Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

Beijing Zhongguancun Development Qihang Industrial Investment Fund

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

CGN Industrial Investment Fund

CGN Industrial Investment Fund Co., Ltd. was co-founded by China General Nuclear Power Group (CGN), China Cinda Asset Management Co., Ltd. and China Three Gorges Corporation in Shenzhen in 2008. With over RMB 15 billion assets under management, the fund invests mainly in the sectors of nuclear power, solar power, forestry and mining.

CGN Industrial Investment Fund Co., Ltd. was co-founded by China General Nuclear Power Group (CGN), China Cinda Asset Management Co., Ltd. and China Three Gorges Corporation in Shenzhen in 2008. With over RMB 15 billion assets under management, the fund invests mainly in the sectors of nuclear power, solar power, forestry and mining.

China Culture Industrial Investment Fund

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

Yuexiu Industrial Fund is a fund management company founded by Yuexiu Group in Guangzhou in August 2011. It works as an investment arm of Yuexiu Group and invests mainly in emerging industries. As at November 2018, it had RMB 50 billion under its management.

Yuexiu Industrial Fund is a fund management company founded by Yuexiu Group in Guangzhou in August 2011. It works as an investment arm of Yuexiu Group and invests mainly in emerging industries. As at November 2018, it had RMB 50 billion under its management.

Guangzhou Yuexiu Industrial Investment Fund Management

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Guangzhou Emerging Industry Development Fund

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Shanghai Artificial Intelligence Industry Investment Fund

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

Co-founder of Duodianyun

Peng Yao has a master’s in Electronic and Information Engineering from Tsinghua University. He was an industry researcher at Taikang Asset, an investment manager at SDIC Fund Management and Vangoo Capital Partners. He has investment experience in diverse industry sectors like healthcare, TMT and advanced equipment manufacturing.

Peng Yao has a master’s in Electronic and Information Engineering from Tsinghua University. He was an industry researcher at Taikang Asset, an investment manager at SDIC Fund Management and Vangoo Capital Partners. He has investment experience in diverse industry sectors like healthcare, TMT and advanced equipment manufacturing.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Co-founder and CEO of Indexa Capital

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

Haishen Tech: Scan image and find your product in one second

Haishen Tech's AI vending machines will revive unmanned retail economy and tap into growing on-demand consumerism worldwide

From real estate to rearing insects for food: Magalarva's way to a sustainable future

The Indonesian agritech startup is already using insects to replace fishmeal and has new funding to grow further

Checkealos: The UX testing platform helping companies boost conversion, engagement and sales

The Spanish startup aims at US expansion with its 13m-strong tester database and simple, intuitive platform

Icaria Medical's CardioSense: Cardiovascular pre-diagnosis in less than 60 seconds

Icaria Medical is seeking clinical validation and funding for its AI-based monitor, which measures blood pressure continuously and non-invasively

Trudy Dai: Alibaba’s jane of all trades

Dai has played a pivotal role in the success of the world’s biggest e-commerce platform; now the tech giant is trusting her to run its VC arm

