Portugal Fintech

-

DATABASE (251)

-

ARTICLES (178)

Co-founder, Head of Sales and Finance of Doinn

Polish-born Weronika de Castro Figueiredo became co-founder at Doinn in March 2016. She was the co-managing partner and founder of e-commerce company WJ Figueiredo in Portugal for over two years until 2016. After graduating with a master's in Law and International Relations at Warsaw University in 2005, she completed an MBA at the Portuguese Catholic University in 2007. The multi-linguist had also worked for almost seven years as a freelance journalist for Grupa ZPR Media until 2004. She went on to become a marketing specialist at Portuguese supermarket chain Pingo Doce for over five years until 2011.

Polish-born Weronika de Castro Figueiredo became co-founder at Doinn in March 2016. She was the co-managing partner and founder of e-commerce company WJ Figueiredo in Portugal for over two years until 2016. After graduating with a master's in Law and International Relations at Warsaw University in 2005, she completed an MBA at the Portuguese Catholic University in 2007. The multi-linguist had also worked for almost seven years as a freelance journalist for Grupa ZPR Media until 2004. She went on to become a marketing specialist at Portuguese supermarket chain Pingo Doce for over five years until 2011.

Co-founder and CEO of 360imprimir (BIZAY)

A former business analyst and adviser to the Bank of Portugal, Sérgio Vieira obtained his MBA from the University Institute of Lisbon. He gained experience in business at consultancy firm Roland Berger and in logistics as a controller at Adicional Logistics. Currently CEO of 360imprimir, a printing B2B online store he co-founded in 2013, he was an assistant professor at the University Institute of Lisbon, where he lectured in Management Accounting and Management Control, for almost seven years. He also holds a degree in Management and Business Administration from the University Institute of Lisbon.

A former business analyst and adviser to the Bank of Portugal, Sérgio Vieira obtained his MBA from the University Institute of Lisbon. He gained experience in business at consultancy firm Roland Berger and in logistics as a controller at Adicional Logistics. Currently CEO of 360imprimir, a printing B2B online store he co-founded in 2013, he was an assistant professor at the University Institute of Lisbon, where he lectured in Management Accounting and Management Control, for almost seven years. He also holds a degree in Management and Business Administration from the University Institute of Lisbon.

Founder and CEO of Plato

Irma Surya is a lawyer and the founder of Plato, a portal for startups and SMEs to access affordable basic corporate legal services. After earning her bachelor’s in Law from Universitas Katolik Atma Jaya, Indonesia, she worked at Ali Budiarjo, Nugroho, Reksodiputro, an Indonesian legal firm from 2011 to 2013. She has been in practice since 2007 and has also worked with international clients. Besides her duties as Plato’s CEO, she continues to work as a freelance lawyer, specializing in startup and fintech companies.

Irma Surya is a lawyer and the founder of Plato, a portal for startups and SMEs to access affordable basic corporate legal services. After earning her bachelor’s in Law from Universitas Katolik Atma Jaya, Indonesia, she worked at Ali Budiarjo, Nugroho, Reksodiputro, an Indonesian legal firm from 2011 to 2013. She has been in practice since 2007 and has also worked with international clients. Besides her duties as Plato’s CEO, she continues to work as a freelance lawyer, specializing in startup and fintech companies.

CTO and co-founder of StudentFinance

Sérgio Pereira is an independent innovation expert at the European Commission, assisting with research and innovation assignments including policy design, monitoring of projects and the evaluation of various programs and proposals. He graduated with a master's in Computer Science at the New University of Lisbon and started his career as a consultant at Accenture. The Portuguese co-founder of StudentFinance has been working as CTO at the fintech since 2019. Prior to this, he founded Tech HQ as CTO of the tech consultancy where he continues to work part-time. Pereira has also worked as CTO at Boston-based student finance and talent platform FutureFuel. The serial entrepreneur has also co-founded Clickly, a Dutch content discovery platform and sportstech Goalstat.

Sérgio Pereira is an independent innovation expert at the European Commission, assisting with research and innovation assignments including policy design, monitoring of projects and the evaluation of various programs and proposals. He graduated with a master's in Computer Science at the New University of Lisbon and started his career as a consultant at Accenture. The Portuguese co-founder of StudentFinance has been working as CTO at the fintech since 2019. Prior to this, he founded Tech HQ as CTO of the tech consultancy where he continues to work part-time. Pereira has also worked as CTO at Boston-based student finance and talent platform FutureFuel. The serial entrepreneur has also co-founded Clickly, a Dutch content discovery platform and sportstech Goalstat.

