Social Innovation Fund

DATABASE (689)

ARTICLES (523)

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

Co-founded by renowned angel investors, Beijing Software and Information Services Exchange, leading IT listed companies and the Administrative Committee of Zhongguancun Haidian Science Park, Beiruan Angel focuses on mobile internet, cloud computing, modern services, cultural innovation and IC. One of its partners, Li Zhu, is also a founding partner of Innoangel Fund.

Co-founded by renowned angel investors, Beijing Software and Information Services Exchange, leading IT listed companies and the Administrative Committee of Zhongguancun Haidian Science Park, Beiruan Angel focuses on mobile internet, cloud computing, modern services, cultural innovation and IC. One of its partners, Li Zhu, is also a founding partner of Innoangel Fund.

Co-founder and co-CEO of Indexa Capital

Since 2016, François Derbaix has become a co-founder and adviser to Indexa Lending, in addition to his role as co-CEO of Indexa Capital. Derbaix is a serial entrepreneur, with interests in the vacation rental and retail sectors like Rentalia and Soysuper. He was the CEO of Toprural from 2000 to 2012, when it was acquired by North American travel giant HomeAway.Derbaix has also invested in various Spanish and Belgian internet businesses like Percentil. The University of Leuven summa cum laude graduate was the first private investor to join a fund managed by the European Investment Fund in 2014.

Since 2016, François Derbaix has become a co-founder and adviser to Indexa Lending, in addition to his role as co-CEO of Indexa Capital. Derbaix is a serial entrepreneur, with interests in the vacation rental and retail sectors like Rentalia and Soysuper. He was the CEO of Toprural from 2000 to 2012, when it was acquired by North American travel giant HomeAway.Derbaix has also invested in various Spanish and Belgian internet businesses like Percentil. The University of Leuven summa cum laude graduate was the first private investor to join a fund managed by the European Investment Fund in 2014.

Zhongguancun Longmen Investment

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Founded by Xiaomi’s Lei Jun, this incubator-investor gets first-mover access to bright business ideas and talent with its startup cafes in China’s “north Silicon Valley”.

Founded by Xiaomi’s Lei Jun, this incubator-investor gets first-mover access to bright business ideas and talent with its startup cafes in China’s “north Silicon Valley”.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Based in Madrid, K Fund is a VC firm founded in July 2016 by Ian Noel and Iñaki Arrola, focusing on seed and early-stage investments in digital technology startups. It has to date raised one fund of €50m. As of 1Q 2020, K Fund had invested in 25 companies, with its most recent investments including HR platform Factorial's €15m Series A round and in open source platform Frontity's €1m seed round.Noel represents Bonsai VC while Arrola is a serial entrepreneur (Coches.com and Vitamina K). A third co-founder is Carina Szpilka from ING Direct. Other team members include Ignacio Larrú (IE Business School), Pablo Ventura (JME Ventures) and technology journalist Jaime Novoa (Novobrief, Tech.eu). K Fund’s other investors include public institutions such as EIF and private investors.

Based in Madrid, K Fund is a VC firm founded in July 2016 by Ian Noel and Iñaki Arrola, focusing on seed and early-stage investments in digital technology startups. It has to date raised one fund of €50m. As of 1Q 2020, K Fund had invested in 25 companies, with its most recent investments including HR platform Factorial's €15m Series A round and in open source platform Frontity's €1m seed round.Noel represents Bonsai VC while Arrola is a serial entrepreneur (Coches.com and Vitamina K). A third co-founder is Carina Szpilka from ING Direct. Other team members include Ignacio Larrú (IE Business School), Pablo Ventura (JME Ventures) and technology journalist Jaime Novoa (Novobrief, Tech.eu). K Fund’s other investors include public institutions such as EIF and private investors.

Founded in 2006 and renamed in 2010, Floodgate Fund is a venture capital firm focused on early-stage investment in technology sectors.

Founded in 2006 and renamed in 2010, Floodgate Fund is a venture capital firm focused on early-stage investment in technology sectors.

Hai Quan Fund is founded by Hu Haiquan (a famous singer in China). It now manages over 1.3bn RMB and has invested in more than 40 startups in 3 years.

