Sinar Mas Digital Ventures

-

DATABASE (538)

-

ARTICLES (408)

Co-founder, COO of Bodyswaps

Julien Denoël is the Belgian co-founder and COO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and managing director at VR marketing agency Somewhere Else from 2016, before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Denoël has also been a guest lecturer in VR and AR at INSEEC business school in London and Geneva since 2017. Prior to this, Denoël also co-founded another VR agency, Exheb, in 2014, where he worked for almost three years as VR Producer. He also worked in digital marketing for Quotient Technology, formerly Coupons.com for two years, and in business development and marketing at the WorldOne agency for the same amount of time. Denoël holds both a master’s and a bachelor’s degree from HEC Management School in Liege, Belgium, the former in Marketing and Organization, the latter in Management.

Julien Denoël is the Belgian co-founder and COO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and managing director at VR marketing agency Somewhere Else from 2016, before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Denoël has also been a guest lecturer in VR and AR at INSEEC business school in London and Geneva since 2017. Prior to this, Denoël also co-founded another VR agency, Exheb, in 2014, where he worked for almost three years as VR Producer. He also worked in digital marketing for Quotient Technology, formerly Coupons.com for two years, and in business development and marketing at the WorldOne agency for the same amount of time. Denoël holds both a master’s and a bachelor’s degree from HEC Management School in Liege, Belgium, the former in Marketing and Organization, the latter in Management.

Co-founder of Refurbed

Peter Windischhofer graduated with a management degree in 2012 at Vienna University of Economics and Business, including a stint at the University of Hong Kong. Student internships included various roles at McKinsey & Company, Perella Weinberg Partners, Realtreuhand and Raiffeisen Bank.In 2012, he joined CUDOS Group and worked for over a year as a business analyst in Vienna. In 2013, he met Refurbed co-founder Kilian Kaminski during a master’s program run by Hult International Business School. Both men worked in China while studying international business. Windischhofer spent six months running an online “TripAdvisor” review platform for Chinese language schools in Shanghai.In October 2014, Windischhofer joined McKinsey & Company as a management consultant working on digital marketing and product development projects for marketplaces and e-commerce companies in Europe.In 2017, he left McKinsey to co-found Refurbed with Kaminski to build an Amazon-style marketplace for refurbished electronic goods. The idea was inspired by a personal experience when Windischhofer bought a used smartphone after seeing a classified ad. The phone stopped working after two weeks. The incident prompted him to create an e-commerce platform specializing in selling quality refurbished e-products with carbon-neutral credentials like planting a tree for every sales transaction.

Peter Windischhofer graduated with a management degree in 2012 at Vienna University of Economics and Business, including a stint at the University of Hong Kong. Student internships included various roles at McKinsey & Company, Perella Weinberg Partners, Realtreuhand and Raiffeisen Bank.In 2012, he joined CUDOS Group and worked for over a year as a business analyst in Vienna. In 2013, he met Refurbed co-founder Kilian Kaminski during a master’s program run by Hult International Business School. Both men worked in China while studying international business. Windischhofer spent six months running an online “TripAdvisor” review platform for Chinese language schools in Shanghai.In October 2014, Windischhofer joined McKinsey & Company as a management consultant working on digital marketing and product development projects for marketplaces and e-commerce companies in Europe.In 2017, he left McKinsey to co-found Refurbed with Kaminski to build an Amazon-style marketplace for refurbished electronic goods. The idea was inspired by a personal experience when Windischhofer bought a used smartphone after seeing a classified ad. The phone stopped working after two weeks. The incident prompted him to create an e-commerce platform specializing in selling quality refurbished e-products with carbon-neutral credentials like planting a tree for every sales transaction.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