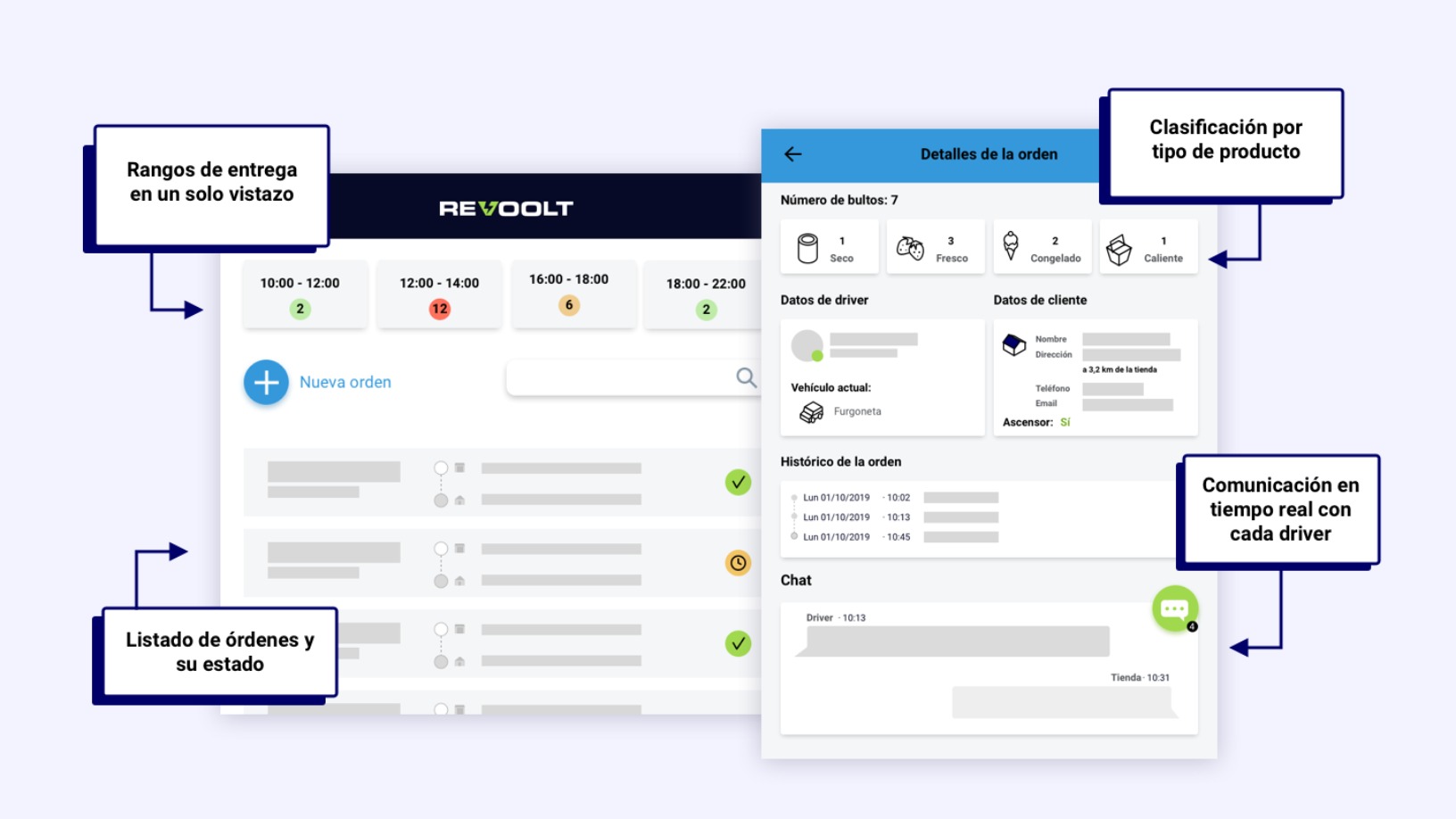

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

Airhopping: Breakthrough in the OTA sector for millennials

Offering cheap and flexible multi-destination flight packages is helping the platform become the go-to reservation agent for budget travelers

Keep: Social fitness app bags $80m Series E as Covid-19 lockdown fuels demand for virtual gyms

Keep becomes China’s first sports tech unicorn as number of fitness app users in the country almost doubled to 89m amid home confinement and gym closures

Shiheng Tech: The brains behind Starbucks' online delivery success in China

Using real-time data analytics to optimize last-mile delivery, Shiheng Tech offers the perfect on-demand recipe for F&B businesses

8villages to refocus business, shelve B2C agri-ecommerce ops as Covid boost proves short-lived

Despite a spike in B2C demand during Indonesia’s initial lockdowns, 8villages customers returned to shopping offline once restrictions eased

Thousands of Farmers: Creative subscription model to help farms sell seasonal produce

Just a few months old, Thousands of Farmers plans to add more entertaining features to its farm-to-table social commerce, attracting young consumers

SWITCH Singapore: Investors highlight Vietnam startup ecosystem's potential and resilience

The quality of Vietnam’s local talent remains one of its biggest strengths, but foreign investors also need to be patient and be familiar with the local regulatory landscape

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

Demand Side Instruments: Using small data to solve big problems

Following a €3.6m Series A round, the French startup is growing its workforce to commercialize its precision irrigation technology in new markets in Europe and North America

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.