QKM Technology

-

DATABASE (584)

-

ARTICLES (519)

Reus Capital is a pledge fund focused on technology startups in the Catalan ecosystem. It was founded in 2013 and is headquartered in Reus, Catalonia. To date, it has invested a total of €10 million in more than 20 startup companies.

Reus Capital is a pledge fund focused on technology startups in the Catalan ecosystem. It was founded in 2013 and is headquartered in Reus, Catalonia. To date, it has invested a total of €10 million in more than 20 startup companies.

Co-founder and CTO of Madhang

Fadhil Nur Mahardi graduated from Universitas Dian Nuswantoro with a bachelor's in Information Technology and worked as a web developer for Seven Media Technology from 2015 to 2018. His programming skills includes familiarity with NodeJS, Swift and back-end web development. In late 2017, he co-founded Indonesian home chef meal service Madhang.

Fadhil Nur Mahardi graduated from Universitas Dian Nuswantoro with a bachelor's in Information Technology and worked as a web developer for Seven Media Technology from 2015 to 2018. His programming skills includes familiarity with NodeJS, Swift and back-end web development. In late 2017, he co-founded Indonesian home chef meal service Madhang.

Co-founder of QinLin Technology

Wu Rang co-founded QinLin Technology with Guan Ke in 2015.

Wu Rang co-founded QinLin Technology with Guan Ke in 2015.

Velos Partners brands itself as a Consumer Growth Capital Fund investing in companies at the intersection of consumer and technology. Based in Los Angeles, USA, its global portfolio includes women focused e-commerce site Orami, wearable tech firm Doppler Labs and property listing site 99.co.

Velos Partners brands itself as a Consumer Growth Capital Fund investing in companies at the intersection of consumer and technology. Based in Los Angeles, USA, its global portfolio includes women focused e-commerce site Orami, wearable tech firm Doppler Labs and property listing site 99.co.

Lenovo Capital & Incubator Group

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

Established in 2016, Lenovo Capital is a venture capital fund that invests in the global technology sector. The fourth business division of Legend Group, Lenovo Capital has invested in and supported more than 80 startups and incubated nine subsidiaries that have more than one billion global users.

