Rent the Runway

-

DATABASE (998)

-

ARTICLES (811)

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

Pere Valles is an entrepreneur and angel investor in the Spanish startup ecosystem, sitting on the board of several companies. Valles has been chairman of Spanish digital voting platform Scytl since 2004. In 2018, he was appointed CEO of travel platform Exoticca, which sells long haul touring holidays and has a presence in Spain, France and the UK. He had been a financial director of GlobalNet and a senior manager at KPMG's mergers & acquisitions group in the US.

Pere Valles is an entrepreneur and angel investor in the Spanish startup ecosystem, sitting on the board of several companies. Valles has been chairman of Spanish digital voting platform Scytl since 2004. In 2018, he was appointed CEO of travel platform Exoticca, which sells long haul touring holidays and has a presence in Spain, France and the UK. He had been a financial director of GlobalNet and a senior manager at KPMG's mergers & acquisitions group in the US.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

An entrepreneur and investor in new technologies and digital business, Manuel Serrano has extensive experience in the field of digital transformation and startups' mentoring.He is the managing director and founder of FHIOS Smart Knowledge, a company that specializes in consultancy services for digital innovation, where he has worked since 2012. Serrano is also a committee member of FC Barcelona, the city's famous soccer club, and an investor in fast-growing Spanish startups like Red Points, Wysee and CITIBOX. He has also managed and founded several IT companies in the Barcelona area.

An entrepreneur and investor in new technologies and digital business, Manuel Serrano has extensive experience in the field of digital transformation and startups' mentoring.He is the managing director and founder of FHIOS Smart Knowledge, a company that specializes in consultancy services for digital innovation, where he has worked since 2012. Serrano is also a committee member of FC Barcelona, the city's famous soccer club, and an investor in fast-growing Spanish startups like Red Points, Wysee and CITIBOX. He has also managed and founded several IT companies in the Barcelona area.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Founded in 1969, Hong Kong-based Sun Hung Kai & Co is an investment company listed in the Hong Kong Stock Exchange. Its founder, Fung King-hey, is also the co-founder of Sun Hung Kai Properties. It invests mainly in finance, fintech, health insurance, media and technology sectors. The company has about HKD 43bn in assets and is the main shareholder of UA Finance and Everbright Sun Hung Kai.

Founded in 1969, Hong Kong-based Sun Hung Kai & Co is an investment company listed in the Hong Kong Stock Exchange. Its founder, Fung King-hey, is also the co-founder of Sun Hung Kai Properties. It invests mainly in finance, fintech, health insurance, media and technology sectors. The company has about HKD 43bn in assets and is the main shareholder of UA Finance and Everbright Sun Hung Kai.

Guangzhou Emerging Industry Development Fund

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Guangzhou Emerging Industry Development Fund (Emerging Fund) is a wholly-owned subsidiary of Guangzhou Industrial Investment Fund Management Co Ltd (SFund).It was found in line with the Guangzhou Municipal Government’s industrial upgrade strategy, with the aim of pooling capital, projects and talents together in Guangzhou. The Emerging Fund currently manages a set of government-guided funds and direct investment funds. It also invests in several state-level guidance funds on behalf of the municipal government. It mainly invests in emerging sectors in manufacturing, information technology, service sectors, seed and related industries.

Founded in 2016, Berlin-based investor BlueYard invests in startups aiming to tackle the planet’s greatest challenges. It typically makes $1m–3m as an initial investment and has no geographical bias. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech and in the February 2021 $4m seed round of Next Matter, a German Open Source automation tool for operations teams.

Founded in 2016, Berlin-based investor BlueYard invests in startups aiming to tackle the planet’s greatest challenges. It typically makes $1m–3m as an initial investment and has no geographical bias. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech and in the February 2021 $4m seed round of Next Matter, a German Open Source automation tool for operations teams.

Founded in 2003 in New York, Vast Ventures has invested in over 70 early-stage companies, with a focus on companies tackling global problems or which are rooted in sustainability. It has managed 22 exits to date. It currently has 45 companies in its portfolio, the overwhelming majority of which are based in the Americas. Its most recent investments include participation in the May 2021 $8m seed round for Chilean rental management proptech player Houm, as well as the April 2021 $17m Series A round of MedChart, a Canadian healthcare data systems startup.

Founded in 2003 in New York, Vast Ventures has invested in over 70 early-stage companies, with a focus on companies tackling global problems or which are rooted in sustainability. It has managed 22 exits to date. It currently has 45 companies in its portfolio, the overwhelming majority of which are based in the Americas. Its most recent investments include participation in the May 2021 $8m seed round for Chilean rental management proptech player Houm, as well as the April 2021 $17m Series A round of MedChart, a Canadian healthcare data systems startup.