Founded in Silicon Valley by serial investor and founder of Google Ventures Bill Marris, Section 32 has multiple investment interests with medicine and biotech key amongst them. Marris himself has invested in over 500 companies, with over one-third resulting in IPO or M&A. Fifty of his portfolio companies have exceeded $1bn valuations, including Uber. Section 32 currently has 48 companies in its portfolio. Its most recent investments have included in Canadian remote medicine platform Cover Health’s $43m Series B round and in the $100m Series B round of US cancer detection software C2i Genomics, both in April 2021. In March 2021, it participated in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in Silicon Valley by serial investor and founder of Google Ventures Bill Marris, Section 32 has multiple investment interests with medicine and biotech key amongst them. Marris himself has invested in over 500 companies, with over one-third resulting in IPO or M&A. Fifty of his portfolio companies have exceeded $1bn valuations, including Uber. Section 32 currently has 48 companies in its portfolio. Its most recent investments have included in Canadian remote medicine platform Cover Health’s $43m Series B round and in the $100m Series B round of US cancer detection software C2i Genomics, both in April 2021. In March 2021, it participated in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Tony Fadell is the inventor of the iPod, co-inventor of the iPhone, and former CEO and founder of Nest Labs, which was later acquired by Google. He is also an angel investor and head of Paris-based deeptech advisory and investing firm Future Shape, which has over 200 companies in its portfolio and a focus on issues like the electrification and digital connection of things, biomanufacturing and the eradication of waste. Fadell has invested in at least 10 startups, with his most recent disclosed investments having taken place in 4Q20. These included his participation in the $7m seed round of London-based consumer technology and conceptual design house Nothing, the $45m Series B round of US biotech firm and vegan leather maker MycoWorks, well as the $31m Series A round of video call effects and presentation tools company mmhmm.

Tony Fadell is the inventor of the iPod, co-inventor of the iPhone, and former CEO and founder of Nest Labs, which was later acquired by Google. He is also an angel investor and head of Paris-based deeptech advisory and investing firm Future Shape, which has over 200 companies in its portfolio and a focus on issues like the electrification and digital connection of things, biomanufacturing and the eradication of waste. Fadell has invested in at least 10 startups, with his most recent disclosed investments having taken place in 4Q20. These included his participation in the $7m seed round of London-based consumer technology and conceptual design house Nothing, the $45m Series B round of US biotech firm and vegan leather maker MycoWorks, well as the $31m Series A round of video call effects and presentation tools company mmhmm.

OneRagtime is a platform that brings together ventures, startups and advisory services, providing access to capital, industry expertise and operational resources. It also uses a fully-digitalized investment process for its users to carry out due diligence and negotiations. Founded in 2014 by Stéphanie Hospital and Jean-Marie Messier, One Ragtime is headquartered in London with offices in Paris and Barcelona. The company’s mentors include Josep Solé and Laurence Bret, who advise Spanish/Latin American and European technology companies, respectively.

OneRagtime is a platform that brings together ventures, startups and advisory services, providing access to capital, industry expertise and operational resources. It also uses a fully-digitalized investment process for its users to carry out due diligence and negotiations. Founded in 2014 by Stéphanie Hospital and Jean-Marie Messier, One Ragtime is headquartered in London with offices in Paris and Barcelona. The company’s mentors include Josep Solé and Laurence Bret, who advise Spanish/Latin American and European technology companies, respectively.

Joe Zhou graduated from Beijing University of Technology in 1982 and worked five years as a lecturer at his alma mater. In 1987, he went to study in the US and obtained a master’s at the New Jersey Institute of Technology in 1989. He stayed in New Jersey and worked for five years at AT&T Bell Labs and its spin-off Lepton Inc.In 1995, Zhou returned to work in China as the VP of UTStarcom China until 1999 when he joined Softbank China Venture Capital as the head of its Beijing office. In October 2001, he became a partner at Softbank’s SAIF for five years. In 2007, he became a founding managing partner at Kleiner Perkins Caufield & Byers China. In April 2008, he co-founded Keytone Ventures as managing partner.

