Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Founded in Beijing in May 2015, Chunxiao Capital mainly invests in angel/seed to Series B funding rounds. With staff of 22, the VC has invested in over 50 companies by March 2019. Investments include technology innovations in fintech, big data and AI. Other investment sectors involve corporate services, Industry 4.0, B2B and SaaS for industrial enterprises and consumer-oriented businesses like retail, sports, maternal and infant care.In May 2019, the Asset Management Association of China revoked Chunxiao's private equity certification due to links with five online P2P lending firms facing default problems.

Founded in Beijing in May 2015, Chunxiao Capital mainly invests in angel/seed to Series B funding rounds. With staff of 22, the VC has invested in over 50 companies by March 2019. Investments include technology innovations in fintech, big data and AI. Other investment sectors involve corporate services, Industry 4.0, B2B and SaaS for industrial enterprises and consumer-oriented businesses like retail, sports, maternal and infant care.In May 2019, the Asset Management Association of China revoked Chunxiao's private equity certification due to links with five online P2P lending firms facing default problems.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

Co-founder and CEO of Ajaib

Anderson Sumarli is the CEO and co-founder of Ajaib, an online investment advisory startup. Anderson worked at JP Morgan and IBM before joining the Boston Consulting Group. He holds an MBA from the Stanford Graduate School of Business, as well as a bachelor’s in finance from Cornell University. He met Ajaib's two other co-founders during his time at these institutions.

Anderson Sumarli is the CEO and co-founder of Ajaib, an online investment advisory startup. Anderson worked at JP Morgan and IBM before joining the Boston Consulting Group. He holds an MBA from the Stanford Graduate School of Business, as well as a bachelor’s in finance from Cornell University. He met Ajaib's two other co-founders during his time at these institutions.

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded in 2016, BHCP is an equity investment fund under BOC International. The wholly-owned subsidiary of Bank of China offers investment banking and securities brokerage services. It mainly invests in companies at a later stage, usually after Series C round.

Founded in 2016, BHCP is an equity investment fund under BOC International. The wholly-owned subsidiary of Bank of China offers investment banking and securities brokerage services. It mainly invests in companies at a later stage, usually after Series C round.

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

Co-founder and CFO of Parclick

Giuseppe Fortuna is an Italian mechanical engineer and MBA graduate from the IESE Business School in Barcelona. With over 20 years of experience, Fortuna is currently Procurement Director at Tecnica Reunidas, an international general contractor engaged in the engineering, design and construction of oil and gas industrial facilities. Fontana is a former co-founder and ex-CFO of Parclick, a parking reservation app.

Giuseppe Fortuna is an Italian mechanical engineer and MBA graduate from the IESE Business School in Barcelona. With over 20 years of experience, Fortuna is currently Procurement Director at Tecnica Reunidas, an international general contractor engaged in the engineering, design and construction of oil and gas industrial facilities. Fontana is a former co-founder and ex-CFO of Parclick, a parking reservation app.

Founded in 2001, Oriza Holdings manages over RMB 51.4 billion in assets. The fund focuses on equity investment, debt financing and equity investment services. Through its equity investment platforms and venture capital funds, Oriza Holdings has backed 65 startups that have gone public.

Founded in 2001, Oriza Holdings manages over RMB 51.4 billion in assets. The fund focuses on equity investment, debt financing and equity investment services. Through its equity investment platforms and venture capital funds, Oriza Holdings has backed 65 startups that have gone public.

Based in Beijing, Xianghe Capital was founded in 2016. It runs a USD fund and an RMB fund. The founders of Xianghe Capital formerly led Baidu’s investment department. Xianghe Capital invests in the following areas: artificial intelligence, internet and traditional industries (e.g., online education, logistics, finance, medical care), B2B, culture, entertainment and enterprise services.

Based in Beijing, Xianghe Capital was founded in 2016. It runs a USD fund and an RMB fund. The founders of Xianghe Capital formerly led Baidu’s investment department. Xianghe Capital invests in the following areas: artificial intelligence, internet and traditional industries (e.g., online education, logistics, finance, medical care), B2B, culture, entertainment and enterprise services.

