Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Co-founder of Waterdrop and general manager of Shuidi Chou of Waterdrop (Shuidi)

Xu Hanhan graduated from the Guanghua School of Management, Peking University, in 2008. She then worked at the VC, China Renaissance Capital Investment, and later became personal assistant to ByteDance CEO and founder Zhang Yiming during the startup's early years. She co-founded Waterdrop in 2016 and is now in charge of Waterdrop Crowdfunding. She also started another of Waterdrop's platforms, Waterdrop Public Wellness, which helps charitable organizations fundraise as well as report on the usage of the funds received.

Xu Hanhan graduated from the Guanghua School of Management, Peking University, in 2008. She then worked at the VC, China Renaissance Capital Investment, and later became personal assistant to ByteDance CEO and founder Zhang Yiming during the startup's early years. She co-founded Waterdrop in 2016 and is now in charge of Waterdrop Crowdfunding. She also started another of Waterdrop's platforms, Waterdrop Public Wellness, which helps charitable organizations fundraise as well as report on the usage of the funds received.

A spinoff from Chinese investment bank China International Capital Corp, CDH has its roots in private equity. It started in 2002, raising its first fund of US$102 million. As of end-2015, it had over US$15 billion in assets under management, spanning private equity, public equities, real estate and more. It has invested in more than 150 companies, including WH Group, Belle International, Mengniu Dairy, Qihoo 360 and Luye Pharma; and has offices in Beijing, Hong Kong, Shanghai, Shenzhen, Singapore and Jakarta.

A spinoff from Chinese investment bank China International Capital Corp, CDH has its roots in private equity. It started in 2002, raising its first fund of US$102 million. As of end-2015, it had over US$15 billion in assets under management, spanning private equity, public equities, real estate and more. It has invested in more than 150 companies, including WH Group, Belle International, Mengniu Dairy, Qihoo 360 and Luye Pharma; and has offices in Beijing, Hong Kong, Shanghai, Shenzhen, Singapore and Jakarta.

IDC Ventures is the VC arm of Grupo IDC, a Latin American investment bank. The fund was created in 2019 by corporate executives, entrepreneurs and investors from Latin America, focused on pre-Series A to Series B rounds. Headquartered in Madrid with offices in Copenhagen and Guatemala, the company acts as an international VC working with tech companies to accelerate expansion across LatAm markets. Sectors of interest include fintech, on-demand transportation, digital tools for small and large retailers, and commercialization platforms for robotics.

IDC Ventures is the VC arm of Grupo IDC, a Latin American investment bank. The fund was created in 2019 by corporate executives, entrepreneurs and investors from Latin America, focused on pre-Series A to Series B rounds. Headquartered in Madrid with offices in Copenhagen and Guatemala, the company acts as an international VC working with tech companies to accelerate expansion across LatAm markets. Sectors of interest include fintech, on-demand transportation, digital tools for small and large retailers, and commercialization platforms for robotics.

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

Founded in 2003, Bezos Expeditions is a family investment office based in Mercer Island in the US. The firm was originally set up to manage the personal investments of Amazon founder, Jeff Bezos.The Bezos fund owns the Washington Post, Blue Origin space projects and the Bezos family foundation. The fund has also backed early tech startups like Twitter, Airbnb and Uber. Today, Bezos Expeditions also supports non-profit projects. In 2013, it helped to recover parts of two engines from the Atlantic Ocean that were later identified as belonging to Apollo 11, the first space mission that successfully landed humans on the moon in 1969. The crew of the ship Seabed Worker spent three weeks at sea pulling up pieces of the Apollo F1 engines.

Established in 2011, Shilling Capital Partners is a Portuguese angel investment fund and one of the three subsidiaries of Mogope, a Portuguese investment manager, whose partners are also co-founders of Shilling. To date, the company has invested in 18 startups, both tech and bricks-and-mortar, and has managed three exits, including BestTables that was acquired by TripAdvisor. It typically invests between €250,000 and €1m in seed and Series A rounds and ensures liquidity until the next funding round, or when the startup becomes capable of funding its own growth. Recent investments include petcare marketplace Barkyn, healthy meal service delivery app EatTasty and blockchain-based online betting application BetProtocol.

