Social Coin

-

DATABASE (207)

-

ARTICLES (272)

Social Capital is a Palo Alto-based venture capital firm. Its stated mission is to "advance humanity by solving the world's hardest problems", with the firm investing in entrepreneurs who markedly improve their communities. Social Capital's diverse portfolio comprises healthcare companies, workplace productivity software Slack and SurveyMonkey and coworking space operator Rework (now GoWork).

Social Capital is a Palo Alto-based venture capital firm. Its stated mission is to "advance humanity by solving the world's hardest problems", with the firm investing in entrepreneurs who markedly improve their communities. Social Capital's diverse portfolio comprises healthcare companies, workplace productivity software Slack and SurveyMonkey and coworking space operator Rework (now GoWork).

CEO and founder of Citibeats

Caballero is serial entrepreneur dedicated to purpose-driven entrepreneurship harnessing technology to support social initiatives. He was Head of New Media in Doctors Without Borders, has held senior level positions in multinational companies and co-founded tech startups in the field of social intelligence and analytic platforms.In 2013, he founded The Social Coin, an NGO for social movement and game-changing technology rewarding people for socially responsible acts. In 2018, the company launched Citibeats, a social intelligence platform deploying NLP and machine-learning to analyze online speech and convert it into relevant insights that governments, cities and companies can use to provide immediate response to social needs.

Caballero is serial entrepreneur dedicated to purpose-driven entrepreneurship harnessing technology to support social initiatives. He was Head of New Media in Doctors Without Borders, has held senior level positions in multinational companies and co-founded tech startups in the field of social intelligence and analytic platforms.In 2013, he founded The Social Coin, an NGO for social movement and game-changing technology rewarding people for socially responsible acts. In 2018, the company launched Citibeats, a social intelligence platform deploying NLP and machine-learning to analyze online speech and convert it into relevant insights that governments, cities and companies can use to provide immediate response to social needs.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Founder of ICOAGE, a popular Chinese initial coin offering platform, and ChainB.com, which used to be China’s largest blockchain-specific portal.Known in the blockchain field as “Baozou Gongqinwang,” Gong graduated from Shanghai University with a bachelor’s degree in mathematics and computer science.

Founder of ICOAGE, a popular Chinese initial coin offering platform, and ChainB.com, which used to be China’s largest blockchain-specific portal.Known in the blockchain field as “Baozou Gongqinwang,” Gong graduated from Shanghai University with a bachelor’s degree in mathematics and computer science.

Rubio Impact Ventures (formerly Social Impact Ventures)

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

The Repsol Foundation, part of the Repsol Group, is committed to improving social and environmental outcomes.Repsol has launched a €50m social investment fund to be used in developing a portfolio of social enterprises focused on energy transition and social inclusion of vulnerable groups in Spain. The firm invested €9,5m during 2018.

The Repsol Foundation, part of the Repsol Group, is committed to improving social and environmental outcomes.Repsol has launched a €50m social investment fund to be used in developing a portfolio of social enterprises focused on energy transition and social inclusion of vulnerable groups in Spain. The firm invested €9,5m during 2018.

Phitrust Partenaires is a France-based investment fund focused on social businesses in Europe and Asia.In Europe, the company acts as a VC firm dedicated to impact investing. Its investment vehicle contributes €150,000 to €800,000 to support projects that address social needs. Phitrust Partenaires also works in partnership with prominent European social funds.

Phitrust Partenaires is a France-based investment fund focused on social businesses in Europe and Asia.In Europe, the company acts as a VC firm dedicated to impact investing. Its investment vehicle contributes €150,000 to €800,000 to support projects that address social needs. Phitrust Partenaires also works in partnership with prominent European social funds.

Spain's first social impact investment fund Creas Foundation invests in business projects which prioritize the creation of social and environmental value. It acts as an investor and partner in financial, management and strategic decisions. Its goal is to facilitate access to funding and accelerate growth of social businesses which have an innovative approach and sustainable income model. It has fixed a target of €30m to invest in social enterprise startups. The fund offers participatory loans or capital injections ranging from €5,000 to €25,000.

