Prasetiya Mulya University

-

DATABASE (963)

-

ARTICLES (253)

Co-founder, CMO and COO of Limakilo

Lisa Ayu Wulandari is an alumni of Telkom University in Bandung with an engineering degree in Electrical & Instrumentation. She later obtained a master’s in Business, Management and Marketing at Jakarta’s Prasetiya Mulya University in 2015.Lisa started as a management trainee at PT Schneider Electric in 2011. She worked in the Services Marketing division for more than five years at PT Schneider Indonesia.

Lisa Ayu Wulandari is an alumni of Telkom University in Bandung with an engineering degree in Electrical & Instrumentation. She later obtained a master’s in Business, Management and Marketing at Jakarta’s Prasetiya Mulya University in 2015.Lisa started as a management trainee at PT Schneider Electric in 2011. She worked in the Services Marketing division for more than five years at PT Schneider Indonesia.

Co-founder and CEO of Crowde

Yohanes Sugihtononugroho is an experienced serial entrepreneur who started his first venture, a shoe manufacturing company, while reading his degree in Business at Universitas Prasetiya Mulya, Indonesia. As a student, he had also established agricultural and fashion-related businesses and continued to do so after graduation. His current venture is Crowde, a crowd investment platform connecting farmers and individual investors. Yohanes holds a Professional Development Certificate in Entrepreneurship from Stanford University.

Yohanes Sugihtononugroho is an experienced serial entrepreneur who started his first venture, a shoe manufacturing company, while reading his degree in Business at Universitas Prasetiya Mulya, Indonesia. As a student, he had also established agricultural and fashion-related businesses and continued to do so after graduation. His current venture is Crowde, a crowd investment platform connecting farmers and individual investors. Yohanes holds a Professional Development Certificate in Entrepreneurship from Stanford University.

Co-founder and Commissioner of Tanamduit

Indra Suryawan is the co-founder of Star Mercato Capitale, the company behind mutual fund investment platform Tanamduit. Between 1997 and 2001, he was the department head of business and development at Bank Bali. He later joined Jatis Solutions, which specializes in developing enterprise IT applications, leaving as deputy CEO in 2010. Between 2013 and 2017, Indra was the CEO of PT Digital Artha Media, which developed Bank Mandiri's e-cash system. Indra holds a master's in Management and Finance from Prasetiya Mulya Business School, Indonesia.

Indra Suryawan is the co-founder of Star Mercato Capitale, the company behind mutual fund investment platform Tanamduit. Between 1997 and 2001, he was the department head of business and development at Bank Bali. He later joined Jatis Solutions, which specializes in developing enterprise IT applications, leaving as deputy CEO in 2010. Between 2013 and 2017, Indra was the CEO of PT Digital Artha Media, which developed Bank Mandiri's e-cash system. Indra holds a master's in Management and Finance from Prasetiya Mulya Business School, Indonesia.

Co-founder and CFO of HarukaEdu

Tovan Krisdianto started his career as an auditor at KPMG Indonesia before moving on to work at Schlumberger. After graduating in 2003 from the Prasetiya Mulya Business School with a master’s in Management, he worked as a CFO at PT Trouw Nutrition Indonesia (Nutreco) and also at Coda Payments. He co-founded an online education services provider HarukaEdu in February 2013. He is the CFO of PT Haruka Edukasi Utama. He also runs his own business as the founder of TTT Coaching and Consulting. He had also worked as an associate lecturer at Binus Business School in 2014.

Tovan Krisdianto started his career as an auditor at KPMG Indonesia before moving on to work at Schlumberger. After graduating in 2003 from the Prasetiya Mulya Business School with a master’s in Management, he worked as a CFO at PT Trouw Nutrition Indonesia (Nutreco) and also at Coda Payments. He co-founded an online education services provider HarukaEdu in February 2013. He is the CFO of PT Haruka Edukasi Utama. He also runs his own business as the founder of TTT Coaching and Consulting. He had also worked as an associate lecturer at Binus Business School in 2014.

