Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

CEO and co-founder of Vence

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

Former US investment banker Frank Wooten graduated in accounting and finance at the College of William and Mary in Virginia. He also went on a study program in Madrid at Saint Louis University in 2002.After his graduation in 2003, he worked as managing director of CJS Securities in New York, a company that follows 100 underpriced stocks. In July 2008, he founded Point Blank Capital and became the managing partner of the financial services company based in Miami. In January 2016, he became the CFO and COO for Sao Paulo-based startup Squad, a platform that connects self-employed workers with companies.Wooten also met up with Jasper Holdsworth, a cattle rancher from New Zealand who was exploring the use of GPS tracking sensors to create a virtual fencing system for livestock management. In July 2016, Wooten became the CEO and co-founder of Vence Corp. The tech company designs and makes AI-enabled tracking devices like animal collars to help livestock owners reduce animal husbandry costs and improve the productivity of their pastureland.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Launched in 2014, Convergence Ventures (formerly Convergence Accel) is a venture fund focused on investing in Indonesia. The fund is led by Donald Wihardja and ex-Rocket Internet man Adrian Li. Li is also the co-founder of Qraved, one of Indonesia's leading food social networking startup.

Launched in 2014, Convergence Ventures (formerly Convergence Accel) is a venture fund focused on investing in Indonesia. The fund is led by Donald Wihardja and ex-Rocket Internet man Adrian Li. Li is also the co-founder of Qraved, one of Indonesia's leading food social networking startup.

Established in San Francisco in 1998, global VC firm e.ventures now has offices and teams in the US, Brazil, Germany, China and Japan. The company invests from seed stage to later stages in sums ranging from US$500,000 to US$30m. It has invested in over 275 companies to date, as lead investor in 70, and has managed 42 exits, including Groupon and Farfetch. Recent investments include cloud-based contract management company Icertis's US$115m Series E round and workforce app Staffbase's Series C round. The VC has six investment funds, totaling US$1.1bn, including a US$125m European-dedicated fund established in June 2019.

Established in San Francisco in 1998, global VC firm e.ventures now has offices and teams in the US, Brazil, Germany, China and Japan. The company invests from seed stage to later stages in sums ranging from US$500,000 to US$30m. It has invested in over 275 companies to date, as lead investor in 70, and has managed 42 exits, including Groupon and Farfetch. Recent investments include cloud-based contract management company Icertis's US$115m Series E round and workforce app Staffbase's Series C round. The VC has six investment funds, totaling US$1.1bn, including a US$125m European-dedicated fund established in June 2019.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Bynd Venture Capital (formerly Busy Angels)

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Bynd Venture Capital is a Portuguese seed/early-stage VC firm that changed its name from Busy Angels in 2019 and opened a new €10M investment fund, with Didimo its first recipient. Busy Angels' more than 30-strong portfolio has passed under Bynd's stewardship. Bynd is led by former senior corporate executives and counts among its shareholders former Cabinet minister Luís Mira Amaral and corporate entities Danone, P&G and Pepsi. Busy Angels was founded in 2010 in Lisbon and concentrates on seed and early-stage B2B and B2C startups doing business in Portugal and/or Spain. DefinedCrowd and Zaask! are among its best known portfolio companies.

Multimedia and telecoms postgrad Carlos Blanco Vázquez is a serial entrepreneur, business angel and VC managing partner. He had worked in IT until 1996 when he founded OACE Servicios Informaticos SL. A sports fanatic, he also became a football talent scout (u15-u17) for RCD Espanyol de Barcelona S.A.D.His most profitable venture is his social gaming platform Akamon Entertainment that was sold for € 23.7 million to Imperus in 2015. He co-founded Nuclio Venture Builder to manage all his business interests, while VC firm Encomenda Smart Capital manages an investment fund of €20 million.

Multimedia and telecoms postgrad Carlos Blanco Vázquez is a serial entrepreneur, business angel and VC managing partner. He had worked in IT until 1996 when he founded OACE Servicios Informaticos SL. A sports fanatic, he also became a football talent scout (u15-u17) for RCD Espanyol de Barcelona S.A.D.His most profitable venture is his social gaming platform Akamon Entertainment that was sold for € 23.7 million to Imperus in 2015. He co-founded Nuclio Venture Builder to manage all his business interests, while VC firm Encomenda Smart Capital manages an investment fund of €20 million.

