Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Winning (Shanghai) Investment Management

Winning (Shanghai) Investment Management was founded in 2015 with Winning (Shanghai) Asset Management as its controlling shareholder. It mainly invests in the sectors of healthcare, consumer goods, entertainment and sports, and advanced manufacturing.

Winning (Shanghai) Investment Management was founded in 2015 with Winning (Shanghai) Asset Management as its controlling shareholder. It mainly invests in the sectors of healthcare, consumer goods, entertainment and sports, and advanced manufacturing.

CEO and Founder of QinLin Technology

Guan Ke has nearly 20 years of work experience in the media industry. He was the general manager of Shenzhen Jusiwei Advertising Co Ltd. He was also a former stockholder of Shenzhen One Media Investment Holdings Limited. He founded QinLin Technology in Shenzhen in 2015.

Guan Ke has nearly 20 years of work experience in the media industry. He was the general manager of Shenzhen Jusiwei Advertising Co Ltd. He was also a former stockholder of Shenzhen One Media Investment Holdings Limited. He founded QinLin Technology in Shenzhen in 2015.

Co-founder and CEO of Nodeflux

Meidy Fitranto is an experienced business analyst and manager with an industrial engineering background. Between 2010 and 2014, he filled supply chain management roles at two oil & gas companies, PT Energi Mega Persada and Kangean Energy Indonesia Ltd. In 2016, he established Nodeflux, a computer vision startup.

Meidy Fitranto is an experienced business analyst and manager with an industrial engineering background. Between 2010 and 2014, he filled supply chain management roles at two oil & gas companies, PT Energi Mega Persada and Kangean Energy Indonesia Ltd. In 2016, he established Nodeflux, a computer vision startup.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Co-founder and CEO of Farmlink

A former computer programmer turned investment banker, Liu Yuan spent two years on Wall Street before returning to China, where he founded two startups, zhekouwang (a discount information site) and ximi.com (online store selling snacks to office workers). Both ventures folded up; Farmlink is his latest undertaking.

A former computer programmer turned investment banker, Liu Yuan spent two years on Wall Street before returning to China, where he founded two startups, zhekouwang (a discount information site) and ximi.com (online store selling snacks to office workers). Both ventures folded up; Farmlink is his latest undertaking.

Chairman, General Manager and Founder, of Zhongzheng Information

Zeng Binhuang is an executive director at Shenzhen Tianyuan Real Estate Consulting Co Ltd. He is also the board chairman of Shenzhen Baiwangda Industrial Company Limited and Seven Gomall (Shenzhen) Network Technology Co Ltd. He founded Zhongzheng Information in 2015 and currently serves as its chairman and general manager.

Zeng Binhuang is an executive director at Shenzhen Tianyuan Real Estate Consulting Co Ltd. He is also the board chairman of Shenzhen Baiwangda Industrial Company Limited and Seven Gomall (Shenzhen) Network Technology Co Ltd. He founded Zhongzheng Information in 2015 and currently serves as its chairman and general manager.

Co-founder and Board Chairman of Ziztour

With a computer engineering background, Zheng Junde was formerly general manager of Proxim Wireless Corporation in the US. Zheng has 30 years of working experience in the US, mainland China, Hong Kong and Taiwan, and is now chairman of Ziztour and co-chairman of China Fortune Investment.

With a computer engineering background, Zheng Junde was formerly general manager of Proxim Wireless Corporation in the US. Zheng has 30 years of working experience in the US, mainland China, Hong Kong and Taiwan, and is now chairman of Ziztour and co-chairman of China Fortune Investment.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Co-founder and COO of Tanijoy

Kukuh Budi Santoso graduated from Indonesia’s Universitas Brawijaya with a degree in Agriculture. While at university, he was an active in student organizations such as the IAAS (an international organization of agriculture students) and founded social enterprises. Prior to co-founding agri-investment platform Tanijoy, Kukuh ran Escape.id, a community-based tourism business.

Kukuh Budi Santoso graduated from Indonesia’s Universitas Brawijaya with a degree in Agriculture. While at university, he was an active in student organizations such as the IAAS (an international organization of agriculture students) and founded social enterprises. Prior to co-founding agri-investment platform Tanijoy, Kukuh ran Escape.id, a community-based tourism business.

Western Technology Investment (WTI)

Founded in 1980, Western Technology Investment invests in tech and life science startups. To date, it has invested over $6bn in 1,300 companies worldwide across diverse market segments.The Silicon Valley-based WTI currently has more than 500 companies in its global portfolio. Recent investments include US anti-aging medtech Elevio’s $15m funding in November 2020 and the $4.3m seed round in August 2020 for US fintech for teens Copper Banking.

Founded in 1980, Western Technology Investment invests in tech and life science startups. To date, it has invested over $6bn in 1,300 companies worldwide across diverse market segments.The Silicon Valley-based WTI currently has more than 500 companies in its global portfolio. Recent investments include US anti-aging medtech Elevio’s $15m funding in November 2020 and the $4.3m seed round in August 2020 for US fintech for teens Copper Banking.

Carlos Gallardo is an industrial engineer with an MBA from Stanford University. He spent most of his career at the pharmaceutical company Almirall and was promoted through the ranks rapidly holding multiple C-level roles. He became the MD for UK and Ireland for over five years and joined Almirall’s board of directors in 2014.In 2015, he founded CG Health Ventures, a VC firm investing in early-stage digital health companies worldwide. He’s also an active angel investor and advisor for startups developing frontier technologies in the healthcare sector.

