QKM Technology

-

DATABASE (584)

-

ARTICLES (519)

Co-Founder & CEO of Bipi

Hans Christ has worked internationally across Latin America, Europe and the USA. He is the co-founder of transport technology startup Bipi, a Spanish on-demand car rental app and Lollo Mobility, Bipi’s parent company and transport app company. He co-founded Colombia Cave Box Crossfit in 2013 and was previously Groupon Iberia’s Head of Goods, where he helped established its product department. Christ started his career as a Credit Manager in Walls Cargo Bank. Christ holds a Business Administration degree from Southern Methodist University (SMU) and an MBA in Marketing from the University of Dallas.

Hans Christ has worked internationally across Latin America, Europe and the USA. He is the co-founder of transport technology startup Bipi, a Spanish on-demand car rental app and Lollo Mobility, Bipi’s parent company and transport app company. He co-founded Colombia Cave Box Crossfit in 2013 and was previously Groupon Iberia’s Head of Goods, where he helped established its product department. Christ started his career as a Credit Manager in Walls Cargo Bank. Christ holds a Business Administration degree from Southern Methodist University (SMU) and an MBA in Marketing from the University of Dallas.

One of China’s most famous angel investors and a prolific speaker, Xu Xiaoping (b.1960) is the managing partner of ZhenFund, a TMT-focused seed fund he founded with close friend and business partner Wang Qiang, in collaboration with Sequoia Capital China, in 2011. Xu began investing in 2006, after the New Oriental Education & Technology Group he co-founded became the first Chinese education company to list on NYSE. Trained as a professional musician, Xu plays the piano, violin, and oboe, and composes music as a hobby. He is also the author of more than 10 books. He studied at the Beijing Central Conservatory of Music and holds a master's in Music from the University of Saskatchewan.

One of China’s most famous angel investors and a prolific speaker, Xu Xiaoping (b.1960) is the managing partner of ZhenFund, a TMT-focused seed fund he founded with close friend and business partner Wang Qiang, in collaboration with Sequoia Capital China, in 2011. Xu began investing in 2006, after the New Oriental Education & Technology Group he co-founded became the first Chinese education company to list on NYSE. Trained as a professional musician, Xu plays the piano, violin, and oboe, and composes music as a hobby. He is also the author of more than 10 books. He studied at the Beijing Central Conservatory of Music and holds a master's in Music from the University of Saskatchewan.

Creandum invests in early-stage technology firms in the consumer internet, software and hardware sectors. The firm has grown from having 10 startups in its portfolio and an advisory team scattered across Sweden in 2007, to being headquartered in Stockholm with offices in Berlin, San Francisco and Guernsey and a total five funds raised worth over €700m. It's most recent fund raised €265m in 2019 and will ofcus on European startups. The company was the lead investor in more than a third of its almost 150 investments to date and was Spotify's first institutional investor. The most recent investments include in Spanish HR SaaS Factorial's €15m Series A round and in German tax assistant app Taxfix's US$65m Series C round.

Creandum invests in early-stage technology firms in the consumer internet, software and hardware sectors. The firm has grown from having 10 startups in its portfolio and an advisory team scattered across Sweden in 2007, to being headquartered in Stockholm with offices in Berlin, San Francisco and Guernsey and a total five funds raised worth over €700m. It's most recent fund raised €265m in 2019 and will ofcus on European startups. The company was the lead investor in more than a third of its almost 150 investments to date and was Spotify's first institutional investor. The most recent investments include in Spanish HR SaaS Factorial's €15m Series A round and in German tax assistant app Taxfix's US$65m Series C round.

Founded in Beijing in May 2015, Chunxiao Capital mainly invests in angel/seed to Series B funding rounds. With staff of 22, the VC has invested in over 50 companies by March 2019. Investments include technology innovations in fintech, big data and AI. Other investment sectors involve corporate services, Industry 4.0, B2B and SaaS for industrial enterprises and consumer-oriented businesses like retail, sports, maternal and infant care.In May 2019, the Asset Management Association of China revoked Chunxiao's private equity certification due to links with five online P2P lending firms facing default problems.

Founded in Beijing in May 2015, Chunxiao Capital mainly invests in angel/seed to Series B funding rounds. With staff of 22, the VC has invested in over 50 companies by March 2019. Investments include technology innovations in fintech, big data and AI. Other investment sectors involve corporate services, Industry 4.0, B2B and SaaS for industrial enterprises and consumer-oriented businesses like retail, sports, maternal and infant care.In May 2019, the Asset Management Association of China revoked Chunxiao's private equity certification due to links with five online P2P lending firms facing default problems.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

CEO and Co-founder of Glovo

Oscar Pierre (b.1992) trained as an aerospace engineer at the Polytechnic University of Barcelona (UPC) in Spain and later at the Georgia Institute of Technology in Atlanta, USA. He interned at Airbus, before starting his entrepreneurial career in 2014 by founding startups like Zikkomo and FUO Concept. Zikkomo is a platform that drives education in Malawi through multiple Active Africa ONG projects. FUO Concept was an e-commerce marketplace for local handicrafts.Pierre is now the CEO and co-founder of Glovo, an on-demand delivery platform with operations in 22 markets worldwide.

