global business. In November 2007, its wholly-owned unit Hong Kong was set up and has received licenses from the Hong Kong stock exchange for businesses including securities dealing, advisory and asset management. In September 2016, Taikang Asset founded Taikang Asset (Beijing), a new equity investment platform, and raised RMB 2bn for its Phase I Industrial Development Fund by May 2017. Apart from managing and utilizing self-owned and insurance capital, the company manages assets for clients and provides advice on asset management. It also issues public security investment funds among other asset management businesses.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

Jason Stockwood is the chairman and co-owner of Grimsby Town Football Club. The Grimsby working-class lad managed to get a scholarship to study in the US, worked at Trailfinders and Lastminute.com in the 1990s. He was a non-executive director of Skyscanner and international MD at Travelocity Business and also at Match.com. In 2010, he became the CEO and vice-chair of online insurance company, Simply Business, that was sold for £400m in 2017.The co-founder of VC 53° has also invested in British startups across market segments, including the Series B investment round of food-sharing app OLIO in September 2021 and August 2020 financing of carbon tracking platform for banks and investors CoGo UK.

Jason Stockwood is the chairman and co-owner of Grimsby Town Football Club. The Grimsby working-class lad managed to get a scholarship to study in the US, worked at Trailfinders and Lastminute.com in the 1990s. He was a non-executive director of Skyscanner and international MD at Travelocity Business and also at Match.com. In 2010, he became the CEO and vice-chair of online insurance company, Simply Business, that was sold for £400m in 2017.The co-founder of VC 53° has also invested in British startups across market segments, including the Series B investment round of food-sharing app OLIO in September 2021 and August 2020 financing of carbon tracking platform for banks and investors CoGo UK.

Founded in 2003, Ismaya Group is a key player in Indonesia’s premium food and beverage industry, and has companies in Jakarta, Bali, Bandung, Dubai and some cities in Malaysia.

Founded in 2003, Ismaya Group is a key player in Indonesia’s premium food and beverage industry, and has companies in Jakarta, Bali, Bandung, Dubai and some cities in Malaysia.