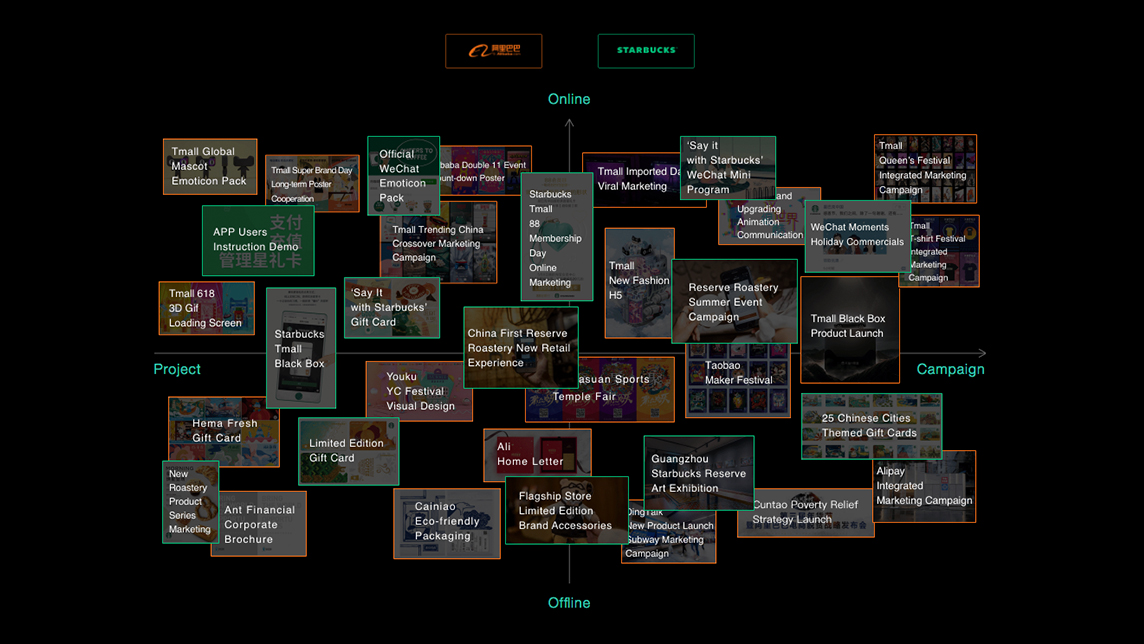

Linear Venture was co-founded by Wang Huai, a former Facebook employee, and Zhan Chuan, who served as a senior executive to Alibaba’s Tmall and JD.com. The firm invests mainly in early-stage technology-driven startups in the intelligence and big data fields.

Linear Venture was co-founded by Wang Huai, a former Facebook employee, and Zhan Chuan, who served as a senior executive to Alibaba’s Tmall and JD.com. The firm invests mainly in early-stage technology-driven startups in the intelligence and big data fields.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

Beijing Zhongguancun Development Qihang Industrial Investment Fund

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

DCP Capital is an international private equity firm that mainly invests in Asia. The DCP team previously led KKR and Morgan Stanley’s private equity businesses in Asia. Over the past 27 years, it has invested in a number of leading enterprises including Ping An Insurance, Mengniu Dairy, CICC and Haier Electronics. Its existing investors include leading sovereign wealth funds, pension funds, endowments, family offices and funds of funds (FOF) across the world.In April 2019, DCP successfully raised over $2bn for its first Greater China-focused USD fund known as DCP Capital Partners I. The fund mainly invests in diverse sectors including consumer goods, industrial technology, healthcare, agrifood, enterprise tech, financial services and technology, media & telecom (TMT).

DCP Capital is an international private equity firm that mainly invests in Asia. The DCP team previously led KKR and Morgan Stanley’s private equity businesses in Asia. Over the past 27 years, it has invested in a number of leading enterprises including Ping An Insurance, Mengniu Dairy, CICC and Haier Electronics. Its existing investors include leading sovereign wealth funds, pension funds, endowments, family offices and funds of funds (FOF) across the world.In April 2019, DCP successfully raised over $2bn for its first Greater China-focused USD fund known as DCP Capital Partners I. The fund mainly invests in diverse sectors including consumer goods, industrial technology, healthcare, agrifood, enterprise tech, financial services and technology, media & telecom (TMT).

CAS Investment Management Co., Ltd.

Established in 1987 by the National Economic Commission and the Chinese Academy of Sciences as the Foundation for Economic Development, the renamed CAS Investment Management Co., Ltd. was transformed into a limited liability company in 2006. It has invested in and made profitable more than 300 technology projects.

Established in 1987 by the National Economic Commission and the Chinese Academy of Sciences as the Foundation for Economic Development, the renamed CAS Investment Management Co., Ltd. was transformed into a limited liability company in 2006. It has invested in and made profitable more than 300 technology projects.

Founder of Rainier

Born in October 1962, Wen Fu'an is a professor at the Institute of Educational Technology, Beijing University of Posts and Telecommunications (BUPT). He is also a director of BUPT Network Teaching System Research Center and the deputy director of BUPT Electronic Information Virtual Simulation Experiment Teaching Center. He started his research on virtual experiments in 1998. He founded Rainier Science and Technology in 2007.

Born in October 1962, Wen Fu'an is a professor at the Institute of Educational Technology, Beijing University of Posts and Telecommunications (BUPT). He is also a director of BUPT Network Teaching System Research Center and the deputy director of BUPT Electronic Information Virtual Simulation Experiment Teaching Center. He started his research on virtual experiments in 1998. He founded Rainier Science and Technology in 2007.

CTO and co-founder of KlikDaily

Dhanurendra is co-founder and CTO of FMCG supply chain KlikDaily, which he co-founded with Amos Gunawan in 2015. He was also a Mentor / Entrepreneur In Residence at Skystar Ventures and the of Business Development at PT Red Dot Indonesia in Singapore. He obtained his Bachelor of Technology in Information Technology from Universitas Pelita Harapan (UPH).

