Qihang Industrial Investment Fund

-

DATABASE (993)

-

ARTICLES (506)

Beijing Zhongguancun Development Qihang Industrial Investment Fund

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

Beijing Zhongguancun Development Qihang Industrial Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on biotechnology, pharmaceuticals, next-generation information technology, new energy, new materials and intelligent manufacturing.

CGN Industrial Investment Fund

CGN Industrial Investment Fund Co., Ltd. was co-founded by China General Nuclear Power Group (CGN), China Cinda Asset Management Co., Ltd. and China Three Gorges Corporation in Shenzhen in 2008. With over RMB 15 billion assets under management, the fund invests mainly in the sectors of nuclear power, solar power, forestry and mining.

CGN Industrial Investment Fund Co., Ltd. was co-founded by China General Nuclear Power Group (CGN), China Cinda Asset Management Co., Ltd. and China Three Gorges Corporation in Shenzhen in 2008. With over RMB 15 billion assets under management, the fund invests mainly in the sectors of nuclear power, solar power, forestry and mining.

China Culture Industrial Investment Fund

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

Yuexiu Industrial Fund is a fund management company founded by Yuexiu Group in Guangzhou in August 2011. It works as an investment arm of Yuexiu Group and invests mainly in emerging industries. As at November 2018, it had RMB 50 billion under its management.

Yuexiu Industrial Fund is a fund management company founded by Yuexiu Group in Guangzhou in August 2011. It works as an investment arm of Yuexiu Group and invests mainly in emerging industries. As at November 2018, it had RMB 50 billion under its management.

Guangzhou Yuexiu Industrial Investment Fund Management

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Beijing Zhongguancun Development Frontier Enterprise Investment Fund was launched by Zhongguancun Development Group, a hi-tech commercialization platform backed by the municipal government of Beijing. It focuses on artificial intelligence and big data, mainly investing in sectors like industrial internet, connected vehicles, biotechnology and healthcare.

Guangzhou Emerging Industry Development Fund

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Shanghai Artificial Intelligence Industry Investment Fund

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

Co-founder of Duodianyun

Peng Yao has a master’s in Electronic and Information Engineering from Tsinghua University. He was an industry researcher at Taikang Asset, an investment manager at SDIC Fund Management and Vangoo Capital Partners. He has investment experience in diverse industry sectors like healthcare, TMT and advanced equipment manufacturing.

Peng Yao has a master’s in Electronic and Information Engineering from Tsinghua University. He was an industry researcher at Taikang Asset, an investment manager at SDIC Fund Management and Vangoo Capital Partners. He has investment experience in diverse industry sectors like healthcare, TMT and advanced equipment manufacturing.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Co-founder and CEO of Indexa Capital

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

Teliman: Driver-centered mobility model assisting Malian development

The startup addresses a basic necessity with its on-demand ride-hailing services while supporting the personal and economic progress of its drivers, including empowering women

Gigacover: Providing a financial safety net for gig workers

Gigacover is eyeing multi-billion-dollar opportunities in income and healthcare protection and financial services for the 150m self-employed workers in Southeast Asia, about half of whom are underbanked

