Social Innovation Fund

-

DATABASE (689)

-

ARTICLES (523)

CEO and co-founder of agroSingularity

In 2019, Juanfra Abad Navarro became the CEO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from wasted agricultural by-products.The graphic and product designer has led multiple international innovation projects at the Catholic University of Murcia and at the European Business Factory. He also co-founded and headed Innovarligero for over nine years, facilitating innovative agile processes for agrifood SMEs. Navarro was selected as one of 10 brilliant Murcian entrepreneurs to join the executive training programs of the Advanced Leadership Foundation (ALF). Through AFL, he had the opportunity to meet former US President Barack Obama during the Summit of Technological Innovation and Circular Economy held in Madrid in 2018.

In 2019, Juanfra Abad Navarro became the CEO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from wasted agricultural by-products.The graphic and product designer has led multiple international innovation projects at the Catholic University of Murcia and at the European Business Factory. He also co-founded and headed Innovarligero for over nine years, facilitating innovative agile processes for agrifood SMEs. Navarro was selected as one of 10 brilliant Murcian entrepreneurs to join the executive training programs of the Advanced Leadership Foundation (ALF). Through AFL, he had the opportunity to meet former US President Barack Obama during the Summit of Technological Innovation and Circular Economy held in Madrid in 2018.

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

Based in New York City, Pavilion Capital is linked to Singapore's Temasek Holdings. The firm primarily invests in US and Asian companies. Its portfolio includes entertainment and social media holding company M17, smart retail kiosk startup Warung Pintar and delivery coffee chain Fore Coffee.

Based in New York City, Pavilion Capital is linked to Singapore's Temasek Holdings. The firm primarily invests in US and Asian companies. Its portfolio includes entertainment and social media holding company M17, smart retail kiosk startup Warung Pintar and delivery coffee chain Fore Coffee.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Co-founder of Tonic App

couldnt find a colour picDavid Bórsos is the Hungarian-born co-founder of Tonic App for medical doctors and currently works as an officer at the European Investment Fund in Luxembourg. He co-founded Tonic App after studying for his MBA at IE Business School in Madrid, where he met the rest of the co-founding team. Bórsos previously worked as Head of Business Intelligence at Job Today and as a Business Analyst at various levels at Goodyear, both in Luxembourg. He also holds a BSc from Deberceni Egyetem in Hungary and worked for Samsung Electronics and TVA in the same country.

couldnt find a colour picDavid Bórsos is the Hungarian-born co-founder of Tonic App for medical doctors and currently works as an officer at the European Investment Fund in Luxembourg. He co-founded Tonic App after studying for his MBA at IE Business School in Madrid, where he met the rest of the co-founding team. Bórsos previously worked as Head of Business Intelligence at Job Today and as a Business Analyst at various levels at Goodyear, both in Luxembourg. He also holds a BSc from Deberceni Egyetem in Hungary and worked for Samsung Electronics and TVA in the same country.

Co-Founder and CEO of Lemonilo

Harvard Law graduate Shinta Nurfauzia earned her bachelor's degree in law at Universitas Indonesia. After working as a banking and finance associate at Allen & Overy Indonesia, and as a law associate at Lubis, Santosa & Maramis, Nurfauzia received the prestigious Indonesia Endowment Fund For Education Scholarship to Harvard Law School. Post-Harvard, Nurfauzia worked as a consultant to the Indonesian government sustainability program (REDD+) before founding the healthcare platform Konsula. She started her first business at 14 years old, a pancake business, and then a luxury bag reseller business.After Konsula pivoted to health food company Lemonilo, Nurfauzia remained at the company. She is currently Lemonilo’s co-CEO, sharing the role with Ronald Wijaya.

Harvard Law graduate Shinta Nurfauzia earned her bachelor's degree in law at Universitas Indonesia. After working as a banking and finance associate at Allen & Overy Indonesia, and as a law associate at Lubis, Santosa & Maramis, Nurfauzia received the prestigious Indonesia Endowment Fund For Education Scholarship to Harvard Law School. Post-Harvard, Nurfauzia worked as a consultant to the Indonesian government sustainability program (REDD+) before founding the healthcare platform Konsula. She started her first business at 14 years old, a pancake business, and then a luxury bag reseller business.After Konsula pivoted to health food company Lemonilo, Nurfauzia remained at the company. She is currently Lemonilo’s co-CEO, sharing the role with Ronald Wijaya.

Co-Founder and CEO of Kitabisa

On Forbes 30 Under 30 Asia 2016 list at age 24, Alfatih Timur (known as Timmy) holds a bachelor’s degree in Management from the University of Indonesia (UI). As a student, Timmy initiated UI Faculty of Economy’s first social service program that has since become an annual program where freshman students live and work in villages. He was also the program coordinator for UI’s Indonesia Leadership Development Program. Timmy had worked as a researcher at Indonesia Social Entrepreneurship Association (AKSI) and as an assistant to the CEO at Rumah Perubahan (literally, “House of Change”).

On Forbes 30 Under 30 Asia 2016 list at age 24, Alfatih Timur (known as Timmy) holds a bachelor’s degree in Management from the University of Indonesia (UI). As a student, Timmy initiated UI Faculty of Economy’s first social service program that has since become an annual program where freshman students live and work in villages. He was also the program coordinator for UI’s Indonesia Leadership Development Program. Timmy had worked as a researcher at Indonesia Social Entrepreneurship Association (AKSI) and as an assistant to the CEO at Rumah Perubahan (literally, “House of Change”).

