Sinar Mas Digital Ventures

-

DATABASE (538)

-

ARTICLES (408)

Co-founder, CTO, COO. of HypeLabs

Established in 2015, HypeLabs is the third startup founded by André Francisco. With over 20 years of experience as a developer and researcher, the Portuguese co-founder is the CTO and COO of HypeLabs.He co-founded WINK digital agency that lasted nine months until July 2015. He was also the founder and president of the Computer Science Club of his alma mater University of Oporto. He graduated in Computer Science in 2014 and has worked as a project manager for various IT projects like VideoJojos2011 and OpenJelly.

Established in 2015, HypeLabs is the third startup founded by André Francisco. With over 20 years of experience as a developer and researcher, the Portuguese co-founder is the CTO and COO of HypeLabs.He co-founded WINK digital agency that lasted nine months until July 2015. He was also the founder and president of the Computer Science Club of his alma mater University of Oporto. He graduated in Computer Science in 2014 and has worked as a project manager for various IT projects like VideoJojos2011 and OpenJelly.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Pere Valles is an entrepreneur and angel investor in the Spanish startup ecosystem, sitting on the board of several companies. Valles has been chairman of Spanish digital voting platform Scytl since 2004. In 2018, he was appointed CEO of travel platform Exoticca, which sells long haul touring holidays and has a presence in Spain, France and the UK. He had been a financial director of GlobalNet and a senior manager at KPMG's mergers & acquisitions group in the US.

Pere Valles is an entrepreneur and angel investor in the Spanish startup ecosystem, sitting on the board of several companies. Valles has been chairman of Spanish digital voting platform Scytl since 2004. In 2018, he was appointed CEO of travel platform Exoticca, which sells long haul touring holidays and has a presence in Spain, France and the UK. He had been a financial director of GlobalNet and a senior manager at KPMG's mergers & acquisitions group in the US.

BDMI is a New York-based VC company that is part of the global media group, Bertelsmann, which backs mainly companies in the new digital media ecosystem. The company usually invests through Series A and Series B rounds ranging from US$500,000 to US$5 million with reserves for follow-ons.Companies backed by BDMI get access to a vast network of media companies in the Bertelsmann group and benefit from their extensive media expertise with a global perspective.The firm’s portfolio includes startups from North America, Europe and Israel.

BDMI is a New York-based VC company that is part of the global media group, Bertelsmann, which backs mainly companies in the new digital media ecosystem. The company usually invests through Series A and Series B rounds ranging from US$500,000 to US$5 million with reserves for follow-ons.Companies backed by BDMI get access to a vast network of media companies in the Bertelsmann group and benefit from their extensive media expertise with a global perspective.The firm’s portfolio includes startups from North America, Europe and Israel.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

Chris Bouwer is a Barcelona-based angel investor, active in the Spanish tech ecosystem and known for backing startups including Delivery Hero, Fanly and Airhelp. More recently, he was the lead investor in a funding round by Polaroo, a mobile app that manages and automates household payments, as well as investing in Cobee, a compensation and benefits management SaaS. He’s currently Board Advisor in Cellulant, a financial service provider providing digital payments in Africa. Bouwer has a background in sales, with his last key position as VP of Sales (2007–2015) in Adyen, a Dutch PSP services fintech he co-founded.

Chris Bouwer is a Barcelona-based angel investor, active in the Spanish tech ecosystem and known for backing startups including Delivery Hero, Fanly and Airhelp. More recently, he was the lead investor in a funding round by Polaroo, a mobile app that manages and automates household payments, as well as investing in Cobee, a compensation and benefits management SaaS. He’s currently Board Advisor in Cellulant, a financial service provider providing digital payments in Africa. Bouwer has a background in sales, with his last key position as VP of Sales (2007–2015) in Adyen, a Dutch PSP services fintech he co-founded.

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

NEEQ-listed NewMargin Capital is a venture capital management firm founded in 2011 by the team of NewMargin Ventures. It focuses on early-stage companies in the TMT, energy efficiency and healthcare sectors.

NEEQ-listed NewMargin Capital is a venture capital management firm founded in 2011 by the team of NewMargin Ventures. It focuses on early-stage companies in the TMT, energy efficiency and healthcare sectors.

Kejora is a stage agnostic venture capital firm that focuses in investments in Southeast Asia. Since established in 2008, Kejora has expanded to three offices in Singapore, Philippines and Indonesia. It is headquartered in Jakarta, Indonesia.

Kejora is a stage agnostic venture capital firm that focuses in investments in Southeast Asia. Since established in 2008, Kejora has expanded to three offices in Singapore, Philippines and Indonesia. It is headquartered in Jakarta, Indonesia.

Founded in 2006, the Silicon Valley-based venture capital firm was one of the earliest to focus on seed investing. It has around US$1.3 billion under management and has backed more than 700 founders.

Founded in 2006, the Silicon Valley-based venture capital firm was one of the earliest to focus on seed investing. It has around US$1.3 billion under management and has backed more than 700 founders.

The venture arm of American cloud computing company Salesforce has invested in more than 150 companies since 2009.

The venture arm of American cloud computing company Salesforce has invested in more than 150 companies since 2009.

Established in 2007, Exago is an innovation management software and service provider for companies in 19 countries across four continents. Its clients include Shell, Carrefour and Barclays. Exago has offices in Lisbon, London, and São Paulo, Brazil.

