Point Nine Capital

-

DATABASE (745)

-

ARTICLES (491)

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Tipping Point Capital was established by Huang Shengli, former managing director of China Renaissance and founder of Modian.com, a crowdfunding website for gaming projects. The core team has over 40 years of experience in the internet industry, investment banking and M&As.

Tipping Point Capital was established by Huang Shengli, former managing director of China Renaissance and founder of Modian.com, a crowdfunding website for gaming projects. The core team has over 40 years of experience in the internet industry, investment banking and M&As.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Lenovo Capital & Incubator Group

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

The Oslo-born venture capital company, Northzone VC, has offices in Norway, Sweden, London and New York, and was founded in 1996. It has invested in more than 130 companies globally, across a spectrum of sectors, and at different stages, and has around €1 billion under investment currently. It has seen nine IPOs from its portfolio and manages nine funds. It has been lead investor in almost 70 rounds and has seen 30 exits to date.

The Oslo-born venture capital company, Northzone VC, has offices in Norway, Sweden, London and New York, and was founded in 1996. It has invested in more than 130 companies globally, across a spectrum of sectors, and at different stages, and has around €1 billion under investment currently. It has seen nine IPOs from its portfolio and manages nine funds. It has been lead investor in almost 70 rounds and has seen 30 exits to date.

Director and Founder of Mayordomo

UK-born serial entrepreneur Edward Hamilton founded his first tech startup, Lavalocker, in Barcelona in 2013 to provide on-demand laundry and dry-cleaning services. He later built on the smart-locker technology to establish Mayordomo that launched Smart Point in 2016, a digital vending system with smart lockers to offer personal shopping, delivery and pickups for over 200 categories of goods and services. Hamilton graduated in Business Administration from Berkeley, University of California in 2000. He worked for almost four years at WP Carey & Co in New York specializing in investments and acquisitions. In March 2006, he moved to London to work as a real estate equity investment manager at Barclay’s Capital. In 2010, he went to Spain to work as a Green Bean business coach for SMEs based in Barcelona. His latest venture is Droppo, which he co-founded in 2019. Based in Barcelona, Droppo is a zero-emission electric last-mile logistics transport network.

UK-born serial entrepreneur Edward Hamilton founded his first tech startup, Lavalocker, in Barcelona in 2013 to provide on-demand laundry and dry-cleaning services. He later built on the smart-locker technology to establish Mayordomo that launched Smart Point in 2016, a digital vending system with smart lockers to offer personal shopping, delivery and pickups for over 200 categories of goods and services. Hamilton graduated in Business Administration from Berkeley, University of California in 2000. He worked for almost four years at WP Carey & Co in New York specializing in investments and acquisitions. In March 2006, he moved to London to work as a real estate equity investment manager at Barclay’s Capital. In 2010, he went to Spain to work as a Green Bean business coach for SMEs based in Barcelona. His latest venture is Droppo, which he co-founded in 2019. Based in Barcelona, Droppo is a zero-emission electric last-mile logistics transport network.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

CEO and co-founder of Vence

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

Powered by smart navigation technologies, eKuaisong’s on-demand intra-city courier service offers faster delivery by 1–2 hours; its point-to-point delivery also minimizes damage to goods.

Powered by smart navigation technologies, eKuaisong’s on-demand intra-city courier service offers faster delivery by 1–2 hours; its point-to-point delivery also minimizes damage to goods.

Beenext is a new venture fund started by Beenos founder and former CEO Teruhide “Teru” Sato. The fund describes itself as a “partnership of the founders, by the founders, for the founders”; bringing their wealth of global experience and capital backing to support promising entrepreneurs. Beenext has invested in nine countries, including India, Singapore and Indonesia.

Beenext is a new venture fund started by Beenos founder and former CEO Teruhide “Teru” Sato. The fund describes itself as a “partnership of the founders, by the founders, for the founders”; bringing their wealth of global experience and capital backing to support promising entrepreneurs. Beenext has invested in nine countries, including India, Singapore and Indonesia.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Co-Founder of Zhuazhua

In his nine years at Tencent, Jia Jinlin was at one time heading the operations of the tech giant’s most profitable gaming unit.

In his nine years at Tencent, Jia Jinlin was at one time heading the operations of the tech giant’s most profitable gaming unit.

Co-founder and CEO of Medigo

Harya Bimo was a freelance digital designer before starting his first business, digital agency Definite, in 2009. Over the years, Definite spawned smaller teams and subsidiaries, including the mobile-focused Flipbox, which Harya headed from 2013 to 2018. After shutting down Flipbox and leaving Definite in February 2018, Harya established Medigo, a hospital management platform. He is also co-founder and advisor of Qasir, a point-of-sale system startup.

