Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

Based in Singapore, GreenMeadows Accelerator (GMA) is a VC firm that provides incubator and accelerator services. GMA mainly invests in advanced manufacturing, engineering and clean/green-tech sectors. Enterprise Singapore Startup Equity SG is its co-investment partner.

Based in Singapore, GreenMeadows Accelerator (GMA) is a VC firm that provides incubator and accelerator services. GMA mainly invests in advanced manufacturing, engineering and clean/green-tech sectors. Enterprise Singapore Startup Equity SG is its co-investment partner.

Global technology investment firm Atomico was set up in 2006 by Skype co-founder Niklas Zennström. Since then, it has made over 140 investments with a focus on the European market. Atomico’s team of investors includes founders of six billion-dollar companies, and operational leaders at companies such as Skype, Google, Uber, Facebook and Spotify. The London-based investment company has managed 27 exits to date including Supercell, Fab, the Climate Corporation and Rovio Entertainment. Its recent investments include in Peakon's Series B, AccuRx's Series A and in Graphcore and Clutter's Series D rounds.

Global technology investment firm Atomico was set up in 2006 by Skype co-founder Niklas Zennström. Since then, it has made over 140 investments with a focus on the European market. Atomico’s team of investors includes founders of six billion-dollar companies, and operational leaders at companies such as Skype, Google, Uber, Facebook and Spotify. The London-based investment company has managed 27 exits to date including Supercell, Fab, the Climate Corporation and Rovio Entertainment. Its recent investments include in Peakon's Series B, AccuRx's Series A and in Graphcore and Clutter's Series D rounds.

Sofina began in 1898 as Société Financière de Transport et d’Entreprises Industrielles, an engineering conglomerate in Belgium. In the late 1960s, Sofina changed course to become an investment company. As a holding company, its major investments lie in the consumer goods, energy, and distribution sectors, with stakes in companies like Danone and communications satellite operator SES. It has also been involved in various venture capital investment activities, both as an LP to other VCs and as a VC itself, running the Sofina Growth portfolio. The Sofina Growth portfolio spans a wide range of sectors and geographies, from China to Southeast Asia, with investments in notable companies like Zilingo, Byju’s and Kopi Kenangan.

Sofina began in 1898 as Société Financière de Transport et d’Entreprises Industrielles, an engineering conglomerate in Belgium. In the late 1960s, Sofina changed course to become an investment company. As a holding company, its major investments lie in the consumer goods, energy, and distribution sectors, with stakes in companies like Danone and communications satellite operator SES. It has also been involved in various venture capital investment activities, both as an LP to other VCs and as a VC itself, running the Sofina Growth portfolio. The Sofina Growth portfolio spans a wide range of sectors and geographies, from China to Southeast Asia, with investments in notable companies like Zilingo, Byju’s and Kopi Kenangan.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

Established in 1953, Gunung Sewu is a privately owned Indonesian conglomerate and investment management group that operates diversified businesses in insurance, food, real estate, consumer and resources. Founded by Om Go Soei Kie, aka Dasuki Angkosubroto, Gunung Sewu was originally a commodity trading enterprise.

Established in 1953, Gunung Sewu is a privately owned Indonesian conglomerate and investment management group that operates diversified businesses in insurance, food, real estate, consumer and resources. Founded by Om Go Soei Kie, aka Dasuki Angkosubroto, Gunung Sewu was originally a commodity trading enterprise.

Sinolink Securities, one of China’s first securities exchanges, was founded in 1990. Since 2013, its securities have been graded AA by the China Securities Regulatory Commission. Sinolink Securities’ main focuses are securities, futures exchange and funds, but it also has an investment bank department.

Sinolink Securities, one of China’s first securities exchanges, was founded in 1990. Since 2013, its securities have been graded AA by the China Securities Regulatory Commission. Sinolink Securities’ main focuses are securities, futures exchange and funds, but it also has an investment bank department.

Alvaro Córdoba is better known as co-founder and chief strategy officer at Spanish online room rental platform Badi that secured US$30m in Series B investment in 2019. Córdoba joined the seed round of household bill management tool Polaroo in 2019.

Alvaro Córdoba is better known as co-founder and chief strategy officer at Spanish online room rental platform Badi that secured US$30m in Series B investment in 2019. Córdoba joined the seed round of household bill management tool Polaroo in 2019.

Focused on life sciences, OrbiMed has been investing in the global healthcare industry for over 20 years. Its portfolio ranges from early-stage startups to multinational corporations. With more than 100 scientific, medical, and investment professionals, it manages over $17bn assets worldwide.

Focused on life sciences, OrbiMed has been investing in the global healthcare industry for over 20 years. Its portfolio ranges from early-stage startups to multinational corporations. With more than 100 scientific, medical, and investment professionals, it manages over $17bn assets worldwide.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Oriental Fortune Capital is an entrepreneur-oriented investment management company that was founded in 2006. It manages 26 funds with capital over RMB 10 billion. It has invested in over 220 projects, 20% of which are early stage startups and 80% growing or mature enterprises.