President Director of Pintek

Tommy Yuwono founded his first venture, a business publication Milestone Interactive Digital magazine in 2011, while reading a business degree at Prasetiya Mulya Business School. After graduating in 2014, he joined securities company MNC Sekuritas to specialize in investment banking products like bond and medium-term notes for public and private companies.In 2016, he left MNC to become the chief digital officer and co-founder of online payments platform Ayopop. After securing Series A funding for Ayopop, he left and established education loan platform Pintek as CEO in 2018, together with Ayopop's CFO Ioann Fainsilber as co-founder.

Tommy Yuwono founded his first venture, a business publication Milestone Interactive Digital magazine in 2011, while reading a business degree at Prasetiya Mulya Business School. After graduating in 2014, he joined securities company MNC Sekuritas to specialize in investment banking products like bond and medium-term notes for public and private companies.In 2016, he left MNC to become the chief digital officer and co-founder of online payments platform Ayopop. After securing Series A funding for Ayopop, he left and established education loan platform Pintek as CEO in 2018, together with Ayopop's CFO Ioann Fainsilber as co-founder.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

Yangtze Delta Region Institute of Tsinghua University, Zhejiang

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

After a decade of technology and capability development, Alén Space's proprietary nanosatellites offer a faster, cheaper way to meet the growing demand for new Space applications.

After a decade of technology and capability development, Alén Space's proprietary nanosatellites offer a faster, cheaper way to meet the growing demand for new Space applications.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Mari Elka Pangestu is the first female Chinese Indonesian to hold a cabinet position. She was the Minister of Trade from 2004 to 2011 and the Minister of Tourism from 2011 to 2014. She holds a doctorate in Economics from the University of California, USA. Returning to academia at the University of Indonesia, the professor is also part of the Indonesian network of angel investors ANGIN.

Mari Elka Pangestu is the first female Chinese Indonesian to hold a cabinet position. She was the Minister of Trade from 2004 to 2011 and the Minister of Tourism from 2011 to 2014. She holds a doctorate in Economics from the University of California, USA. Returning to academia at the University of Indonesia, the professor is also part of the Indonesian network of angel investors ANGIN.

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

Stanford Graduate School of Business

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Veteran Portuguese investor Diamantino Costa, aka Dino, is the founder and managing partner of DCVentures and Ganexa Capital. He is also the chairman and CEO of Intelligent Sensing Anywhere (ISA), an IoT firm in energy, oil and gas. He is a former chairman of the Portuguese Aerospace Industry Association (PEMAS).Costa has a master’s in Computer Science from the University of Coimbra. He co-founded and exited Critical Software, one of Portugal’s first startups. The business application development company has its roots at the University of Coimbra and secured NASA as its first client.

Veteran Portuguese investor Diamantino Costa, aka Dino, is the founder and managing partner of DCVentures and Ganexa Capital. He is also the chairman and CEO of Intelligent Sensing Anywhere (ISA), an IoT firm in energy, oil and gas. He is a former chairman of the Portuguese Aerospace Industry Association (PEMAS).Costa has a master’s in Computer Science from the University of Coimbra. He co-founded and exited Critical Software, one of Portugal’s first startups. The business application development company has its roots at the University of Coimbra and secured NASA as its first client.