Oscar Pierre (b.1992) trained as an aerospace engineer at the Polytechnic University of Barcelona (UPC) in Spain and later at the Georgia Institute of Technology in Atlanta, USA. He interned at Airbus, before starting his entrepreneurial career in 2014 by founding startups like Zikkomo and FUO Concept. Zikkomo is a platform that drives education in Malawi through multiple Active Africa ONG projects. FUO Concept was an e-commerce marketplace for local handicrafts.Pierre is now the CEO and co-founder of Glovo, an on-demand delivery platform with operations in 22 markets worldwide.

CTO & Co-founder of Place to Plug

Ruiz was 15 when he founded his first startup, Enfilio, mixing magic and software engineering. Enfilio was sold in 2014 and is now one of the most recognized magic companies globally. He also co-founded Lymbit Technological Company, an IoT company for object tracking and location-based advertising. As a researcher at Rovira i Virgili University, he designed and published technology to protect online votes, and co-designed end-to-end encryption and an access control protocol, Attribute-Based Encryption.Today, he’s the CTO and co-founder of Place to Plug, a smart cities platform that connects electric vehicle (EV) drivers with charging stations of individuals, businesses and public institutions.

Ruiz was 15 when he founded his first startup, Enfilio, mixing magic and software engineering. Enfilio was sold in 2014 and is now one of the most recognized magic companies globally. He also co-founded Lymbit Technological Company, an IoT company for object tracking and location-based advertising. As a researcher at Rovira i Virgili University, he designed and published technology to protect online votes, and co-designed end-to-end encryption and an access control protocol, Attribute-Based Encryption.Today, he’s the CTO and co-founder of Place to Plug, a smart cities platform that connects electric vehicle (EV) drivers with charging stations of individuals, businesses and public institutions.

Founder, CEO of Zero 2 Infinity

López-Urdiales is a Spanish aeronautical engineer. In 2009, he founded space transportation company, Zero 2 Infinity, and is also its CEO. Prior to that, he lectured at the Polytechnic University of Catalonia in space vehicles and space propulsion and was General Manager at the Barcelona Aeronautics and Space Association. He has previously worked at Boeing and Boston Consulting Group. He holds an MBA in Management from Paris' Institute of Engineers and two master's degrees, one in Aeronautical Engineering from the University Polytechnic of Madrid, and the other in Aeronautics and Astronautics from the Massachusetts Institute of Technology (MITT).

López-Urdiales is a Spanish aeronautical engineer. In 2009, he founded space transportation company, Zero 2 Infinity, and is also its CEO. Prior to that, he lectured at the Polytechnic University of Catalonia in space vehicles and space propulsion and was General Manager at the Barcelona Aeronautics and Space Association. He has previously worked at Boeing and Boston Consulting Group. He holds an MBA in Management from Paris' Institute of Engineers and two master's degrees, one in Aeronautical Engineering from the University Polytechnic of Madrid, and the other in Aeronautics and Astronautics from the Massachusetts Institute of Technology (MITT).

Co-founder and COO of McFly

Born in 1982, Chen Qi graduated from Wuhan University with a bachelor’s degree in Remote Sensing in 2005, the same year as fellow alumnus Gong Huaze. Both became co-founders of McFly, with Chen as COO in December 2016.After graduation, Chen moved to Beijing and worked at NavInfo, a digital map supplier under the state-owned China Aerospace Science and Technology Corporation (CASC). He also earned a master’s in Photogrammetry and Remote Sensing at Wuhan University while working at NavInfo. In 2013, he worked at Alibaba Mobile Business Group as a product manager until he left to establish agtech startup McFly.

Born in 1982, Chen Qi graduated from Wuhan University with a bachelor’s degree in Remote Sensing in 2005, the same year as fellow alumnus Gong Huaze. Both became co-founders of McFly, with Chen as COO in December 2016.After graduation, Chen moved to Beijing and worked at NavInfo, a digital map supplier under the state-owned China Aerospace Science and Technology Corporation (CASC). He also earned a master’s in Photogrammetry and Remote Sensing at Wuhan University while working at NavInfo. In 2013, he worked at Alibaba Mobile Business Group as a product manager until he left to establish agtech startup McFly.

CEO and Co-founder of Coinffeine

Alberto Gómez Toribio is a computer engineer and an influential blockchain expert in Spain. In 2013, he co-founded Coinffeine, a P2P cryptocurrency exchange platform and the first to on-board a banking investor. Coinffeine consulted institutions including the Bank of Spain, the US Federal Reserve and the European Commission during development of the platform. In 2015, Toribio established the blockchain division within the Barrabés Group to launch blockchain startups projects. He has also worked as a technology expert for Sony Entertainment and Telefonica R&D. Currently he is working on projects developing blockchain strategies to identify business opportunities and new innovative product design.