Established in 2007, Exago is an innovation management software and service provider for companies in 19 countries across four continents. Its clients include Shell, Carrefour and Barclays. Exago has offices in Lisbon, London, and São Paulo, Brazil.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

A Linz-based pre-seed investor founded in 2015, the company currently has 17 companies in its portfolio. Its interests span market verticals and technologies, with tech and non-tech startups supported, and varied geographical locations across Europe. It also runs an online learning lab for startups called Zero21. Its most recent investments include the €2m seed round of Austrian second-hand electronics marketplace refurbed and the €300,000 pre-seed round of German interview platform-as-a-service LAMA.

A Linz-based pre-seed investor founded in 2015, the company currently has 17 companies in its portfolio. Its interests span market verticals and technologies, with tech and non-tech startups supported, and varied geographical locations across Europe. It also runs an online learning lab for startups called Zero21. Its most recent investments include the €2m seed round of Austrian second-hand electronics marketplace refurbed and the €300,000 pre-seed round of German interview platform-as-a-service LAMA.

Amidst a flurry of funding from overseas, local players urge a review of startup ownership rules in Indonesia

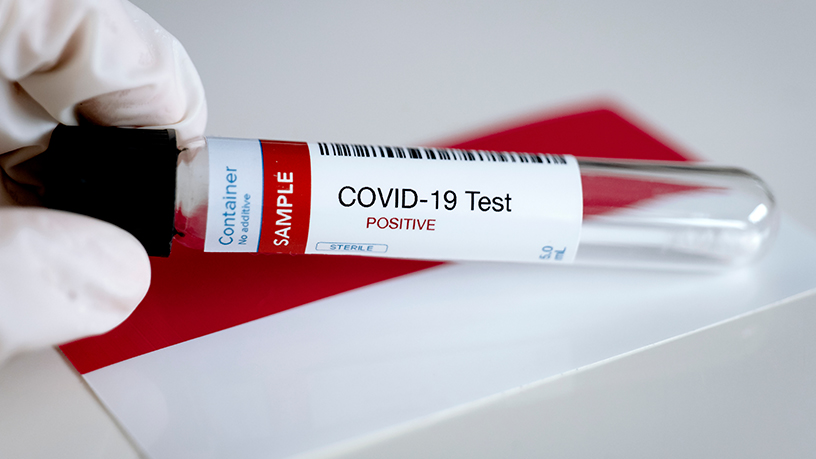

East Ventures raises funds, teams up with state agency to produce Covid-19 tests for Indonesia

East Ventures investee Nusantics has been working with state researchers to produce the prototype; expects mass production of the test kits soon

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

Alberto Gómez, Spain's blockchain evangelist

Alberto Gómez Toribio has been pioneering blockchain technology in Spain since 2013. He convinced the Bank of Spain to authorize capital raising with cryptocurrency and built the world's first decentralized Bitcoin exchange

Clicars: Bringing certainty to buying a used car

Spanish online used car dealer aims to sell 10,000 vehicles by 2021 via its unique sales offer that has booked it €50 million in sales since 2016

Spain's gig and sharing economy startups flourish, despite barrage of restrictions

Startups like Glovo and Spotahome topped fundings raised in 2018 despite local regulatory risks, as Spanish tech firms conquer overseas markets

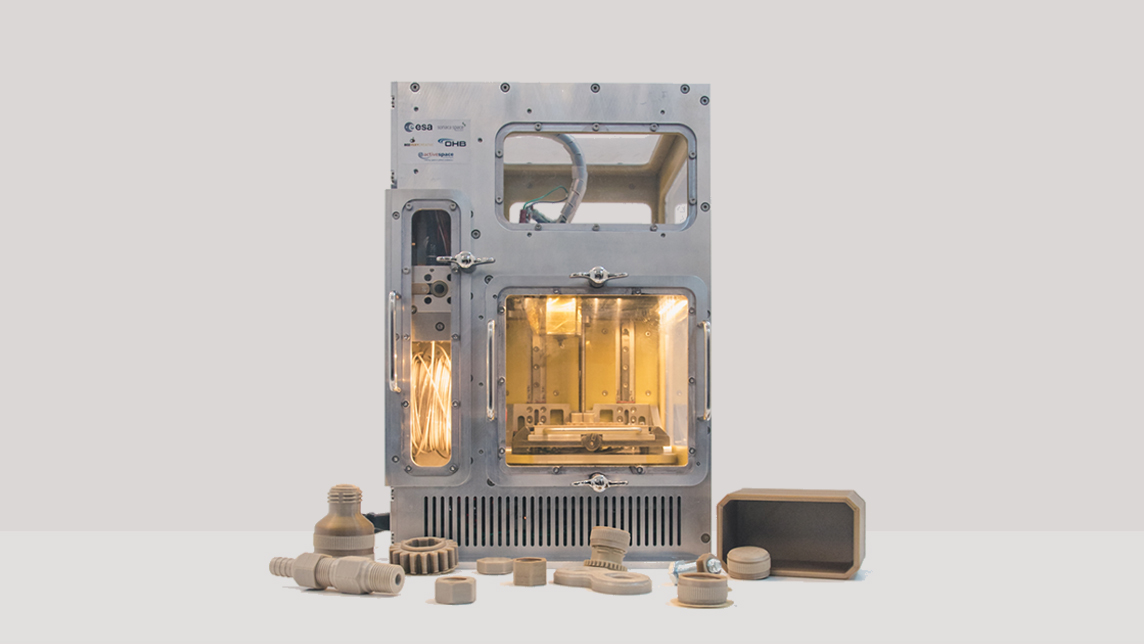

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

Psquared: Providing flexible workplaces to help early-stage startups

The Barcelona-based startup converts a variety of buildings to hybrid office spaces for flexible work brought about by Covid-19, includes a reservations system to manage desk and meeting spaces

Sorry, we couldn’t find any matches for“Sinar Mas Digital Ventures”.