Founded in 2000 by Hans-Jurgen Schmitz and Mark Tluszcz, Mangrove Capital Partners is a Luxembourg-based fund. It has, as an early investor, backed four unicorns, namely, Skype, Wix, WalkMe and LetGo, as well as a multitude of other successful tech startups. It participates at all stages of investment and has made over 120 investments, including as lead investor in 40 of these. It has seen 15 exits to date, including Skype and, most recently, has invested in the Seed round of Attentive.us and in the Series B of K Health and Series A of Flo Health.

Founded in 2000 by Hans-Jurgen Schmitz and Mark Tluszcz, Mangrove Capital Partners is a Luxembourg-based fund. It has, as an early investor, backed four unicorns, namely, Skype, Wix, WalkMe and LetGo, as well as a multitude of other successful tech startups. It participates at all stages of investment and has made over 120 investments, including as lead investor in 40 of these. It has seen 15 exits to date, including Skype and, most recently, has invested in the Seed round of Attentive.us and in the Series B of K Health and Series A of Flo Health.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

Itnig was formed in Barcelona in 2011 as an independent and private initiative of a serial-entrepreneurs and tech-enthusiast group.Headquartered in 22@, the tech district of Barcelona, the company offers startup mentoring and services including accounting, business and software development, legal and human resources. Itnig acts as a startup builder, counting on a network of more than 160 people and over 70 investors. The company has also created its own fund to invest a maximum of €100,000 per company without following up on the investment.To date, Itnig has contributed to forming six startups.

Itnig was formed in Barcelona in 2011 as an independent and private initiative of a serial-entrepreneurs and tech-enthusiast group.Headquartered in 22@, the tech district of Barcelona, the company offers startup mentoring and services including accounting, business and software development, legal and human resources. Itnig acts as a startup builder, counting on a network of more than 160 people and over 70 investors. The company has also created its own fund to invest a maximum of €100,000 per company without following up on the investment.To date, Itnig has contributed to forming six startups.

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

Chairman and co-founder of Everimpact

Jan Mattsson is a former senior UN official and the head of an ESG management consultancy. He is also chairman and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more reliable carbon emissions data to public bodies, municipalities, and businesses. Mattsson has four decades of experience in development, humanitarian and peacekeeping operations, and has led operations and programs in Asia, Africa, Latin America and Central Asia. He spent nearly 14 years as UN Under-Secretary-General and Executive Director of the United Nations Office for Project Services (UNOPS), the operational arm of the UN. Over his professional career, Mattsson has also engaged with international organizations such as the World Bank and the Green Climate Fund. Outside of Everimpact, Mattsson is founder and CEO of M-Trust Leadership AB, an independent ESG and sustainable development management consultancy. He chairs the board of the Museum for the United Nations, and 4Life Solutions (formerly known as SolarSack), a company offering a solar-powered product that can provide safe drinking water to low-income and vulnerable communities. Mattsson also serves on the boards of The Management Lab, which aims to help investors analyze the social and environmental impact of their investments and philanthropy, as well as the World Benchmarking Alliance, an Amsterdam-based non-profit organization that aims to measure and incentivise businesses’ contributions towards the UN SDGs.

Jan Mattsson is a former senior UN official and the head of an ESG management consultancy. He is also chairman and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more reliable carbon emissions data to public bodies, municipalities, and businesses. Mattsson has four decades of experience in development, humanitarian and peacekeeping operations, and has led operations and programs in Asia, Africa, Latin America and Central Asia. He spent nearly 14 years as UN Under-Secretary-General and Executive Director of the United Nations Office for Project Services (UNOPS), the operational arm of the UN. Over his professional career, Mattsson has also engaged with international organizations such as the World Bank and the Green Climate Fund. Outside of Everimpact, Mattsson is founder and CEO of M-Trust Leadership AB, an independent ESG and sustainable development management consultancy. He chairs the board of the Museum for the United Nations, and 4Life Solutions (formerly known as SolarSack), a company offering a solar-powered product that can provide safe drinking water to low-income and vulnerable communities. Mattsson also serves on the boards of The Management Lab, which aims to help investors analyze the social and environmental impact of their investments and philanthropy, as well as the World Benchmarking Alliance, an Amsterdam-based non-profit organization that aims to measure and incentivise businesses’ contributions towards the UN SDGs.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

Founded in 2008, Legend Star is an early-stage venture fund with about RMB 1.5 billion under management.

