Smart City Expo World Congress

-

DATABASE (293)

-

ARTICLES (536)

Founded in Hong Kong in 2018, Lake Bleu Capital currently operates in both Hong Kong and Shanghai. With assets worth billions of US dollars under management, it mainly invests in pharmaceuticals, biotech, medical devices and healthcare services companies in Asia, especially Greater China. Its limited partners include sovereign wealth funds, university endowments, foundations, pension funds, and family offices across the world.With a long-term investment strategy, Lake Bleu Capital invests through both public and private equity with a focus on mid- to late-stage companies.

Founded in Hong Kong in 2018, Lake Bleu Capital currently operates in both Hong Kong and Shanghai. With assets worth billions of US dollars under management, it mainly invests in pharmaceuticals, biotech, medical devices and healthcare services companies in Asia, especially Greater China. Its limited partners include sovereign wealth funds, university endowments, foundations, pension funds, and family offices across the world.With a long-term investment strategy, Lake Bleu Capital invests through both public and private equity with a focus on mid- to late-stage companies.

Adidas is a German multinational corporation manufacturing shoes, clothing and accessories. It is the largest sportswear manufacturer in Europe, and the second-largest in the world, after Nike. The Adidas brand is part of the Adidas Group which also includes Reebok sportswear company, a 8.33% stake in football club Bayern München and also has interest in Runtastic, an Austrian fitness technology company. Total revenue exceeded €21bn in 2018.

Adidas is a German multinational corporation manufacturing shoes, clothing and accessories. It is the largest sportswear manufacturer in Europe, and the second-largest in the world, after Nike. The Adidas brand is part of the Adidas Group which also includes Reebok sportswear company, a 8.33% stake in football club Bayern München and also has interest in Runtastic, an Austrian fitness technology company. Total revenue exceeded €21bn in 2018.

Pegasus Tech Ventures (Fenox Venture Capital)

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

CEO and co-founder of HumanITcare

Núria Pastor is the CEO and co-founder of HumanITcare, a telemedicine platform for remote patient monitoring using real-world data and AI to treat patients affected by chronic diseases and also to accelerate drug development and clinical trials. Under the helm of Pastor the startup has doubled its user base and is poised to become a leading player in digital health. Pastor holds a bachelor’s in psychology from the University of Barcelona and a Masters in Research in neuroscience from the Autonomous University of Barcelona. Prior to HumanITcare, she worked as a researcher at the Hospital del Mar Research Institute and the University of Barcelona. She has also worked as Business Analyst in EIT Health and has mentored at the European Commission.

Núria Pastor is the CEO and co-founder of HumanITcare, a telemedicine platform for remote patient monitoring using real-world data and AI to treat patients affected by chronic diseases and also to accelerate drug development and clinical trials. Under the helm of Pastor the startup has doubled its user base and is poised to become a leading player in digital health. Pastor holds a bachelor’s in psychology from the University of Barcelona and a Masters in Research in neuroscience from the Autonomous University of Barcelona. Prior to HumanITcare, she worked as a researcher at the Hospital del Mar Research Institute and the University of Barcelona. She has also worked as Business Analyst in EIT Health and has mentored at the European Commission.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

News aggregator app Kurio brings back the pleasure of reading by selecting and showing only the most relevant and interesting Indonesian-language materials, reducing content overload.

News aggregator app Kurio brings back the pleasure of reading by selecting and showing only the most relevant and interesting Indonesian-language materials, reducing content overload.

China- and Asia Pacific-focused SAIF Partners is one of China's largest homegrown PE firms, managing about $4 billion in capital. Led by former World Bank economist Andy Yan, it has invested in more than 200 companies. Taking a value-based investment approach, it says: "We generally make individual equity investments of between $10 million and $100 million, in one or more rounds of financing, and generally seek to obtain a significant minority equity ownership position in the range of 15% to 40% of a portfolio company." SAIF also has a strong presence in India.