Founder and CEO of Yunjiazheng

A Jack of many trades, Xue Shuai majored in investment at East China Normal University, and pursued postgraduate studies in Chinese painting. He dabbled in selling wine and tourism, before joining Huawei as a project manager in 2001 (the year China entered the WTO), traveling across China and overseas (India, Thailand, Nepal, etc.) for work. Xue quit Huawei in 2008, spent a “gap year” mountaineering, before founding Yunjiazheng.

A Jack of many trades, Xue Shuai majored in investment at East China Normal University, and pursued postgraduate studies in Chinese painting. He dabbled in selling wine and tourism, before joining Huawei as a project manager in 2001 (the year China entered the WTO), traveling across China and overseas (India, Thailand, Nepal, etc.) for work. Xue quit Huawei in 2008, spent a “gap year” mountaineering, before founding Yunjiazheng.

Co-founder of Ajaib

During her time as a consultant at McKinsey from 2012 to 2014, Yada Piyajomkwan worked with governments from the Association of South East Asian Nations (ASEAN) on financial inclusion. The topic became her focus of study when she enrolled at the Stanford Graduate School of Business’ MBA program as a Fulbright scholar. After earning her MBA, she and fellow Stanford alumnus Anderson Sumarli established online investment advisory startup Ajaib.

During her time as a consultant at McKinsey from 2012 to 2014, Yada Piyajomkwan worked with governments from the Association of South East Asian Nations (ASEAN) on financial inclusion. The topic became her focus of study when she enrolled at the Stanford Graduate School of Business’ MBA program as a Fulbright scholar. After earning her MBA, she and fellow Stanford alumnus Anderson Sumarli established online investment advisory startup Ajaib.

Co-CEO and Co-founder of Notpla (formerly Skipping Rocks Lab)

Currently based in London, French national Pierre Yves Paslier completed a master’s in materials science and engineering from INSA in Lyon in 2010. In 2012, he went on to complete a master’s in industrial and product design at the Royal College of Art in London. He also studied innovation design engineering at Imperial College.After graduating in 2014, Paslier and university alumnus Rodrigo García González co-founded Skipping Rocks Lab that was pivoted as Notpla in 2019. Both are co-CEOs of the UK-based startup that develops compostable and edible packaging material made of seaweed and other plants.Before becoming an entrepreneur, Paslier worked as a packaging engineer for L’Oréal from 2010 to 2012. He has been invited to speak at TEDx conferences in Athens and Warwick to share his experience and innovative projects in packaging and product design. In 2020, he became an industrial advisory board member at Imperial College London Dyson School of Design Engineering. In 2019, he also became a fellow of the Royal Academy of Engineering Enterprise Hub.

Currently based in London, French national Pierre Yves Paslier completed a master’s in materials science and engineering from INSA in Lyon in 2010. In 2012, he went on to complete a master’s in industrial and product design at the Royal College of Art in London. He also studied innovation design engineering at Imperial College.After graduating in 2014, Paslier and university alumnus Rodrigo García González co-founded Skipping Rocks Lab that was pivoted as Notpla in 2019. Both are co-CEOs of the UK-based startup that develops compostable and edible packaging material made of seaweed and other plants.Before becoming an entrepreneur, Paslier worked as a packaging engineer for L’Oréal from 2010 to 2012. He has been invited to speak at TEDx conferences in Athens and Warwick to share his experience and innovative projects in packaging and product design. In 2020, he became an industrial advisory board member at Imperial College London Dyson School of Design Engineering. In 2019, he also became a fellow of the Royal Academy of Engineering Enterprise Hub.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

CNBB Venture Partners is a Dutch fund with 30+ years' experience in the SaaS cloud industry – the company’s main investment focus. Through the VC fund, CNBB invests in funding rounds from €500,000 to €5m, usually provided to companies with a minimum of €1m annual recurring revenue.Through the private equity vehicle, CNBB identifies and acquires Europe-based SaaS companies active in markets with consistent growth, profitability and consolidation. CNBB provides equity investment from €3m to €10m.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

