Repsol Foundation

-

DATABASE (62)

-

ARTICLES (89)

The Repsol Foundation, part of the Repsol Group, is committed to improving social and environmental outcomes.Repsol has launched a €50m social investment fund to be used in developing a portfolio of social enterprises focused on energy transition and social inclusion of vulnerable groups in Spain. The firm invested €9,5m during 2018.

The Repsol Foundation, part of the Repsol Group, is committed to improving social and environmental outcomes.Repsol has launched a €50m social investment fund to be used in developing a portfolio of social enterprises focused on energy transition and social inclusion of vulnerable groups in Spain. The firm invested €9,5m during 2018.

Based in the municipality of Falkenburg, the Bertebos Foundation was founded in 1994 by Olof and Brita Stenström to promote education and scientific research in the food industry. The family-run foundation holds 30% shares in the family business Bertegruppen AB. The group’s food brand portfolio includes producer of ice-cream and sorbets SIA Glass and Berte Qvarn that runs a dairy farm, flour mill and bakery.

Based in the municipality of Falkenburg, the Bertebos Foundation was founded in 1994 by Olof and Brita Stenström to promote education and scientific research in the food industry. The family-run foundation holds 30% shares in the family business Bertegruppen AB. The group’s food brand portfolio includes producer of ice-cream and sorbets SIA Glass and Berte Qvarn that runs a dairy farm, flour mill and bakery.

Based in San Francisco, the Mulago Foundation is a philanthropic foundation designed to carry on the life work of pediatrician Rainer Arnhold who died in 1993 while working in the mountains of Bolivia. He originally set up the Mulago Foundation in 1968, naming it after a hospital in Uganda. His Jewish family, bankers for generations, continued to support the foundation for impact investing across diverse sectors and geographies, with scalable solutions to alleviate poverty.It has invested in 61 companies to date. Successful ventures include: Kenya’s Komaza that raised $28m in its 2020 Series B and Myanmar’s Proximity Finance, a fintech for small-holder farmers that raised $14m in 2020. Komaza helps poor families turn dry land into small-scale, income-generating tree farms, benefiting more than 2m farmers in Sub-Saharan Africa.

Based in San Francisco, the Mulago Foundation is a philanthropic foundation designed to carry on the life work of pediatrician Rainer Arnhold who died in 1993 while working in the mountains of Bolivia. He originally set up the Mulago Foundation in 1968, naming it after a hospital in Uganda. His Jewish family, bankers for generations, continued to support the foundation for impact investing across diverse sectors and geographies, with scalable solutions to alleviate poverty.It has invested in 61 companies to date. Successful ventures include: Kenya’s Komaza that raised $28m in its 2020 Series B and Myanmar’s Proximity Finance, a fintech for small-holder farmers that raised $14m in 2020. Komaza helps poor families turn dry land into small-scale, income-generating tree farms, benefiting more than 2m farmers in Sub-Saharan Africa.

Shell Foundation is the not-for-profit investment arm of the global energy giant Shell. Based in London, the foundation was set up in 2000 to invest in social and environmental impact companies, including startups with the potential to reach out to over 10m low-income consumers and achieve financial viability within 10 years. The foundation mainly invests at the pre-seed and seed funding stage and currently has 77 startups in its portfolio. In January 2021, it joined the $790,000 seed round of African agritech social enterprise AgroCenta and also gave a $350,000 grant to sustainable mobility platform Easy Matatu in Uganda.

Shell Foundation is the not-for-profit investment arm of the global energy giant Shell. Based in London, the foundation was set up in 2000 to invest in social and environmental impact companies, including startups with the potential to reach out to over 10m low-income consumers and achieve financial viability within 10 years. The foundation mainly invests at the pre-seed and seed funding stage and currently has 77 startups in its portfolio. In January 2021, it joined the $790,000 seed round of African agritech social enterprise AgroCenta and also gave a $350,000 grant to sustainable mobility platform Easy Matatu in Uganda.

