Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

Founded in 2010, Greenwoods Investment has invested in over 60 startups, with three RMB-denominated PE funds and two USD PE funds under management.

Founded in 2010, Greenwoods Investment has invested in over 60 startups, with three RMB-denominated PE funds and two USD PE funds under management.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Founded in 2006, Abacus Alpha is a German VC that has invested in water or industry service companies instead of the typical tech startups. Based in Frankenthal, Rheinland-Pfalz, it is the investment arm of German multinational, KSB Group, a pump and valve producer. Its most recent investments were the 2019 undisclosed seed funding of industrial tech company Applied Nano Services, the 2018 undisclosed seed round in desalination innovator Salinova and the 2017 undisclosed seed investment in AddVolt, pioneer of renewable energy generation technology to replace diesel engines for cold chain transport.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd., was co-founded by Bank of China Group Investment Ltd., a subsidiary of the Bank of China, and Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital.

Boc&Utrust Private Equity Fund Management (Guangdong) Co., Ltd., was co-founded by Bank of China Group Investment Ltd., a subsidiary of the Bank of China, and Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital.

Co-founder of Dana+

Holding an MBA from Lancaster University, UK, Yang co-founded Dana+ with Ren Xinxin and Lv Xin in 2015. He’s also a partner of Lidafeng Investment, and of Ming Capital, an investment management company co-founded by popular Chinese actor Huang Xiaoming.

Holding an MBA from Lancaster University, UK, Yang co-founded Dana+ with Ren Xinxin and Lv Xin in 2015. He’s also a partner of Lidafeng Investment, and of Ming Capital, an investment management company co-founded by popular Chinese actor Huang Xiaoming.

Yingke PE was founded in 2010 and is headquartered in Shanghai. By the end of 2020, it had managed assets worth nearly RMB 50bn. In May 2021, it closed the RMB 10bn Yingke Science & Technology Innovation Industrial Fund. Over 90% of its funds come from financial institutions, state-owned enterprises and listed companies. Yingke PE has invested in more than 200 companies, focusing on biopharmaceuticals, core technology and upgraded consumption. Since its founding, the company has exited 53 projects, with an internal rate of return up to 54%.

Yingke PE was founded in 2010 and is headquartered in Shanghai. By the end of 2020, it had managed assets worth nearly RMB 50bn. In May 2021, it closed the RMB 10bn Yingke Science & Technology Innovation Industrial Fund. Over 90% of its funds come from financial institutions, state-owned enterprises and listed companies. Yingke PE has invested in more than 200 companies, focusing on biopharmaceuticals, core technology and upgraded consumption. Since its founding, the company has exited 53 projects, with an internal rate of return up to 54%.

Changce Investment was established in Guangzhou in May 2015. With more than RMB 1 billion under management, the firm invests mainly in unlisted high-growth companies in the IoT sector.

Changce Investment was established in Guangzhou in May 2015. With more than RMB 1 billion under management, the firm invests mainly in unlisted high-growth companies in the IoT sector.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

The VC arm of Kalonia, a Barcelona-based management consultancy focused on corporate digital transformation, Kalonia Venture Partners invests in B2B software, AI and fintech startups in the Spanish-speaking world. The VC is currently investing via its KVP III fund of €4.3m, with a target of 10 investments of about €5m on average each, taking equity stakes of 10% onward in co-investment; plus two follow-ons. Founded by Josep Arroyo, Alejandro Olabarría y Enrique Marugán, Kalonia began helping Spanish investors diversify into Silicon Valley and other US startups as early as 2001. Currently its funds come mainly from Barcelona-based family offices. Co-founder Alejandro Olabarría is son of Pedro Olabarría Delclaux, the powerful patriarch heading one of Spain's richest industrialist families today, with interests across industrial farming, banking, real estate, automotive and paper.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

Founded in 1980, INELCOM is a large Spanish manufacturing company that specializes in hardware, including microelectronics, optoelectronics and digital signal processors. It does not typically invest in tech startups, and, to date, its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed pre-seed and seed funding rounds totalling just over €3m. It is the startup’s industrial partner and manufactures its hardware.

Founded in 1980, INELCOM is a large Spanish manufacturing company that specializes in hardware, including microelectronics, optoelectronics and digital signal processors. It does not typically invest in tech startups, and, to date, its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed pre-seed and seed funding rounds totalling just over €3m. It is the startup’s industrial partner and manufactures its hardware.

Cloud Angel Fund was co-founded by China Broadband Capital, Sequoia China, Northern Light Venture Capital, GSR Ventures and Wu Capital in 2013. It operates as a VC firm and invests mainly in early-stage startups in China.

Cloud Angel Fund was co-founded by China Broadband Capital, Sequoia China, Northern Light Venture Capital, GSR Ventures and Wu Capital in 2013. It operates as a VC firm and invests mainly in early-stage startups in China.

Based in Shanghai, Sharewin Investment was founded in 2005. In 2010, the company changed its focus from PE to VC. It invests mainly in the healthcare, TMT, new material, advanced manufacturing, arts and entertainment and consumer products sectors.

Based in Shanghai, Sharewin Investment was founded in 2005. In 2010, the company changed its focus from PE to VC. It invests mainly in the healthcare, TMT, new material, advanced manufacturing, arts and entertainment and consumer products sectors.

Yifuze Investment was founded in 2010 by renowned trader and investor Lin Guangmao. Lin made his name trading cotton futures that year, turning RMB 30,000 worth of contracts into a RMB 2 billion fortune.

