SME

-

DATABASE (13)

-

ARTICLES (39)

Ellipsis Technologies provides startups with strategic, commercial, financial and operational advising. It identifies new seed ventures from IT and e-commerce startups, offering mentoring and investing (direct and sweat equity). It also helps SME and big corporations in their digital transformation. Its founder and CEO is Marc Costacela, one of Atomian’s advisors.

Ellipsis Technologies provides startups with strategic, commercial, financial and operational advising. It identifies new seed ventures from IT and e-commerce startups, offering mentoring and investing (direct and sweat equity). It also helps SME and big corporations in their digital transformation. Its founder and CEO is Marc Costacela, one of Atomian’s advisors.

Co-founder and CTO of Prodsmart

Samuel Martins is an experienced software developer and founder of motorbike dealership LxMotos. He was a systems administrator at his alma mater Superior Technical Institute in Lisbon before joining IT consulting firm Crazydog in 2008 as a systems administrator and developer.In 2012, Martins and Crazydog founder Gonçalo Fortes began creating AI-powered software to improve the efficiency and productivity of local factories. In 2014, Fortes and Martins decided to team up as co-founders of Prodsmart to focus on providing IoT solutions to help SME firms to transform into digital manufacturers.

Samuel Martins is an experienced software developer and founder of motorbike dealership LxMotos. He was a systems administrator at his alma mater Superior Technical Institute in Lisbon before joining IT consulting firm Crazydog in 2008 as a systems administrator and developer.In 2012, Martins and Crazydog founder Gonçalo Fortes began creating AI-powered software to improve the efficiency and productivity of local factories. In 2014, Fortes and Martins decided to team up as co-founders of Prodsmart to focus on providing IoT solutions to help SME firms to transform into digital manufacturers.

Agentes y Asesores Financieros

Agentes y Asesores Financieros is a Madrid-based small and medium enterprise (SME) founded in 2003 that has evolved from traditional legal and financial advice to one focused on real estate asset management and advisory services and management of financial investments. It is led by José Antonio Bautista Molero.

Agentes y Asesores Financieros is a Madrid-based small and medium enterprise (SME) founded in 2003 that has evolved from traditional legal and financial advice to one focused on real estate asset management and advisory services and management of financial investments. It is led by José Antonio Bautista Molero.

Co-founder and CEO of Halofina

Adjie Wicaksana graduated from the Bandung Institute of Technology (ITB) with a degree in Industrial Engineering. He also holds a master's in Social Entrepreneurship from the University of Southern California. Wicaksana is active in the Social Organization Center for Innovation and Community Development, the Indonesian Youth Student Association in the United States (Permias) Los Angeles and the Global Shapers Community - World Economic Forum. He is also a facilitator, specializing in business financial management, for BEKRAF's (Indonesia's Creative Economy Agency) Creative SME Finance Class Training Series. Wicaksana started Halofina with Eko Pratomo in 2017.

Adjie Wicaksana graduated from the Bandung Institute of Technology (ITB) with a degree in Industrial Engineering. He also holds a master's in Social Entrepreneurship from the University of Southern California. Wicaksana is active in the Social Organization Center for Innovation and Community Development, the Indonesian Youth Student Association in the United States (Permias) Los Angeles and the Global Shapers Community - World Economic Forum. He is also a facilitator, specializing in business financial management, for BEKRAF's (Indonesia's Creative Economy Agency) Creative SME Finance Class Training Series. Wicaksana started Halofina with Eko Pratomo in 2017.

Established in 2003, COTEC Portugal is a business association which seeks to advance technological development and innovation cooperation. Its network comprises multinationals and SMEs operating across most sectors whose gross added value represents more than 16% of Portugal's national GDP and 8% of private employment. COTEC Portugal has an Innovative SME Network that seeks to promote public knowledge of its members, attract investment and help them grow internationally. The president of Portugal is the honorary president of COTEC Portugal.

Established in 2003, COTEC Portugal is a business association which seeks to advance technological development and innovation cooperation. Its network comprises multinationals and SMEs operating across most sectors whose gross added value represents more than 16% of Portugal's national GDP and 8% of private employment. COTEC Portugal has an Innovative SME Network that seeks to promote public knowledge of its members, attract investment and help them grow internationally. The president of Portugal is the honorary president of COTEC Portugal.