The Ford Foundation is an international philanthropy established in 1936 by Edsel Ford, son of the founder of the Ford Motor Company Henry Ford. The foundation funds initiatives in various fields with the goal of advancing human welfare. Headquartered in New York, it has offices outside the US, including an Indonesian branch that was opened in 1953. In 2014, it awarded a total of US$750,000 to 12 projects through Cipta Media Seluler (CMS), an open grant that supports social change initiatives powered by mobile phone-related technologies in Indonesia.

The Ford Foundation is an international philanthropy established in 1936 by Edsel Ford, son of the founder of the Ford Motor Company Henry Ford. The foundation funds initiatives in various fields with the goal of advancing human welfare. Headquartered in New York, it has offices outside the US, including an Indonesian branch that was opened in 1953. In 2014, it awarded a total of US$750,000 to 12 projects through Cipta Media Seluler (CMS), an open grant that supports social change initiatives powered by mobile phone-related technologies in Indonesia.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

H&M Foundation is a non-profit foundation established in 2013. It is privately funded by the Stefan Persson family, the founders and major shareholders of the H&M Group, who have donated SEK 1.5 billion to it to date. The foundation aims to help accelerate progress towards the UN Sustainable Development Goals 2030, by developing, funding and sharing solutions to address the world’s most urgent issues. It has a particular focus on promoting a planet-positive fashion industry and on building inclusive societies.Tackling mostly challenges associated with the fast fashion industry and its supply chain, H&M Foundation advocates for more sustainable practices across the fashion value chain and more inclusive business practices. The foundation is also actively involved in providing emergency relief for natural disasters or pandemics. It also aims to encourage innovation that promotes social change and sustainability. To this end, it provides startups support in accelerating and scale new technologies. It also runs the Global Change Award. Dubbed the Nobel Prize of fashion, this aims to recognise disruptive innovations that have the potential to make fashion more sustainable, and transform the way garments are designed, produced, shipped, bought, used and recycled.

H&M Foundation is a non-profit foundation established in 2013. It is privately funded by the Stefan Persson family, the founders and major shareholders of the H&M Group, who have donated SEK 1.5 billion to it to date. The foundation aims to help accelerate progress towards the UN Sustainable Development Goals 2030, by developing, funding and sharing solutions to address the world’s most urgent issues. It has a particular focus on promoting a planet-positive fashion industry and on building inclusive societies.Tackling mostly challenges associated with the fast fashion industry and its supply chain, H&M Foundation advocates for more sustainable practices across the fashion value chain and more inclusive business practices. The foundation is also actively involved in providing emergency relief for natural disasters or pandemics. It also aims to encourage innovation that promotes social change and sustainability. To this end, it provides startups support in accelerating and scale new technologies. It also runs the Global Change Award. Dubbed the Nobel Prize of fashion, this aims to recognise disruptive innovations that have the potential to make fashion more sustainable, and transform the way garments are designed, produced, shipped, bought, used and recycled.

The Plantbase Foundation is a non-profit institution run by entrepreneur and impact investor Willem Blom based in The Netherlands. Most of the Plantbase activities are backed by donors. At least 80% of the donations are used to support enterprises that facilitate the shift from animal agriculture to a vegan lifestyle. The foundation has invested in foodtechs involved in the meat, fish and dairy industries; as well as food delivery and apps. Its portfolio includes fast-growing startups like Heura, Meatable, Livekindly and Mission Barns. It also works with investment partners like Kale United, Mile High Vegan Network, Vegan Entrepreneurs Network and GlassWall Syndicate.