Yifuze Investment was founded in 2010 by renowned trader and investor Lin Guangmao. Lin made his name trading cotton futures that year, turning RMB 30,000 worth of contracts into a RMB 2 billion fortune.

Established in 2007, Hongkun Yirun Investment is an investment management firm under Hongkun Group. It has invested in over 50 enterprises, more than 10 of which have been listed. Assets under management have exceeded RMB 10 billion. Hongkun Yirun Investment targets emerging industries and focuses on asset management, private equity investment, M&A and internet finance.

Established in 2007, Hongkun Yirun Investment is an investment management firm under Hongkun Group. It has invested in over 50 enterprises, more than 10 of which have been listed. Assets under management have exceeded RMB 10 billion. Hongkun Yirun Investment targets emerging industries and focuses on asset management, private equity investment, M&A and internet finance.

Centro para el Desarollo Tecnológico Industrial (CDTI) is a Spanish government startup accelerator under the Ministry of Science, Education and Universities. Based in Madrid, it has invested in 13 startups since 2015, predominantly focusing on scientific enterprises.

Centro para el Desarollo Tecnológico Industrial (CDTI) is a Spanish government startup accelerator under the Ministry of Science, Education and Universities. Based in Madrid, it has invested in 13 startups since 2015, predominantly focusing on scientific enterprises.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

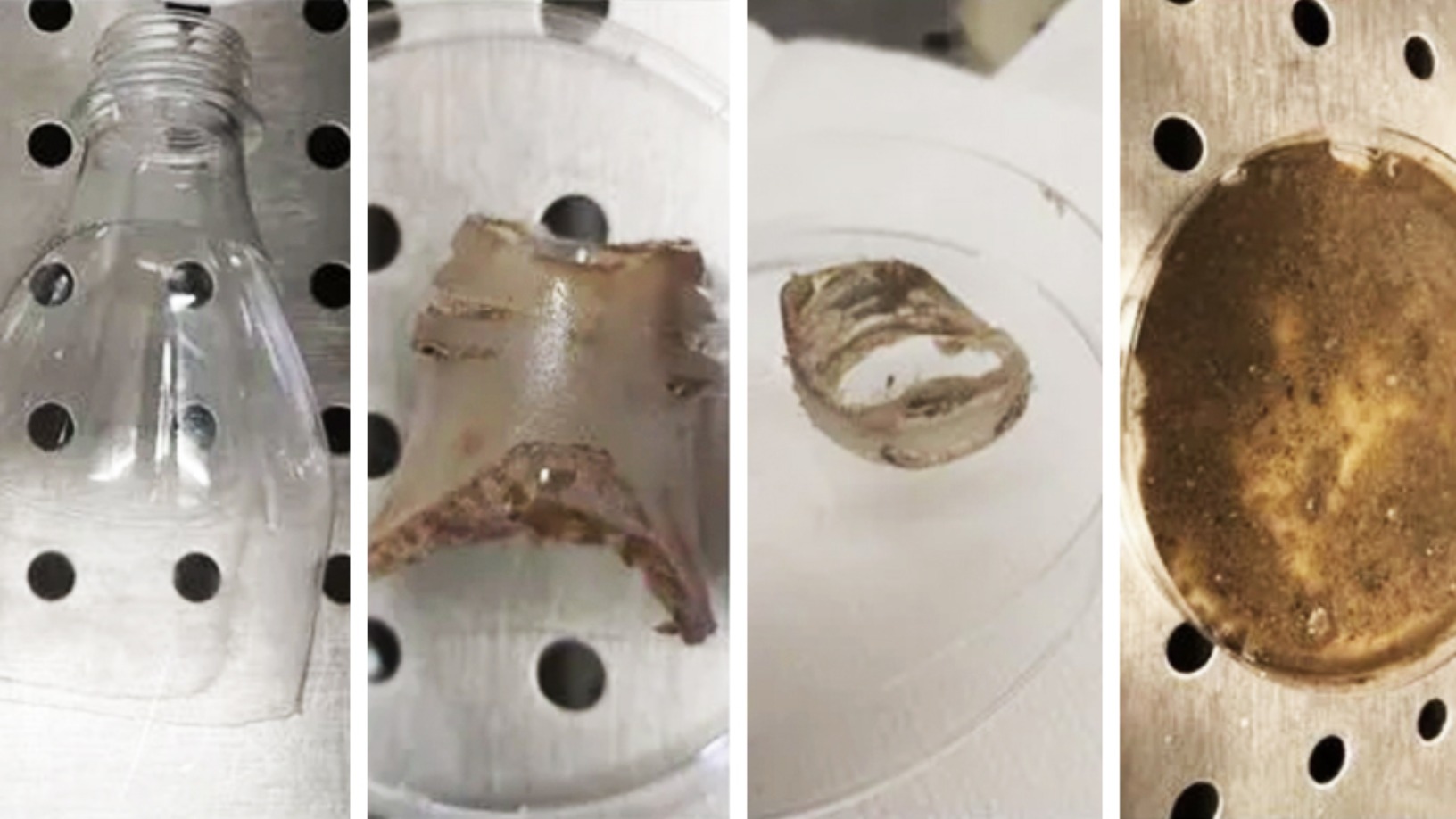

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

360imprimir: “We want to be the Amazon of corporate products and marketing services”

Online printing services platform 360imprimir recently raised €18m, one of Portugal's biggest funding rounds, for its global expansion

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

With recent funding of $182m, drone maker XAG is set to make its mark as agritech leader

XAG has been reaping the benefits of its 2012 pivot to agriculture as demand for high-tech automation in China’s farms continues to grow strongly amid government push

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.