Oriental Fortune Capital is an entrepreneur-oriented investment management company that was founded in 2006. It manages 26 funds with capital over RMB 10 billion. It has invested in over 220 projects, 20% of which are early stage startups and 80% growing or mature enterprises.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

One of the earliest RMB-denominated funds to invest in mobile Internet in China, Meridian Capital China now manages about RMB 5 billion in capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.

One of the earliest RMB-denominated funds to invest in mobile Internet in China, Meridian Capital China now manages about RMB 5 billion in capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.capital, having issued 4 RMB funds and two SGD funds. It focuses on Series A stage financing and has backed over 100 Internet and media entertainment companies to date, including more than 20 successful exits. It was founded in 2008 by former IDG Capital Partners investment director Xiong Xiangdong.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

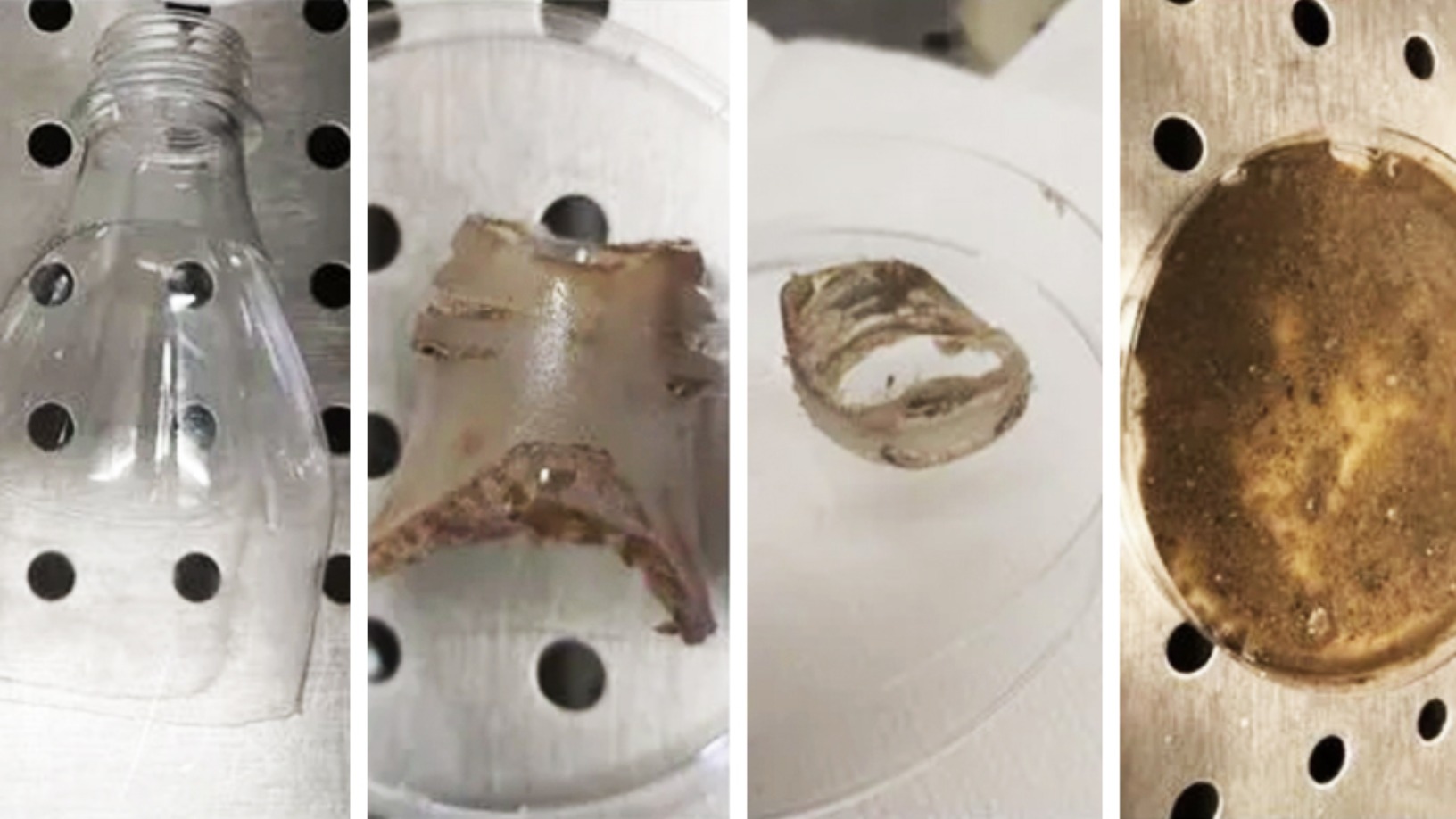

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.