Hai Quan Fund is founded by Hu Haiquan (a famous singer in China). It now manages over 1.3bn RMB and has invested in more than 40 startups in 3 years.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

The first Chinese rehabilitation robotics company to have its robots used for clinical and research purposes in major rehabilitation hospitals and institutions worldwide.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

The Rise Fund is a $2bn impact investing fund co-founded by U2 front man Bono, Bill McGlashan and Jeff Skoll. The fund has partnered with nonprofit consultancy The Bridgespan Group to develop an evidence-based model for quantifying the impact of the firm’s investments.The global impact investment vehicle is managed by TPGGrowth, part of the multibillion-dollar investment firm TPG that focuses on growth equity investments and mid-market buyouts. As of December 2019, the fund has deployed $1.4bn across its investment portfolio.

The Rise Fund is a $2bn impact investing fund co-founded by U2 front man Bono, Bill McGlashan and Jeff Skoll. The fund has partnered with nonprofit consultancy The Bridgespan Group to develop an evidence-based model for quantifying the impact of the firm’s investments.The global impact investment vehicle is managed by TPGGrowth, part of the multibillion-dollar investment firm TPG that focuses on growth equity investments and mid-market buyouts. As of December 2019, the fund has deployed $1.4bn across its investment portfolio.

Co-founder of Duodianyun

Peng Yao has a master’s in Electronic and Information Engineering from Tsinghua University. He was an industry researcher at Taikang Asset, an investment manager at SDIC Fund Management and Vangoo Capital Partners. He has investment experience in diverse industry sectors like healthcare, TMT and advanced equipment manufacturing.

Peng Yao has a master’s in Electronic and Information Engineering from Tsinghua University. He was an industry researcher at Taikang Asset, an investment manager at SDIC Fund Management and Vangoo Capital Partners. He has investment experience in diverse industry sectors like healthcare, TMT and advanced equipment manufacturing.

Stanford Graduate School of Business

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Zhongli Hecai Fund was set up by the Finance Bureau of Heping District of Shenyang City on behalf of the Heping District Government in April 2018. With a total asset of RMB 2 billion, the fund is operated by Hecai (Liaoning) Fund Management Company, a joint venture established by the Finance Bureau of Heping District and Tianjin Everbright Securities Sino-Briller Investment Management.

Zhongli Hecai Fund was set up by the Finance Bureau of Heping District of Shenyang City on behalf of the Heping District Government in April 2018. With a total asset of RMB 2 billion, the fund is operated by Hecai (Liaoning) Fund Management Company, a joint venture established by the Finance Bureau of Heping District and Tianjin Everbright Securities Sino-Briller Investment Management.

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

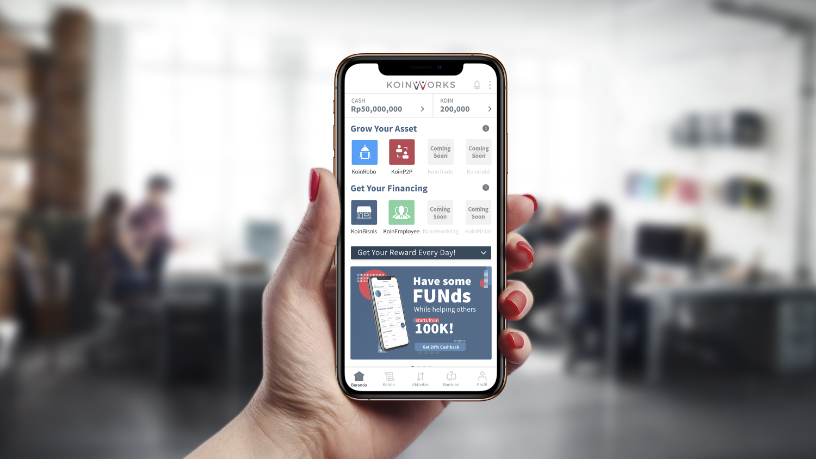

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Women entrepreneurs get ahead faster in Portugal

Still a long way to go for equality, but female founders in Portugal have made significant headstarts as tech innovators

Portugal's health & medtech startups: Taking innovation and disruption to heart

Backed by local and foreign money, Portugal’s healthcare and medical technology startups are hungry to go global

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Animal AgTech Innovation Summit 2021: Experts discuss post-pandemic priorities

The pandemic not only put digital tech in everyone’s hands, it also forced thinking about collecting meaningful data and moving it on-demand to both producers and decision makers

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Sorry, we couldn’t find any matches for“Social Innovation Fund”.