Rent the Runway

-

DATABASE (998)

-

ARTICLES (811)

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

HUNOSA Group is a Spanish energy and mining company based in the northern region of Asturias, founded in 1967. Its only disclosed tech startup investment to date was in the 2021 $1.8m seed round of Asturias-based Triditive the first automated additive manufacturing technology.

Waheed Ali became a Labour life peer and Baron of Norbury at aged 33, the youngest to join the House of Lords in 1998. He is also one of the few openly gay Muslim politicians in the world and a gay rights activist. Waheed Ali left school and started work in financial research at the age of 16 to support his mother and siblings. He moved on to a media career by co-founding an independent television company Planet 24 with Bob Geldof during the 1990s, pioneering TV reality shows like Survivor. Planet 24 was sold to ITV franchisee Carlton Communications in 1999 for £15m. He also backed Elizabeth Murdoch’s TV production company Shine that was sold to her father, Rupert Murdoch’s media group, 21st Century Fox. Of Guyana and Trinidad descent, the well-known British media tycoon is also a businessman and investor. In 2011, he lost millions by investing in loss-making Chorion that owned the Agatha Christie literary rights. He formed a television production company Silvergate Media to acquire the rights to several Chorion TV series like Beatrix Potter. As an investor, he became the chairman of online fashion marketplace ASOS for 12 years until 2012. He later founded the “ASOS of India,” Koovs that was listed in London in 2014. Most recently, he joined the Series B funding round of London-based zero-food-waste app OLIO in September 2021.

Waheed Ali became a Labour life peer and Baron of Norbury at aged 33, the youngest to join the House of Lords in 1998. He is also one of the few openly gay Muslim politicians in the world and a gay rights activist. Waheed Ali left school and started work in financial research at the age of 16 to support his mother and siblings. He moved on to a media career by co-founding an independent television company Planet 24 with Bob Geldof during the 1990s, pioneering TV reality shows like Survivor. Planet 24 was sold to ITV franchisee Carlton Communications in 1999 for £15m. He also backed Elizabeth Murdoch’s TV production company Shine that was sold to her father, Rupert Murdoch’s media group, 21st Century Fox. Of Guyana and Trinidad descent, the well-known British media tycoon is also a businessman and investor. In 2011, he lost millions by investing in loss-making Chorion that owned the Agatha Christie literary rights. He formed a television production company Silvergate Media to acquire the rights to several Chorion TV series like Beatrix Potter. As an investor, he became the chairman of online fashion marketplace ASOS for 12 years until 2012. He later founded the “ASOS of India,” Koovs that was listed in London in 2014. Most recently, he joined the Series B funding round of London-based zero-food-waste app OLIO in September 2021.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Jason Stockwood is the chairman and co-owner of Grimsby Town Football Club. The Grimsby working-class lad managed to get a scholarship to study in the US, worked at Trailfinders and Lastminute.com in the 1990s. He was a non-executive director of Skyscanner and international MD at Travelocity Business and also at Match.com. In 2010, he became the CEO and vice-chair of online insurance company, Simply Business, that was sold for £400m in 2017.The co-founder of VC 53° has also invested in British startups across market segments, including the Series B investment round of food-sharing app OLIO in September 2021 and August 2020 financing of carbon tracking platform for banks and investors CoGo UK.

Jason Stockwood is the chairman and co-owner of Grimsby Town Football Club. The Grimsby working-class lad managed to get a scholarship to study in the US, worked at Trailfinders and Lastminute.com in the 1990s. He was a non-executive director of Skyscanner and international MD at Travelocity Business and also at Match.com. In 2010, he became the CEO and vice-chair of online insurance company, Simply Business, that was sold for £400m in 2017.The co-founder of VC 53° has also invested in British startups across market segments, including the Series B investment round of food-sharing app OLIO in September 2021 and August 2020 financing of carbon tracking platform for banks and investors CoGo UK.

CEO of Shenzhourong

Data services veteran Huang Haijia was the director of the Chinese government’s first online project in 1998; and the co-founder and former COO of ID5, set up in cooperation with the national police, for online identification checks and involving the digitization of ID data of the 1.3 billion population. In 2001, Huang founded Guozhengtong, an IT consultancy supporting local governments in their digitization and, subsequently, banks and telcos. He later founded financial data and credit risk management SaaS company Shenzhourong, which he heads as CEO. Huang holds an EMBA from the Central European International Business School. He is also a member of the fifth batch of entrepreneurs from the incubation program of AAMA (Asia America Multi-Technology Association), Silicon Valley's largest non-profit organization dedicated to the Asian American high-tech community.