Alberto Gómez Toribio is a computer engineer and an influential blockchain expert in Spain. In 2013, he co-founded Coinffeine, a P2P cryptocurrency exchange platform and the first to on-board a banking investor. Coinffeine consulted institutions including the Bank of Spain, the US Federal Reserve and the European Commission during development of the platform. In 2015, Toribio established the blockchain division within the Barrabés Group to launch blockchain startups projects. He has also worked as a technology expert for Sony Entertainment and Telefonica R&D. Currently he is working on projects developing blockchain strategies to identify business opportunities and new innovative product design.

Li Zexiang and his game-changing plans to take Chinese robotics global

An early supporter of drone giant DJI, Professor Li Zexiang is building robotics hubs across China to pivot homegrown enterprises into global players

Tezign, where design meets technology

By building a bridge between creative talents and enterprises, this Chinese startup is providing designers with more work opportunities

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

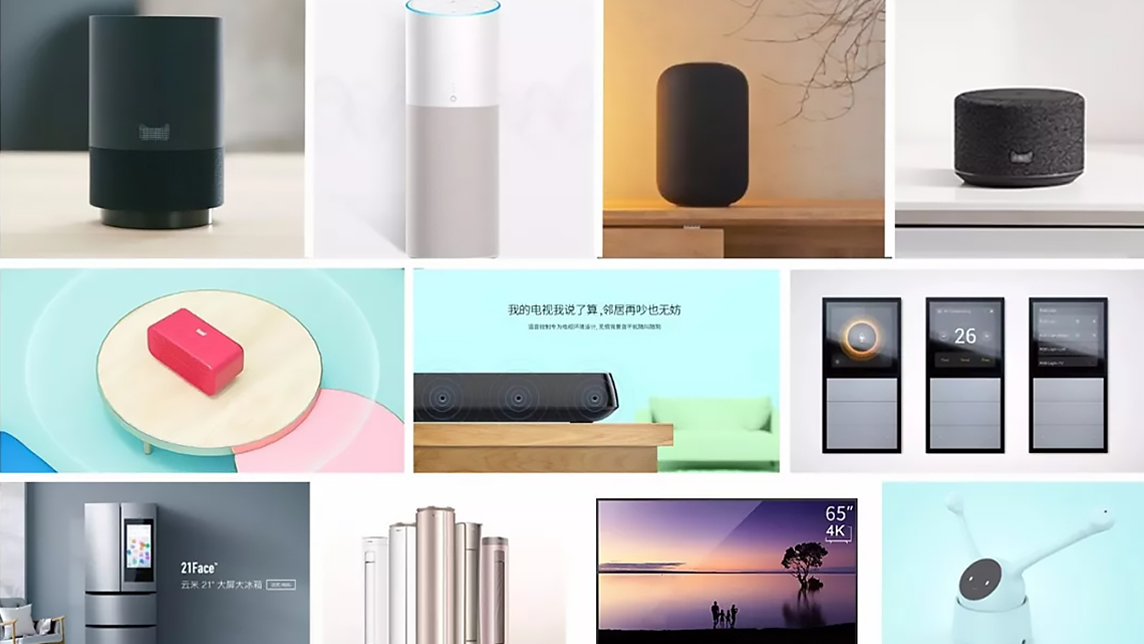

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

iOLAND: Farm management technology created for and by farmers

Precision farming startup iOLAND provides farmers recommendations based on data collected by its IoT devices and refined by machine learning

IONIC AI: Human-centric technology that enhances mobile phone performance

Giving new life to old mobile phones and upgrading cheaper ones, IONIC AI's tech also keeps gamers' phones cool for longer usage

Sonic Boom: Using sound wave technology to understand shopper behaviour

Sonic Boom's solution, which enables data to be captured from mobile devices without needing an internet connection, is eyeing Indonesia's huge retail market

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Creatio Energy Systems: From personal hobby to Iberian enabler of IoT technology

Creatio develops fully compatible sensors with a matching SaaS platform, meeting fast-growing IoT demand in Spain, where there are only a few local players

Ontruck CTO: How to build, scale technology in the road freight sector

Iterate fast and understand your clients, explains Samuel Fuentes, co-founder and CTO of Ontruck, because "for us, innovation is business as usual”

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Volantis Technology: Guiding Indonesian enterprises into "Industry 4.0" with end-to-end AI platform

Volantis Technology helps Indonesian companies incorporate digital transformation and make the best use of their data; eyes Singapore office for overseas markets

Triditive: Enabling SME manufacturers to catch up, thrive in Industry 4.0

An Asturian startup has created the first automated additive manufacturing technology for round-the-clock industrial production

Sorry, we couldn’t find any matches for“QKM Technology”.