Spain's first social impact investment fund Creas Foundation invests in business projects which prioritize the creation of social and environmental value. It acts as an investor and partner in financial, management and strategic decisions. Its goal is to facilitate access to funding and accelerate growth of social businesses which have an innovative approach and sustainable income model. It has fixed a target of €30m to invest in social enterprise startups. The fund offers participatory loans or capital injections ranging from €5,000 to €25,000.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

Founder and CEO of GetSocial

Armed with a master’s in Business Administration and Computer Science from the Instituto Universitário de Lisboa, João Romão is looking to change the way companies and audiences interact with social media and social networks. His experience includes consulting stints around Portugal at AIESEC and Novabase Consulting and as the CEO of Wishareit, a Lisbon-based social shopping platform. In 2013, Romão founded GetSocial, a social analytics and content automation platform that helps marketers and publishers measure, promote and amplify their best work.

Armed with a master’s in Business Administration and Computer Science from the Instituto Universitário de Lisboa, João Romão is looking to change the way companies and audiences interact with social media and social networks. His experience includes consulting stints around Portugal at AIESEC and Novabase Consulting and as the CEO of Wishareit, a Lisbon-based social shopping platform. In 2013, Romão founded GetSocial, a social analytics and content automation platform that helps marketers and publishers measure, promote and amplify their best work.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Ship2B is an accelerator and investor for social impact startups and spin-offs. It acts principally in three sectors: health tech, social tech for vulnerable groups and climate technology. It also fosters networking alliances between startups and large companies, and has a network of high-level mentors available to assist startups.To date, Ship2B has invested €40m in 146 startups and spin-offs.

Ship2B is an accelerator and investor for social impact startups and spin-offs. It acts principally in three sectors: health tech, social tech for vulnerable groups and climate technology. It also fosters networking alliances between startups and large companies, and has a network of high-level mentors available to assist startups.To date, Ship2B has invested €40m in 146 startups and spin-offs.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

Founded in 2014 by China’s No.1 high-end human resource and online social platform for entrepreneurs, Zhisland Capital is an investment platform.

Founded in 2014 by China’s No.1 high-end human resource and online social platform for entrepreneurs, Zhisland Capital is an investment platform.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Indonesian esports team RRQ dreams of being "the king of kings"

The Jakarta team is growing its brand with collaborations and its academy, expects more esports interest amid Covid-19 home confinements

Indonesian online basic food startups like Sayurbox and Wahyoo have had as much as a fivefold jump in orders and are working to sustain strong sales post-social distancing