CEO and co-founder of Coinscrap

David Conde is a serial entrepreneur from Galicia. He holds an executive MBA, a Fintech certificate from the Massachusetts Institute of Technology and participated in the Oxford Blockchain Strategy Program.He was one of the first European financial planners in Spain and is well-recognized in the financial sector, having over 10 years of experience in private banking roles. In 2015, he co-founded Senseitrade, a revolutionary technology that captures sentiments about the stock market from social networks, predicting stock exchange evolution with a success rate of 87%.Since 2017, he has been CEO and co-founder of Coinscrap, an app that facilitates micro-savings by rounding up purchases made with credit cards to the nearest euro.

David Conde is a serial entrepreneur from Galicia. He holds an executive MBA, a Fintech certificate from the Massachusetts Institute of Technology and participated in the Oxford Blockchain Strategy Program.He was one of the first European financial planners in Spain and is well-recognized in the financial sector, having over 10 years of experience in private banking roles. In 2015, he co-founded Senseitrade, a revolutionary technology that captures sentiments about the stock market from social networks, predicting stock exchange evolution with a success rate of 87%.Since 2017, he has been CEO and co-founder of Coinscrap, an app that facilitates micro-savings by rounding up purchases made with credit cards to the nearest euro.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Established as a venture capital firm in 2014, Ultrabuttonwood Capital has invested in over 50 startups in diverse sectors like entertainment, education, fintech, telecommunications, big data and artificial intelligence.

Established as a venture capital firm in 2014, Ultrabuttonwood Capital has invested in over 50 startups in diverse sectors like entertainment, education, fintech, telecommunications, big data and artificial intelligence.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Co-founder of Wallapop

Miguel Vicente is an entrepreneur, based in Barcelona, Spain, who is Chairman and Co-founder of Antai Venture Builder, the leading online and mobile venture builder in Southern Europe. He is also Chairman of Barcelona Tech City, the city's main startup cluster and has co-founded numerous start-ups including Wallapop, JustBell (merged with Glovo), Carnovo, Deliberry, Elma Care, BePretty, Prontopiso and Media Digital Ventures. His first major international startup experience was as Founder and CEO of LetsBonus in 2009, a successful social shopping company in Spain, Italy and Portugal. He led the company until its 2012 sale to Living Social.

Miguel Vicente is an entrepreneur, based in Barcelona, Spain, who is Chairman and Co-founder of Antai Venture Builder, the leading online and mobile venture builder in Southern Europe. He is also Chairman of Barcelona Tech City, the city's main startup cluster and has co-founded numerous start-ups including Wallapop, JustBell (merged with Glovo), Carnovo, Deliberry, Elma Care, BePretty, Prontopiso and Media Digital Ventures. His first major international startup experience was as Founder and CEO of LetsBonus in 2009, a successful social shopping company in Spain, Italy and Portugal. He led the company until its 2012 sale to Living Social.

Co-founder and COO of Line Health

Former journalist Sofia Simões de Almeida graduated from New University of Lisbon with degrees in Law and Communication Sciences. In 2010, she became a founding member and editor at Lead Magazine. After working at Human Resources Portugal in Lisbon, she founded HR startup "Make it Happy" in 2012 that was incubated at Startup Lisboa.In 2014, she co-founded Line Health and worked at the healthtech as COO until the company was closed down in 2018. Currently based in Berlin, she is now the head of Feed Rocket, an online marketing tool launched by Visual Meta Business Labs.

Former journalist Sofia Simões de Almeida graduated from New University of Lisbon with degrees in Law and Communication Sciences. In 2010, she became a founding member and editor at Lead Magazine. After working at Human Resources Portugal in Lisbon, she founded HR startup "Make it Happy" in 2012 that was incubated at Startup Lisboa.In 2014, she co-founded Line Health and worked at the healthtech as COO until the company was closed down in 2018. Currently based in Berlin, she is now the head of Feed Rocket, an online marketing tool launched by Visual Meta Business Labs.

CreditEase New Financial Industry Investment Fund

Credit Ease Financial Industry Investment Fund was founded in 2016 and now manages a combined total of RMB 3 billion and US$ 500 million. It has invested in more than 20 Fintech companies around the world.

Credit Ease Financial Industry Investment Fund was founded in 2016 and now manages a combined total of RMB 3 billion and US$ 500 million. It has invested in more than 20 Fintech companies around the world.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Headquartered in Hong Kong, Summer Capital was founded by senior UBS banker Joseph Chee in 2015. Focused on both public and private investments, it mainly invests in sectors of healthcare, consumer products, education, logistics and fintech.