Joe Zhou graduated from Beijing University of Technology in 1982 and worked five years as a lecturer at his alma mater. In 1987, he went to study in the US and obtained a master’s at the New Jersey Institute of Technology in 1989. He stayed in New Jersey and worked for five years at AT&T Bell Labs and its spin-off Lepton Inc.In 1995, Zhou returned to work in China as the VP of UTStarcom China until 1999 when he joined Softbank China Venture Capital as the head of its Beijing office. In October 2001, he became a partner at Softbank’s SAIF for five years. In 2007, he became a founding managing partner at Kleiner Perkins Caufield & Byers China. In April 2008, he co-founded Keytone Ventures as managing partner.

Based in Amsterdam, BC Begin Capital Limited was established in April 2019 by Alexey Menn as managing partner in Moscow. The VC has invested in five startups. In 2019, it invested in e-grocery food delivery service Samokat that was acquired by Mail.Ru Group.In February 2020, the international firm was lead investor for Finnish fashion marketplace Zadaa, raising €3.5m for its Series A round. Both Begin Capital and Bulgaria’s BrightCap Ventures were lead investors for Woom, raising €2m in May. The two investments are the biggest so far, compared to previous fundraisers for startups like Bulbshare in March 2020.

Based in Amsterdam, BC Begin Capital Limited was established in April 2019 by Alexey Menn as managing partner in Moscow. The VC has invested in five startups. In 2019, it invested in e-grocery food delivery service Samokat that was acquired by Mail.Ru Group.In February 2020, the international firm was lead investor for Finnish fashion marketplace Zadaa, raising €3.5m for its Series A round. Both Begin Capital and Bulgaria’s BrightCap Ventures were lead investors for Woom, raising €2m in May. The two investments are the biggest so far, compared to previous fundraisers for startups like Bulbshare in March 2020.

Diego Ballesteros is one of Spain's most prominent serial entrepreneurs and business angels, backing some of the most successful acquisitions in Spain and Latin America. He made his first disclosed investment in 2016, as an angel investor of Spanish femtech WOOM’s pre-seed and seed funding rounds. He is currently the sole founder of Bewe SaaS for beauty and wellness professionals.Ballesteros started his first enterprise in 1997, an online classified ads platform Ocioteca.com and also MundoSalud that was acquired by Sanitas of Bupa Group. Cabify and co-investments with Seaya Ventures also form part of his investment portfolio. One of his biggest successes is on-demand food delivery platform SinDelantal with operations in Spain and Mexico. In 2013, the Spanish delivery company was acquired by Just Eat that later also bought the Mexican company in 2015.

Diego Ballesteros is one of Spain's most prominent serial entrepreneurs and business angels, backing some of the most successful acquisitions in Spain and Latin America. He made his first disclosed investment in 2016, as an angel investor of Spanish femtech WOOM’s pre-seed and seed funding rounds. He is currently the sole founder of Bewe SaaS for beauty and wellness professionals.Ballesteros started his first enterprise in 1997, an online classified ads platform Ocioteca.com and also MundoSalud that was acquired by Sanitas of Bupa Group. Cabify and co-investments with Seaya Ventures also form part of his investment portfolio. One of his biggest successes is on-demand food delivery platform SinDelantal with operations in Spain and Mexico. In 2013, the Spanish delivery company was acquired by Just Eat that later also bought the Mexican company in 2015.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Based in Linz, Klaus Hofbauer is an angel investor via his investment vehicle HOKL Ventures and the co-founder and CEO of Austria’s leading career job portal Karriere.at, established in 2004. As an angel investor, Hofbauer’s investments have included agriculture marketplace Markta, second-hand electronics marketplace Refurbed and leisure fishing booking site Hejfish. As a shareholder, he joined Refurbed as a board member in 2020.

