Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

The independent VC arm of Legend Holdings, Legend Capital currently manages several USD funds and RMB funds with over RMB 26 billion in assets under management. It focuses on early- and expansion-stage investment and has invested in over 300 companies as of 2016, of which more than 40 were exited via IPO, and around 40 were exits through M&A.

The independent VC arm of Legend Holdings, Legend Capital currently manages several USD funds and RMB funds with over RMB 26 billion in assets under management. It focuses on early- and expansion-stage investment and has invested in over 300 companies as of 2016, of which more than 40 were exited via IPO, and around 40 were exits through M&A.

Founder of DST Global, a late-stage investment firm with US $10 billion under management. Yuri Milner is one of the most influential tech investor in Russia. Under his leadership, DST Global invested in industry leading companies like Facebook, Twitter, Airbnb, Alibaba and Xiaomi. Together with Mark Zuckerberg and Sergey Brin, Yuri Milner founded the Breakthrough Prize to reward top scientists.

Founder of DST Global, a late-stage investment firm with US $10 billion under management. Yuri Milner is one of the most influential tech investor in Russia. Under his leadership, DST Global invested in industry leading companies like Facebook, Twitter, Airbnb, Alibaba and Xiaomi. Together with Mark Zuckerberg and Sergey Brin, Yuri Milner founded the Breakthrough Prize to reward top scientists.

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Established in 2009, TCL Capital is the investment arm of TCL Corporation, which makes home appliances. TCL Capital has founded 12 venture capital funds in partnership with other stakeholders in China. Its assets under management are valued at billions of RMB. As of April 2017, it had invested in 76 startups, with an emphasis on display technology, high-end manufacturing, integrated circuits and high-end software services.

Established in 2009, TCL Capital is the investment arm of TCL Corporation, which makes home appliances. TCL Capital has founded 12 venture capital funds in partnership with other stakeholders in China. Its assets under management are valued at billions of RMB. As of April 2017, it had invested in 76 startups, with an emphasis on display technology, high-end manufacturing, integrated circuits and high-end software services.

EDB Investments (EDBI) is an investment arm of Singapore's Economic Development Board. It has invested in emerging technologies since 1991, with particular focus on healthcare and information/communication tech. EDBI seeks companies with the potential to support Singapore's economy through existing economic pillars or the development of new industry sectors, as well as companies that can potentially go global through Singapore.

EDB Investments (EDBI) is an investment arm of Singapore's Economic Development Board. It has invested in emerging technologies since 1991, with particular focus on healthcare and information/communication tech. EDBI seeks companies with the potential to support Singapore's economy through existing economic pillars or the development of new industry sectors, as well as companies that can potentially go global through Singapore.

Seedrocket 4Founders Capital is a business accelerator based in Barcelona. Established in 2017, it has invested in 60 startups including six exits. The accelerator provides promising startups with initial funding of €30,000–€50,000. Additional finance of up to €700,000 per company may also be available for the lifetime of the investment, in conjuction with other business angels and partners.

Seedrocket 4Founders Capital is a business accelerator based in Barcelona. Established in 2017, it has invested in 60 startups including six exits. The accelerator provides promising startups with initial funding of €30,000–€50,000. Additional finance of up to €700,000 per company may also be available for the lifetime of the investment, in conjuction with other business angels and partners.

Established as an asset management company in 2017, Chasestone Capital has launched major funds in real estate, private equity, consumer finance and securities investment. The company completed its Series A funding round in September 2017 with backing from well-known investors such as Orient Capital, SBCVC, Cowin Capital, Bridge Capital, GIG and Tsing Ventures.

Established as an asset management company in 2017, Chasestone Capital has launched major funds in real estate, private equity, consumer finance and securities investment. The company completed its Series A funding round in September 2017 with backing from well-known investors such as Orient Capital, SBCVC, Cowin Capital, Bridge Capital, GIG and Tsing Ventures.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

Moventis is a Spanish family-run transportation company that specializes in urban and inter-city bus and tram services, as well as bus rentals. It was established in 1923 and is based in the Catalan city of Lerida. It does not normally invest in tech startups and its investment in Shotl is believed to be its first in a startup.

