Portugal Ventures

-

DATABASE (401)

-

ARTICLES (266)

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

Established in 2003, COTEC Portugal is a business association which seeks to advance technological development and innovation cooperation. Its network comprises multinationals and SMEs operating across most sectors whose gross added value represents more than 16% of Portugal's national GDP and 8% of private employment. COTEC Portugal has an Innovative SME Network that seeks to promote public knowledge of its members, attract investment and help them grow internationally. The president of Portugal is the honorary president of COTEC Portugal.

Established in 2003, COTEC Portugal is a business association which seeks to advance technological development and innovation cooperation. Its network comprises multinationals and SMEs operating across most sectors whose gross added value represents more than 16% of Portugal's national GDP and 8% of private employment. COTEC Portugal has an Innovative SME Network that seeks to promote public knowledge of its members, attract investment and help them grow internationally. The president of Portugal is the honorary president of COTEC Portugal.

EDP Ventures is the VC arm of EDP, or Energias de Portugal, a global energy company based in Portugal. It invests in early-stage startups both Portuguese and from other nations across varied sectors and is a promoter of renewable energies.

EDP Ventures is the VC arm of EDP, or Energias de Portugal, a global energy company based in Portugal. It invests in early-stage startups both Portuguese and from other nations across varied sectors and is a promoter of renewable energies.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

Knokcare (formerly Knok Healthcare)

After disrupting Portugal’s public healthcare system with video consultations via app, Knokcare is offering its SaaS services to health insurers in Europe and beyond.

After disrupting Portugal’s public healthcare system with video consultations via app, Knokcare is offering its SaaS services to health insurers in Europe and beyond.

Founded in 2010 and based in Lisbon, eggNEST is a seed capital fund targeting Portuguese startups in the fields of digital marketing and software engineering. eggNEST is partnered with VC firms such as Caixa Capital and Portugal Ventures, as well as accelerators such as Startup Lisboa and Startup Braga, to build the country’s startup ecosystem.

Founded in 2010 and based in Lisbon, eggNEST is a seed capital fund targeting Portuguese startups in the fields of digital marketing and software engineering. eggNEST is partnered with VC firms such as Caixa Capital and Portugal Ventures, as well as accelerators such as Startup Lisboa and Startup Braga, to build the country’s startup ecosystem.

Co-founder of Wallapop

Miguel Vicente is an entrepreneur, based in Barcelona, Spain, who is Chairman and Co-founder of Antai Venture Builder, the leading online and mobile venture builder in Southern Europe. He is also Chairman of Barcelona Tech City, the city's main startup cluster and has co-founded numerous start-ups including Wallapop, JustBell (merged with Glovo), Carnovo, Deliberry, Elma Care, BePretty, Prontopiso and Media Digital Ventures. His first major international startup experience was as Founder and CEO of LetsBonus in 2009, a successful social shopping company in Spain, Italy and Portugal. He led the company until its 2012 sale to Living Social.

Miguel Vicente is an entrepreneur, based in Barcelona, Spain, who is Chairman and Co-founder of Antai Venture Builder, the leading online and mobile venture builder in Southern Europe. He is also Chairman of Barcelona Tech City, the city's main startup cluster and has co-founded numerous start-ups including Wallapop, JustBell (merged with Glovo), Carnovo, Deliberry, Elma Care, BePretty, Prontopiso and Media Digital Ventures. His first major international startup experience was as Founder and CEO of LetsBonus in 2009, a successful social shopping company in Spain, Italy and Portugal. He led the company until its 2012 sale to Living Social.

Paulo Mateus Pinto was the CEO of La Redoute Portugal and Spain for four years until 2018 when he stayed on as CEO of La Redoute Portugal. He also joined NERLEI as a board director in 2018, after serving seven years as director and VP of ACEPI.After completing his degree in Economics at the University of Coimbra in 1992, Pinto has worked as country manager of Vertbaudet Portugal for over six years before becoming an international director for the brand at other European countries. In 2007, he left to become the general manager of Redcats until 2013.

Paulo Mateus Pinto was the CEO of La Redoute Portugal and Spain for four years until 2018 when he stayed on as CEO of La Redoute Portugal. He also joined NERLEI as a board director in 2018, after serving seven years as director and VP of ACEPI.After completing his degree in Economics at the University of Coimbra in 1992, Pinto has worked as country manager of Vertbaudet Portugal for over six years before becoming an international director for the brand at other European countries. In 2007, he left to become the general manager of Redcats until 2013.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

Co-founder, CTO and Head of Innovation of BEEVERYCREATIVE

Francisco Mendes is the CTO, Head of Innovation and co-founder of BEEVERYCREATIVE, the innovative 3D printer and software producer in Portugal. In 2010, he co-founded the startup's preliminary project bitBOX that was transformed into BEEVERYCREATIVE in 2013.Mendes is also a co-founder of Hardware City, a community of entrepreneurs that links hardware startups to manufacturers. He has worked in R&D at Tellus Mater and Milenio 3 in Portugal. He has a master's in Industrial Automation from the University of Aveiro in Portugal.