United Fund was founded in 2015 to provide Zhejiang's SME businesses with support in financing, business collaborations, operations and management. It now manages total of assets worth RMB 3bn.

United Fund was founded in 2015 to provide Zhejiang's SME businesses with support in financing, business collaborations, operations and management. It now manages total of assets worth RMB 3bn.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

The first equity crowdfunding company to be licensed in Indonesia, Santara started locally in Yogyakarta to help SMEs in Indonesia, attract investors and raise capital.

The first equity crowdfunding company to be licensed in Indonesia, Santara started locally in Yogyakarta to help SMEs in Indonesia, attract investors and raise capital.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

Connecting cashflow-challenged SMEs with individual lenders seeking alternative investments, P2P lending marketplace Investree processes loans in just three days, with no default to date.

Connecting cashflow-challenged SMEs with individual lenders seeking alternative investments, P2P lending marketplace Investree processes loans in just three days, with no default to date.

Triditive's AMCELL is the first automated additive manufacturing technology to enable round-the-clock mass production, empowering SME manufacturers to access Industry 4.0.

Triditive's AMCELL is the first automated additive manufacturing technology to enable round-the-clock mass production, empowering SME manufacturers to access Industry 4.0.

With €42m in investment and trusted by microfinance institutions and unicorns, Mambu is an agile, customizable cloud-based banking architecture SaaS, quick to deploy and transact.

With €42m in investment and trusted by microfinance institutions and unicorns, Mambu is an agile, customizable cloud-based banking architecture SaaS, quick to deploy and transact.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

NANOxARCH: Pioneering awareness and use of sustainable materials in China

Founder Lei Yuxi reckons Covid-19 could usher China into a new era of sustainability, as her startup seeks to make sustainable materials more affordable

Education for all: Interview with DANAdidik CEO Dipo Satria

The student loan startup is narrowing its focus to funding students planning on healthcare careers, and it also hopes to attract more financing from impact investors