Moventis is a Spanish family-run transportation company that specializes in urban and inter-city bus and tram services, as well as bus rentals. It was established in 1923 and is based in the Catalan city of Lerida. It does not normally invest in tech startups and its investment in Shotl is believed to be its first in a startup.

China Creation Ventures (CCV) was founded in 2017 by Wei Zhou, the former managing partner of KPCB China. Headquartered in Beijing, it invests mainly in early-stage startups in sectors such as finance and TMT. Series A funding accounts for around 70% of total investment. CCV manages USD and RMB funds collectively worth over RMB 3 billion.

China Creation Ventures (CCV) was founded in 2017 by Wei Zhou, the former managing partner of KPCB China. Headquartered in Beijing, it invests mainly in early-stage startups in sectors such as finance and TMT. Series A funding accounts for around 70% of total investment. CCV manages USD and RMB funds collectively worth over RMB 3 billion.

Established in 1978, Ultramagic Balloons is a Spanish balloon manufacturer based in the town of Igualada, in Barcelona province. It designs and manufactures hot air and high altitude balloons that are used by Zero 2 Infinity. It is the world's second-largest producer of high altitude balloons. It's sole investment to date was in the seed round of Zero 2 Infinity in 2010.

Established in 1978, Ultramagic Balloons is a Spanish balloon manufacturer based in the town of Igualada, in Barcelona province. It designs and manufactures hot air and high altitude balloons that are used by Zero 2 Infinity. It is the world's second-largest producer of high altitude balloons. It's sole investment to date was in the seed round of Zero 2 Infinity in 2010.

BraveGeneration is a Portuguese investment vehicle founded in 2015 for projects arising from the television series Shark Tank Portugal. South African entrepreneur Tim Vieira acts as its principal investor and mentor. The holding currently funds around 30 startups, both in tech and in other sectors. Consumers Trust is the first company it has invested in not to have appeared on the television show.

BraveGeneration is a Portuguese investment vehicle founded in 2015 for projects arising from the television series Shark Tank Portugal. South African entrepreneur Tim Vieira acts as its principal investor and mentor. The holding currently funds around 30 startups, both in tech and in other sectors. Consumers Trust is the first company it has invested in not to have appeared on the television show.

Eurovending is a family-run, Italian business in the automatic vending sector based in Trento. To date, it has only invested in one tech startup, the Spanish vending machine hardware and interactive payment app Orain, leading its €1m seed investment round in 2017. The company is a producer of plastic cups and also rents and services automatic vending machines across Italy and Spain.

Eurovending is a family-run, Italian business in the automatic vending sector based in Trento. To date, it has only invested in one tech startup, the Spanish vending machine hardware and interactive payment app Orain, leading its €1m seed investment round in 2017. The company is a producer of plastic cups and also rents and services automatic vending machines across Italy and Spain.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

Portuguese venture capital firm Best Horizon was established in 2014. Since then, its portfolio has grown to about 50 companies based in Portugal, Spain, the Netherlands, Brazil and the US. The firm has €3m in two investment vehicles for pre-seed and seed investments in tech companies that either have their headquarters or a subsidiary in the North, Centre, Alentejo and Azores regions of Portugal.

Based in Madrid, Ultano Kindelan works at US-based monetization platform Fyber as VP for Sales covering various regions. He has over 15 years of experience in digital advertising and adtech. He previously worked at Madrid-based Falk Realtime adtech. In 2017, he participated in the first seed round of Spanish AI-driven femtech WOOM, his only disclosed investment to date.