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

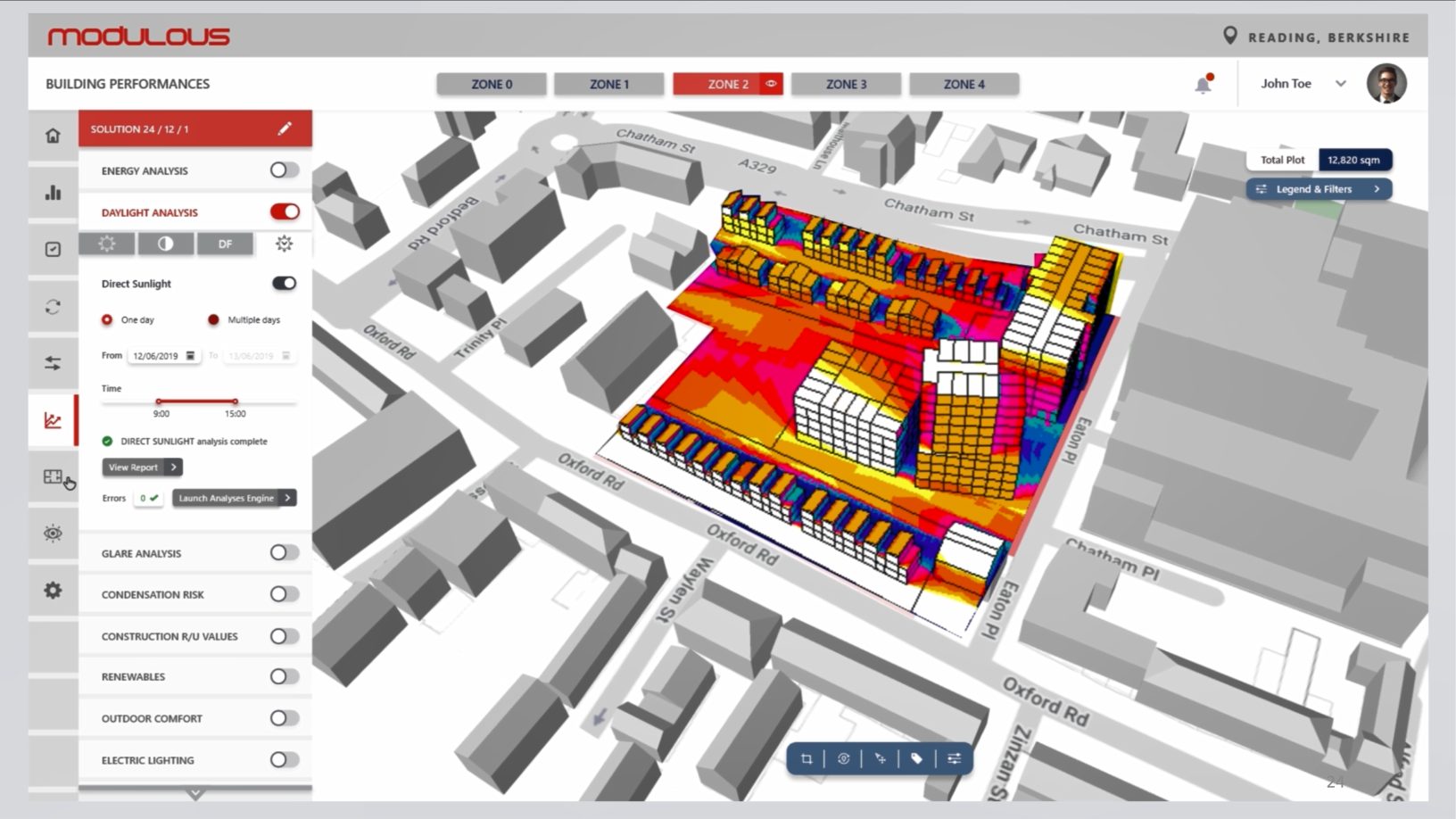

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Glovo’s 2018 rollercoaster ride

The year saw the delivery giant dealing with labor unions, diversification and international expansion

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Lu Qi: Before Baidu and Y Combinator, there was Bing

The AI legend was also an impoverished child, whose ambition was to become a shipyard worker

Napbox: Sleeping capsule mania takes off in Spain

Napbox's on-demand and intelligent cabins give privacy and connectivity in public spaces and offices

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

Narasi TV: Creating a better media experience for Indonesia

Spearheaded by a popular talkshow host, this new media startup seeks to cultivate a more positive online media environment

Vegan fish substitute Mimic Seafood set to disrupt the sustainable food market

Founder of food innovation hub Ivoro launches Mimic Seafood, a European pioneer in vegan fish substitutes

Indonesia gaming and esports – Covid-19 brings increased interest but also challenges

Canceled industry events may have curtailed promotion and investment opportunities, but interest in gaming and esports has increased

Xing Nong Fu: Using earthworms to create sustainable local farming and livelihoods

Worm castings can rehabilitate infertile land due to excessive soil salinity in just seven days, compared with three to five years using traditional methods, and 90% more cheaply

In Indonesia, equity crowdfunding is gaining in popularity among SMEs, challenging P2P lending

Equity crowdfunding platforms are offering new approaches to SME financing in Indonesia, with more players entering the market

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Sorry, we couldn’t find any matches for“Qihang Industrial Investment Fund”.