Based in Linz, Klaus Hofbauer is an angel investor via his investment vehicle HOKL Ventures and the co-founder and CEO of Austria’s leading career job portal Karriere.at, established in 2004. As an angel investor, Hofbauer’s investments have included agriculture marketplace Markta, second-hand electronics marketplace Refurbed and leisure fishing booking site Hejfish. As a shareholder, he joined Refurbed as a board member in 2020.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

Amidst a flurry of funding from overseas, local players urge a review of startup ownership rules in Indonesia

East Ventures raises funds, teams up with state agency to produce Covid-19 tests for Indonesia

East Ventures investee Nusantics has been working with state researchers to produce the prototype; expects mass production of the test kits soon

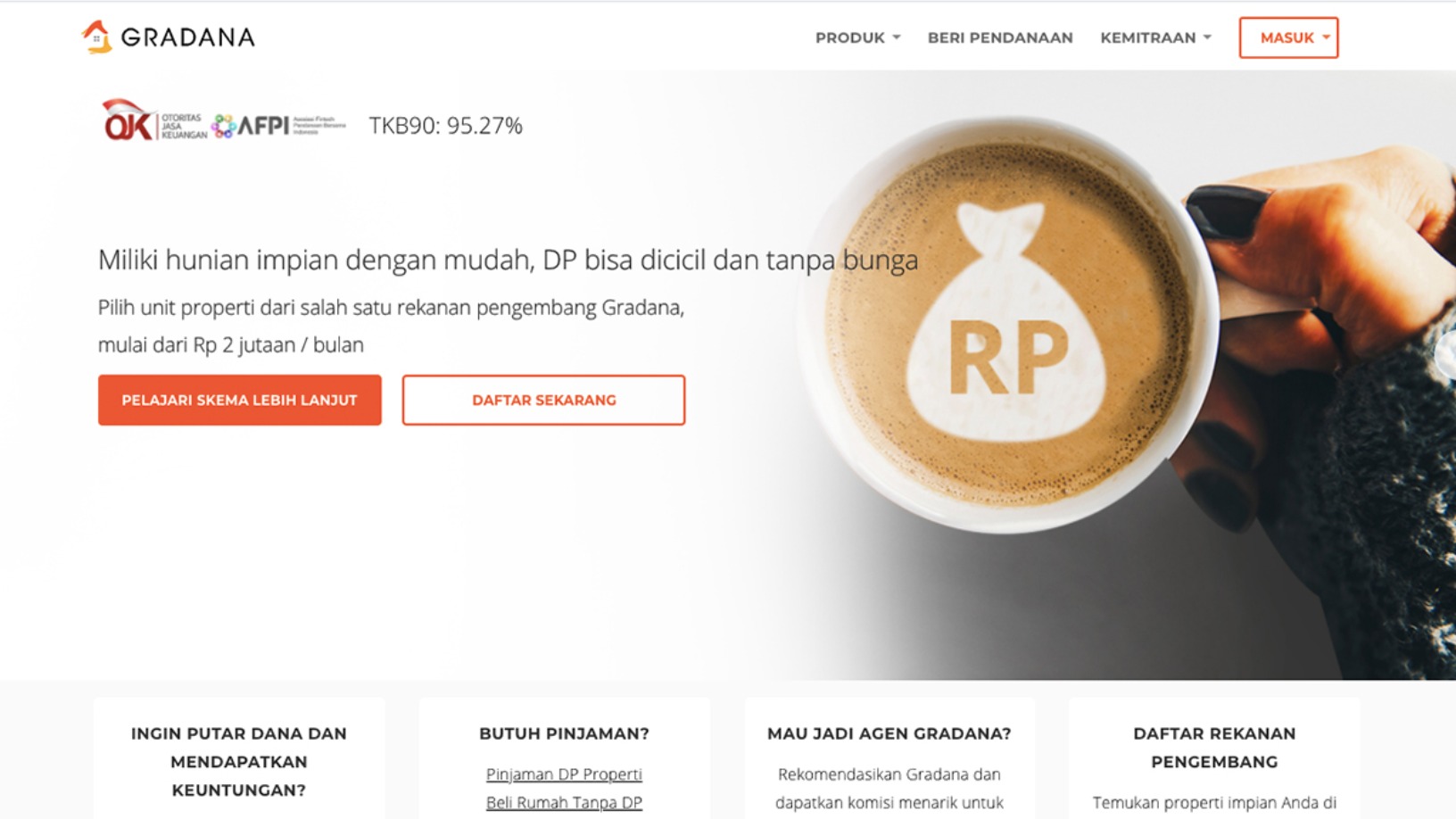

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

Alberto Gómez, Spain's blockchain evangelist

