Point Nine Capital

-

DATABASE (745)

-

ARTICLES (491)

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Tipping Point Capital was established by Huang Shengli, former managing director of China Renaissance and founder of Modian.com, a crowdfunding website for gaming projects. The core team has over 40 years of experience in the internet industry, investment banking and M&As.

Tipping Point Capital was established by Huang Shengli, former managing director of China Renaissance and founder of Modian.com, a crowdfunding website for gaming projects. The core team has over 40 years of experience in the internet industry, investment banking and M&As.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Lenovo Capital & Incubator Group

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

The Oslo-born venture capital company, Northzone VC, has offices in Norway, Sweden, London and New York, and was founded in 1996. It has invested in more than 130 companies globally, across a spectrum of sectors, and at different stages, and has around €1 billion under investment currently. It has seen nine IPOs from its portfolio and manages nine funds. It has been lead investor in almost 70 rounds and has seen 30 exits to date.

The Oslo-born venture capital company, Northzone VC, has offices in Norway, Sweden, London and New York, and was founded in 1996. It has invested in more than 130 companies globally, across a spectrum of sectors, and at different stages, and has around €1 billion under investment currently. It has seen nine IPOs from its portfolio and manages nine funds. It has been lead investor in almost 70 rounds and has seen 30 exits to date.

Director and Founder of Mayordomo

UK-born serial entrepreneur Edward Hamilton founded his first tech startup, Lavalocker, in Barcelona in 2013 to provide on-demand laundry and dry-cleaning services. He later built on the smart-locker technology to establish Mayordomo that launched Smart Point in 2016, a digital vending system with smart lockers to offer personal shopping, delivery and pickups for over 200 categories of goods and services. Hamilton graduated in Business Administration from Berkeley, University of California in 2000. He worked for almost four years at WP Carey & Co in New York specializing in investments and acquisitions. In March 2006, he moved to London to work as a real estate equity investment manager at Barclay’s Capital. In 2010, he went to Spain to work as a Green Bean business coach for SMEs based in Barcelona. His latest venture is Droppo, which he co-founded in 2019. Based in Barcelona, Droppo is a zero-emission electric last-mile logistics transport network.

UK-born serial entrepreneur Edward Hamilton founded his first tech startup, Lavalocker, in Barcelona in 2013 to provide on-demand laundry and dry-cleaning services. He later built on the smart-locker technology to establish Mayordomo that launched Smart Point in 2016, a digital vending system with smart lockers to offer personal shopping, delivery and pickups for over 200 categories of goods and services. Hamilton graduated in Business Administration from Berkeley, University of California in 2000. He worked for almost four years at WP Carey & Co in New York specializing in investments and acquisitions. In March 2006, he moved to London to work as a real estate equity investment manager at Barclay’s Capital. In 2010, he went to Spain to work as a Green Bean business coach for SMEs based in Barcelona. His latest venture is Droppo, which he co-founded in 2019. Based in Barcelona, Droppo is a zero-emission electric last-mile logistics transport network.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

CEO and co-founder of Vence

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

Powered by smart navigation technologies, eKuaisong’s on-demand intra-city courier service offers faster delivery by 1–2 hours; its point-to-point delivery also minimizes damage to goods.

Powered by smart navigation technologies, eKuaisong’s on-demand intra-city courier service offers faster delivery by 1–2 hours; its point-to-point delivery also minimizes damage to goods.

Beenext is a new venture fund started by Beenos founder and former CEO Teruhide “Teru” Sato. The fund describes itself as a “partnership of the founders, by the founders, for the founders”; bringing their wealth of global experience and capital backing to support promising entrepreneurs. Beenext has invested in nine countries, including India, Singapore and Indonesia.

Beenext is a new venture fund started by Beenos founder and former CEO Teruhide “Teru” Sato. The fund describes itself as a “partnership of the founders, by the founders, for the founders”; bringing their wealth of global experience and capital backing to support promising entrepreneurs. Beenext has invested in nine countries, including India, Singapore and Indonesia.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Co-Founder of Zhuazhua

In his nine years at Tencent, Jia Jinlin was at one time heading the operations of the tech giant’s most profitable gaming unit.

In his nine years at Tencent, Jia Jinlin was at one time heading the operations of the tech giant’s most profitable gaming unit.

Co-founder and CEO of Medigo

Harya Bimo was a freelance digital designer before starting his first business, digital agency Definite, in 2009. Over the years, Definite spawned smaller teams and subsidiaries, including the mobile-focused Flipbox, which Harya headed from 2013 to 2018. After shutting down Flipbox and leaving Definite in February 2018, Harya established Medigo, a hospital management platform. He is also co-founder and advisor of Qasir, a point-of-sale system startup.

Harya Bimo was a freelance digital designer before starting his first business, digital agency Definite, in 2009. Over the years, Definite spawned smaller teams and subsidiaries, including the mobile-focused Flipbox, which Harya headed from 2013 to 2018. After shutting down Flipbox and leaving Definite in February 2018, Harya established Medigo, a hospital management platform. He is also co-founder and advisor of Qasir, a point-of-sale system startup.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Award-winning proptech Mayordomo expects total revenues to reach €75m by 2024, banking on rapid adoption of Smart Point shopping and locker delivery services across Europe.

Award-winning proptech Mayordomo expects total revenues to reach €75m by 2024, banking on rapid adoption of Smart Point shopping and locker delivery services across Europe.