The Plantbase Foundation is a non-profit institution run by entrepreneur and impact investor Willem Blom based in The Netherlands. Most of the Plantbase activities are backed by donors. At least 80% of the donations are used to support enterprises that facilitate the shift from animal agriculture to a vegan lifestyle. The foundation has invested in foodtechs involved in the meat, fish and dairy industries; as well as food delivery and apps. Its portfolio includes fast-growing startups like Heura, Meatable, Livekindly and Mission Barns. It also works with investment partners like Kale United, Mile High Vegan Network, Vegan Entrepreneurs Network and GlassWall Syndicate.

Spain's first social impact investment fund Creas Foundation invests in business projects which prioritize the creation of social and environmental value. It acts as an investor and partner in financial, management and strategic decisions. Its goal is to facilitate access to funding and accelerate growth of social businesses which have an innovative approach and sustainable income model. It has fixed a target of €30m to invest in social enterprise startups. The fund offers participatory loans or capital injections ranging from €5,000 to €25,000.

Spain's first social impact investment fund Creas Foundation invests in business projects which prioritize the creation of social and environmental value. It acts as an investor and partner in financial, management and strategic decisions. Its goal is to facilitate access to funding and accelerate growth of social businesses which have an innovative approach and sustainable income model. It has fixed a target of €30m to invest in social enterprise startups. The fund offers participatory loans or capital injections ranging from €5,000 to €25,000.

Falkenbergs Sparbanks Foundation

Falkenbergs Sparbanks Foundation is part of the Swedish savings bank in the municpality of Falkenberg. Falkenbergs Sparbank is the 37th largest bank in Sweden in terms of total assets.

Falkenbergs Sparbanks Foundation is part of the Swedish savings bank in the municpality of Falkenberg. Falkenbergs Sparbank is the 37th largest bank in Sweden in terms of total assets.

Red Avenue Foundation was founded by Zhang Ning, chairwoman of Red Avenue New Materials Group, in 2002. It focuses on various areas, including student assistance, disaster relief and environmental protection. It mainly invests in startups that offer the highest social return on investment (SROI).

Red Avenue Foundation was founded by Zhang Ning, chairwoman of Red Avenue New Materials Group, in 2002. It focuses on various areas, including student assistance, disaster relief and environmental protection. It mainly invests in startups that offer the highest social return on investment (SROI).

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Founder of Inibudi

Najelaa Shihab is an education philanthropist. She is the elder sister of Najwa Shihab, a well-known Indonesian presenter. After graduating in 1997, Najelaa established an international curriculum school foundation in 1999. She completed a master’s in 2002, also from her alma mater Faculty of Psychology, University of Indonesia.In 2016, she created Sinedu, an online kid-safe educational movies platform and Youthmanual, a career portal for youths. She also founded an Education and Policy Research Institution in 2015 and a teachers’ professional development and school foundation in 2014. She also supports Indonesia’s breastfeeding mothers’ association AIMI.

Najelaa Shihab is an education philanthropist. She is the elder sister of Najwa Shihab, a well-known Indonesian presenter. After graduating in 1997, Najelaa established an international curriculum school foundation in 1999. She completed a master’s in 2002, also from her alma mater Faculty of Psychology, University of Indonesia.In 2016, she created Sinedu, an online kid-safe educational movies platform and Youthmanual, a career portal for youths. She also founded an Education and Policy Research Institution in 2015 and a teachers’ professional development and school foundation in 2014. She also supports Indonesia’s breastfeeding mothers’ association AIMI.

Co-Founder and Chairman of iGrow

Agricultural and food engineer Muhaimin Iqbal graduated from Bogor Institute of Agriculture in 1985. He has over 10 years of experience in the plantation sector and has founded several companies including 101 Salad and Natural Resources Indonesia. He is currently the chairman for Gerai Dinar Group, Indonesia Waqf Fund Foundation, Biomass Energy Indonesia and Badr Interactive.

Agricultural and food engineer Muhaimin Iqbal graduated from Bogor Institute of Agriculture in 1985. He has over 10 years of experience in the plantation sector and has founded several companies including 101 Salad and Natural Resources Indonesia. He is currently the chairman for Gerai Dinar Group, Indonesia Waqf Fund Foundation, Biomass Energy Indonesia and Badr Interactive.