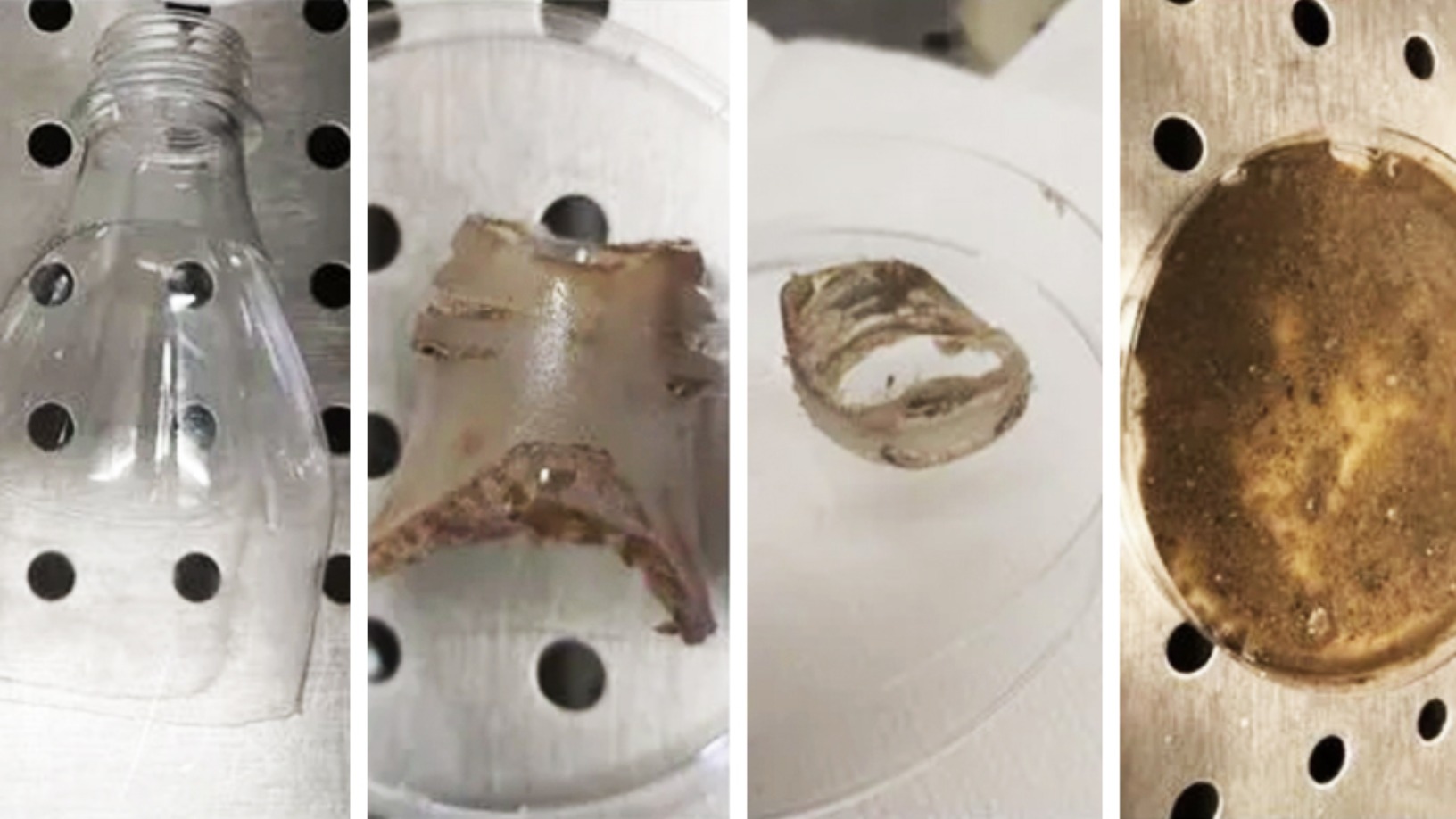

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.