Sinar Mas Digital Ventures

-

DATABASE (538)

-

ARTICLES (408)

Rubio Impact Ventures (formerly Social Impact Ventures)

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Indonesia's first digital signature service offers a convenient, efficient and secure tool for individuals and organizations upgrading their manual processes.

Indonesia's first digital signature service offers a convenient, efficient and secure tool for individuals and organizations upgrading their manual processes.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Easo Ventures is a Spanish early-stage VC established in 2018 in the Basque city of San Sebastian, offering selected companies either €50,000 or €100,000 according to their development stage. It currently has 29 companies in its portfolio across verticals and technologies, but all must be based in Spain. Its most recent investments include the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and the €1.2m post-seed round of drone company Alerion.

Easo Ventures is a Spanish early-stage VC established in 2018 in the Basque city of San Sebastian, offering selected companies either €50,000 or €100,000 according to their development stage. It currently has 29 companies in its portfolio across verticals and technologies, but all must be based in Spain. Its most recent investments include the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and the €1.2m post-seed round of drone company Alerion.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Founded and headed by Susan Choe in 2018, Katalyst Ventures is based in San Francisco with a debut fund of $34m raised in 2018. Choe is also a partner at another Zipline investor Visionnaire Ventures (VV) also based in Silicon Valley. Katalyst invests in seed and early-stage tech startups with human-centric solutions. About 45% of the VC funds are invested in startups with women as CEO or CTO. By February 2020, the Kalatyst portfolio included 22 enterprises and three exits.The founder of Outspark was removed as CEO by the board of directors due to disagreements over the sale of Outspark. She had used her own money in 2006 to create Outspark, a data-driven publishing platform for game developers. Outspark was eventually sold to Axel Springer and Choe went left the company to join Taizo Son’s venture capital group. In 2013, VV was set up to support tech startups in the US. Choe had worked for Yahoo! and also was the COO of the public-listed holding company of South Korean search and media company NHN.

Partech Ventures is a global venture capital firm established in San Francisco in 1982 as Paribas Technologies, a subsidiary of French bank Paribas that currently holds €1.3 billion in assets under its management. In addition to San Francisco, Partech also has offices in Paris, Berlin and Dakar, Senegal, with the latter focused exclusively on African startups. The company is now based in Paris and has invested in over 300 companies across different funding stages with 48 exits to date.

Partech Ventures is a global venture capital firm established in San Francisco in 1982 as Paribas Technologies, a subsidiary of French bank Paribas that currently holds €1.3 billion in assets under its management. In addition to San Francisco, Partech also has offices in Paris, Berlin and Dakar, Senegal, with the latter focused exclusively on African startups. The company is now based in Paris and has invested in over 300 companies across different funding stages with 48 exits to date.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Ufi Ventures is the investment arm of Ufi VocTech Trust, a UK-based grant-funding body created following the sale of Learndirect in 2010. With an initial fund of £50m, the organization is focussed on delivering an increase in the scale of vocational learning. The firm can invest from £150,000 to £1m as equity or debt in early-stage companies. To date, its disclosed investments include many UK public-private training initiatives, plus seed investments in two tech startups: soft-skills VR software Bodyswaps (£470,000) and childcare marketplace Kinderly (£325,000).

Ufi Ventures is the investment arm of Ufi VocTech Trust, a UK-based grant-funding body created following the sale of Learndirect in 2010. With an initial fund of £50m, the organization is focussed on delivering an increase in the scale of vocational learning. The firm can invest from £150,000 to £1m as equity or debt in early-stage companies. To date, its disclosed investments include many UK public-private training initiatives, plus seed investments in two tech startups: soft-skills VR software Bodyswaps (£470,000) and childcare marketplace Kinderly (£325,000).

Co-founder and CEO of Farmlink

A former computer programmer turned investment banker, Liu Yuan spent two years on Wall Street before returning to China, where he founded two startups, zhekouwang (a discount information site) and ximi.com (online store selling snacks to office workers). Both ventures folded up; Farmlink is his latest undertaking.

A former computer programmer turned investment banker, Liu Yuan spent two years on Wall Street before returning to China, where he founded two startups, zhekouwang (a discount information site) and ximi.com (online store selling snacks to office workers). Both ventures folded up; Farmlink is his latest undertaking.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

Established in 2014 by Niu Wenwen, chief editor, president and publisher of Entrepreneur magazine, Dark Horse Ventures invests in early-stage startups in the internet, consumption upgrade, pan-entertainment and high-tech fields. Its backers include many well-known founders, institutional and individual investors such as Liu Qiangdong, Yao Jingbo, Wang Changtian, Bobo Xu, Sequoia Capital China, etc.