Carlos Gallardo is an industrial engineer with an MBA from Stanford University. He spent most of his career at the pharmaceutical company Almirall and was promoted through the ranks rapidly holding multiple C-level roles. He became the MD for UK and Ireland for over five years and joined Almirall’s board of directors in 2014.In 2015, he founded CG Health Ventures, a VC firm investing in early-stage digital health companies worldwide. He’s also an active angel investor and advisor for startups developing frontier technologies in the healthcare sector.

Closed Loop Ventures is an early-stage investment fund focused on the development of the circular economy.

Closed Loop Ventures is an early-stage investment fund focused on the development of the circular economy.

Beijing-based Telescope Investments is a VC/PE firm, investing primarily in consumer, supply chain, education, and healthcare sectors. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group.

Beijing-based Telescope Investments is a VC/PE firm, investing primarily in consumer, supply chain, education, and healthcare sectors. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group.

A pioneer of China's IT industry, Zhu Min founded Cybernaut in 2005. To date, the firm has invested over $10bn in Chinese technology companies through 70 funds, in addition to another $10bn jointly managed with its partners outside China. Cybernaut also has about 20 startup incubators (Cybernaut Internet+) across China. Zhu studied at Stanford University in the 1980s and founded web conference solutions provider WebEx Communications Inc., which went public on NASDAQ in 2000, before being sold to Cisco for $3.2bn.

A pioneer of China's IT industry, Zhu Min founded Cybernaut in 2005. To date, the firm has invested over $10bn in Chinese technology companies through 70 funds, in addition to another $10bn jointly managed with its partners outside China. Cybernaut also has about 20 startup incubators (Cybernaut Internet+) across China. Zhu studied at Stanford University in the 1980s and founded web conference solutions provider WebEx Communications Inc., which went public on NASDAQ in 2000, before being sold to Cisco for $3.2bn.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

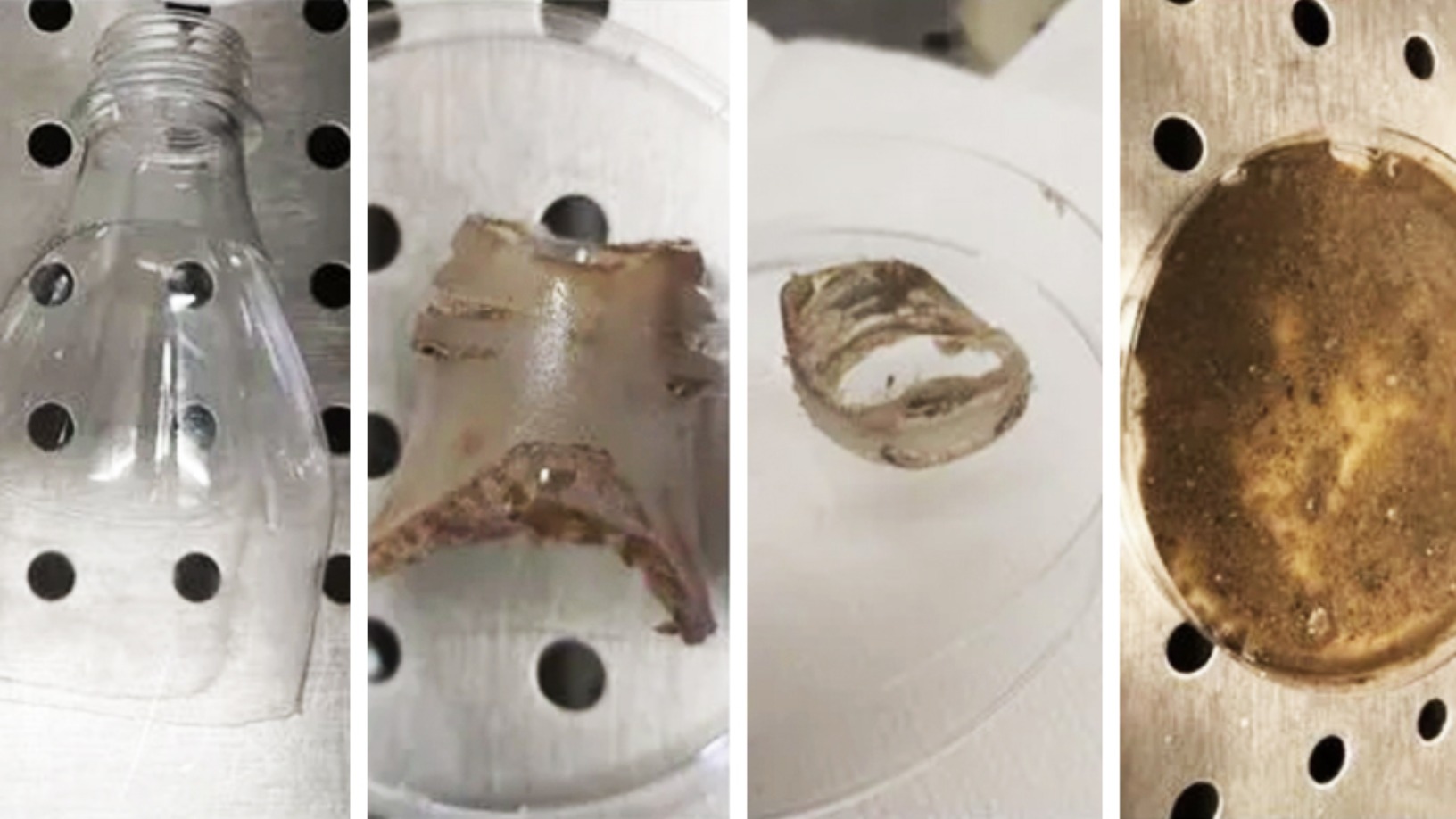

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.