Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

Phitrust Partenaires is a France-based investment fund focused on social businesses in Europe and Asia.In Europe, the company acts as a VC firm dedicated to impact investing. Its investment vehicle contributes €150,000 to €800,000 to support projects that address social needs. Phitrust Partenaires also works in partnership with prominent European social funds.

Phitrust Partenaires is a France-based investment fund focused on social businesses in Europe and Asia.In Europe, the company acts as a VC firm dedicated to impact investing. Its investment vehicle contributes €150,000 to €800,000 to support projects that address social needs. Phitrust Partenaires also works in partnership with prominent European social funds.

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

Skystar Capital is a fund that invests in technology startups in the Asia Pacific region, particularly Indonesia. It is backed by Kompas Gramedia, Indonesia's largest media conglomerate. Skystar Capital is a separate and independent investment arm from Skystar Ventures

Skystar Capital is a fund that invests in technology startups in the Asia Pacific region, particularly Indonesia. It is backed by Kompas Gramedia, Indonesia's largest media conglomerate. Skystar Capital is a separate and independent investment arm from Skystar Ventures

SyndicateRoom is a Cambridge-based VC authorized and regulated by the Financial Conduct Authority (FCA), founded in 2013 by Gonçalo de Vasconcelos and Tom Britton, after studying together at the University of Cambridge. The company was initially started as an equity crowdfunding platform allowing its members to co-invest with experienced angel investors and high-net-worth individuals. Each investor is offered the same investment opportunities as lead investors, with the same share class and price per share.In July 2019, Gonçalo de Vasconcelos stepped down as CEO and was replaced by Graham Schwikkard. Soon afterward, the company announced a pivot of its investment model, becoming a VC fund that no longer offers individual crowdfunding investment opportunities. In the same year, SyndicateRoom launched Access EIS, the first data-driven Enterprise Investment Scheme fund.

SyndicateRoom is a Cambridge-based VC authorized and regulated by the Financial Conduct Authority (FCA), founded in 2013 by Gonçalo de Vasconcelos and Tom Britton, after studying together at the University of Cambridge. The company was initially started as an equity crowdfunding platform allowing its members to co-invest with experienced angel investors and high-net-worth individuals. Each investor is offered the same investment opportunities as lead investors, with the same share class and price per share.In July 2019, Gonçalo de Vasconcelos stepped down as CEO and was replaced by Graham Schwikkard. Soon afterward, the company announced a pivot of its investment model, becoming a VC fund that no longer offers individual crowdfunding investment opportunities. In the same year, SyndicateRoom launched Access EIS, the first data-driven Enterprise Investment Scheme fund.

CFO and Co-founder of Solatom

Raul Villalba Van Dijk is currently an energy management consultant at KPMG Madrid, having spent time in the consulting industry in Spain, South Africa and the UK. Since 2016, he has been CFO and a member of the founding team of Solatom, a startup developing solar concentrators for industrial applications. He graduated with a masters in science specializing in thermal energy systems for solar plants. He also holds an MBA from the London Business School.

Raul Villalba Van Dijk is currently an energy management consultant at KPMG Madrid, having spent time in the consulting industry in Spain, South Africa and the UK. Since 2016, he has been CFO and a member of the founding team of Solatom, a startup developing solar concentrators for industrial applications. He graduated with a masters in science specializing in thermal energy systems for solar plants. He also holds an MBA from the London Business School.

Co-founder and CEO of Muslimarket

Pramadita Tasmaya, aka Riel, has a master’s in International Business from Australia’s Monash University and also an MBA from Nottingham University Business School, United Kingdom. He has worked at Citibank, HSBC and Asuransi Syariah Mubarakah before becoming the managing director of oil company PT Ranji Karya Sakti in 2012.In 2013, he founded Eempat Kapital, using the boutique investment and consulting company as a springboard for other ventures including Muslimarket, Rifat Drive Labs, Kurirmart and social media consulting firm Sharkcode Indonesia.

Pramadita Tasmaya, aka Riel, has a master’s in International Business from Australia’s Monash University and also an MBA from Nottingham University Business School, United Kingdom. He has worked at Citibank, HSBC and Asuransi Syariah Mubarakah before becoming the managing director of oil company PT Ranji Karya Sakti in 2012.In 2013, he founded Eempat Kapital, using the boutique investment and consulting company as a springboard for other ventures including Muslimarket, Rifat Drive Labs, Kurirmart and social media consulting firm Sharkcode Indonesia.