Established in 2014 by Niu Wenwen, chief editor, president and publisher of Entrepreneur magazine, Dark Horse Ventures invests in early-stage startups in the internet, consumption upgrade, pan-entertainment and high-tech fields. Its backers include many well-known founders, institutional and individual investors such as Liu Qiangdong, Yao Jingbo, Wang Changtian, Bobo Xu, Sequoia Capital China, etc.

Cashing in on social media and curated art mania, Printerous is fast becoming Indonesia’s sassiest digital printing and photo studio for artists and event managers.

Cashing in on social media and curated art mania, Printerous is fast becoming Indonesia’s sassiest digital printing and photo studio for artists and event managers.

Based in Sofia, BrightCap ventures is an early-stage VC supported by the European Investment Fund and Ministry of Economy of Bulgaria. Founded in 2018, the company has invested in seven startups based in various countries across market verticals. To date, it has managed one exit for London-based Cloudpipes, a cloud integration as a service manager.Its most recent investments include co-leading a post-seed round with Begin Capital to raise €2m for Spanish femtech Woom and a funding round for Enview, a 3D geospacial analytics company based in the US.

Based in Sofia, BrightCap ventures is an early-stage VC supported by the European Investment Fund and Ministry of Economy of Bulgaria. Founded in 2018, the company has invested in seven startups based in various countries across market verticals. To date, it has managed one exit for London-based Cloudpipes, a cloud integration as a service manager.Its most recent investments include co-leading a post-seed round with Begin Capital to raise €2m for Spanish femtech Woom and a funding round for Enview, a 3D geospacial analytics company based in the US.

Amidst a flurry of funding from overseas, local players urge a review of startup ownership rules in Indonesia

East Ventures raises funds, teams up with state agency to produce Covid-19 tests for Indonesia

East Ventures investee Nusantics has been working with state researchers to produce the prototype; expects mass production of the test kits soon