Shanghai Artificial Intelligence Industry Investment Fund

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

Shanghai Artificial Intelligence Industry Investment Fund was launched at the closing ceremony of the 2019 World Artificial Intelligence conference. It was co-led by state-owned enterprises such as Guosheng Group and Lingang Group, and backed by local governments, state-owned industrial groups, and financing firms. The fund was initially be valued at RMB 10bn, with plans to increase this figure to RMB 100bn. It operates through direct investment and sub-funds.It mainly invests in early-stage tech companies as well as leading players that apply AI technologies in various verticals.

CreditEase New Financial Industry Investment Fund

Credit Ease Financial Industry Investment Fund was founded in 2016 and now manages a combined total of RMB 3 billion and US$ 500 million. It has invested in more than 20 Fintech companies around the world.

Credit Ease Financial Industry Investment Fund was founded in 2016 and now manages a combined total of RMB 3 billion and US$ 500 million. It has invested in more than 20 Fintech companies around the world.

Co-founder and CEO of Oper

Robin Lazendra is the CEO and co-founder of Oper Indonesia, a designated-driver services platform. He previously founded the Indonesian social media app GetFolks. He studied IT at Bina Nusantara university in Jakarta.

Robin Lazendra is the CEO and co-founder of Oper Indonesia, a designated-driver services platform. He previously founded the Indonesian social media app GetFolks. He studied IT at Bina Nusantara university in Jakarta.

Co-founder and COO of Performetric

To help young girls excel in the field of technology, Olaide Olambiwonnu takes time out of running Performetric, the tech startup she co-founded, to mentor middle-school girls. Olambiwonnu holds master’s degrees in Electrical Engineering from UCLA and in Entrepreneurship and Innovation from MIT. She is currently the COO of Performetric.

To help young girls excel in the field of technology, Olaide Olambiwonnu takes time out of running Performetric, the tech startup she co-founded, to mentor middle-school girls. Olambiwonnu holds master’s degrees in Electrical Engineering from UCLA and in Entrepreneurship and Innovation from MIT. She is currently the COO of Performetric.

Founder & CEO of Shuimu / Peinikan

Dubbed “star performer” in angel investor Leo Wang (Wang Lijie)’s portfolio. Big on social networks, Liu was part of China’s first social media generation. She worked in 13 different jobs before founding Shuimu. Her first “startup” experience was at aged 15, running an online store selling cut-out CDs on the then three-month-old Taobao, using her uncle’s Internet connection in a rural village in Shaanxi. Liu proclaims herself as “the most movie-savvy person in the internet circle, plus the most internet-savvy person in the movie circle” – i.e., the first to connect the two worlds in China.

Dubbed “star performer” in angel investor Leo Wang (Wang Lijie)’s portfolio. Big on social networks, Liu was part of China’s first social media generation. She worked in 13 different jobs before founding Shuimu. Her first “startup” experience was at aged 15, running an online store selling cut-out CDs on the then three-month-old Taobao, using her uncle’s Internet connection in a rural village in Shaanxi. Liu proclaims herself as “the most movie-savvy person in the internet circle, plus the most internet-savvy person in the movie circle” – i.e., the first to connect the two worlds in China.

Sky9 Capital is founded by the former co-founder and managing director of Lightspeed China Partners, Cao Darong. As an early-stage venture capital firm, it focuses on investing in TMT (Technology, Media and Telecommunications), especially Internet innovation and enterprise services. The company has a strong presence in Beijing, Shanghai, Shenzhen and Silicon Valley in the US.

Sky9 Capital is founded by the former co-founder and managing director of Lightspeed China Partners, Cao Darong. As an early-stage venture capital firm, it focuses on investing in TMT (Technology, Media and Telecommunications), especially Internet innovation and enterprise services. The company has a strong presence in Beijing, Shanghai, Shenzhen and Silicon Valley in the US.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

Guangzhou Yuexiu Industrial Investment Fund Management

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

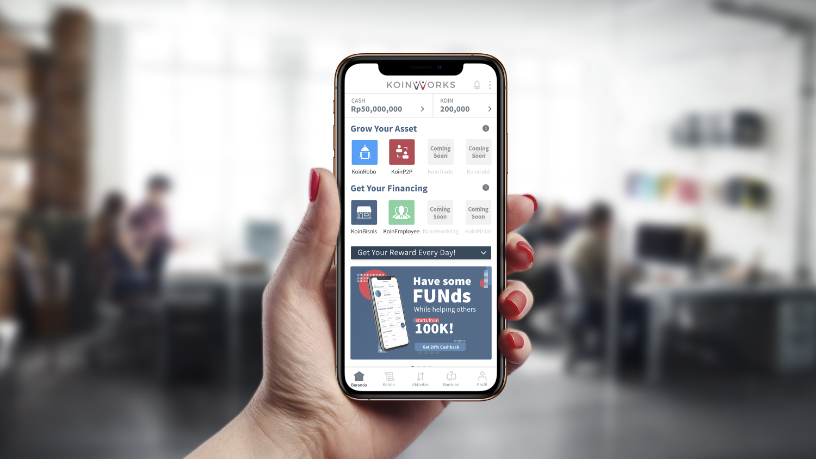

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Women entrepreneurs get ahead faster in Portugal

Still a long way to go for equality, but female founders in Portugal have made significant headstarts as tech innovators

Portugal's health & medtech startups: Taking innovation and disruption to heart

Backed by local and foreign money, Portugal’s healthcare and medical technology startups are hungry to go global

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Animal AgTech Innovation Summit 2021: Experts discuss post-pandemic priorities

The pandemic not only put digital tech in everyone’s hands, it also forced thinking about collecting meaningful data and moving it on-demand to both producers and decision makers

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Sorry, we couldn’t find any matches for“Social Innovation Fund”.