Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Korea Investment Partners is a venture capital fund established in 1986. It primarily invests in companies from Korea, China and the United States. It has invested a total of more than US$1.7 billion in over 500 companies across various sectors, from social media to medtech.

Triditive's AMCELL is the first automated additive manufacturing technology to enable round-the-clock mass production, empowering SME manufacturers to access Industry 4.0.

Triditive's AMCELL is the first automated additive manufacturing technology to enable round-the-clock mass production, empowering SME manufacturers to access Industry 4.0.

Founded by a group of Tsinghua alumni in 2013, Innoangel Fund has invested in 200+ startups. With over RMB 2 billion under management, Innoangel Fund focuses on artificial intelligence and robotics, Internet of Things and the cultural creative industry.

Founded by a group of Tsinghua alumni in 2013, Innoangel Fund has invested in 200+ startups. With over RMB 2 billion under management, Innoangel Fund focuses on artificial intelligence and robotics, Internet of Things and the cultural creative industry.

A partner at Chinese VC firm Ceyuan Ventures, Richard Chen holds a bachelor’s degree in Industrial Management from Carnegie Mellon University in the United States. He is currently CEO of Yifei Investment Holding. Chen is also the founding partner of Huangpu River Capital.

A partner at Chinese VC firm Ceyuan Ventures, Richard Chen holds a bachelor’s degree in Industrial Management from Carnegie Mellon University in the United States. He is currently CEO of Yifei Investment Holding. Chen is also the founding partner of Huangpu River Capital.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

Fenghou Capital is a venture capital firm focusing on early-stage investment in entertainment, industrial internet and fintech. It has invested in more than 80 companies since its inception in 2013 and has about RMB 500 million in assets under management.

Fenghou Capital is a venture capital firm focusing on early-stage investment in entertainment, industrial internet and fintech. It has invested in more than 80 companies since its inception in 2013 and has about RMB 500 million in assets under management.

RiverHill Fund is a VC fund launched by one of Alibaba's founders Simon Xie (Xie Shihuang) in Hangzhou in 2014. With Alibaba as its biggest limited partner, RiverHill primarily invests in angel/seed and Series A funding rounds in sectors like AI, big data, O2O retail, entertainment and online education.

RiverHill Fund is a VC fund launched by one of Alibaba's founders Simon Xie (Xie Shihuang) in Hangzhou in 2014. With Alibaba as its biggest limited partner, RiverHill primarily invests in angel/seed and Series A funding rounds in sectors like AI, big data, O2O retail, entertainment and online education.

Softbank-Indosat Fund (SB-ISAT Fund)

A joint US$50 million venture capital fund by SoftBank and Indonesian telecommunications company Indosat. The fund, founded in 2014, invests in companies based in Indonesia.

A joint US$50 million venture capital fund by SoftBank and Indonesian telecommunications company Indosat. The fund, founded in 2014, invests in companies based in Indonesia.

Civeta is a Madrid-based VC fund founded in 2013 by a small group of Spanish angel investors. It has backed 39 startups in blockchain, education, marketplace and platform.In 2014, the company experienced intense investment activity and was ranked among the most active VC firms in Spain. Since 2016, it has hosted the Civeta Fintech Meetings in Madrid, to which key industry players are invited to discuss and analyze fintech trends and business opportunities. Civeta also offers consultancy services on business model development, branding, UX, social media, data analysis, and legal support.

Civeta is a Madrid-based VC fund founded in 2013 by a small group of Spanish angel investors. It has backed 39 startups in blockchain, education, marketplace and platform.In 2014, the company experienced intense investment activity and was ranked among the most active VC firms in Spain. Since 2016, it has hosted the Civeta Fintech Meetings in Madrid, to which key industry players are invited to discuss and analyze fintech trends and business opportunities. Civeta also offers consultancy services on business model development, branding, UX, social media, data analysis, and legal support.

Payfazz offers Indonesia's rural unbanked convenient access to an expanding range of app-based personal financial services, from bill payments to loan applications and fund transfers.

Payfazz offers Indonesia's rural unbanked convenient access to an expanding range of app-based personal financial services, from bill payments to loan applications and fund transfers.

Bareksa’s low-cost trading platform targets Indonesia’s masses, offering an expanding range of innovative investment products, supported by strong distribution and financial services partners.

Bareksa’s low-cost trading platform targets Indonesia’s masses, offering an expanding range of innovative investment products, supported by strong distribution and financial services partners.