China- and Asia Pacific-focused SAIF Partners is one of China's largest homegrown PE firms, managing about $4 billion in capital. Led by former World Bank economist Andy Yan, it has invested in more than 200 companies. Taking a value-based investment approach, it says: "We generally make individual equity investments of between $10 million and $100 million, in one or more rounds of financing, and generally seek to obtain a significant minority equity ownership position in the range of 15% to 40% of a portfolio company." SAIF also has a strong presence in India.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

Pablo Fernandez Alveraz is the CEO and co-founder of Clicars.com, an online marketplace for second-hand cars. Clicars secured investments from former executives working at Mercedes, General Motors, Santander Bank and Mapfre. He has degrees from Harvard Business School and the University of Madrid. He spent over 14 years working as an investment banker and consultant in Europe, USA and Latin America before diving into the world of startups. The former Boston Consulting Group (BCG) consultant was also part of the team that led the corporate strategy and digital transformation of Santander Bank in the US.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

Greater Bay Area Homeland Development Fund

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

Shanghai Artificial Intelligence Industry Investment Fund

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

Kingfisher is a privately owned, and independently managed financial services firm active for nearly three decades. The firm was established in Charlotte in the US in 1989 and acquired by WealthTrust, LLC in 2004. In 2009, it returned to operate as an independent investment adviser under the name of Kingfisher Capital, LLC and purchased all outstanding ownership interest from WealthTrust LLC. Kingfisher has supported affluent families, professionals, business owners, and institutions through financial advisory, smart investments and personalized client service.The firm is currently led by managing partners and co-founders Alexander Miles and H K Hallett. Prior to founding Kingfisher, Miles worked at WealthTrust Advisors, the Myers Limited Partnerships and Lehman Brothers in New York. Hallett worked for Trust Company Bank of Georgia and Peoples Bank of North Carolina before joining Carolina Securities Corporation, where he co-managed the Charlotte office.

Kingfisher is a privately owned, and independently managed financial services firm active for nearly three decades. The firm was established in Charlotte in the US in 1989 and acquired by WealthTrust, LLC in 2004. In 2009, it returned to operate as an independent investment adviser under the name of Kingfisher Capital, LLC and purchased all outstanding ownership interest from WealthTrust LLC. Kingfisher has supported affluent families, professionals, business owners, and institutions through financial advisory, smart investments and personalized client service.The firm is currently led by managing partners and co-founders Alexander Miles and H K Hallett. Prior to founding Kingfisher, Miles worked at WealthTrust Advisors, the Myers Limited Partnerships and Lehman Brothers in New York. Hallett worked for Trust Company Bank of Georgia and Peoples Bank of North Carolina before joining Carolina Securities Corporation, where he co-managed the Charlotte office.

Proptech Zhongzheng will focus on AI-powered data analytics to optimize performance of smart buildings in China.

Proptech Zhongzheng will focus on AI-powered data analytics to optimize performance of smart buildings in China.

Chairman and co-founder of Everimpact

Jan Mattsson is a former senior UN official and the head of an ESG management consultancy. He is also chairman and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more reliable carbon emissions data to public bodies, municipalities, and businesses. Mattsson has four decades of experience in development, humanitarian and peacekeeping operations, and has led operations and programs in Asia, Africa, Latin America and Central Asia. He spent nearly 14 years as UN Under-Secretary-General and Executive Director of the United Nations Office for Project Services (UNOPS), the operational arm of the UN. Over his professional career, Mattsson has also engaged with international organizations such as the World Bank and the Green Climate Fund. Outside of Everimpact, Mattsson is founder and CEO of M-Trust Leadership AB, an independent ESG and sustainable development management consultancy. He chairs the board of the Museum for the United Nations, and 4Life Solutions (formerly known as SolarSack), a company offering a solar-powered product that can provide safe drinking water to low-income and vulnerable communities. Mattsson also serves on the boards of The Management Lab, which aims to help investors analyze the social and environmental impact of their investments and philanthropy, as well as the World Benchmarking Alliance, an Amsterdam-based non-profit organization that aims to measure and incentivise businesses’ contributions towards the UN SDGs.