Alberto Gómez Toribio has been pioneering blockchain technology in Spain since 2013. He convinced the Bank of Spain to authorize capital raising with cryptocurrency and built the world's first decentralized Bitcoin exchange

Clicars: Bringing certainty to buying a used car

Spanish online used car dealer aims to sell 10,000 vehicles by 2021 via its unique sales offer that has booked it €50 million in sales since 2016

Spain's gig and sharing economy startups flourish, despite barrage of restrictions

Startups like Glovo and Spotahome topped fundings raised in 2018 despite local regulatory risks, as Spanish tech firms conquer overseas markets

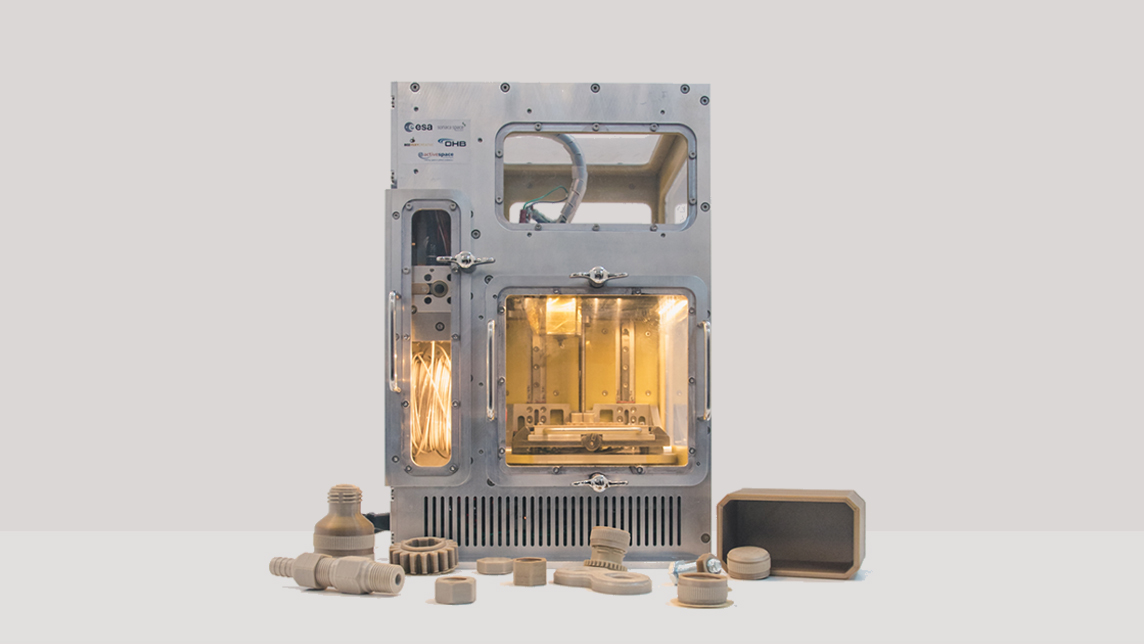

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

Psquared: Providing flexible workplaces to help early-stage startups

The Barcelona-based startup converts a variety of buildings to hybrid office spaces for flexible work brought about by Covid-19, includes a reservations system to manage desk and meeting spaces

Sorry, we couldn’t find any matches for“Sinar Mas Digital Ventures”.