Harya Bimo was a freelance digital designer before starting his first business, digital agency Definite, in 2009. Over the years, Definite spawned smaller teams and subsidiaries, including the mobile-focused Flipbox, which Harya headed from 2013 to 2018. After shutting down Flipbox and leaving Definite in February 2018, Harya established Medigo, a hospital management platform. He is also co-founder and advisor of Qasir, a point-of-sale system startup.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Award-winning proptech Mayordomo expects total revenues to reach €75m by 2024, banking on rapid adoption of Smart Point shopping and locker delivery services across Europe.

Award-winning proptech Mayordomo expects total revenues to reach €75m by 2024, banking on rapid adoption of Smart Point shopping and locker delivery services across Europe.

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Mi Terro turns milk waste into eco-friendly clothing and packaging

With food giants like Danone, Arla and Dole as partners, US-Sino startup Mi Terro plans to extend its technology to plant-based food waste like soy to get plastic and fiber alternatives

Indonesian local crafts marketplace Qlapa shuts down

Series A funding failed to keep startup afloat as business remains unprofitable, regional heavyweights close in

Ento: Making cookies and burger patties from crickets

From whole-roasted crickets and granola bars to sausages and meatballs, Ento aims to tap the growing market for insect-based alternative proteins, targeting enthusiasts and early adopters

China bets on road-vehicle coordination for the mass adoption of autonomous driving cars by 2025

Money pours in as China pushes sector to be the next growth engine, and both self-driving startups and their investors are optimistic about their commercialization attempts

Haoqipei: Connecting China's vast B2B auto parts market

Haoqipei not only connects buyers and sellers with a B2B trading platform, it also uses big data to build trust and relationships in a highly fragmented market

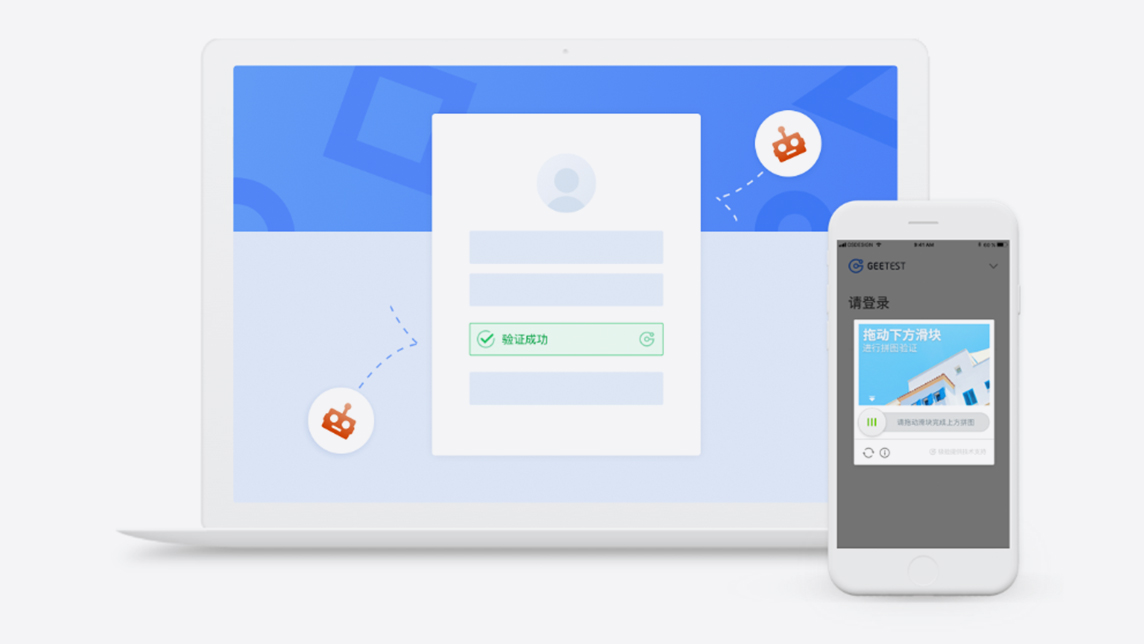

Geetest provides an easy and fun way to secure websites and apps

This startup’s behavior-based verification process takes less than a second to finish, but that’s all the time it needs to distinguish a human from a robot

Ruangguru cracks business model as it reaches 13 million student users

Holding pole position as Indonesia's popular tutoring services app, Ruangguru is revving up to expand into the lucrative corporate training sector

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

CloudYoung: Smart agritech for every process, from farm to table

CloudYoung covers the entire production chain, from cutting costs and pesticide use in its smart greenhouses to connecting farmers with buyers in e-commerce

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Icaria Medical's CardioSense: Cardiovascular pre-diagnosis in less than 60 seconds

Icaria Medical is seeking clinical validation and funding for its AI-based monitor, which measures blood pressure continuously and non-invasively

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

Sorry, we couldn’t find any matches for“Point Nine Capital”.