How millennials travel: Waynabox for low-cost, X-factor surprise getaways

Play online vacation games and let computers plan your holidays from just €150

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

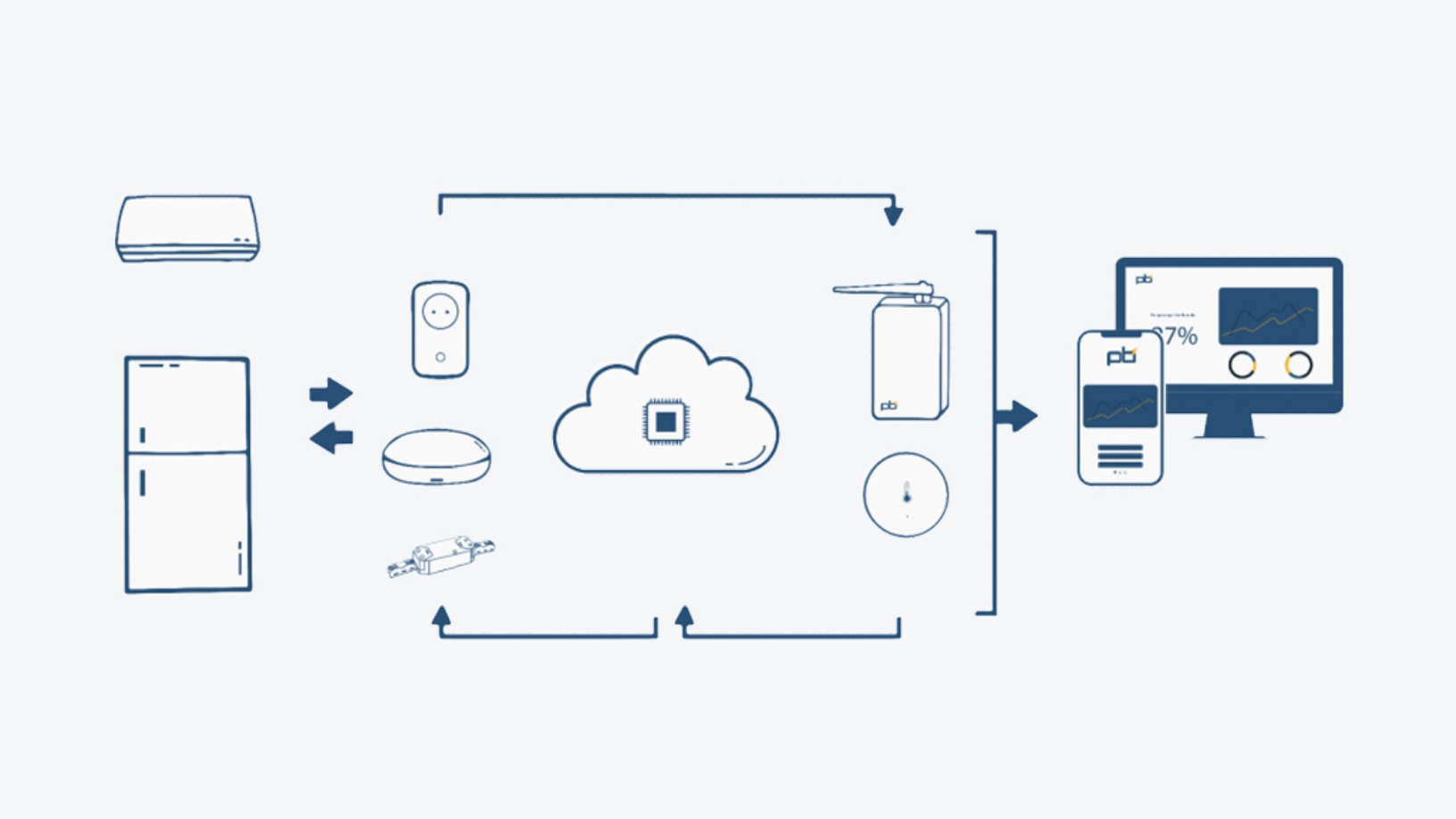

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

Future Food Asia: Covid-19 sparked dramatic shifts in agriculture in China and India

Key Chinese players from e-commerce giant Pinduoduo and and agritech VC Omnivore share their insights at last week’s agrifood conference by ID Capital

Doinn: Impeccable housekeeping for lucrative holiday rentals

With its tech tools, better working conditions and 5-star ratings, the Portuguese startup now wants to expand to Southeast Asia and get Series A funding

This Chinese café startup aims to best Starbucks with “new retail” strategy

Luckin Coffee has gone from scratch to China’s first coffee shop unicorn in less than a year, pouring more than 5 million cups of coffee along the way

Clear Plate: Anti-food waste AI that rewards the diners who finish their food

Taking little steps to make a big difference in fighting food waste, Clear Plate engages with digital natives to spread the message

Day Day Cook: Creating content that sells

She may not be a celebrity chef but Norma Chu, the analyst-turned-cook, is a familiar face in food-obsessed Hong Kong, where she has her recipe website to encourage youths to learn cooking

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

Smile Formula offers orthodontic treatment online, and 70% cheaper

Unaffected by the coronavirus outbreak, Smile Formula served 2,000 customers within nine months of launch and raised RMB 10m seed funding in April

Sorry, we couldn’t find any matches for“Social Coin”.