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

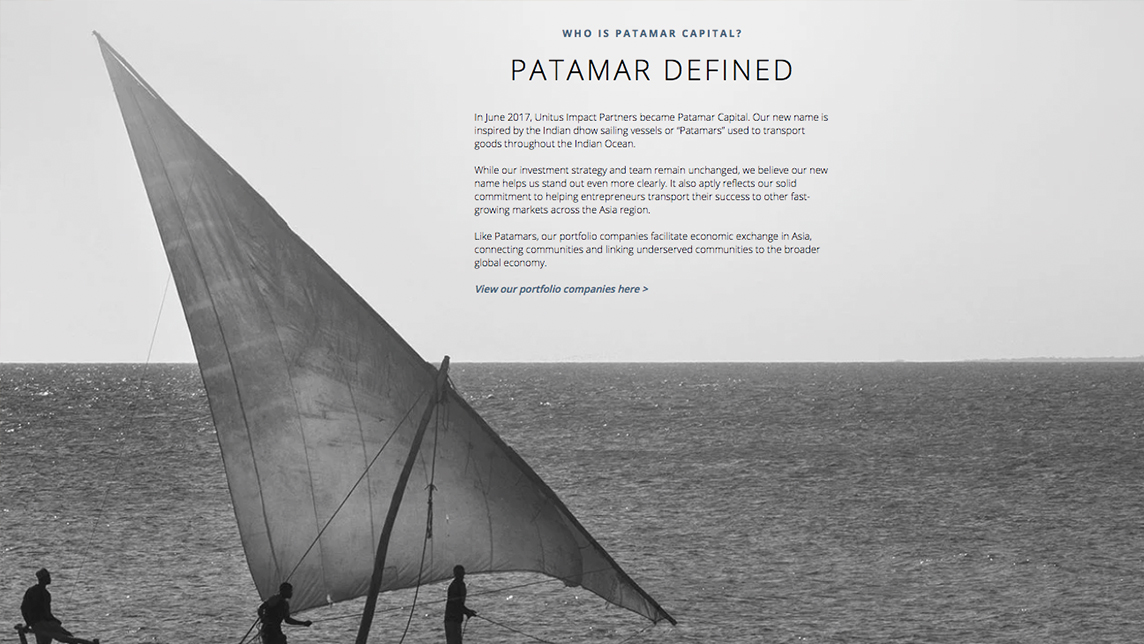

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

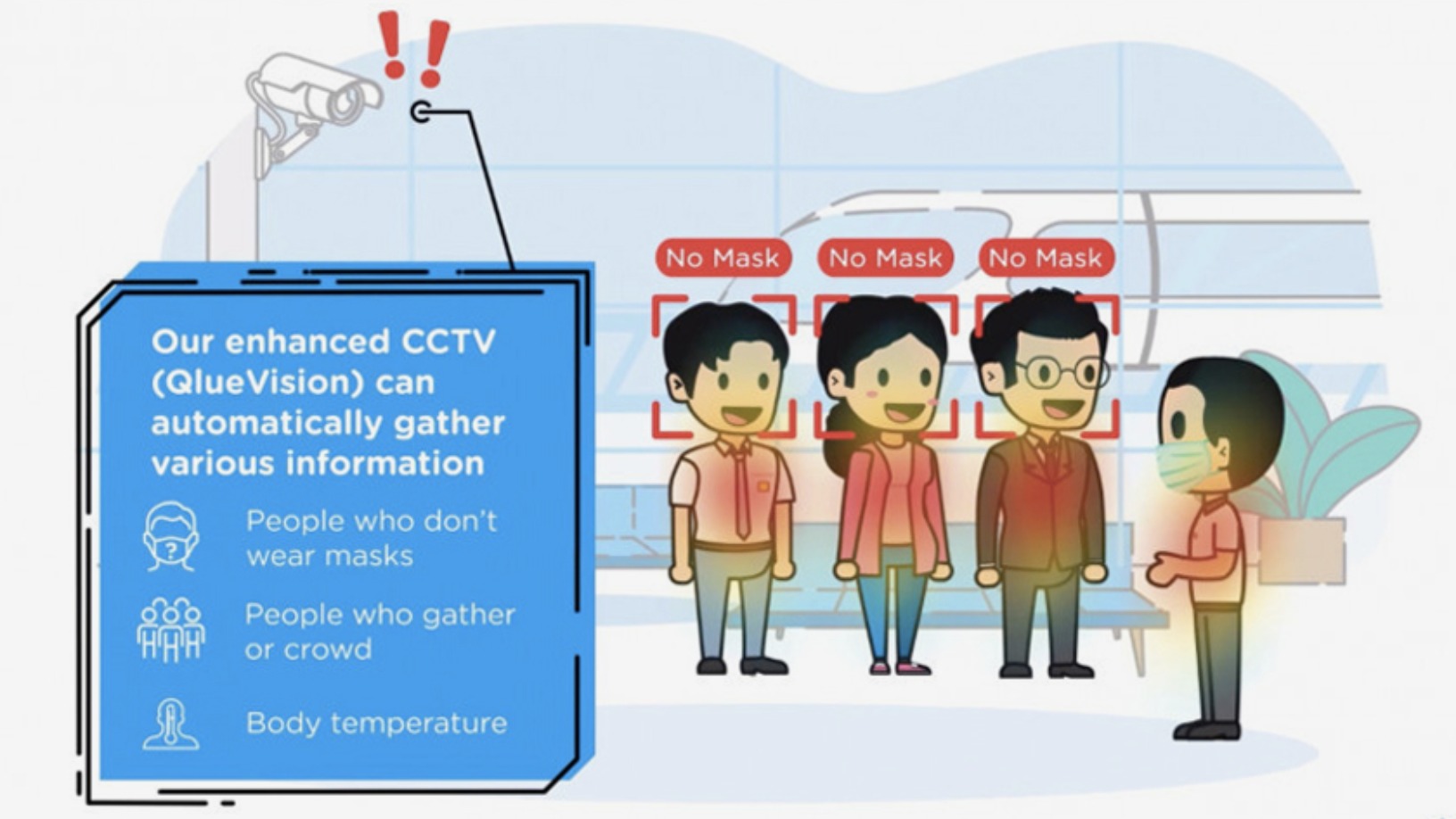

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Wahyoo wins seed funding in push to upgrade Indonesia's street food sector

It's launching a B2C app and an integrated POS system in 2019 to boost street food sales and hawkers' productivity, CEO Peter Shearer tells CompassList

Sorry, we couldn’t find any matches for“SME”.