Data services veteran Huang Haijia was the director of the Chinese government’s first online project in 1998; and the co-founder and former COO of ID5, set up in cooperation with the national police, for online identification checks and involving the digitization of ID data of the 1.3 billion population. In 2001, Huang founded Guozhengtong, an IT consultancy supporting local governments in their digitization and, subsequently, banks and telcos. He later founded financial data and credit risk management SaaS company Shenzhourong, which he heads as CEO. Huang holds an EMBA from the Central European International Business School. He is also a member of the fifth batch of entrepreneurs from the incubation program of AAMA (Asia America Multi-Technology Association), Silicon Valley's largest non-profit organization dedicated to the Asian American high-tech community.

CSO and co-founder of iLoF

Paula Sampaio is a biochemist who completed a PhD in biomedical sciences at the University of Porto in 1998. She worked as a postdoctoral research fellow at the IMBC INEB Associate Laboratory for four years. In 2002, she was promoted to the role of head of advanced light microscopy and stayed there until 2015. Sampaio is now the national coordinator for Portuguese bioimage platform PPBI and the head of advanced light microscopy at the Institute of Research and Innovation of the University of Porto (i3S).In November 2019, she joined iLoF as CSO and co-founder. iLoF gets technical support from i3S at the R&D center in Porto. The medtech startup focuses on personalized medicine through the use of AI and photonics to create optical fingerprints in a cloud-based library to gather and manages disease biomarkers and biological profiles.

Paula Sampaio is a biochemist who completed a PhD in biomedical sciences at the University of Porto in 1998. She worked as a postdoctoral research fellow at the IMBC INEB Associate Laboratory for four years. In 2002, she was promoted to the role of head of advanced light microscopy and stayed there until 2015. Sampaio is now the national coordinator for Portuguese bioimage platform PPBI and the head of advanced light microscopy at the Institute of Research and Innovation of the University of Porto (i3S).In November 2019, she joined iLoF as CSO and co-founder. iLoF gets technical support from i3S at the R&D center in Porto. The medtech startup focuses on personalized medicine through the use of AI and photonics to create optical fingerprints in a cloud-based library to gather and manages disease biomarkers and biological profiles.

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

Fernando Cabello-Astolfi is a Spanish serial entrepreneur and angel investor in the fintech ecosystem. He has a masters degree in Global Market Economics from the London School of Economics. He is the co-founder and CEO of Ibercheck, a leading company that issues solvency reports for individuals in Spain. In 2014, he founded consumer credit fintech Aplazame, which was sold to WiZink Bank in 2018. Fernando is the CEO of Aplazame, heading the product, risk and finance departments. More recently, he launched Devengo, an innovative payroll model that allows employees to collect their salary when needed, instead of on a fixed date each month, at no extra cost to the company.

Fernando Cabello-Astolfi is a Spanish serial entrepreneur and angel investor in the fintech ecosystem. He has a masters degree in Global Market Economics from the London School of Economics. He is the co-founder and CEO of Ibercheck, a leading company that issues solvency reports for individuals in Spain. In 2014, he founded consumer credit fintech Aplazame, which was sold to WiZink Bank in 2018. Fernando is the CEO of Aplazame, heading the product, risk and finance departments. More recently, he launched Devengo, an innovative payroll model that allows employees to collect their salary when needed, instead of on a fixed date each month, at no extra cost to the company.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

Founded in 2008, the US-based Kickstart Fund specializes in supporting midwestern US startups in Utah, Colorado and the Mountain West. The community investment platform has more than 110 companies in its portfolio valued at over $300m. It invests across all market segments, mostly in companies based in Utah, with a few in New Mexico and the UK.Recent investments in May 2021 include participation in the Series A $12m funding of Vence and $1.5m seed round of skincare marketplace, Pomp. In July 2021, it also joined the $4.5m investment round of retail SaaS provider Clientbook.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

Founding partner of China Bridge Capital, Zeng Qiang used to be nominated the Most Influential Chinese IT Leader by TIME in 1998. He founded Sparkice, one of the first B2B e-commerce platforms in China, in 1996. He co-founded LeTV CBC Buyout Fund, Wumei CBC Buyout Fund, iCarbonX CBC Buyout Fund, E-China Alliance, and Yabuli China Entrepreneurs Forum. Zeng Qiang received his Master of Economic Management in Tsinghua University and Master of Financial Economics in The University of Toronto. He also serves as the guest professor at the Business School of Tsinghua.

