Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

Backed by €30m funding and orders from global brands, Finnish cleantech will build flagship factory to scale production of regenerated biodegradable microplastic-free textile fibers.

Backed by €30m funding and orders from global brands, Finnish cleantech will build flagship factory to scale production of regenerated biodegradable microplastic-free textile fibers.

Co-founder and Technology & Innovation Director of Tanamduit

Ferry Aprilianto has over 17 years of experience as an IT engineer. From 2000 to 2005, he was a project manager at enterprise IT firm Jatis Solutions, where he worked on mutual fund distribution systems for major Indonesian banks. In 2005, he became an independent IT consultant, working for companies in Indonesia and the Philippines. In 2013, he joined the company that developed Bank Mandiri's e-cash system, Digital Artha Media, as an IT architect. Ferry graduated from the University of Indonesia with a bachelor's in Electrical and Electronic Engineering.

Ferry Aprilianto has over 17 years of experience as an IT engineer. From 2000 to 2005, he was a project manager at enterprise IT firm Jatis Solutions, where he worked on mutual fund distribution systems for major Indonesian banks. In 2005, he became an independent IT consultant, working for companies in Indonesia and the Philippines. In 2013, he joined the company that developed Bank Mandiri's e-cash system, Digital Artha Media, as an IT architect. Ferry graduated from the University of Indonesia with a bachelor's in Electrical and Electronic Engineering.

Hangzhou Bin Chuang Investment is a wholly owned unit of Hangzhou Binjiang Real Estate Group.

Hangzhou Bin Chuang Investment is a wholly owned unit of Hangzhou Binjiang Real Estate Group.

R&D and Co-founder of Solatom

Carlo Terruzzi is an industrial and mechanical engineer who spent several years as an industry consultant and led the technical department of CMC Marine, a company building stabilization systems for the maritime component industry. He is co-founder and head of R&D in Solatom, a startup developing solar concentrators for industrial applications. Terruzzi specialized in Mechatronics at the University of New South Wales, Australia.

Carlo Terruzzi is an industrial and mechanical engineer who spent several years as an industry consultant and led the technical department of CMC Marine, a company building stabilization systems for the maritime component industry. He is co-founder and head of R&D in Solatom, a startup developing solar concentrators for industrial applications. Terruzzi specialized in Mechatronics at the University of New South Wales, Australia.

Co-founder and COO of Ebaoyang

Former vice-president of China Aerospace Capital, with over 12 years’ experience in finance, investment and operation management.

Former vice-president of China Aerospace Capital, with over 12 years’ experience in finance, investment and operation management.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

MNC Media Investment started out as Linktone, a China-based media company that was acquired in 2008 by Indonesia’s MNC group that is owned by business tycoon and politician Hary Tanoesoedibjo. Linktone was rebranded as MNC Media Investment Ltd in 2014 to focus on various entertainment and marketing products, as well as other media services. Its shares are also listed on the Australian Stock Exchange and quoted on the OTC Markets Group’s OTC Pink.

MNC Media Investment started out as Linktone, a China-based media company that was acquired in 2008 by Indonesia’s MNC group that is owned by business tycoon and politician Hary Tanoesoedibjo. Linktone was rebranded as MNC Media Investment Ltd in 2014 to focus on various entertainment and marketing products, as well as other media services. Its shares are also listed on the Australian Stock Exchange and quoted on the OTC Markets Group’s OTC Pink.

Founded by Xiaomi’s Lei Jun, this incubator-investor gets first-mover access to bright business ideas and talent with its startup cafes in China’s “north Silicon Valley”.

Founded by Xiaomi’s Lei Jun, this incubator-investor gets first-mover access to bright business ideas and talent with its startup cafes in China’s “north Silicon Valley”.

AEInnova's energy harvesting and Industry 4.0 technologies help industries convert waste heat into electricity, saving costs and meeting increasingly strict environmental regulatory requirements.

AEInnova's energy harvesting and Industry 4.0 technologies help industries convert waste heat into electricity, saving costs and meeting increasingly strict environmental regulatory requirements.

Industrial SMEs can save a third on heating costs with Solatom's patented, pre-assembled solar thermal system. Solatom is developing a hybrid solar-natural gas boiler.

Industrial SMEs can save a third on heating costs with Solatom's patented, pre-assembled solar thermal system. Solatom is developing a hybrid solar-natural gas boiler.

With a 55-tone capacity to produce fungi-based proteins annually, Mycorena’s Gothenburg facility will showcase its mycoprotein R&D and spur commercial expansion across Europe.

With a 55-tone capacity to produce fungi-based proteins annually, Mycorena’s Gothenburg facility will showcase its mycoprotein R&D and spur commercial expansion across Europe.

With Allozymes technology, designing industrial enzymes takes months instead of years, helping industries from pharmaceuticals to foodtech get the chemicals they need much faster.

With Allozymes technology, designing industrial enzymes takes months instead of years, helping industries from pharmaceuticals to foodtech get the chemicals they need much faster.

Co-Founder and CEO of Ziztour

MBA of Ivey Business School at Western University. Formerly division manager at 3M. Two years of experience in investment.

MBA of Ivey Business School at Western University. Formerly division manager at 3M. Two years of experience in investment.