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

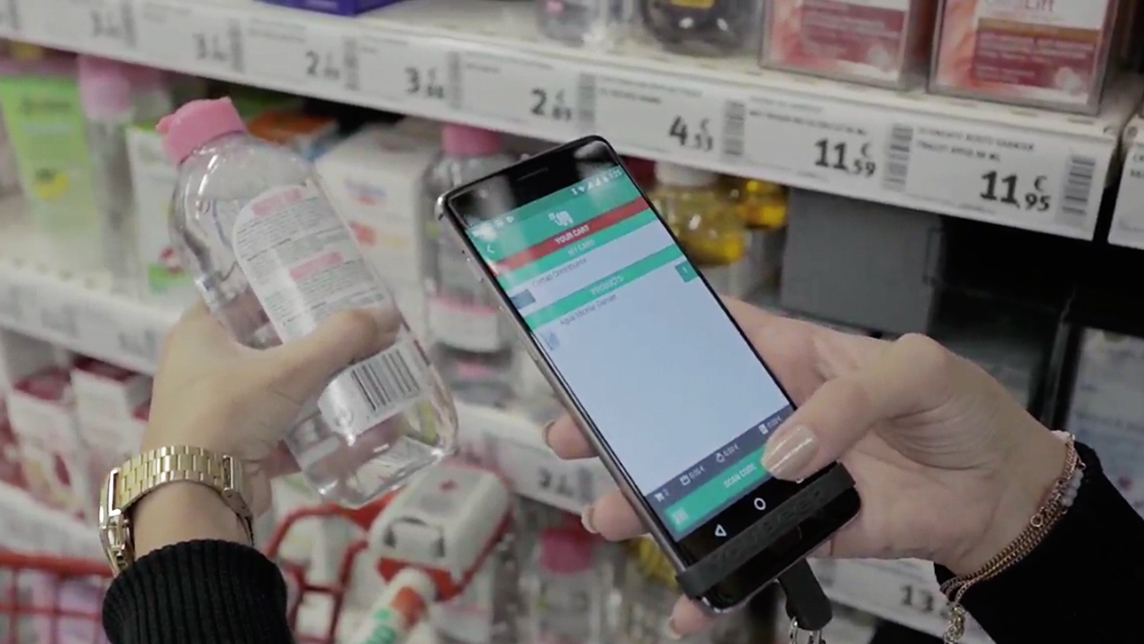

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

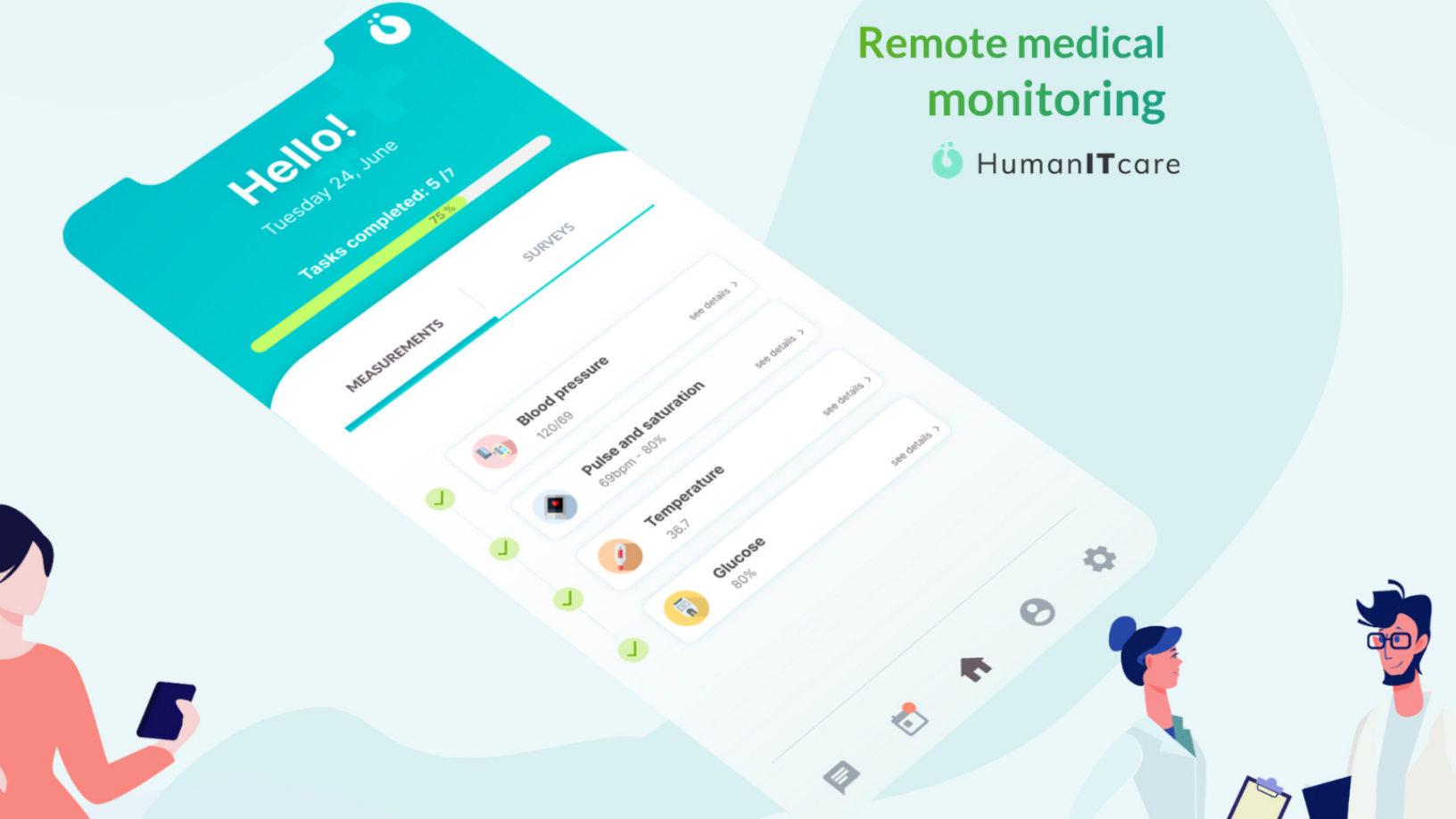

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Can Indonesia plug its tech talent gap to keep its digital economy growing?

Local institutions are stepping up to boost tech skills among students and jobseekers, as the government opens the way for more foreign talent joining startups

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Sorry, we couldn’t find any matches for“Plug and Play Tech Center”.