Co-founder of Ximalaya

Before co-founding Ximalaya with Yu Jianjun, Chen Xiaoyu worked as an investment director at one of Thailand's largest conglomerates, Charoen Pokphand Group, in its China office. There, she supervised the Group’s investments in internet startups. With seed funding from the Group in 2009, Chen and Yu Jianjun founded their first startup, Na Li Shi Jie, building online virtual city maps. Though the business failed after two years, they utilised the rich experience they gained and founded the much more successful Ximalaya in 2012.

Before co-founding Ximalaya with Yu Jianjun, Chen Xiaoyu worked as an investment director at one of Thailand's largest conglomerates, Charoen Pokphand Group, in its China office. There, she supervised the Group’s investments in internet startups. With seed funding from the Group in 2009, Chen and Yu Jianjun founded their first startup, Na Li Shi Jie, building online virtual city maps. Though the business failed after two years, they utilised the rich experience they gained and founded the much more successful Ximalaya in 2012.

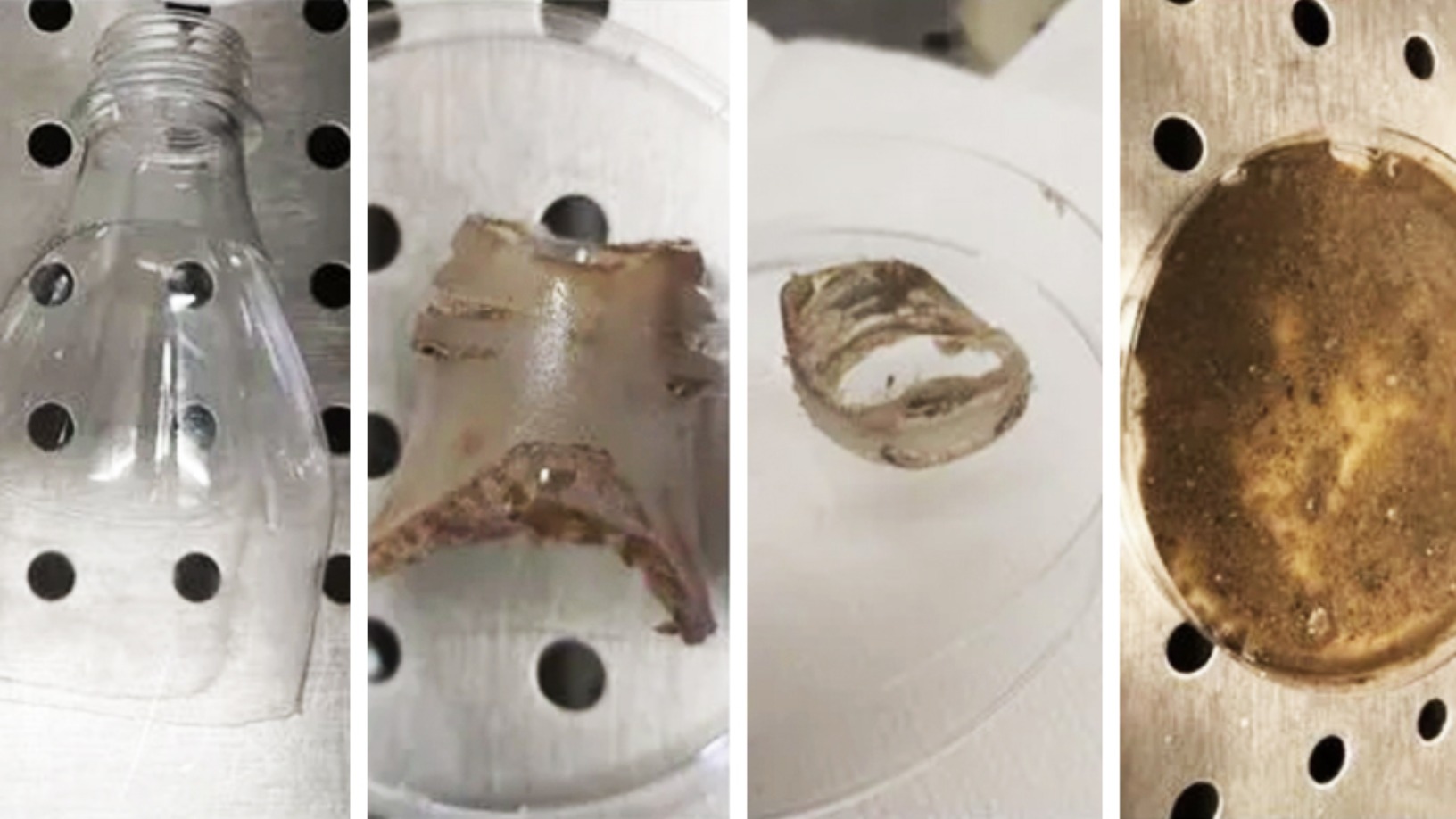

Co-founder, COO of Cocuus

Daniel Rico Aldaz is the Spanish COO and co-founder at 3D printing food tech and cell-based meat startup Cocuus, where he has worked since he co-founded it in 2017. Before Cocuus, Rico founded an industrial design company, Rico Ingenio, which was established in 2009, where he continues to be a founding partner.His last full-time position before Cocuus was at systems automation company Kaizen for less than a year, where he headed up the technical office. Prior to that, Rico briefly led the computer-to-plate (CTP) and quality control departments at printers Estellaprint. For 15 years, until 2016, Rico was founder at his own industrial design company El Seis Y El Cuatro.Rico’s varied career has also seen him as head designer of children's parks and gyms at Mader Play, as an IT teacher at a worker’s foundation and as both a graphic and an artistic designer in two communication agencies and a lighting company. During his career, Rico has had experience with design and manufacturing in 3D processes, which he used to innovate in Cocuus. Rico did not attend university. He studied music and design at high school.

Daniel Rico Aldaz is the Spanish COO and co-founder at 3D printing food tech and cell-based meat startup Cocuus, where he has worked since he co-founded it in 2017. Before Cocuus, Rico founded an industrial design company, Rico Ingenio, which was established in 2009, where he continues to be a founding partner.His last full-time position before Cocuus was at systems automation company Kaizen for less than a year, where he headed up the technical office. Prior to that, Rico briefly led the computer-to-plate (CTP) and quality control departments at printers Estellaprint. For 15 years, until 2016, Rico was founder at his own industrial design company El Seis Y El Cuatro.Rico’s varied career has also seen him as head designer of children's parks and gyms at Mader Play, as an IT teacher at a worker’s foundation and as both a graphic and an artistic designer in two communication agencies and a lighting company. During his career, Rico has had experience with design and manufacturing in 3D processes, which he used to innovate in Cocuus. Rico did not attend university. He studied music and design at high school.