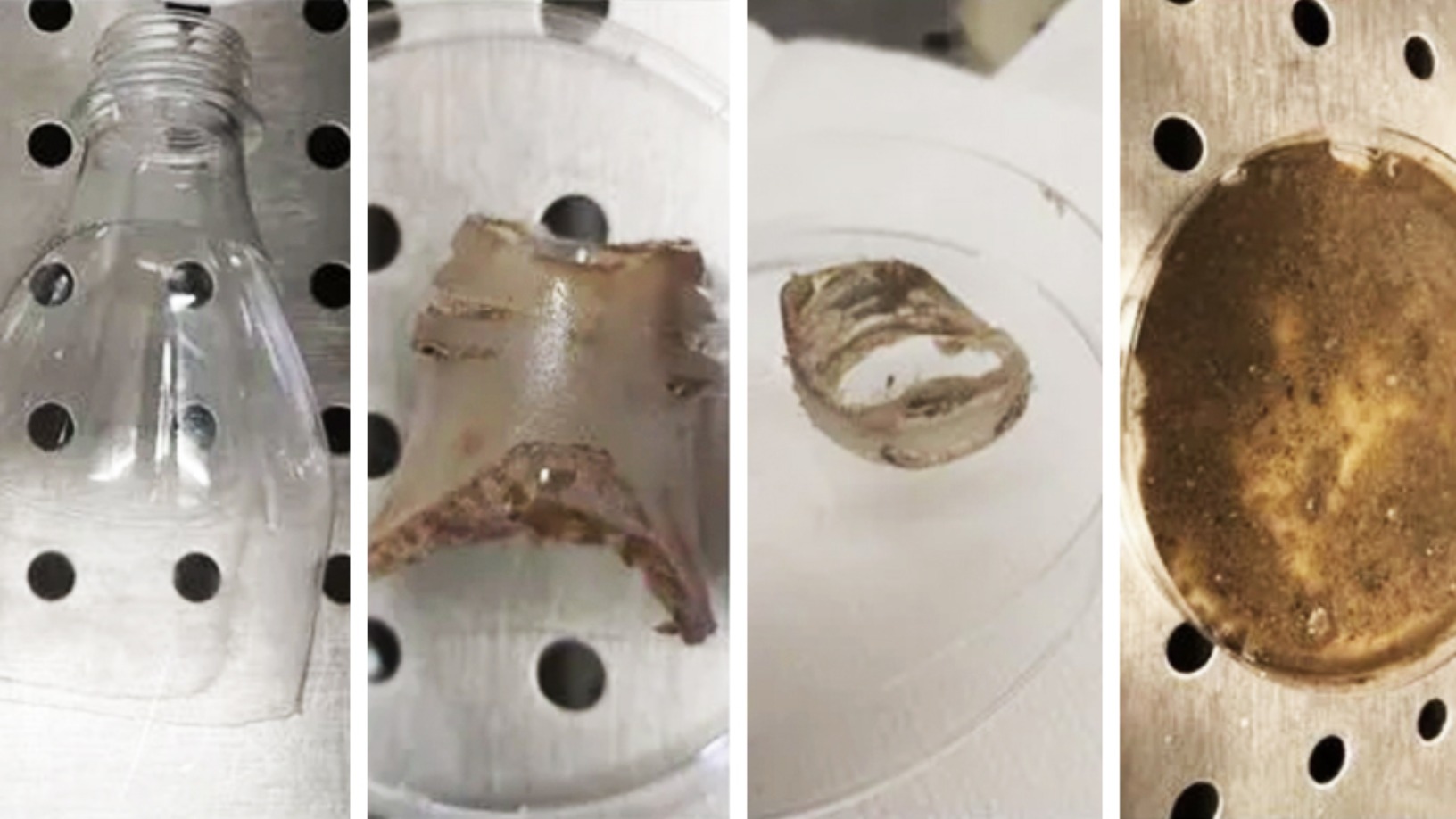

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

East Ventures raises funds, teams up with state agency to produce Covid-19 tests for Indonesia

East Ventures investee Nusantics has been working with state researchers to produce the prototype; expects mass production of the test kits soon

Triditive: Enabling SME manufacturers to catch up, thrive in Industry 4.0

An Asturian startup has created the first automated additive manufacturing technology for round-the-clock industrial production

Tuya Smart announces more partnerships, files for IPO in the US

Tuya Smart’s platform enables the creation of smart devices with little or no code writing needed, shortening R&D from months to a matter of days

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Spotahome CTO: Room for more real estate disruption, beyond rentals

Bryan McEire, CTO and co-founder of the Spanish proptech startup, details their expansion plans this year and more, in a wide-ranging interview

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

Youcheck by Precept: The fact-checking app fighting misinformation

Youcheck, a Google DNI Fund winner, uses AI to spot fake news on social media, help journalists do better work

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

Yudha Kartohadiprodjo wants to empower Indonesian farmers

Kartohadiprodjo founded Karsa, an agritech social media startup, to arm farmers with better knowledge and information sharing

Science4you cancels IPO amid market jitters, foresees slower growth

Portugal's largest toymaker will continue to focus on international markets, digital boost

AltStory: Putting the audience in the director's chair

The Chinese startup has taken interactivity to another level by letting TV and movie viewers decide where the action goes, and how it all ends.

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Sorry, we couldn’t find any matches for“Prasetiya Mulya University”.