Based in Madrid, Ultano Kindelan works at US-based monetization platform Fyber as VP for Sales covering various regions. He has over 15 years of experience in digital advertising and adtech. He previously worked at Madrid-based Falk Realtime adtech. In 2017, he participated in the first seed round of Spanish AI-driven femtech WOOM, his only disclosed investment to date.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

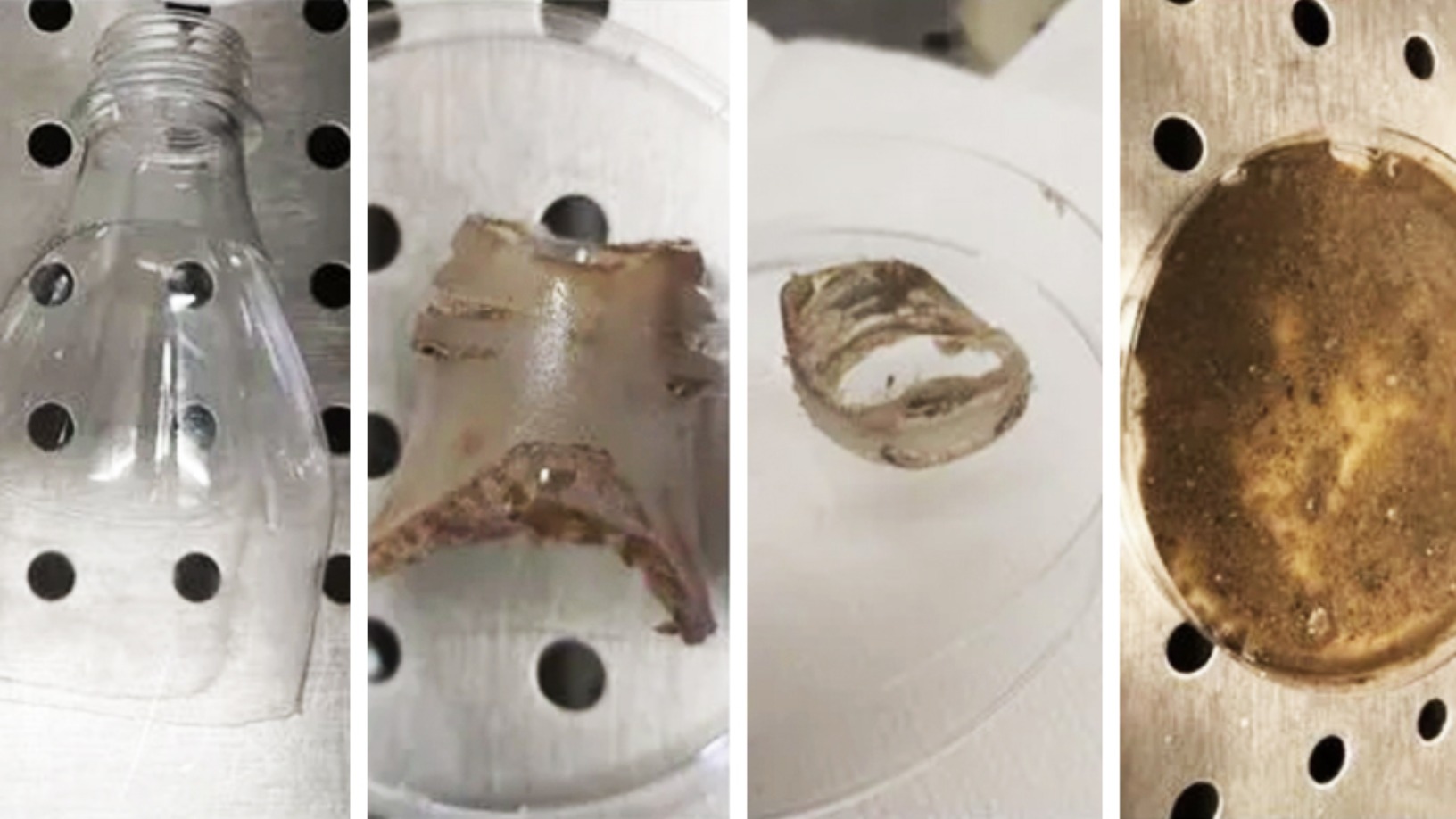

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.