CAS Investment Management Co., Ltd.

Established in 1987 by the National Economic Commission and the Chinese Academy of Sciences as the Foundation for Economic Development, the renamed CAS Investment Management Co., Ltd. was transformed into a limited liability company in 2006. It has invested in and made profitable more than 300 technology projects.

Established in 1987 by the National Economic Commission and the Chinese Academy of Sciences as the Foundation for Economic Development, the renamed CAS Investment Management Co., Ltd. was transformed into a limited liability company in 2006. It has invested in and made profitable more than 300 technology projects.

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

VEnvirotech: Organic waste converted at source into biodegradable raw bioplastic

The Spanish startup presents an innovative circular business model to stand out in the ever-growing bioplastics sector with its on-site smart-waste container and garbage-consuming bacteria

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Koiki: Delivering social advancement, one parcel at a time

Social enterprise startup Koiki seeks to reduce the carbon footprint of e-commerce deliveries and provide jobs for Spain's most vulnerable people

The death of Wazypark: A tale of too much money, and no business model

It was an investors’ and media darling. But the story of Wazypark got bitter in 2017, when management disputes and ballooning losses culminated in the startup’s final days

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

The B2B platform for greater route efficiency and sustainability in trucking raised €17m despite supply chain disruptions, economic uncertainties during Covid-19

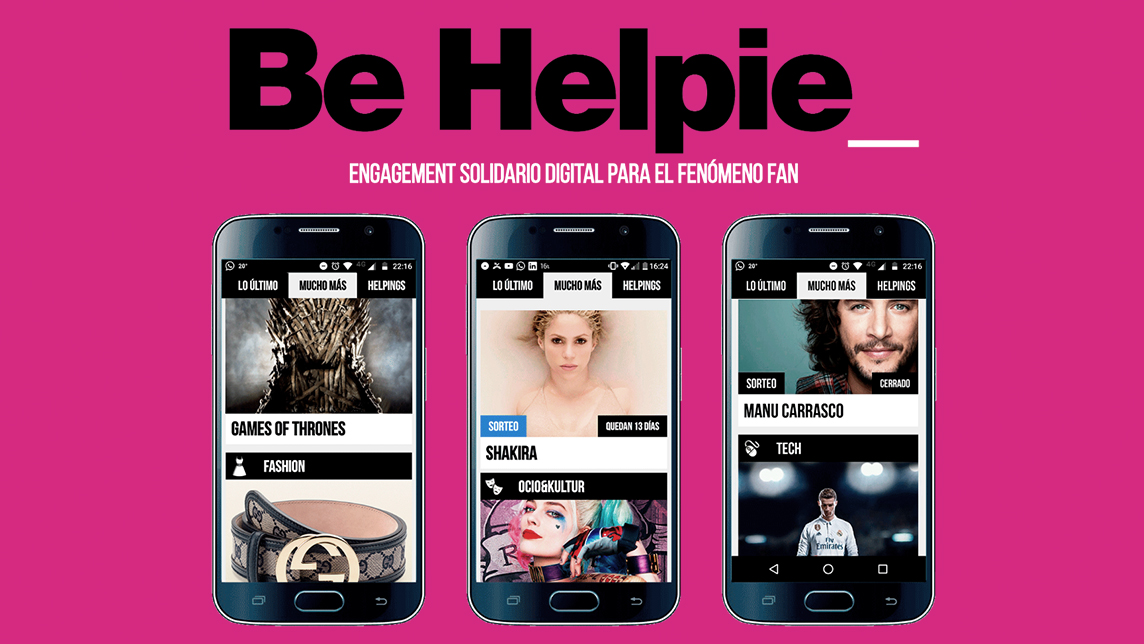

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Sorry, we couldn’t find any matches for“Repsol Foundation”.