As an early investment fund, Jifu Venture Capital invested in Guangfa Securities, Liaoning Chengda and other companies. It has realized returns of more than 2,000% for its shareholders. Jifu Venture Capital was authorized by the Shenzhen city government in September 2004.

As an early investment fund, Jifu Venture Capital invested in Guangfa Securities, Liaoning Chengda and other companies. It has realized returns of more than 2,000% for its shareholders. Jifu Venture Capital was authorized by the Shenzhen city government in September 2004.

Los Riscos de Pedrique is family-owned investment fund and business consultancy based in Madrid, Spain. Established in 2014, the company has assets valued at €35 million and is run by Maria del Valle de la Riva.

Los Riscos de Pedrique is family-owned investment fund and business consultancy based in Madrid, Spain. Established in 2014, the company has assets valued at €35 million and is run by Maria del Valle de la Riva.

Wu Shichun (b. 1977) founded Plum Ventures in 2014, an internet-focused angel fund managing three RMB funds. Wu began investing in 2008 after he quit Kuxun, the leading online travel media he founded in 2006. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Wu Shichun (b. 1977) founded Plum Ventures in 2014, an internet-focused angel fund managing three RMB funds. Wu began investing in 2008 after he quit Kuxun, the leading online travel media he founded in 2006. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded in 2017, Timestamp Capital is a blockchain investment fund. With a focus on research, investment and consulting services in the blockchain field, Timestamp Capital provides all-in-one assistance to blockchain startups by helping them optimize their business models and establish a compliance framework as well as by accelerating the construction of a global community.

Founded in 2017, Timestamp Capital is a blockchain investment fund. With a focus on research, investment and consulting services in the blockchain field, Timestamp Capital provides all-in-one assistance to blockchain startups by helping them optimize their business models and establish a compliance framework as well as by accelerating the construction of a global community.

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

Italy's first impact investment fund is focused mainly on assisting Italian startups. Its investment size ranges from €200,000 to €6m. Oltre Venture was founded in 2006 as Oltre Venture I by Luciano Balbo and Lorenzo Allevi, both pioneers in Europe's impact investing ecosystem and each with extensive experience in investment banking, corporate finance and VC firms.In 2016, the company launched a second investment vehicle (Oltre Venture II) which currently has a portfolio of more than 22 startups.

Italy's first impact investment fund is focused mainly on assisting Italian startups. Its investment size ranges from €200,000 to €6m. Oltre Venture was founded in 2006 as Oltre Venture I by Luciano Balbo and Lorenzo Allevi, both pioneers in Europe's impact investing ecosystem and each with extensive experience in investment banking, corporate finance and VC firms.In 2016, the company launched a second investment vehicle (Oltre Venture II) which currently has a portfolio of more than 22 startups.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.