Qinghan Fund was founded in 2017 by Crystal Stream, New Hope Group and Chinese celebrity Lu Han. Its largest shareholder is Wang Mengqiu, former vice president of Baidu. Qinghan Fund invests primarily in teams (e.g., small groups of people running a WeChat Official Account) that create professionally generated content, media and platforms which cater to the next generation's lifestyle and consumption upgrade needs.

Qinghan Fund was founded in 2017 by Crystal Stream, New Hope Group and Chinese celebrity Lu Han. Its largest shareholder is Wang Mengqiu, former vice president of Baidu. Qinghan Fund invests primarily in teams (e.g., small groups of people running a WeChat Official Account) that create professionally generated content, media and platforms which cater to the next generation's lifestyle and consumption upgrade needs.

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

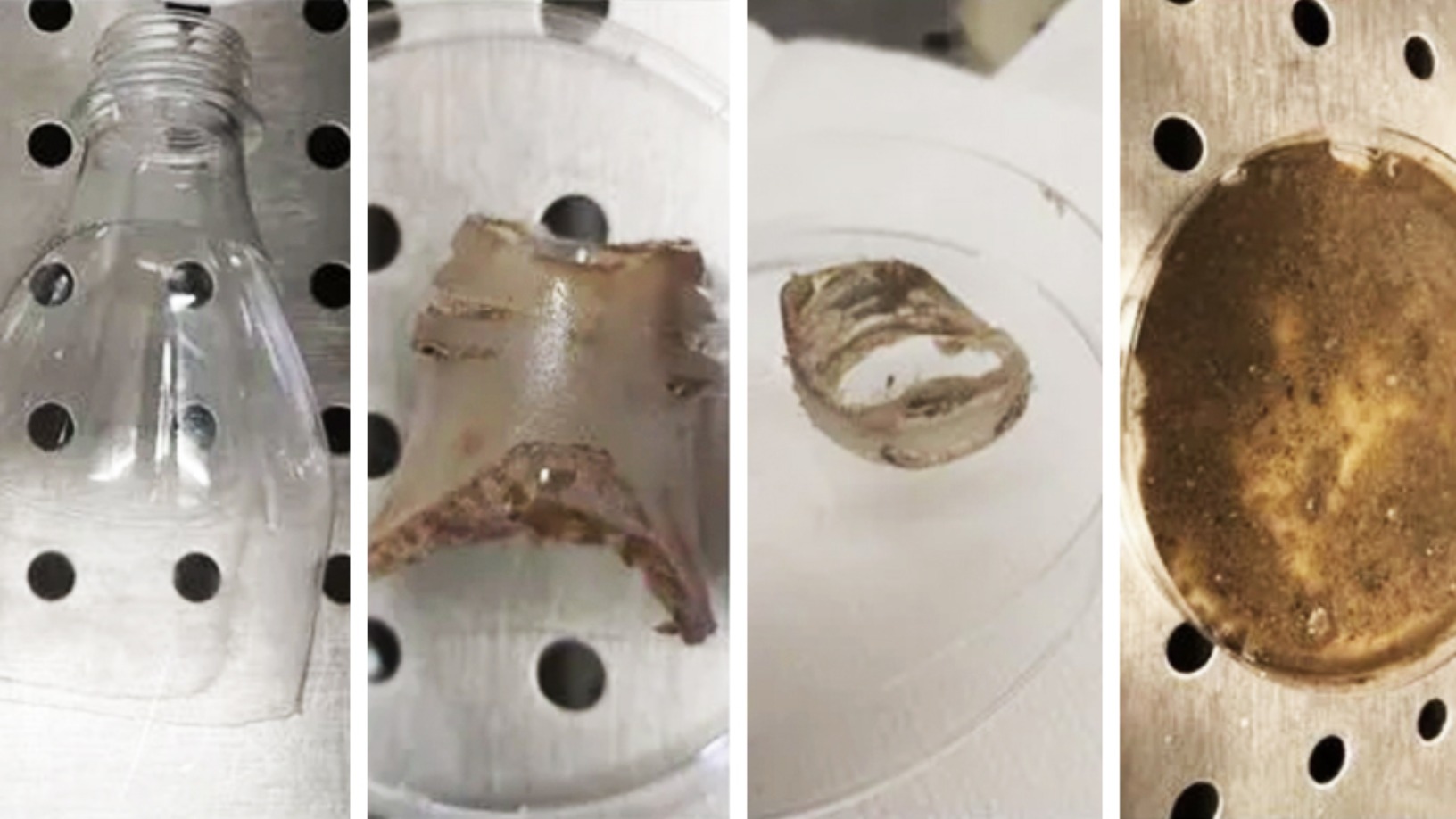

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.