Headquartered in Hong Kong, Summer Capital was founded by senior UBS banker Joseph Chee in 2015. Focused on both public and private investments, it mainly invests in sectors of healthcare, consumer products, education, logistics and fintech.

Founded in 2014, Frankfurt-based CommerzVentures operates as the VC arm of Commerzbank AG. The firm invests mainly in early- and growth-stage startups from Series A onward. Its portfolio features fintech companies such as PayKey and Marqeta.

Founded in 2014, Frankfurt-based CommerzVentures operates as the VC arm of Commerzbank AG. The firm invests mainly in early- and growth-stage startups from Series A onward. Its portfolio features fintech companies such as PayKey and Marqeta.

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

Bdeo: Using video intelligence to automate, speed up insurance claims handling and payouts

Insurtech SaaS Bdeo lets insurers process 70% of motor and property claims without human staff; targets Series A close by year-end

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

StudentFinance: AI screening software matches students to IT courses and jobs

StudentFinance also offers "Study now, pay later" model, making IT courses financially accessible while helping companies overcome skilled tech talent shortage

Women entrepreneurs get ahead faster in Portugal

Still a long way to go for equality, but female founders in Portugal have made significant headstarts as tech innovators

Jojonomic's fintech PaaS helps corporates automate reimbursement, prevent fraud

Jojonomic is used by big companies including Pertamina Patra Niaga, Lazada, Tokopedia and Gojek

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

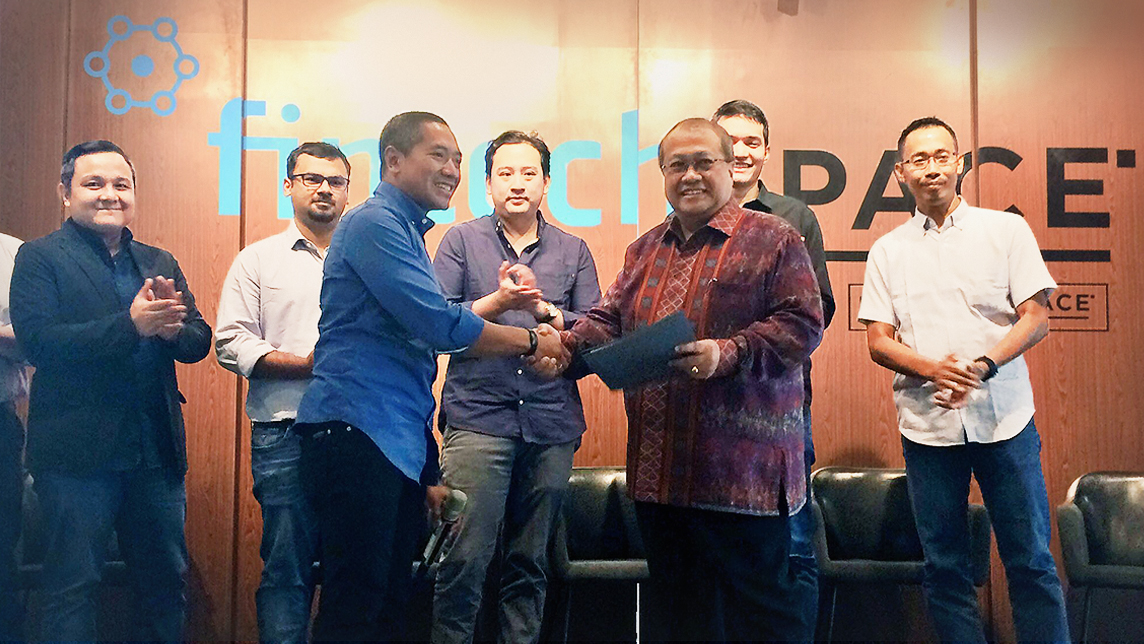

Growing together: a look at the Indonesia Fintech Association (Aftech)

The Indonesia Fintech Association sets an example of how professional associations can help new industries grow faster and better

Capaball: Empowering employees to upskill in tech as more businesses digitalize

The Spanish edtech platform for Fortune 500 clients and professionals is focused on developing new markets in Latin America

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Lota Digital: Disrupting fishing in Portugal for a sustainable future

The “digital fish market” app helps fishermen compete in a market dominated by large players

Portugal looks to its marine heritage to create an oceantech leader

Portugal is tapping oceantech disruption to create new value out of its blue economy, with strong government push

Sorry, we couldn’t find any matches for“Portugal Fintech”.