Established in 2011, Shilling Capital Partners is a Portuguese angel investment fund and one of the three subsidiaries of Mogope, a Portuguese investment manager, whose partners are also co-founders of Shilling. To date, the company has invested in 18 startups, both tech and bricks-and-mortar, and has managed three exits, including BestTables that was acquired by TripAdvisor. It typically invests between €250,000 and €1m in seed and Series A rounds and ensures liquidity until the next funding round, or when the startup becomes capable of funding its own growth. Recent investments include petcare marketplace Barkyn, healthy meal service delivery app EatTasty and blockchain-based online betting application BetProtocol.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

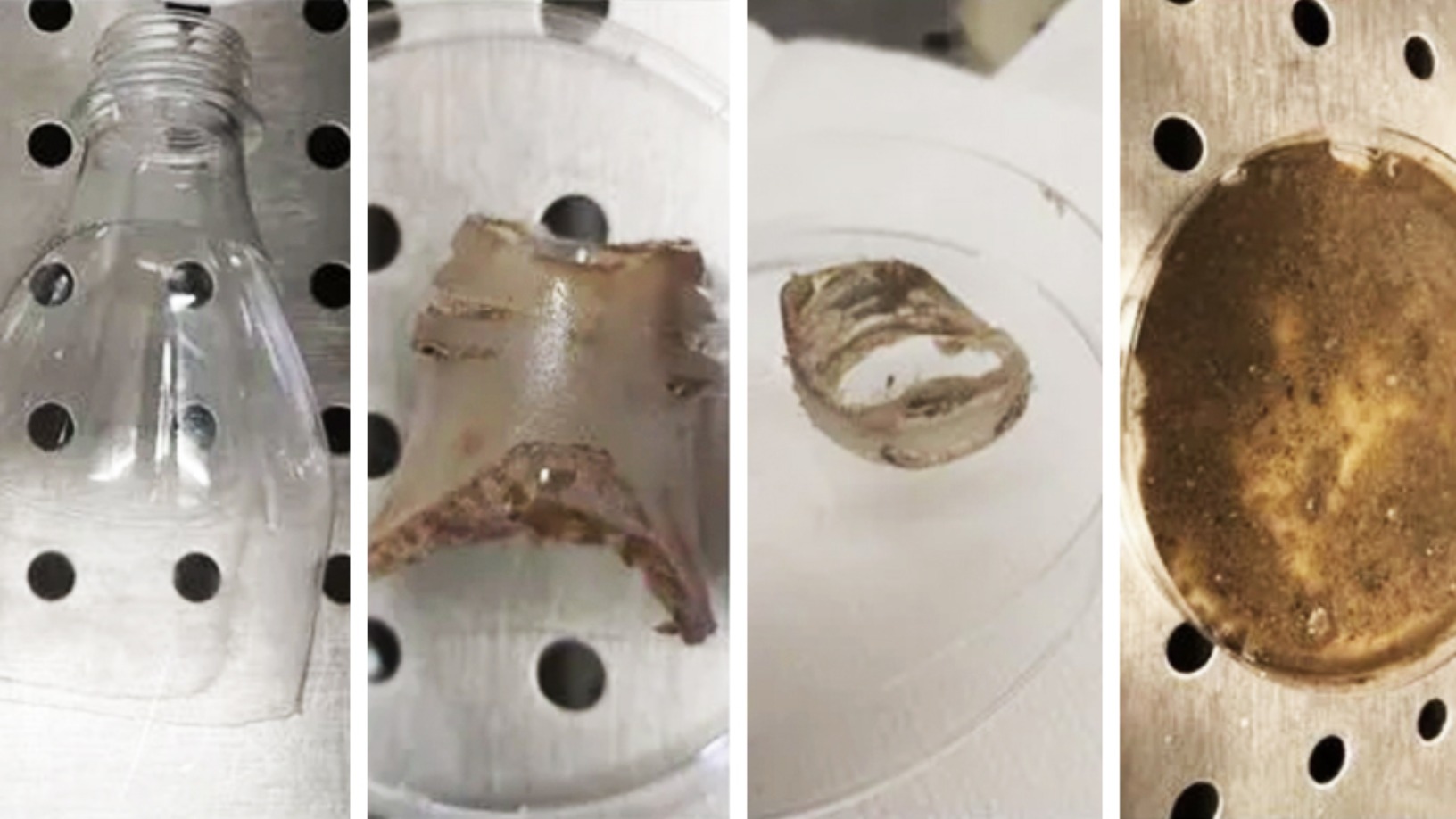

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.