Dhanurendra is co-founder and CTO of FMCG supply chain KlikDaily, which he co-founded with Amos Gunawan in 2015. He was also a Mentor / Entrepreneur In Residence at Skystar Ventures and the of Business Development at PT Red Dot Indonesia in Singapore. He obtained his Bachelor of Technology in Information Technology from Universitas Pelita Harapan (UPH).

CEO and founder of Sound Particles

Nuno Fonseca is the sole founder of Sound Particles, the Portuguese 3D audio software platform for sound designers. Fonseca had been working on his technology since 2012 while working in other roles and founded Sound Particles in 2016. For almost 18 years, Fonseca was Program Coordinator for Digital Games and Multimedia at the Polytechnic University of Leiria. Simultaneously, for six years until 2018, Fonseca was a teacher of Music Technology at Lisbon's Higher School of Music. His educational achievements include a PhD in Computer Engineering in the area of audio production. He has also published two books and more than 20 academic papers on audio technology.

Nuno Fonseca is the sole founder of Sound Particles, the Portuguese 3D audio software platform for sound designers. Fonseca had been working on his technology since 2012 while working in other roles and founded Sound Particles in 2016. For almost 18 years, Fonseca was Program Coordinator for Digital Games and Multimedia at the Polytechnic University of Leiria. Simultaneously, for six years until 2018, Fonseca was a teacher of Music Technology at Lisbon's Higher School of Music. His educational achievements include a PhD in Computer Engineering in the area of audio production. He has also published two books and more than 20 academic papers on audio technology.

Charlotte Street Capital is a London-based venture capital firm focused on early stage investments. It invests from £150,000 to £1 million in innovative technology businesses, ranging from hardware products, software and services in the B2C and B2B sectors.

Charlotte Street Capital is a London-based venture capital firm focused on early stage investments. It invests from £150,000 to £1 million in innovative technology businesses, ranging from hardware products, software and services in the B2C and B2B sectors.

Established in 2014 as a private equity firm, Hawthorn Investment engages in equity investment, M&As and capital management. It invests mainly in the emerging automotive technology, healthcare, high-end manufacturing, culture and sports sectors.

Established in 2014 as a private equity firm, Hawthorn Investment engages in equity investment, M&As and capital management. It invests mainly in the emerging automotive technology, healthcare, high-end manufacturing, culture and sports sectors.

Li Zexiang and his game-changing plans to take Chinese robotics global

An early supporter of drone giant DJI, Professor Li Zexiang is building robotics hubs across China to pivot homegrown enterprises into global players

Tezign, where design meets technology

By building a bridge between creative talents and enterprises, this Chinese startup is providing designers with more work opportunities

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

iOLAND: Farm management technology created for and by farmers

Precision farming startup iOLAND provides farmers recommendations based on data collected by its IoT devices and refined by machine learning

IONIC AI: Human-centric technology that enhances mobile phone performance

Giving new life to old mobile phones and upgrading cheaper ones, IONIC AI's tech also keeps gamers' phones cool for longer usage

Sonic Boom: Using sound wave technology to understand shopper behaviour

Sonic Boom's solution, which enables data to be captured from mobile devices without needing an internet connection, is eyeing Indonesia's huge retail market

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Creatio Energy Systems: From personal hobby to Iberian enabler of IoT technology

Creatio develops fully compatible sensors with a matching SaaS platform, meeting fast-growing IoT demand in Spain, where there are only a few local players

Ontruck CTO: How to build, scale technology in the road freight sector

Iterate fast and understand your clients, explains Samuel Fuentes, co-founder and CTO of Ontruck, because "for us, innovation is business as usual”

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

Fumi Technology: Getting ahead of human wealth managers with its Webull robo-advisors

Fumi's AI-based fintech platform offers real-time quotes and free trading to over 10m punters in 100 countries

Volantis Technology: Guiding Indonesian enterprises into "Industry 4.0" with end-to-end AI platform

Volantis Technology helps Indonesian companies incorporate digital transformation and make the best use of their data; eyes Singapore office for overseas markets

Triditive: Enabling SME manufacturers to catch up, thrive in Industry 4.0

An Asturian startup has created the first automated additive manufacturing technology for round-the-clock industrial production

Sorry, we couldn’t find any matches for“QKM Technology”.