Jan Mattsson is a former senior UN official and the head of an ESG management consultancy. He is also chairman and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more reliable carbon emissions data to public bodies, municipalities, and businesses. Mattsson has four decades of experience in development, humanitarian and peacekeeping operations, and has led operations and programs in Asia, Africa, Latin America and Central Asia. He spent nearly 14 years as UN Under-Secretary-General and Executive Director of the United Nations Office for Project Services (UNOPS), the operational arm of the UN. Over his professional career, Mattsson has also engaged with international organizations such as the World Bank and the Green Climate Fund. Outside of Everimpact, Mattsson is founder and CEO of M-Trust Leadership AB, an independent ESG and sustainable development management consultancy. He chairs the board of the Museum for the United Nations, and 4Life Solutions (formerly known as SolarSack), a company offering a solar-powered product that can provide safe drinking water to low-income and vulnerable communities. Mattsson also serves on the boards of The Management Lab, which aims to help investors analyze the social and environmental impact of their investments and philanthropy, as well as the World Benchmarking Alliance, an Amsterdam-based non-profit organization that aims to measure and incentivise businesses’ contributions towards the UN SDGs.

Vadecity: Stop bicycle theft with an intelligent bike-parking system

The Barcelona-based startup wants more people to bike by offering flexible, affordable parking with its Vadebike solution

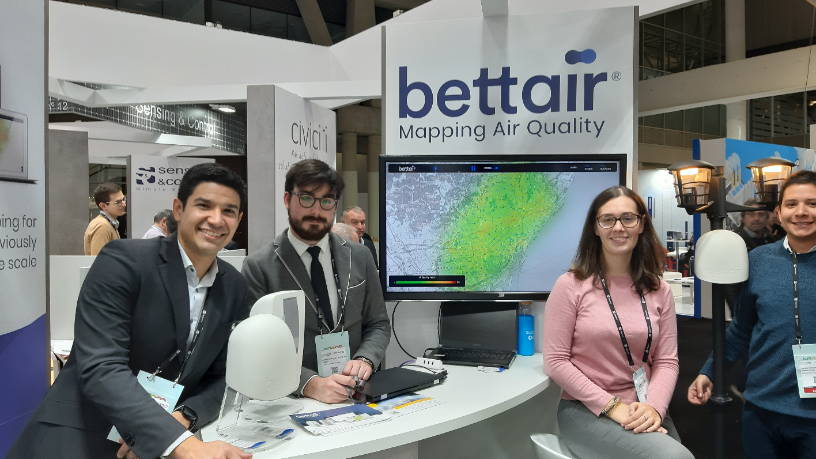

Bettair's air pollution monitoring system for cities promises over 90% accuracy

Combining smart sensors, AI and machine learning, Barcelona-based Bettair has developed a unique, affordable PaaS to accurately measure pollution levels in urban areas

Citibeats, a social trends monitoring tool for governments and businesses, wins €1.4m funding

Citibeats tracks and analyzes what the public is saying online in any language; wants to boost its presence in LatAm and Asia

Orain: Making vending machines smarter and more profitable

Vending machines can now interact with consumers and offer FMCG retailers valuable data, thanks to smart hardware from Barcelona-based Orain

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Foot Analytics: Turning pedestrian footfall into data for smart cities and retail

Applying sensors and proprietary algorithms to digitalize spaces, Foot Analytics gathers data and insights on customer behavior in retail spaces, stadia and airports

Kuorum: a SaaS that enables citizen participation

Kuorum generates citizen engagement webpages in less than a minute to cope with Spain’s mandate of digitalizing administrative procedures by the end of 2020

Interview with Qlue CEO, part II: Smart cities in Indonesia and beyond

Continuing from the first part of an interview, Qlue CEO Rama Raditya discusses trends, achievements and challenges in smart city development

Qlue on international expansion, privacy concerns in smart cities

Qlue's CEO Rama Raditya and CCO Maya Arvini on protecting individual privacy when handling citizens' data in smart cities, the lack of clarity in regulation of use of facial recognition technology in Indonesia

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

Napbox: Sleeping capsule mania takes off in Spain

Napbox's on-demand and intelligent cabins give privacy and connectivity in public spaces and offices

Jakarta Smart City seeks startup solutions for life in post-Covid “new normal”

From collaborative working to cyberbullying, these startups will soon work with Indonesia’s first smart city agency

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

Creatio Energy Systems: From personal hobby to Iberian enabler of IoT technology

Creatio develops fully compatible sensors with a matching SaaS platform, meeting fast-growing IoT demand in Spain, where there are only a few local players

Sorry, we couldn’t find any matches for“Smart City Expo World Congress”.