The merged entity of China’s two largest local services rivals, Meituan has a market cap of HKD 1.93tn in the Hong Kong Stock Exchange, where it is listed. Its total transaction volume reached RMB 682bn in 2019. In 2015, Meituan merged with Chinese rival Dianping and was known as Meituan-Dianping, but the brand has since been unified to Meituan. Now headed by Meituan founder Wang Xing, the Tencent-backed company is China’s largest on-demand, or O2O (online-to-offline), services provider, offering food delivery, restaurant booking, group buying, movie ticket booking and more.

The merged entity of China’s two largest local services rivals, Meituan has a market cap of HKD 1.93tn in the Hong Kong Stock Exchange, where it is listed. Its total transaction volume reached RMB 682bn in 2019. In 2015, Meituan merged with Chinese rival Dianping and was known as Meituan-Dianping, but the brand has since been unified to Meituan. Now headed by Meituan founder Wang Xing, the Tencent-backed company is China’s largest on-demand, or O2O (online-to-offline), services provider, offering food delivery, restaurant booking, group buying, movie ticket booking and more.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Hangzhou-based Tisiwi Ventures is an angel investor focused on Chinese internet companies. One of the earliest in China to adopt the Y Combinator model, it has backed more than 100 startups.

Hangzhou-based Tisiwi Ventures is an angel investor focused on Chinese internet companies. One of the earliest in China to adopt the Y Combinator model, it has backed more than 100 startups.

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

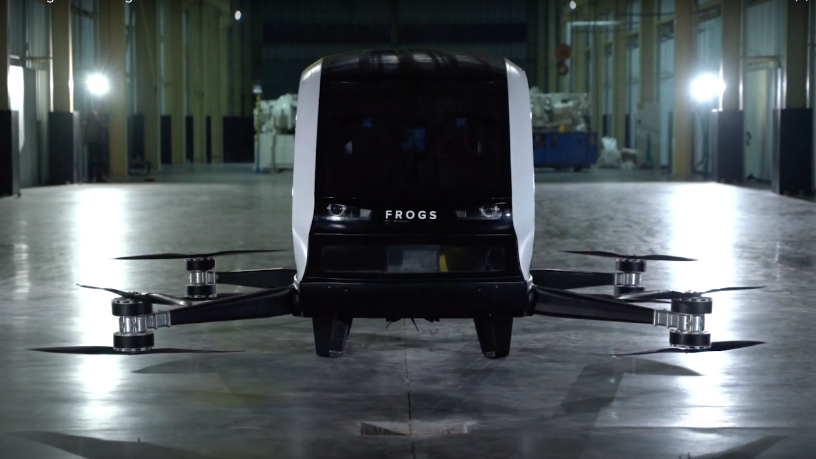

FROGS: Overcoming challenges to launch Indonesia's first drone-taxi for daily commutes

The Yogyakarta-based startup backed by UMG Idealab seeks more technical resources to launch Indonesia's first homegrown “flying taxi,” after the success of its agritech drones

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

Have you ever bought expensive equipment but seldom used it? Do you want to try the latest electronic gadgets at low cost? Try this online sharing and rental platform

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Oyika wants to help 30,000 Indonesian riders switch to electric motorcycles

With unlimited battery swaps and round-the-clock service, the Singapore startup is targeting ride-hailing and delivery drivers in Indonesia, a market with a growing appetite for electric motorcycles

Chinese startup Xianghuanji takes a gamble on smartphone leasing

Now you can rent the newest phones for half the price of an upgrade

DORM: New-generation housing for Indonesia’s tech-savvy, community-driven students

Combining online features with offline services, DORM goes way beyond what the market typically offers in student accommodation

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

Fintech startup Xendit launches aid program for Indonesian businesses amid Covid-19 crisis

Xendit is helping more SMEs go online by waiving transaction fees for its digital payments solution for the first month

eCooltra CEO: Offline-to-online leader in two-wheel sharing economy

Timo Buetefisch, the CEO and co-founder of Europe's largest scooter rental firm Cooltra, discusses the successful offline-to-online shift to scooter-sharing app eCooltra

With a new focus on smart clinics, healthcare SaaS startup Medigo offers Covid-19 testing

A pivot to revenue-sharing and partnerships to provide Covid-19 testing has given Medigo a fighting chance, with a new funding round on the cards

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

Backed by Kleiner Perkins, Spotahome clinches Spain’s first Silicon Valley-led funding

Now in Europe’s US$500 billion home rental market, the Spanish proptech will soon expand to LatAm, the US and Asia

EV maker Xpeng Motors partners Didi to offer car rentals and better charging services

Besides working with China's largest ride-hailing platform, Xpeng Motors has also connected to the charging networks of EV maker NIO and TELD, China's biggest EV charging network

Sorry, we couldn’t find any matches for“Rent the Runway”.