Gemboom Venture Capital was founded in Shenzhen in 2016 and mainly invests in early-stage startups from angel to Series A rounds. It specializes in high-tech, industrial upgrades and consumables. The VC invests primarily in big cities like Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou and Chengdu.

Gemboom Venture Capital was founded in Shenzhen in 2016 and mainly invests in early-stage startups from angel to Series A rounds. It specializes in high-tech, industrial upgrades and consumables. The VC invests primarily in big cities like Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou and Chengdu.

Centurium Capital is a private equity firm specializing in investments in the healthcare and consumer sectors in China. It was founded by David Li, Warburg Pincus's former Asia head, with a US$1.5 billion hard cap. It raised US$925 million in first close in June 2018. Centurium's limited partners include GIC, China Investment Corporation and Temasek Holdings. Centurium has cooperated with UCAR and Lepu Medical Technology to set up and manage two industrial M&A funds with initial funds of over RMB 6 billion.

Centurium Capital is a private equity firm specializing in investments in the healthcare and consumer sectors in China. It was founded by David Li, Warburg Pincus's former Asia head, with a US$1.5 billion hard cap. It raised US$925 million in first close in June 2018. Centurium's limited partners include GIC, China Investment Corporation and Temasek Holdings. Centurium has cooperated with UCAR and Lepu Medical Technology to set up and manage two industrial M&A funds with initial funds of over RMB 6 billion.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

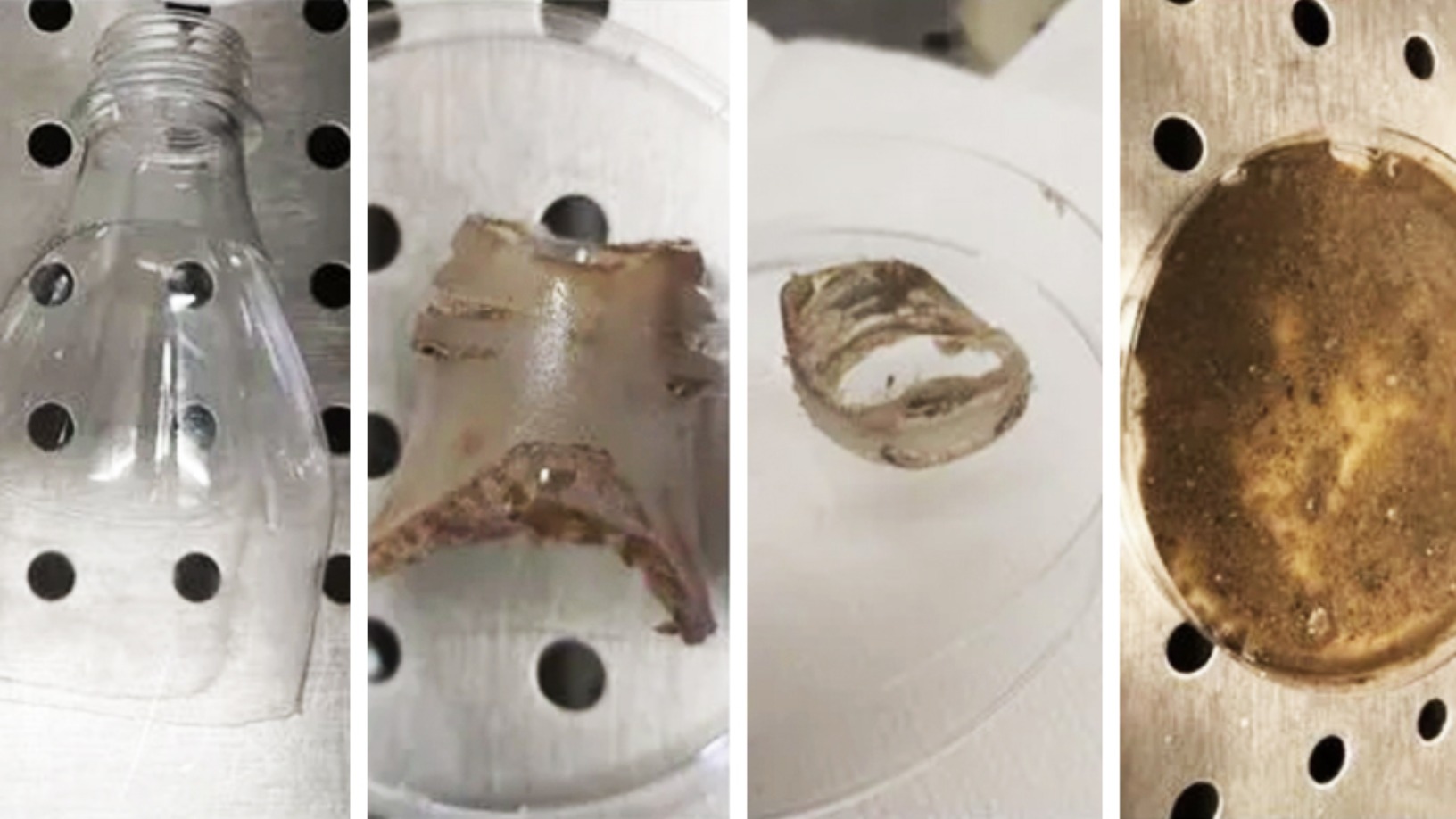

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.