Founded in 2008, Legend Star is an early-stage venture fund with about RMB 1.5 billion under management.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

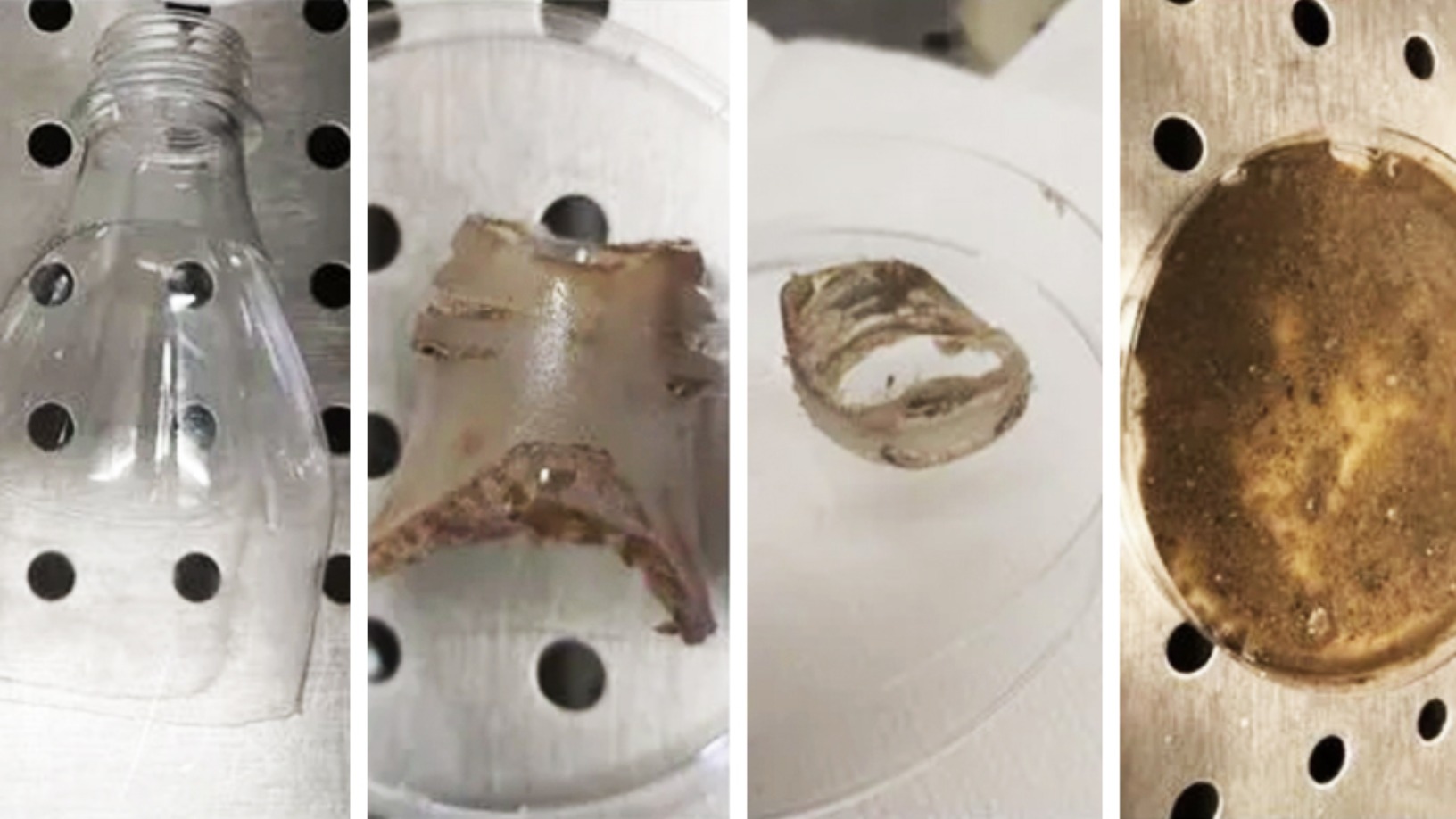

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.