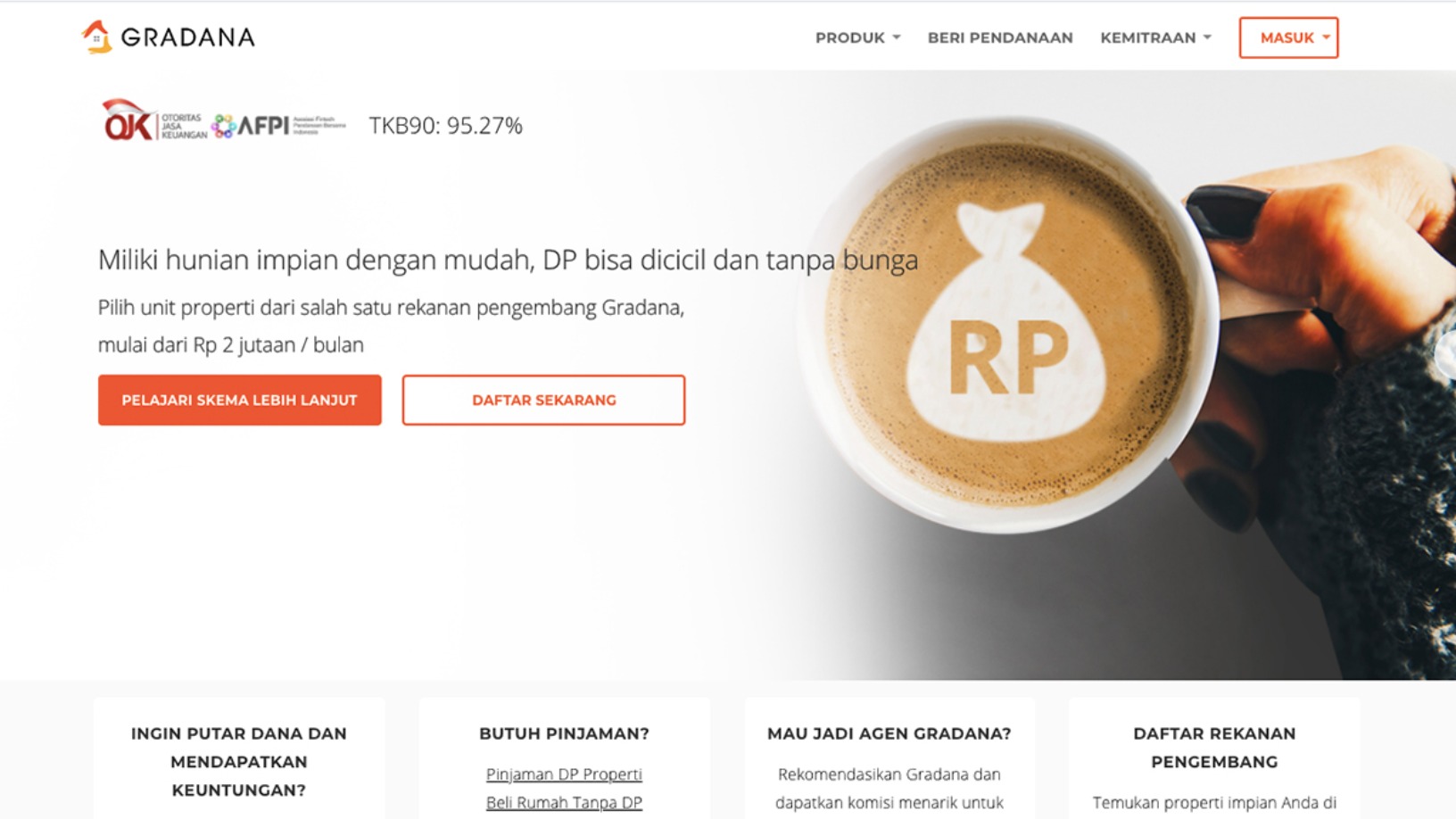

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

Alberto Gómez, Spain's blockchain evangelist

Alberto Gómez Toribio has been pioneering blockchain technology in Spain since 2013. He convinced the Bank of Spain to authorize capital raising with cryptocurrency and built the world's first decentralized Bitcoin exchange

Clicars: Bringing certainty to buying a used car

Spanish online used car dealer aims to sell 10,000 vehicles by 2021 via its unique sales offer that has booked it €50 million in sales since 2016