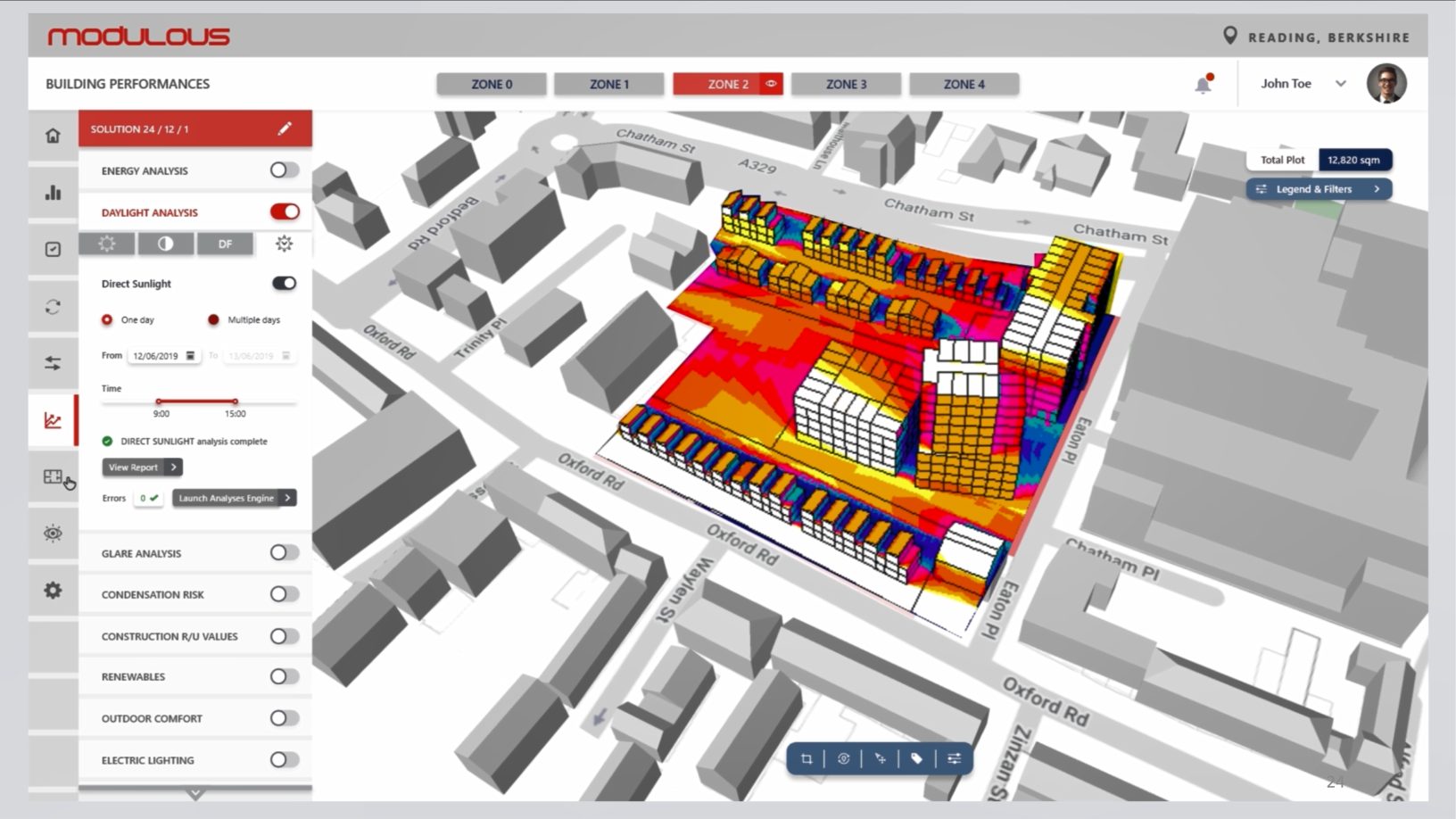

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

How millennials travel: Waynabox for low-cost, X-factor surprise getaways

Play online vacation games and let computers plan your holidays from just €150

Exovite: Revolutionary treatment for broken bones and assisted surgery

Medtech startup Exovite combines 3D printing technology and remote treatment to improve rehabilitation of broken bones, and employs mixed reality to assist surgery

Eliport: Friendly neighborhood robots for cheaper last-mile deliveries

The Spanish logistics robot maker has a solution to improve last-mile delivery, with community-based smart robots, parcel hubs and postboxes. CompassList spoke to its co-founders at the recent 4YFN conference in Barcelona

Bdeo: Using video intelligence to automate, speed up insurance claims handling and payouts

Insurtech SaaS Bdeo lets insurers process 70% of motor and property claims without human staff; targets Series A close by year-end

ADBioplastics primed to help EU manufacturers transition to circular economy

ADBioplastics has developed a biodegradable and compostable bioplastic additive for use in food packaging and is seeking up to €5m in funding

Vegan fish substitute Mimic Seafood set to disrupt the sustainable food market

Founder of food innovation hub Ivoro launches Mimic Seafood, a European pioneer in vegan fish substitutes

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

Xing Nong Fu: Using earthworms to create sustainable local farming and livelihoods

Worm castings can rehabilitate infertile land due to excessive soil salinity in just seven days, compared with three to five years using traditional methods, and 90% more cheaply

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

Dao Foods unfazed by China tech crackdown, says alternative proteins aligned with state goals

Impact investor Dao Foods expects government support for alternative proteins to come, as it announces second batch of startups, diversifying into fermentation and cell-based proteins

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Yu Minhong: Rags-to-riches education guru

When the New Oriental founder was working in the rice paddies as a teenager, it never occurred to him that he would become the richest teacher in China one day

Neosentec: Open source SaaS helping enterprises create customized AR experiences

Neosentec has created an open source SaaS for businesses to offer customized AR experiences

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Sorry, we couldn’t find any matches for“Point Nine Capital”.