Founding partner of China Bridge Capital, Zeng Qiang used to be nominated the Most Influential Chinese IT Leader by TIME in 1998. He founded Sparkice, one of the first B2B e-commerce platforms in China, in 1996. He co-founded LeTV CBC Buyout Fund, Wumei CBC Buyout Fund, iCarbonX CBC Buyout Fund, E-China Alliance, and Yabuli China Entrepreneurs Forum. Zeng Qiang received his Master of Economic Management in Tsinghua University and Master of Financial Economics in The University of Toronto. He also serves as the guest professor at the Business School of Tsinghua.

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

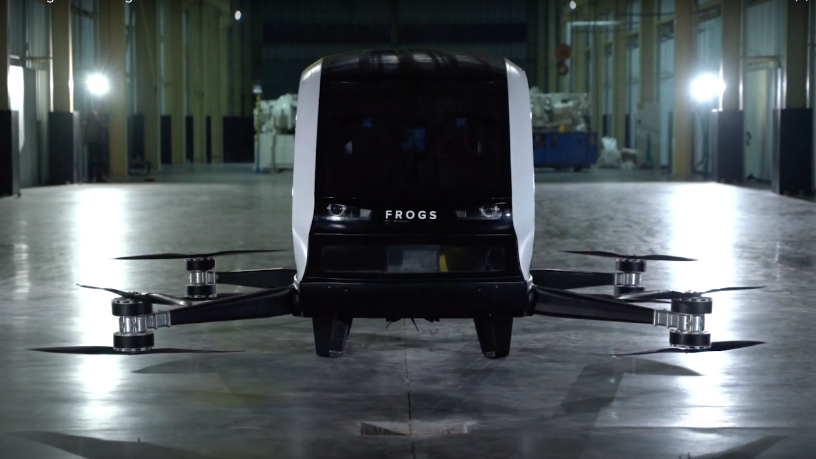

FROGS: Overcoming challenges to launch Indonesia's first drone-taxi for daily commutes

The Yogyakarta-based startup backed by UMG Idealab seeks more technical resources to launch Indonesia's first homegrown “flying taxi,” after the success of its agritech drones

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

Have you ever bought expensive equipment but seldom used it? Do you want to try the latest electronic gadgets at low cost? Try this online sharing and rental platform

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Oyika wants to help 30,000 Indonesian riders switch to electric motorcycles

With unlimited battery swaps and round-the-clock service, the Singapore startup is targeting ride-hailing and delivery drivers in Indonesia, a market with a growing appetite for electric motorcycles

Chinese startup Xianghuanji takes a gamble on smartphone leasing

Now you can rent the newest phones for half the price of an upgrade

DORM: New-generation housing for Indonesia’s tech-savvy, community-driven students

Combining online features with offline services, DORM goes way beyond what the market typically offers in student accommodation

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

Fintech startup Xendit launches aid program for Indonesian businesses amid Covid-19 crisis

Xendit is helping more SMEs go online by waiving transaction fees for its digital payments solution for the first month

eCooltra CEO: Offline-to-online leader in two-wheel sharing economy

Timo Buetefisch, the CEO and co-founder of Europe's largest scooter rental firm Cooltra, discusses the successful offline-to-online shift to scooter-sharing app eCooltra

With a new focus on smart clinics, healthcare SaaS startup Medigo offers Covid-19 testing

A pivot to revenue-sharing and partnerships to provide Covid-19 testing has given Medigo a fighting chance, with a new funding round on the cards

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

Backed by Kleiner Perkins, Spotahome clinches Spain’s first Silicon Valley-led funding

Now in Europe’s US$500 billion home rental market, the Spanish proptech will soon expand to LatAm, the US and Asia

EV maker Xpeng Motors partners Didi to offer car rentals and better charging services

Besides working with China's largest ride-hailing platform, Xpeng Motors has also connected to the charging networks of EV maker NIO and TELD, China's biggest EV charging network

Sorry, we couldn’t find any matches for“Rent the Runway”.