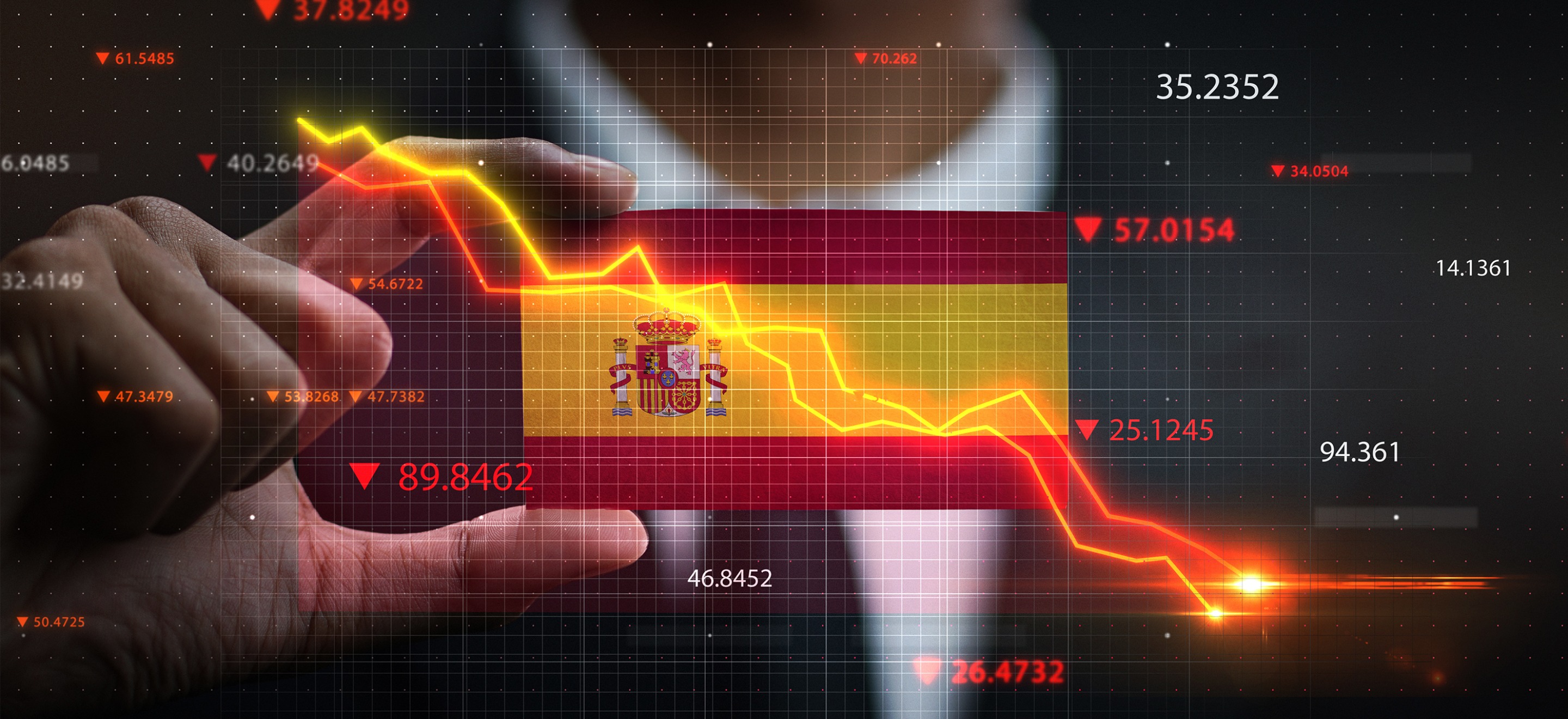

Spain's gig and sharing economy startups flourish, despite barrage of restrictions

Startups like Glovo and Spotahome topped fundings raised in 2018 despite local regulatory risks, as Spanish tech firms conquer overseas markets

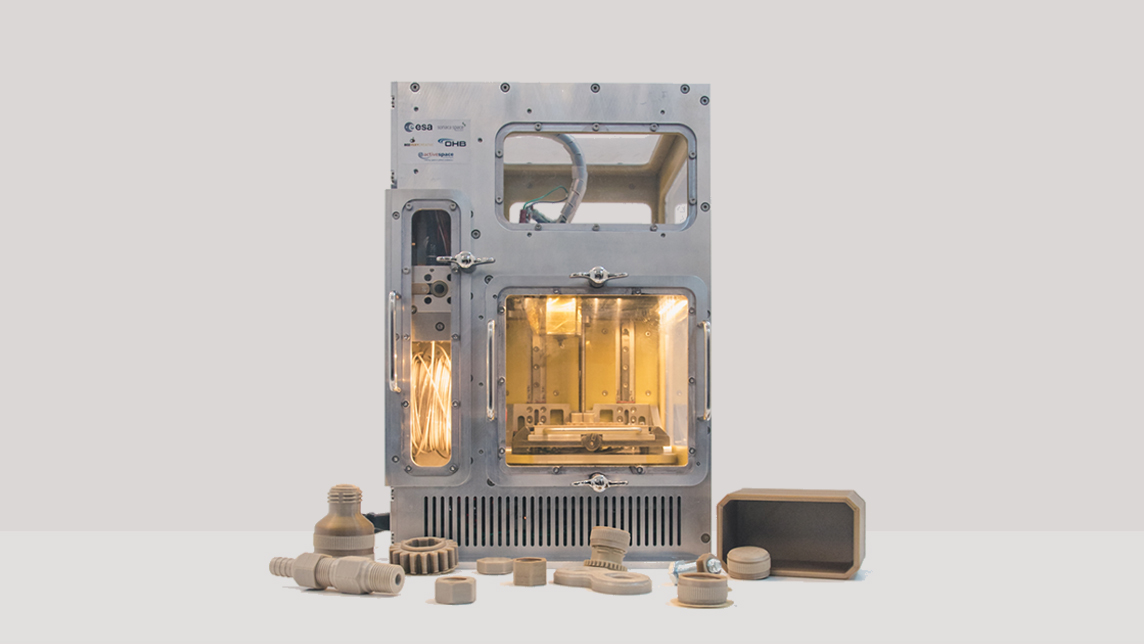

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

Psquared: Providing flexible workplaces to help early-stage startups

The Barcelona-based startup converts a variety of buildings to hybrid office spaces for flexible work brought about by Covid-19, includes a reservations system to manage desk and meeting spaces

Sorry, we couldn’t find any matches for“Sinar Mas Digital Ventures”.