Francisco Mendes is the CTO, Head of Innovation and co-founder of BEEVERYCREATIVE, the innovative 3D printer and software producer in Portugal. In 2010, he co-founded the startup's preliminary project bitBOX that was transformed into BEEVERYCREATIVE in 2013.Mendes is also a co-founder of Hardware City, a community of entrepreneurs that links hardware startups to manufacturers. He has worked in R&D at Tellus Mater and Milenio 3 in Portugal. He has a master's in Industrial Automation from the University of Aveiro in Portugal.

Openspace Ventures (formerly NSI Ventures)

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded in 2011, Atom Ventures is a venture capital firm focused on early-stage investments in internet and mobile startups. Atom Ventures was named “the Most Active Angel Investor in 2016” and “The Top 30 Angel Investors in China”.

Founded in 2011, Atom Ventures is a venture capital firm focused on early-stage investments in internet and mobile startups. Atom Ventures was named “the Most Active Angel Investor in 2016” and “The Top 30 Angel Investors in China”.

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Beonprice’s RMS sets the right price for every single hotel room 24/7

Ranked as 5th best RMS platform globally, Beonprice uses AI to stay ahead of competitors

How millennials travel: Waynabox for low-cost, X-factor surprise getaways

Play online vacation games and let computers plan your holidays from just €150

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

NovoNutrients: Tackling the dual problems of CO2 emissions and over-fishing

The first to transform CO2 to fish food, NovoNutrients is trialing with industry giants Skretting and Chevron, and will soon raise Series A funding

AquaCultured Foods: World's first whole-cut vegan seafood made through microbial fermentation

Armed with its fermentation technology and proprietary strain of fungi, AquaCultured is closing an oversubscribed funding round, raising more than $1.5m to launch its non-GMO seafood alternatives, with plans to expand to more food verticals and overseas

F&B supplier STOQO collapses, a casualty of Covid-19 restaurant closures in Indonesia

A once promising startup, STOQO's woes reflect the challenges faced by the local F&B industry, which is finding new ways to stay afloat

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

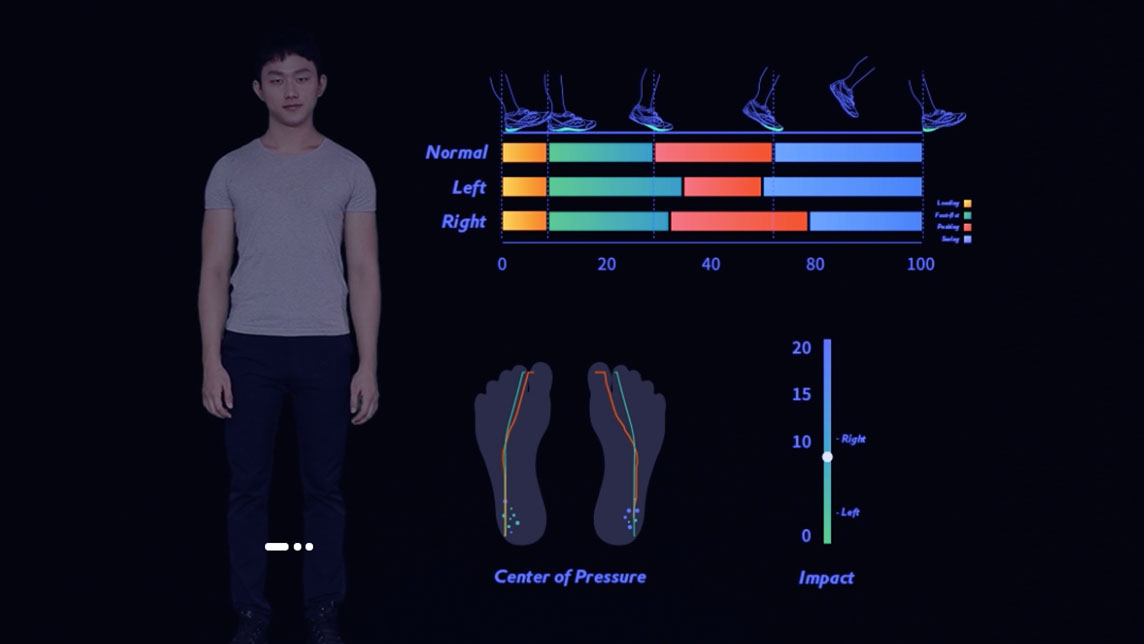

Sennotech offers affordable gait analysis on a mobile phone

Sennotech’s smart gait analysis system helps users choose comfy shoes, improve sports performance and foot health, and facilitate rehabilitation training

StudentFinance: AI screening software matches students to IT courses and jobs

StudentFinance also offers "Study now, pay later" model, making IT courses financially accessible while helping companies overcome skilled tech talent shortage

Narasi TV: Creating a better media experience for Indonesia

Spearheaded by a popular talkshow host, this new media startup seeks to cultivate a more positive online media environment

Sorry, we couldn’t find any matches for“Portugal Ventures”.